Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from rotating leaders to strong earnings, 2026 stories and FOMC impact, and the economy and inflation. Hope you have a great weekend!

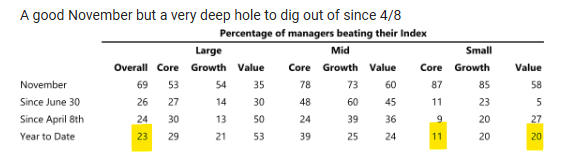

Dave: November was a happier month for active equity managers

Source: Jefferies as of 12.01.2025

Source: Jefferies as of 12.01.2025

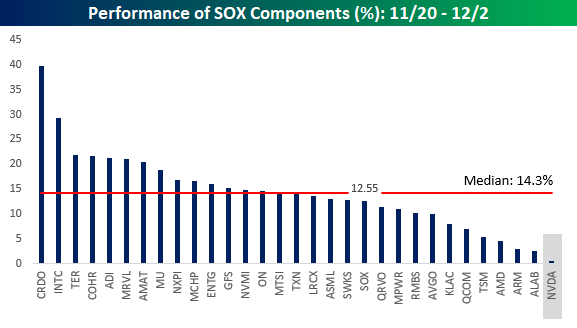

Jake: with even NVDA sharing its good fortune with the rest of its competitors around the Thanksgiving period

Source: Bespoke as of 12.03.2025

Source: Bespoke as of 12.03.2025

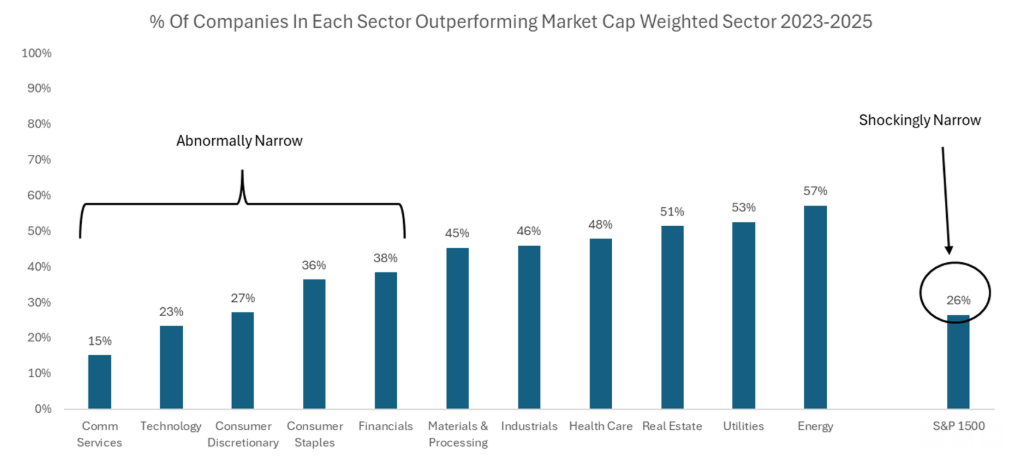

Dave: but the trend remains that it’s been another tough year to be lined up against the biggest names in the glamour sectors

Source: RJ as of 12.02.2025

Source: RJ as of 12.02.2025

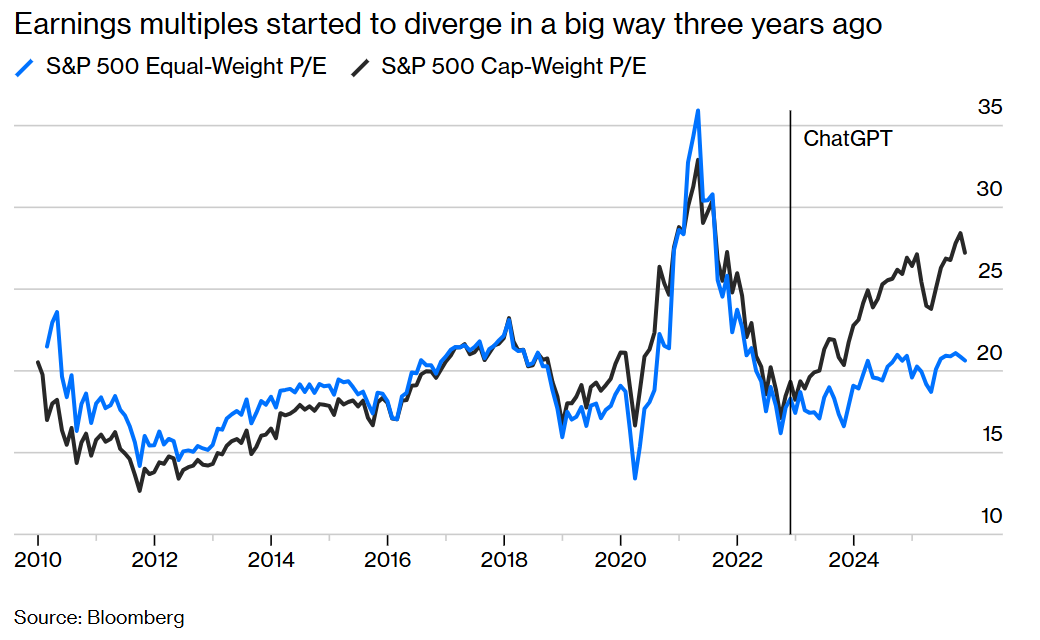

Brian: The AI cycle could be pegged as the catalyst for the recent dominance of megacap tech vs. the rest of the S&P 500

