I’ve been asked what we thought about the magnitude and sustainability of last week’s market reaction to Thursday’s CPI print. We love putting things into context and last week’s rally is very difficult to do so.

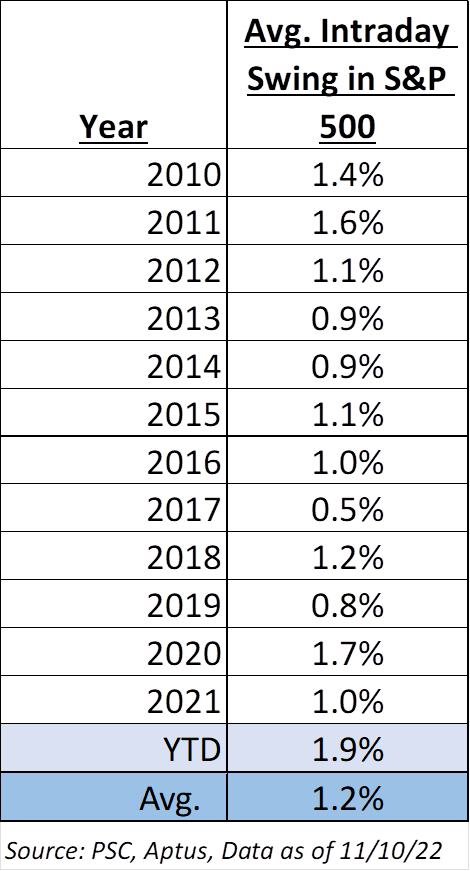

Thursday’s CPI print spurred one of the biggest 1-day moves in history. If you’ve been a long-term reader, you would know that many of the market’s largest moves occur during the midst of a bear markets (please reach out if you’d like this data). Thursday’s market movement was a wild swing, but this year has been full of market swings! Luckily, this swing was to the upside.

Putting It into Perspective

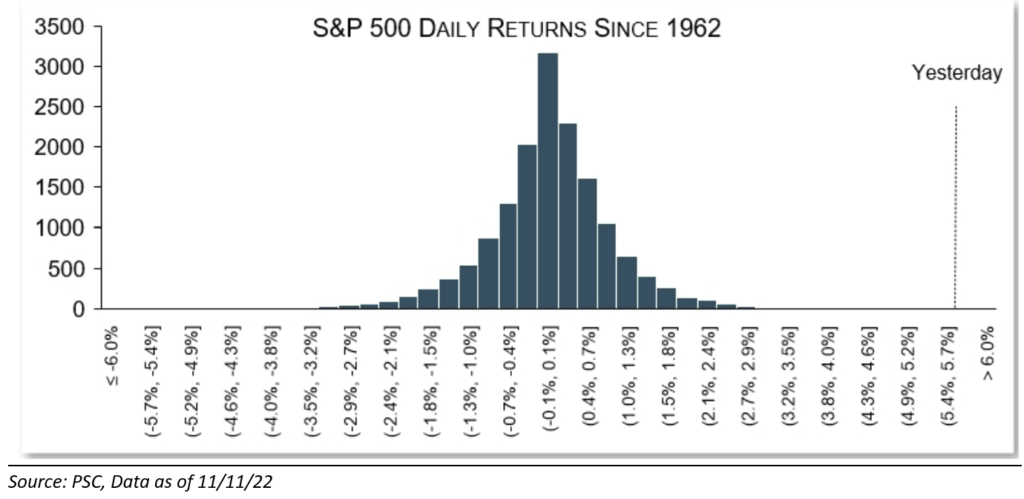

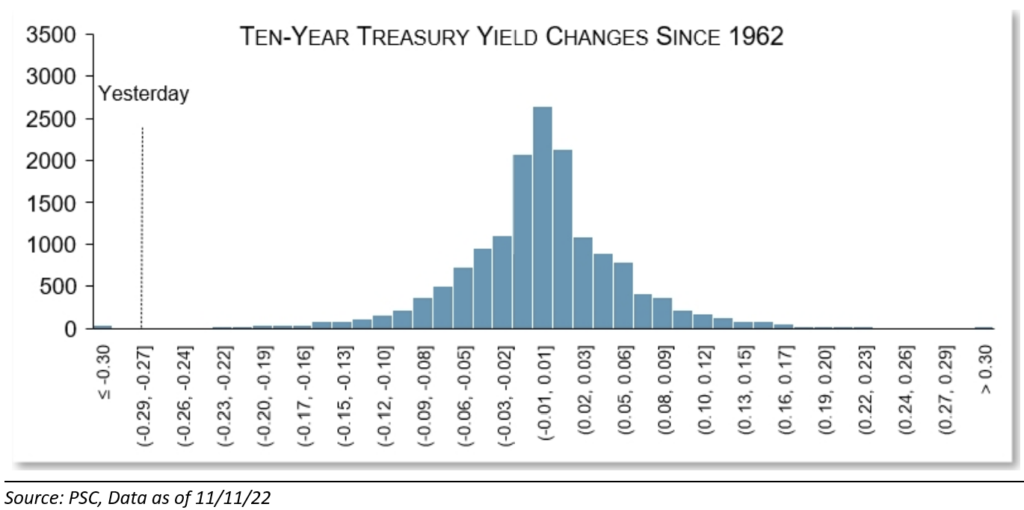

Thursday’s move for both stocks and treasuries is a clear market definition of a right tail event. One of our partners, Piper Sandler, ran some numbers to put the move into context:

- Stocks– Since 1962, the market has seen 15,878 trading days. With the S&P 500 rising 5.54% in a single day, there have only been 14 days on record that have performed better à 0.09% of the time.

