Investors should have one goal – to compound capital. A sufficient compounded return is at the heart of all things related to financial goals.

That’s our goal in 2024. To provide the best solutions possible to improve your compounded returns, and to be excellent in our communication around that process.

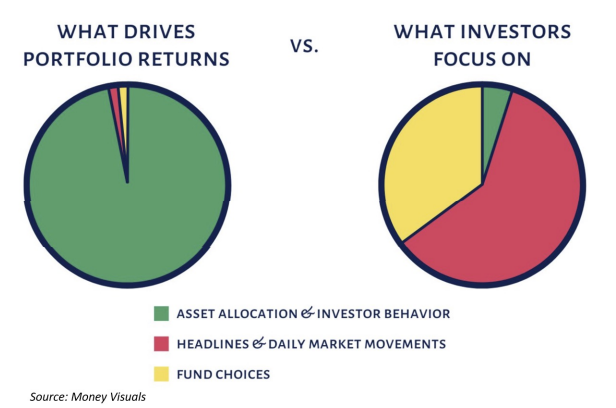

We spend most of our time discussing allocation decisions.

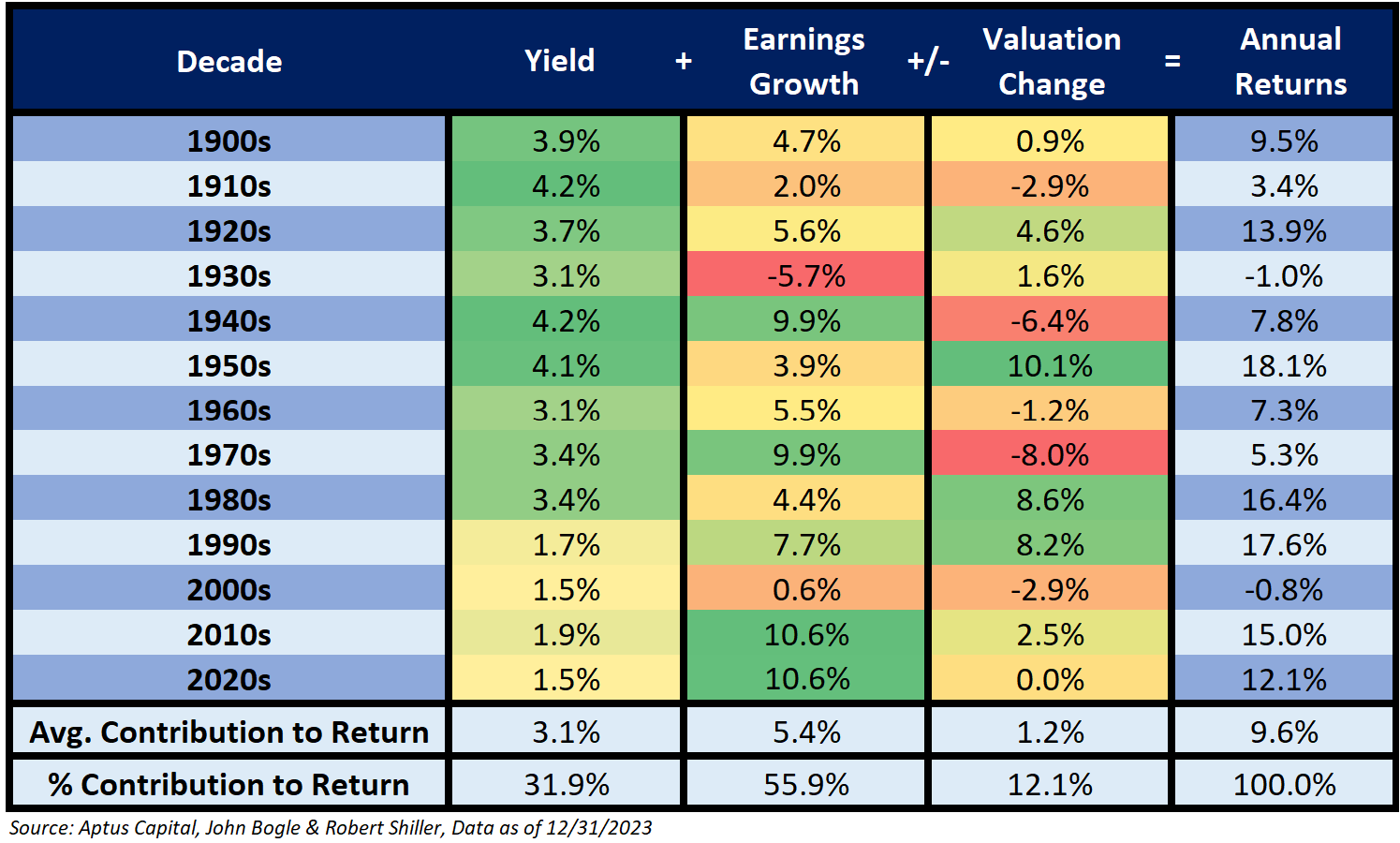

We harp on yield + growth because improving the “y+g” of a portfolio improves the compounded return.

The hardest part is building strategies and portfolio solutions that align with our convictions but are also “normal” enough. Anything different from the typical allocation needs to carry a benefit that outweighs the potential cost.

To kick off the new year, let’s revisit what’s different about our approach.

Compounded

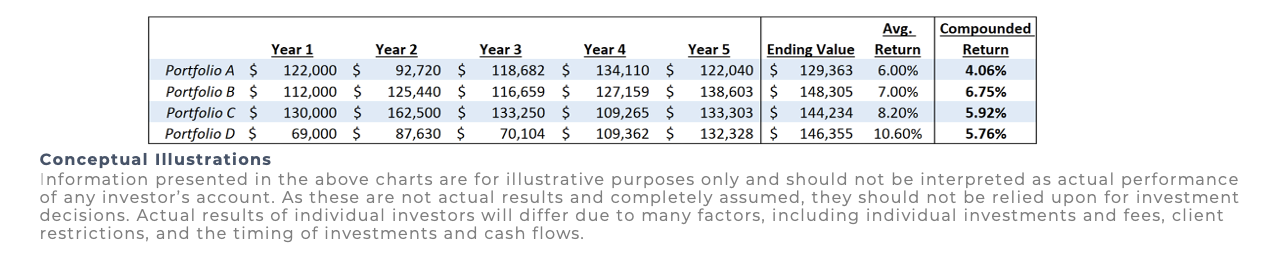

We’ve used the word ‘compounded’ on purpose. Compounded returns are what investors get – it’s how our money grows. The table below illustrates the difference between ‘Average Returns’ and ‘Compounded Returns’ between 4 different portfolios.

Compounded returns are created through a multiplicative process. Each successive return is determined by the previous outcome multiplied by the next one.

If that seems too complicated, the takeaway is simple: large losses are a wealth tax.

Each of the portfolios in the table above delivers 5 years of returns. Notice the arithmetic average is different than the compounded return. The difference can be referred to as the volatility tax.

Notice the winning portfolio B, while having a boring sequence of returns, produced no large losses and thus had the smallest gap between average and compounded return.

Large losses (or big drawdowns) are the single easiest way to create friction on your path toward compounded returns.