Data as of 12.02.2025

Data as of 12.02.2025

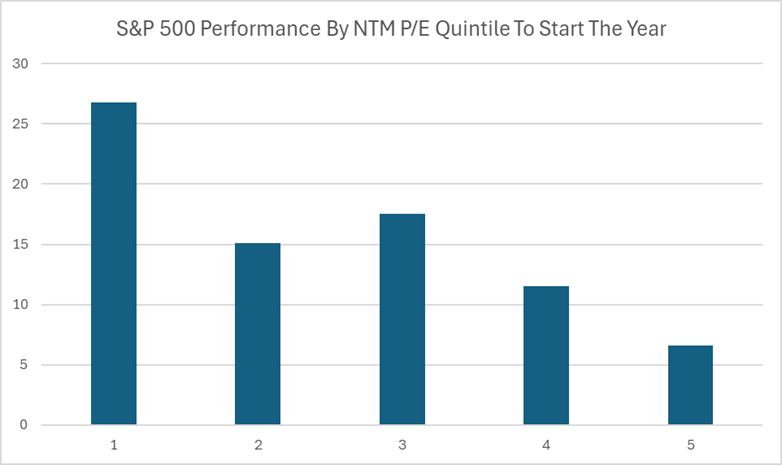

Brad: and in 2025 specifically, the most expensive stocks have built on their gains

Source: Wall Street Journal as of 12.02.2025

Source: Wall Street Journal as of 12.02.2025

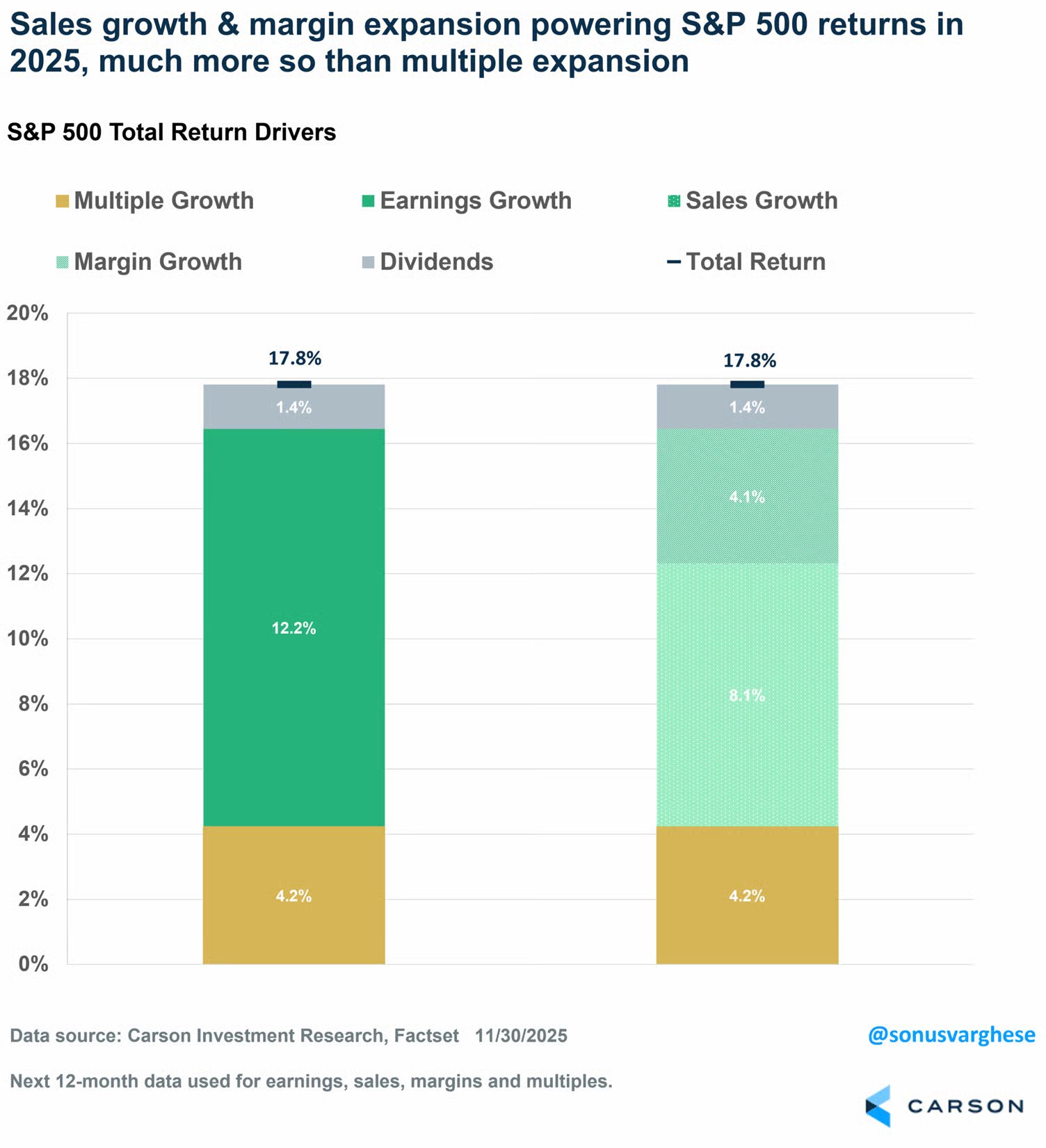

Ten: Make no mistake, strong business fundamentals have been the key catalyst for the ongoing rally in stocks

