Stroke Play or Match Play

For any non-golfers out there, match play is hole-by-hole scoring. Meaning, you play to win each hole individually. Your score from the prior hole is irrelevant to the next. In stroke play, it’s the cumulative total. Each hole contributes to the total.

Your client’s objectives around their investment portfolio are not only additive but compounding. While they may not realize that, you do. Their capital base is their means to play (so it should be protected), and each return is iterative. It builds on itself. I almost wrote this month’s note entirely around the importance of this. Maybe next month.

While short-term focus on each hole/holding can throw gas on the performance-chasing fire, we try to focus on a supported process that we can continually lean on, as the quest for compounded returns that keep financial plans on track extends into time.

In a match play game, there will always be somebody with a better score on each hole. It’s stroke play that ultimately matters…that’s the game we are playing. Our view of how we can utilize volatility in our process, we believe, puts you in a position to sufficiently compound client capital.

The Last Hole

Technology stocks won May. Most everything else lost. This has been the consistent theme of the year.

The QQQ’s were up nearly 8% on the month while the S&P 500 was barely positive. To highlight the discrepancy, compare that to RSP, which is Invesco’s fund that’s carries equal weights to the stocks making up the S&P 500. RSP was down nearly 4% in May.

Client Outcomes

How much does the prior hole impact your process? Maybe a better question, is your process a version of performance-chasing?

Those are tough questions to answer honestly. Performance-chasing is an innate human tendency that’s hard to suppress. The price action YTD, and even more so in May, amplifies the urge.

As with all things, actions speak louder than words.

Did you trade into value after its bounce in 2022? What about energy or managed futures? When did you make those buys? Were those buys driven by a long-term process, or something else?

The negative long-term impact of performance-chasing on a client’s ability to compound outweigh the near-term perceived window dressing effects it can provide. The behavior gap speaks to this.

Path to Success

A big part of our time is spent in internal discussions around our process. It’s what should drive and support the decisions made, and can help safeguard against portfolio changes that are not aligned. In our opinion, that requires a couple of things:

- An actual process

- Conviction and understanding of the process

We have strong convictions in what we do. Yield + Growth & Vol as an Asset Class: all those things you consistently hear and read from us. We believe in them, are always looking for ways to improve, and spend a great deal of time trying to communicate our approach in digestible ways.

We do this because clients are in the middle of a long-term game, one we feel we can help put them in the best possible position to win.

Fundamentals Matter?

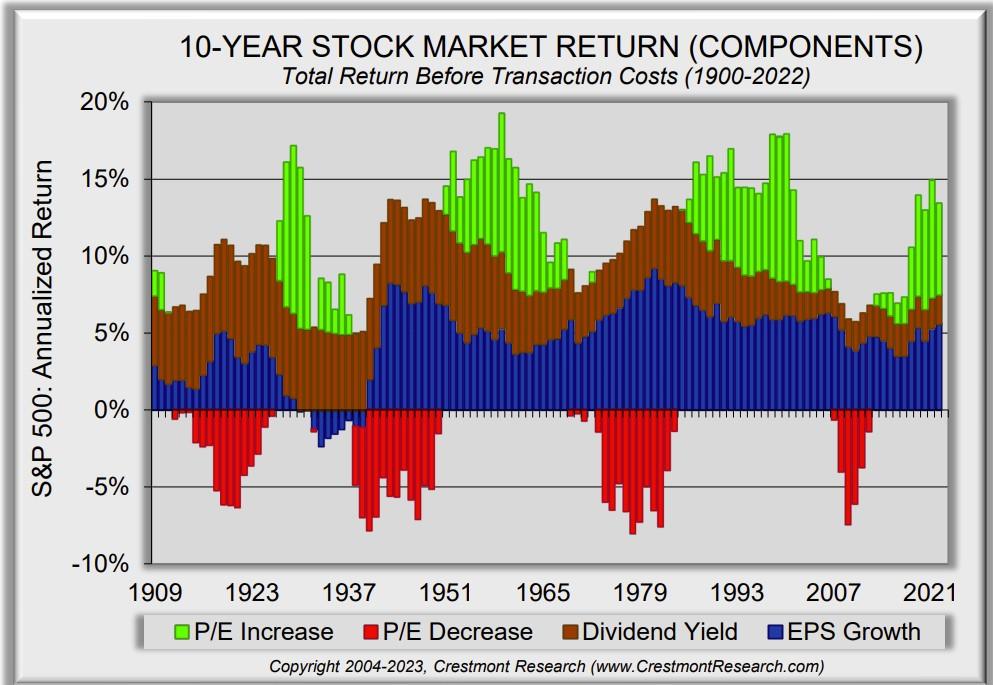

The image below is one to keep handy. Without too many words, I believe it provides compelling support for an approach built on durable Yield + Growth, versus P/E multiple expansion.

Throw in a splash of volatility to cover those periods when P/E ratios contract (green->red), and clients can be confident their financial plans are built on sustainable return drivers not fleeting ones.

Portfolio Updates

Rather than building portfolios with the hope of negative correlation between stocks and bonds to save the day, our focus is on using volatility to create optionality. “Better in the tails” is the mantra, and using volatility as an asset class is the path of execution.

June should be an exciting month as we expect changes to portfolios and the introduction of another strategy. More details to follow.

We are using strategies to position based on the windshield and not the rearview. If the rearview repeats the correlation anomaly, we’ll be plenty happy with the outcome. But if conditions have changed and the recent map is less useful, we’ll be happy to have prepared for a wider range of possibilities.

As always, thank you for your trust and please don’t hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-7.