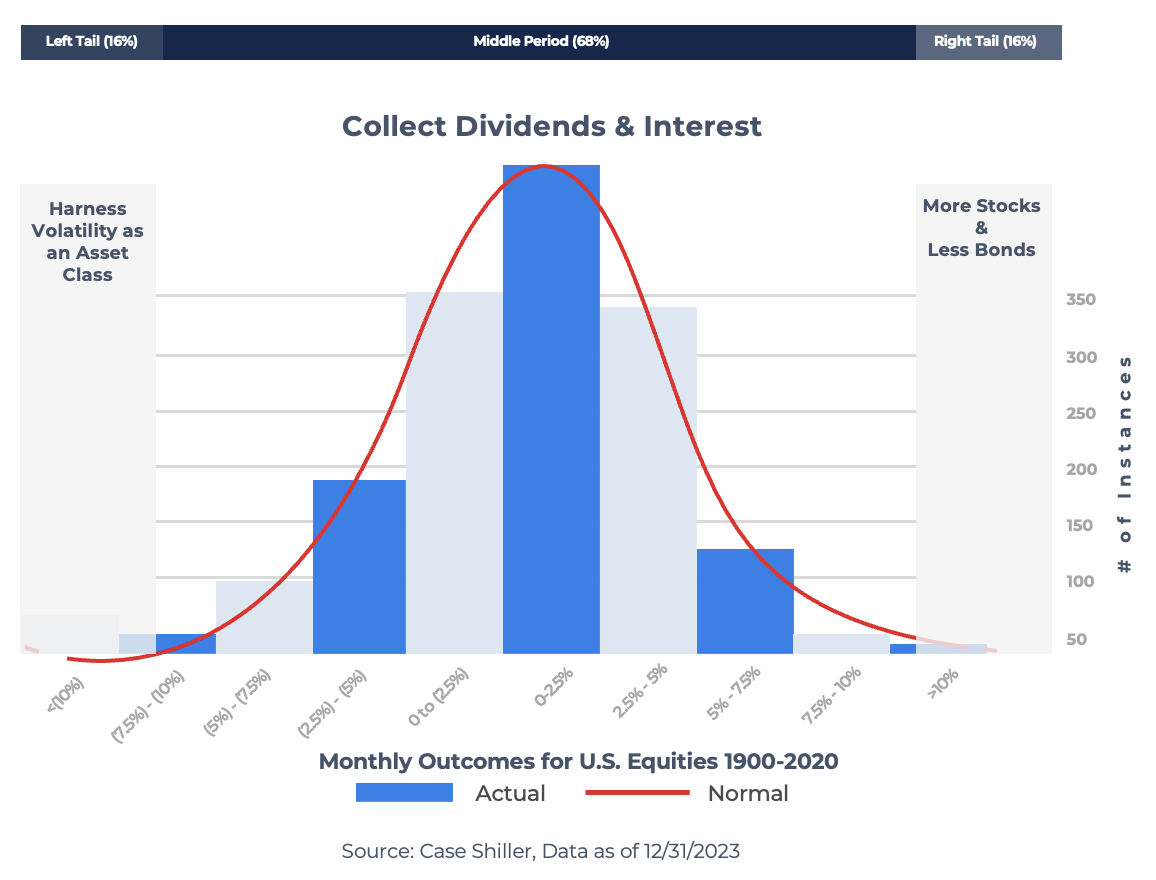

When investors worry about the market, or the Fed, or another financial crisis, etc….they are vocalizing their innate worry about their hard-earned wealth experiencing a ‘left tail’.

Their worries are supported. Their capital base is the thing to which these returns happen – it is what’s at stake. If compounded returns through time are the objective, the base from which they compound must be protected.

What’s the Real Risk?

Drawdown risk is devastating to compounded returns, but investors should be wary of swapping the perceived volatility risk for a known longevity risk.

The threat of drawdown can send investors looking for ‘safety’ when they make allocation decisions. CDs, money markets, fixed annuities, bonds, etc. Especially with the short end of the curve ~5%.

We see longevity risk as the biggest risk most investors face, without them realizing it. Real returns should be the focus, not nominal returns. The willingness to forgo equity risk in favor of perceived safety will have implications for the ultimate compounded return achieved.

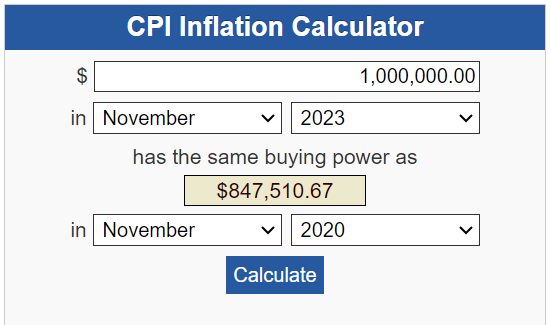

I won’t rehash last month’s note but just a quick reminder of what’s happened to the value of your dollar over the last three years.

Source: BLS as of Dec 2023

Source: BLS as of Dec 2023

Over just the last 3 years, we’ve seen purchasing power fall significantly. While this boiling frog effect may feel different than watching your portfolio fall in a sharp correction…make no mistake, the actual value of your $1m has eroded by >$50k/year!