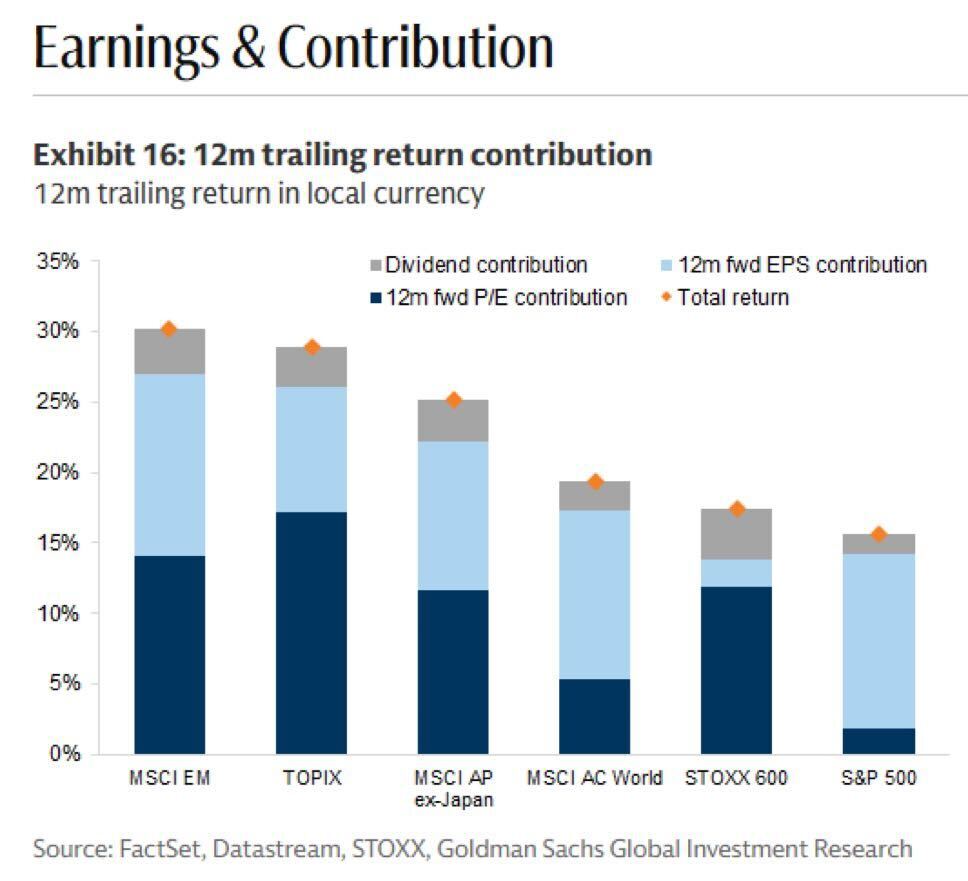

John Luke: and while fundamentals have been strong in most developed markets, the US has stood out for its earnings performance

Data as of 11.28.2025

Data as of 11.28.2025

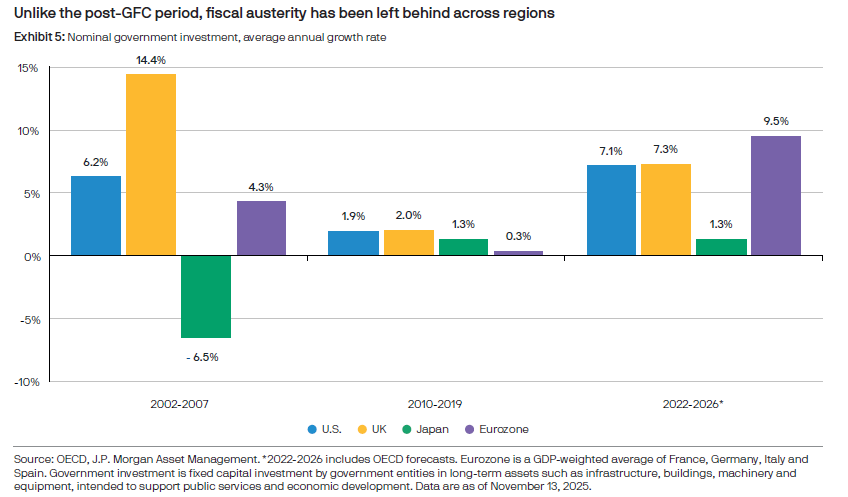

Dave: After failed attempts to hold government spending in check out of the global financial crisis, the rest of the world is now following the US into fiscal stimulus