- Treasuries– Last Thursday saw the 10-YR Treasury fall 27bps. Since 1960, it has dropped by more only 46 other times à 0.29% of the time. The interesting thing about the Treasury market is that about half of the previous outsized drops occurred in 1980 or 1981, when the market wanted to believe that the Fed was finished tightening.

Why Did the Market React the Way that it Did?

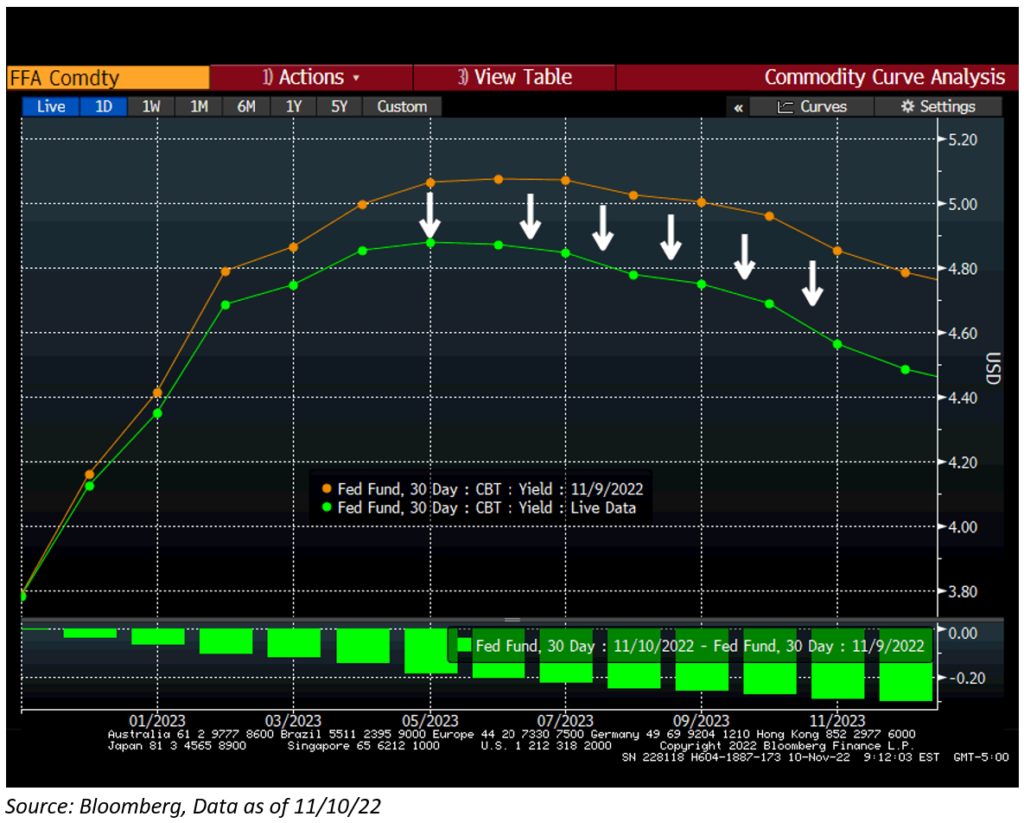

The market now expects a lower and earlier peak rate than it did before yesterday; basically, the terminal rate was moved lower and Fed Funds cuts are pricing in to occur sooner. If you’ve heard us talk recently, you’d know that we are probably on the side that these expectations are a bit too optimistic. Why?

First, the broad inflation picture hasn’t changed. Secondly, the Fed officials who spoke after the CPI release yesterday continue to sound focused on bringing inflation down. Thus, I’d be surprised to see if the median FOMC member changed their expected peak rate from 5% (which the market is pricing in < 5% now).

What Would Prevent a Year-End Rally?

It appears that a 50bps hike can be written in stone in December. But with earnings season over and CPI looking suddenly very encouraging, what could prevent the market from rallying into year end? These are the top risks that come to our mind:

- The Election is Not Finalized– It’s assumed that the Republicans will win the House – Votes are still being tallied. Just a reminder, it’s not over yet.

- Commodity Inflation – The disinflation theme in the near-term could crush spending sentiment as China re-opens and/or Russian sanctions affect supply. I believe that oil / commodity inflation is one of the most impactful risks to inflation re-accelerating.

- Fed Hawkishness – With Fed speeches over the next few weeks, one would assume that they continue their hawkish tone through the remainder of the year regardless of their internal beliefs.

- China Wildcard – If China makes it apparent that that any loosening of their “Zero Covid Policy” will be modest.

- Recession Talk– Economies really start weakening as we head towards year end, getting investors more focused on the declining EPS expectation environment rather than the improved inflationary environment.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10-year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-13.