I know, I know…inflation is coming down. But…

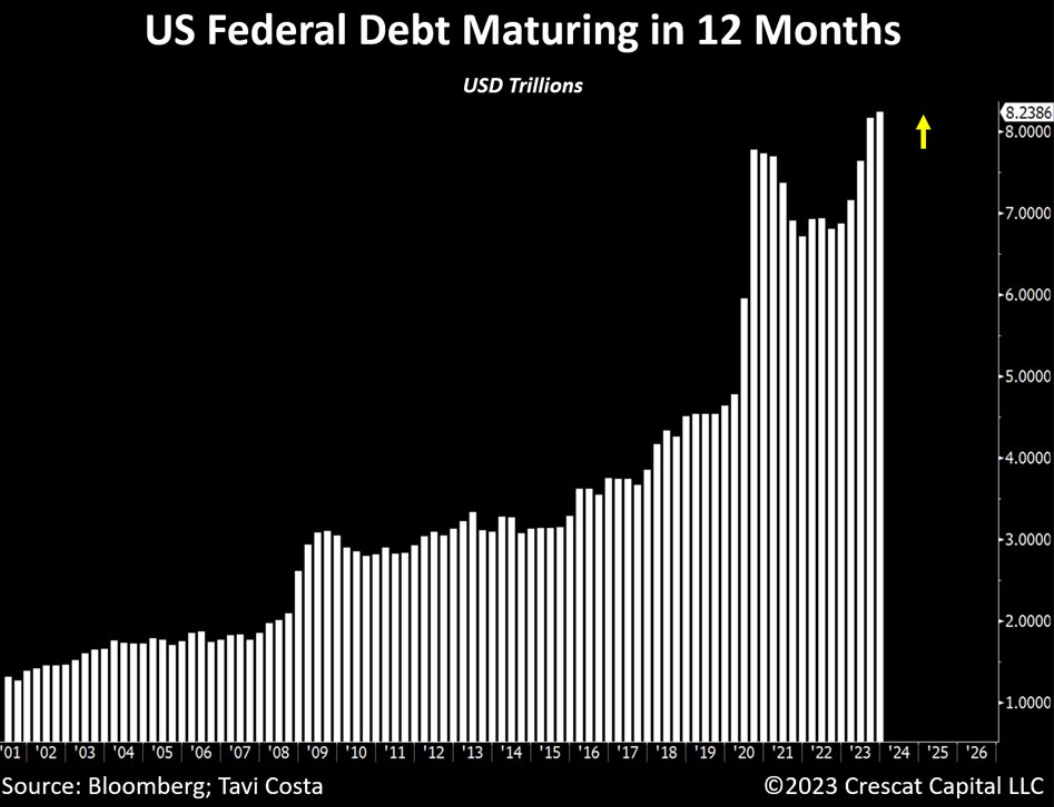

We have $8,200,000,000,000 (that’s Trillion with a ‘T’) of Treasuries that mature in 2024. That’s before we discuss any deficit needs. The supply of treasuries set to hit the market isn’t chump change by any means.

Fiat is created when new debt is created. Do you think the supply of fiat will increase or decrease in the future? If you hold something and the supply of that something can be increased, the value of your something should drop.

In a similar vein, if more treasury debt needs to be issued, thus increasing supply, the only way to have a bid on those bonds is to offer an attractive enough rate.

Data as of December 2023

Data as of December 2023

Without running those thoughts out, the point is to make allocation decisions that give us the best chance to produce real, sufficient, compounded returns. We believe investors will be rewarded for taking on equity risk. In fact, we think equity risk is a necessity, and portfolios positioned based on the golden age of bonds are introducing longevity risk.

Theory vs. Reality

Our industry is entrenched in a theoretical world, where correlations between asset classes are known and static. These assumptions have given rise to the portfolios nearly every wealth management shop delivers. Here’s a blend of stocks and bonds. More aggressive…we tilt towards more stocks. More conservative…we tilt towards more bonds.

For decades these assumptions have been fine. Bonds have provided correlation benefits AND positive returns. Bonds have acted like a positive carry hedge to the equity portion of portfolios.

What happens to these portfolios if that correlation benefit is watered down AND the engine behind those returns is much weaker than in the past?

In the last few years investors have realized that bonds are diversifiers and carry basis risk, meaning bonds can look bad when stocks look bad too. There’s a correlation risk absorbed when you allocate to potential diversifiers within a portfolio. If there’s enough positive return while holding that diversifier, maybe the juice is worth the squeeze.