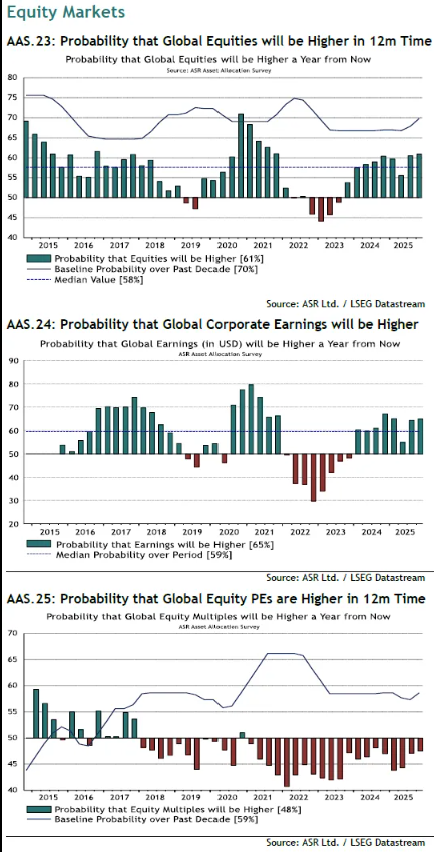

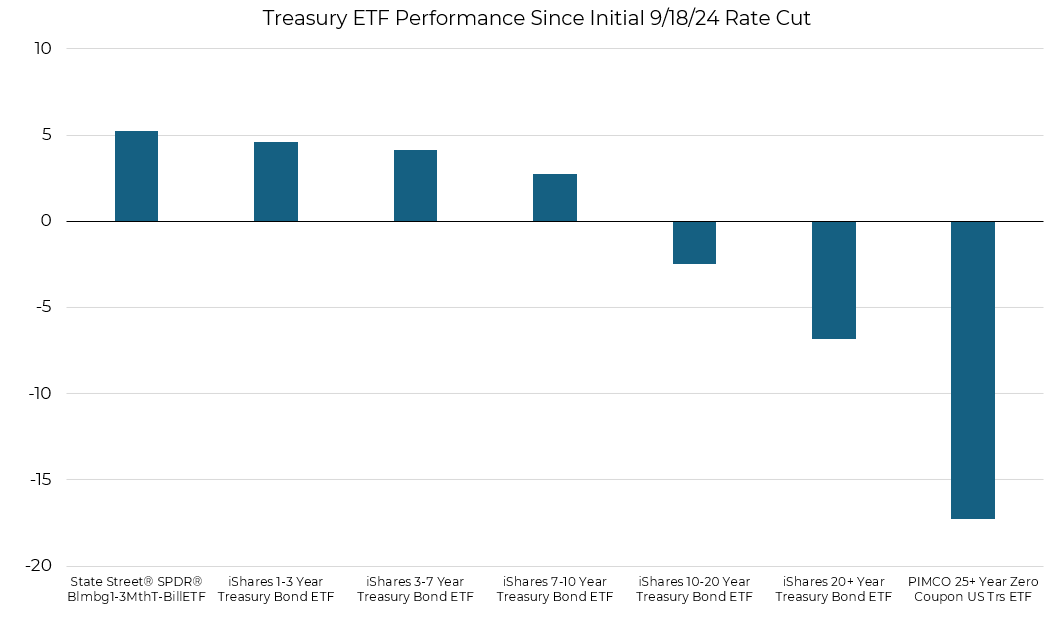

Beckham: Investors have embraced the idea that earnings, and ultimately stock prices, can go higher, but aren’t quite so optimistic about valuations

Graphic via Bloomberg 11.25.2025

Graphic via Bloomberg 11.25.2025

Brad: and the highest number of fund managers just pencil in the standard “5-10% return” for 2026

