The market is learning that the economic cure of last year is now quickly becoming the cause for something else. The ramifications of unprecedented fiscal and monetary responses employed to combat a recession during the global pandemic should not come as a surprise to investors that a bill would come due soon. The question is – are we fully paid up or is there still an outstanding balance? The odds point to the latter.

learning that the economic cure of last year is now quickly becoming the cause for something else. The ramifications of unprecedented fiscal and monetary responses employed to combat a recession during the global pandemic should not come as a surprise to investors that a bill would come due soon. The question is – are we fully paid up or is there still an outstanding balance? The odds point to the latter.

Coming off of a near-decade long period of what felt like “free lunches” —called quantitative easing— investors are quickly learning that the environment today is much different than the one they’ve been accustomed to. As we transition into a quantitative tightening period, many investors were unprepared for the quixotic quest that they had to navigate in ’22. Multi-decade high inflation appears to be more structural than transitory, coupled with the fastest monetary tightening policy in recent memory. And all of this is in the face of slowing growth and a bear market.

After recently traveling to south Spain, where I would routinely pass wind turbines on every train ride, I was reminded of another quixotic quest set forth by someone in the 16th century – Don Quixote and Sancho Panza. This novel describes realistically what befalls an aging knight whose battles were more metaphorical than real, as he was bemused by readings of historical romances. The battles entrancing investors today are not metaphorical by any means, yet they feel like they are being fought with weapons that appear to be based off of techniques used in the 1500s – leaving investors’ sole protection to be weaker than Quixote’s self-made antique armored suit.

There has been no place to hide in the market today, as portfolio positioning was more about mitigating risk. Bonds, the “safe” asset class, were not the chivalrous knight that comes in to save the day. In fact, since 1977, every year that stocks have been down, bonds have appreciated in value.

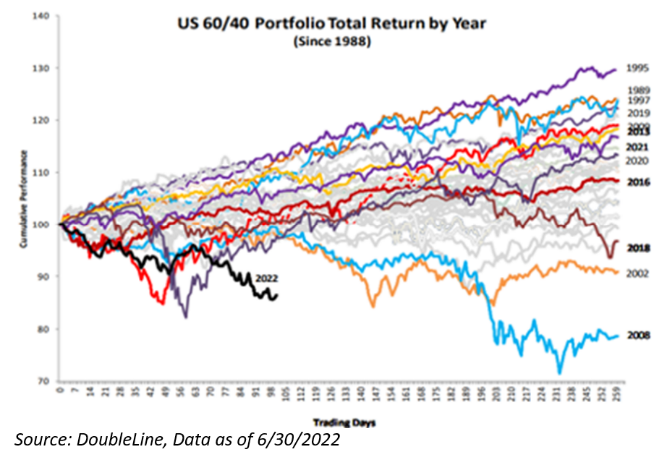

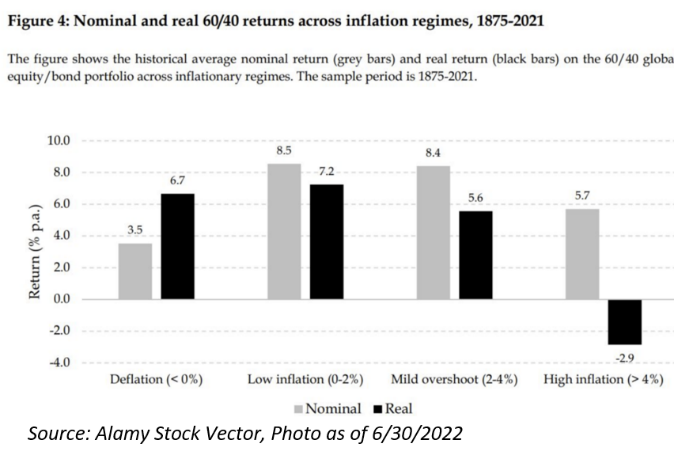

When inflation is the primary macroeconomic driver, stocks and bonds tend to correlate as both prefer low-inflation environments. Given the carnage, the most impactful positioning was avoiding the areas of the market that imploded, i.e., the Ponzi stocks. Given performance in both equities and fixed income, the 60% stocks / 40% bonds portfolio has never produced a worse year-to-date return than it has this year.

At the halfway point of this year, ’22 continues to produce some of the most extreme returns in history.

- The S&P 500 is off to one of the worst starts ever. With price data only going back to 1927, the first six months have produced the fourth worst start to any year on record. Only beating 1932, 1962, and 1970.

- The U.S. Bond Market continued to be a bloodbath with the Barclay’s U.S. Aggregate Index losing 10.35% in 1H ’22. With data only going back to 1976, this is easily the worst start on record. Looking at this from another light, U.S. Bonds are now 12.1% off their peak. This is almost three times larger than most of the drawdowns since the 1990s.

We’ve continued to state that the return of the S&P 500 is fully attributable to valuation compression, and we believe the current multiple reflects this new inflationary regime. But we would be hard pressed to say that current levels reflect the possibility of a corporate profitability recession, i.e., earnings.

Moving forward into the 2H ’22, we continue to focus on three key items: 1) The transition from a QE to QT environment, 2) The structural effects of inflation, and 3) U.S. corporate profitability. We believe that until we get clarity on these items that the volatility in the market will continue.

Idea in the Real

In what has been deemed the first modern novel, the key thematic of Don Quixote is the possibility of finding the idea in the real. Yet, in today’s age, investors are learning that nominal returns aren’t in fact the real returns. The public detest of recognizing the negative aspects of purchasing power, i.e., inflation, has driven the consumer sentiment index to its worst reading on record. The idea in real returns is new to investors, as globalization has kept a lid on inflation since the early ‘80s.

This puts the Fed on the horns of quite a dilemma – to fight inflation for both reputational and political reasons or to backstop the market once again in the face of market turmoil. We’d argue that the former is more important. But this is a heavily debated topic, as history would point otherwise. Since the creation of the Fed Funds rate in 1971, the market has never witnessed a 20% decline in value without the FOMC cutting the Fed Funds rate at least once. But, at this juncture, the market is expecting another 0.75% hike at the next meeting. Quite a change of course.

The second half of this year could depend on if there is some sort of pivot from the Fed. We know that the Fed has never raised rates when market performance was a result of a valuation reset – it has always been the scapegoat of an earnings decline. If the Fed balks and pivots, a new narrative could be created. The Fed has started to talk the talk with inflation, as they are solely focusing on only one aspect of their dual mandate – price stability. We’ll see if the market and rates start to talk the talk. Thus far, given that real rates are negative, the market hasn’t.

Fighting Windmills

At its core, Don Quixote does not accept current reality. His set of chivalry-themed hallucinations, though well intended, ultimately prove to be false. Each hallucination put himself and Sancho Panza in trouble. Over the past year, the Fed has been fighting windmills, hallucinating that inflation was transitory, which ultimately proved to be more structural in nature, putting the market and the consumer in peril. Now, the Fed has a credibility problem, and they’re trying their best to regain it through the fastest period of monetary policy tightening in years.

We will see if the Fed’s actions will be able to navigate a soft or hard landing. The verdict is still out on if the Fed can deliver a soft landing without substantial demand destruction. Moving forward, all we ask is that the Fed fights inflation, not windmills.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-14.