In our opinion, we believe allocations should skew towards heavier weights to stocks. We believe more stocks and less bonds will be important to helping achieve desired compounded returns.

What About the Risk

For us to make this shift towards more stocks, we must account for the increased exposure to a ‘left tail’.

This is where hedges come into play.

Hedges are not diversifiers. Hedges do not carry basis risk. They are negative returning allocations that protect against the ‘left tails’. They protect against the drawdowns we fear so much.

The chart above illustrates what we mean by the ‘tails’. Normal or typical periods happen under the bell curve while the more unusual periods happen in the tails.

From a return perspective, we feel stocks are the stronger engine. We own more of them than typical allocations do. This should translate to higher returns in right-tail environments.

From a risk perspective, we use hedges to defend against the risk that matters. Drawdowns matter in our path of compounding returns, hedges defend against that. As a standalone, a hedge can look like a drag, as it’s a negative returning vehicles in most scenarios. But it’s the presence of their convexity that transforms the portfolio’s ability to take on more risk to drive returns higher. Team over players.

We don’t hedge to reduce risk. We hedge to improve returns. To be repetitive, it’s the presence of the payoff that transforms an allocation. A hedge’s convex payoff shows up in the environment it’s needed most, left tails.

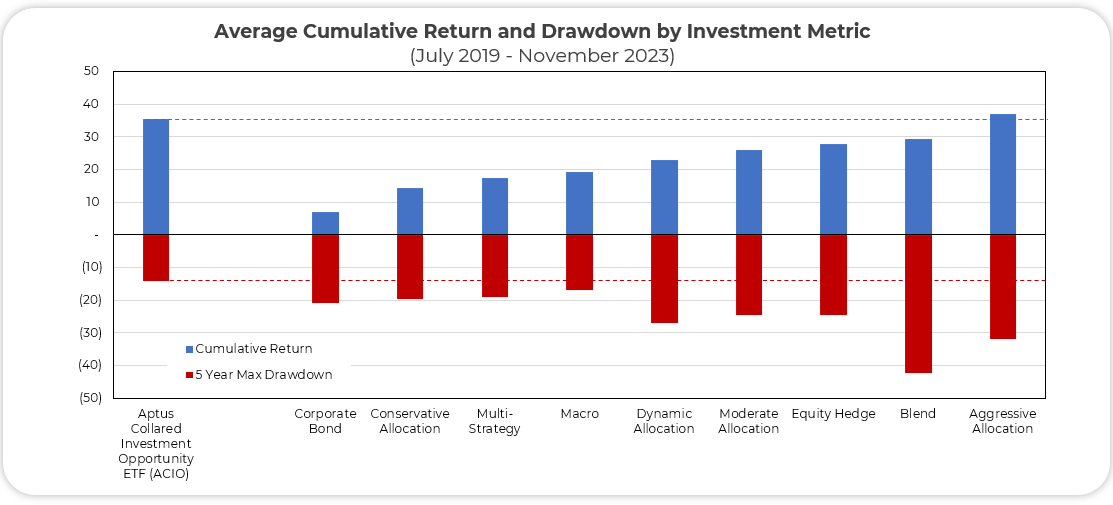

The end result of our portfolios vs. more traditional benchmarks should be higher compounded returns, with digestible drawdown events along the way.

ACIO continues to be a workhorse for us and a great illustration of this in action. It’s a simple equity collar that provides portfolios the ability to confidently absorb more equity exposure.

Source: Aptus via Bloomberg as of 11.30.2023

Source: Aptus via Bloomberg as of 11.30.2023

Our Portfolios in 2024

More stocks & less bonds, that’s been our theme and it’s hard to see that changing.

Within each portfolio and the risk constraints within, we are leaning into more and more of a barbell portfolio. More growth in the allocation, and better brakes.

Convexity is key. Its presence allows us to confidently absorb more stock exposure without worrying about the potential exposure to volatility tax.

As investors and stewards of wealth, we need to consider opportunity costs in each decision we make. We’d rather absorb short-term volatility from greater exposure to growth assets, than watch our purchasing power “safely” erode.

I’m thankful for your trust and I hope this note triggers questions. Please do not hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-11.