Graphic via Bloomberg as of 11.24.2025

Graphic via Bloomberg as of 11.24.2025

Joseph: with an inflation-throttled Fed ranking as the greatest challenge

Data as of 11.24.2025

Data as of 11.24.2025

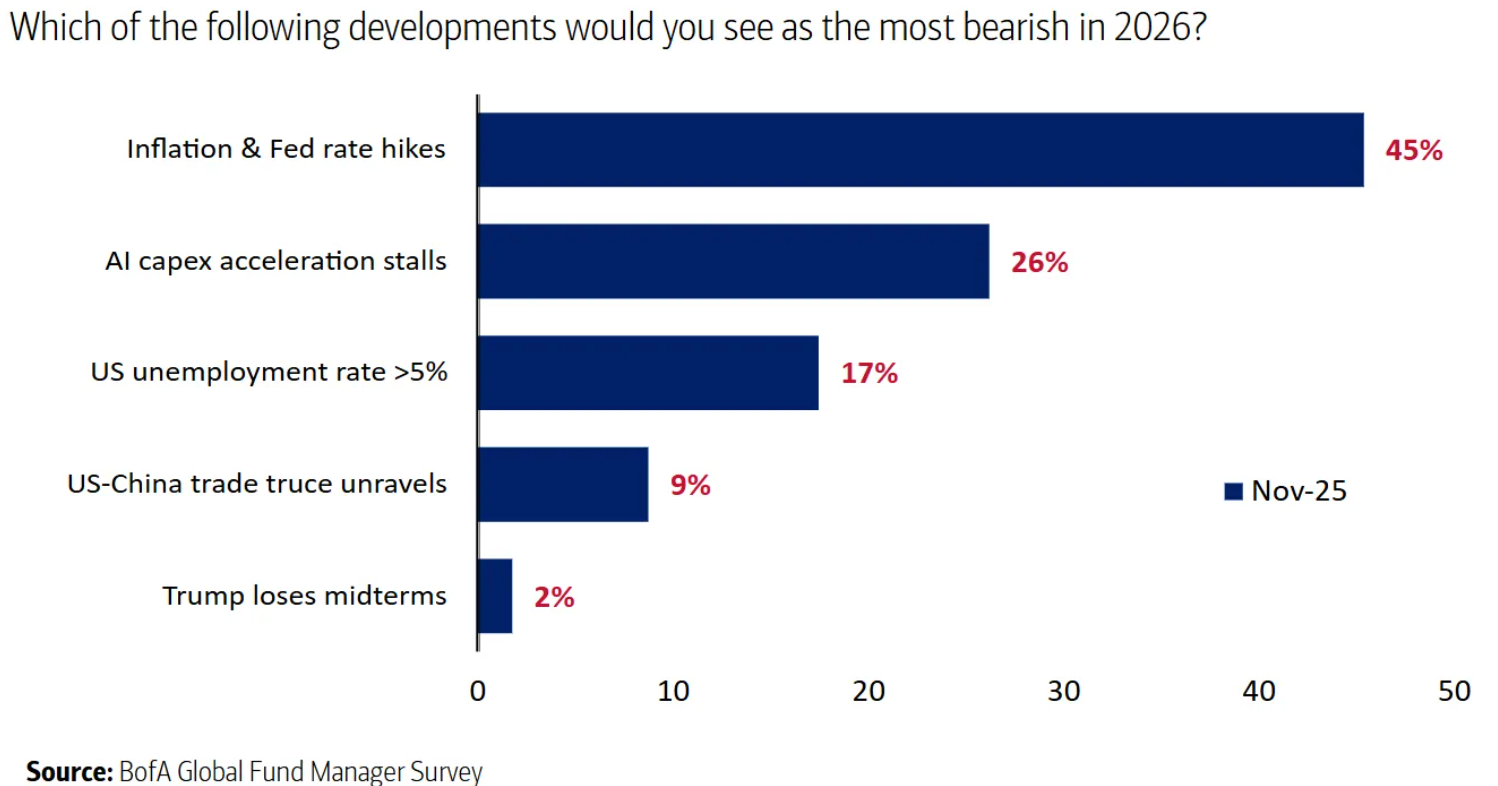

Dave: Long-term rates are behaving a bit better in this phase of the rate-cutting cycle than they did last year

Source: Strategas as of 11.25.2025

Source: Strategas as of 11.25.2025

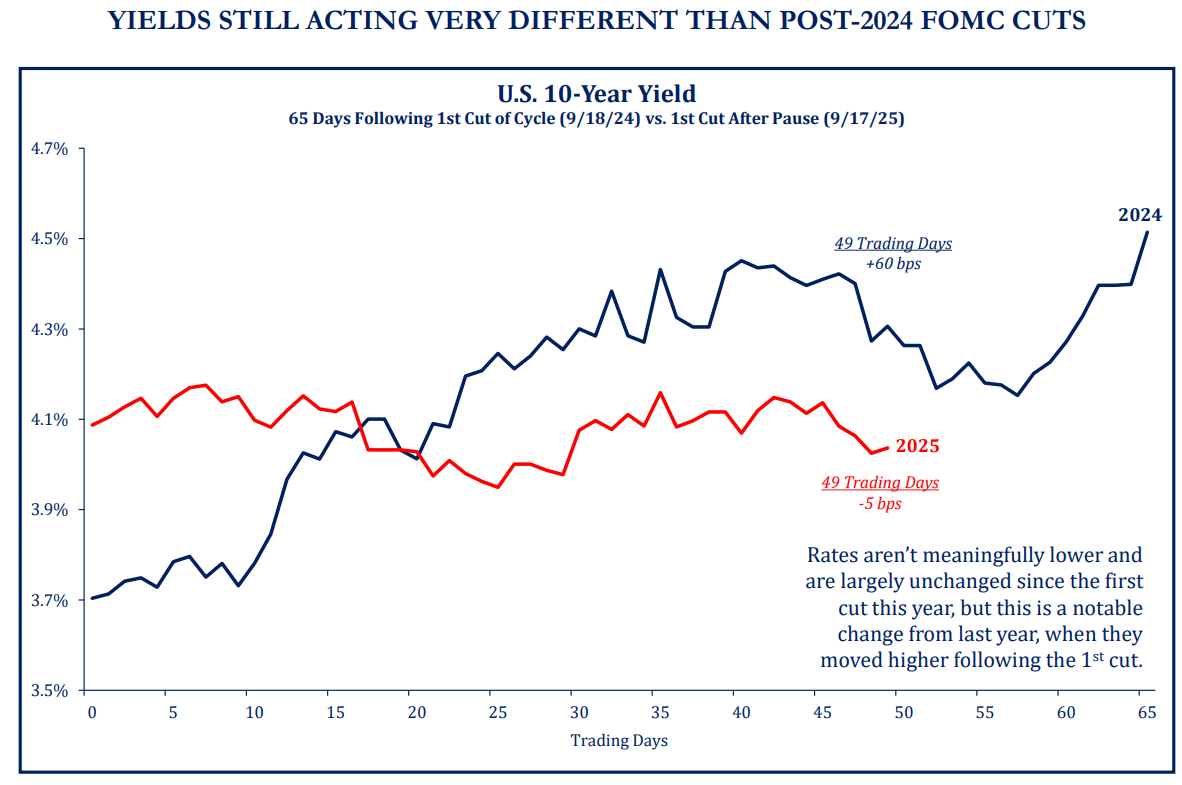

Brian: but the benefits of FOMC rate cuts have clearly faded as you go out into longer maturities

Source: Aptus as of 12.03.2025

Source: Aptus as of 12.03.2025

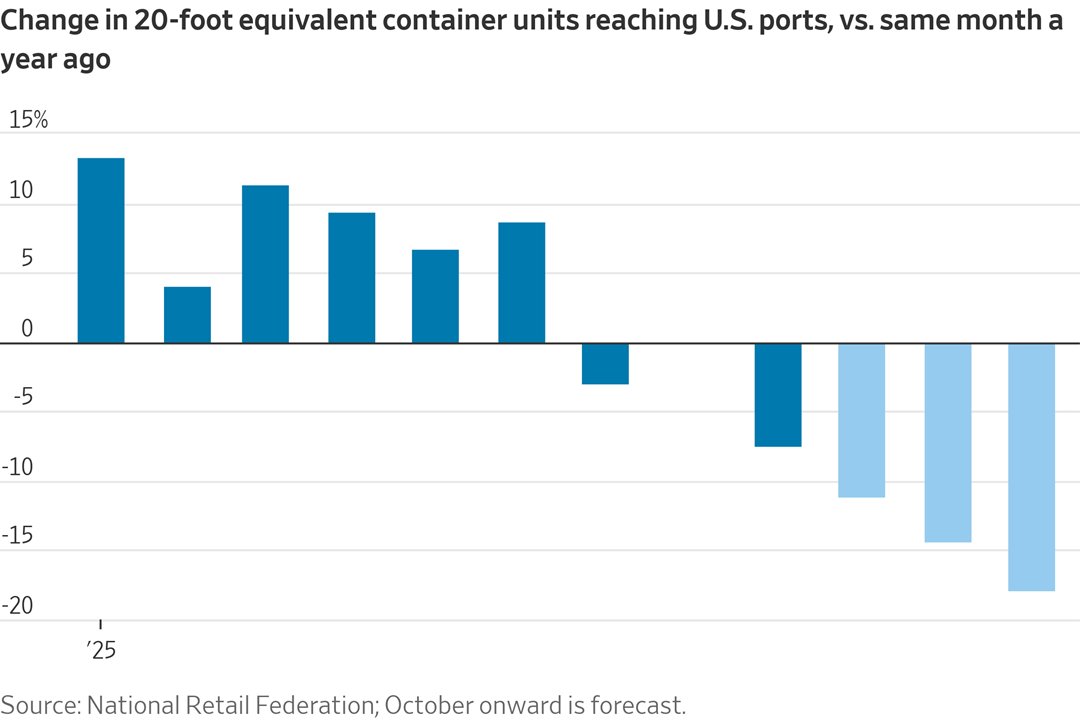

John: The Fed is seemingly dealing with mixed data on the economy and inflation, with trade activity down and expectations even lower

Data as of November 2025

Data as of November 2025

Joseph: and lower economy-wide margins impacting real wage growth

Data as of 12.03.2025

Data as of 12.03.2025

Jake: but large investments are growing at a high rate

Data as of 11.26.2025

Data as of 11.26.2025

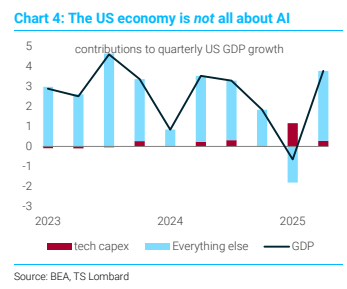

John Luke: and despite stories of AI being the only growth area, strength exists across the economy

Data as of 12.03.2025

Data as of 12.03.2025

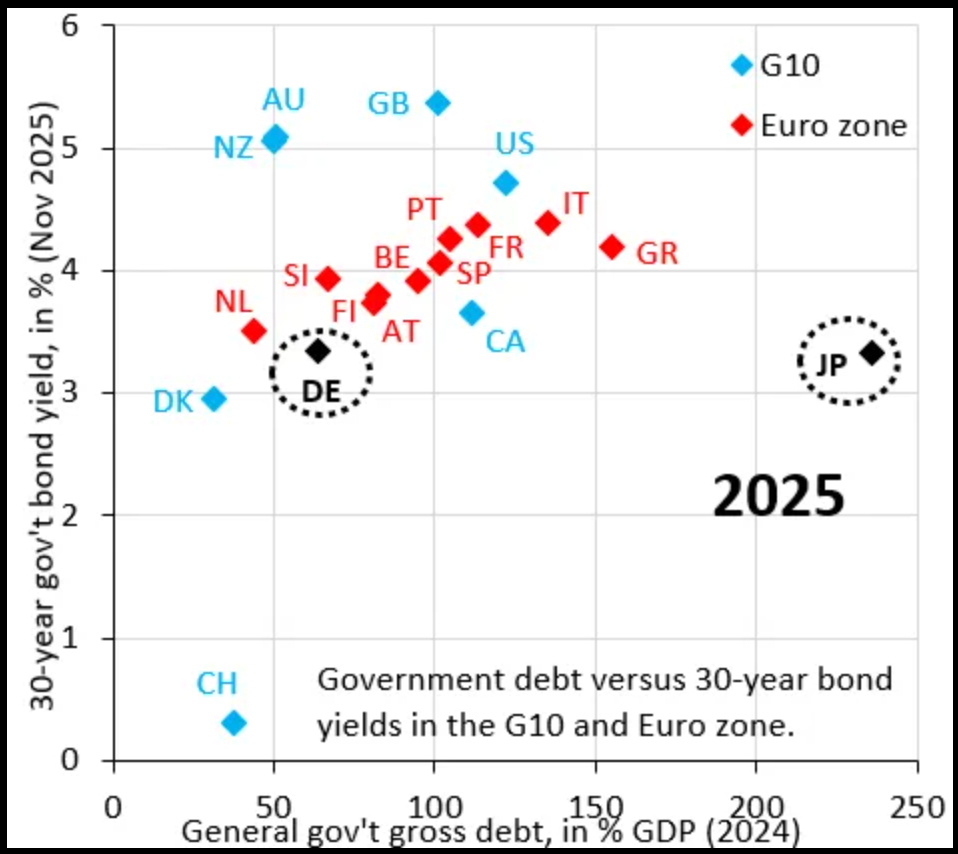

John Luke: Japan is in its own world for government debt

Source: Bloomberg as of 11.23.2025

Source: Bloomberg as of 11.23.2025

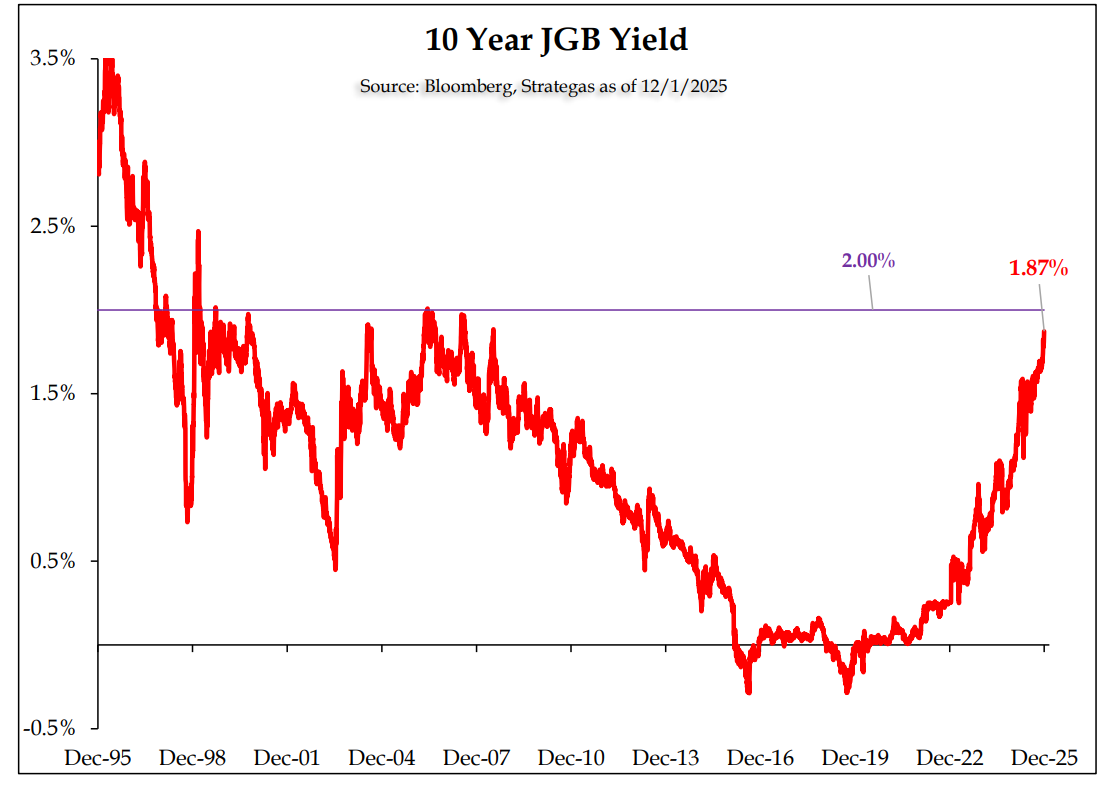

Dave: and we’ve only recently seen compensation move higher

Source: Strategas as of 12.01.2025

Source: Strategas as of 12.01.2025

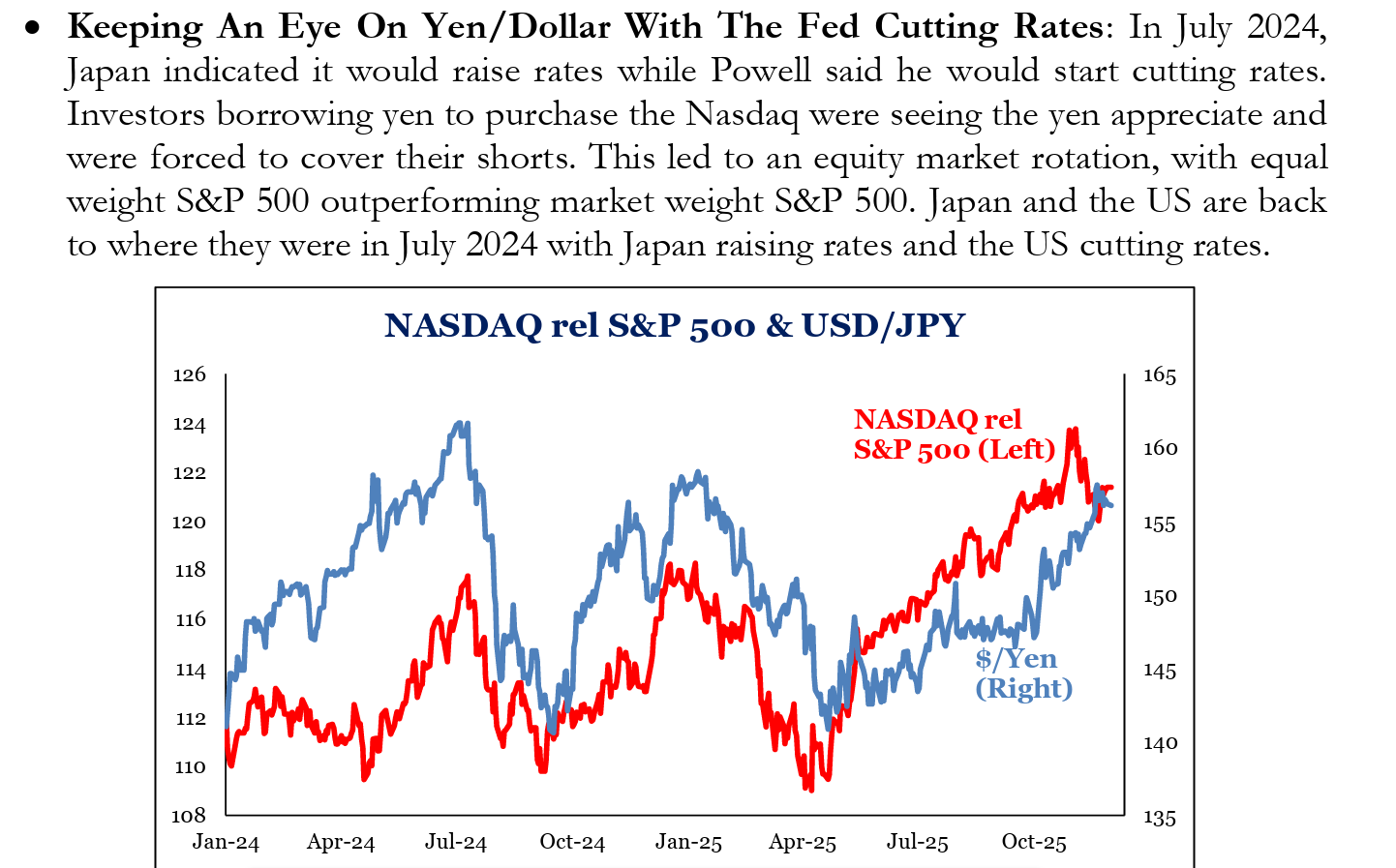

Dave: the main question for US investors is how the relationship between the yen and dollar will impact US stocks

Source: Strategas as of 12.01.2025

Source: Strategas as of 12.01.2025

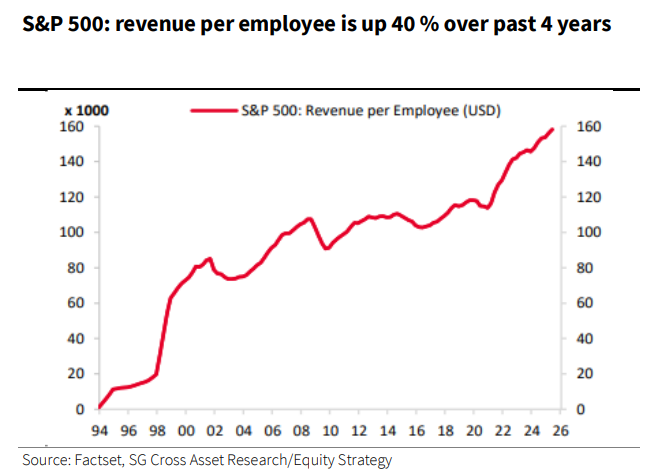

John Luke: Regardless of what’s going on in the rest of the economy, it’s amazing to see how productive the largest US companies have become

Data as of November 2025

Data as of November 2025

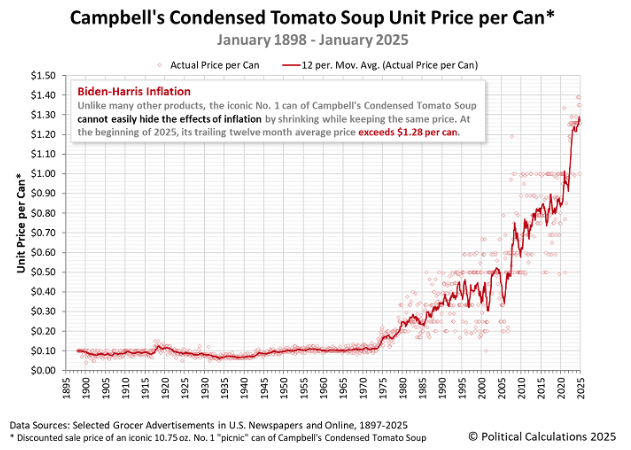

JD: hopefully enough to pay for the rising cost of their soup!

Graphic via Lyn Alden

Graphic via Lyn Alden

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2512-13.