The Cincinnati Bengals had a BYE this week, so I thought that I would do some reflecting not only on their first ten games, but over my last two musings – earnings and the mid-term elections. For the former, unlike the Bengals expectations at the beginning of the year, earnings were relatively strong (versus expectations). For the latter, Democrats performed much better than originally anticipated considering the macro backdrop and low presidential approval rating.

A few things that I’m watching into the end of the year – please reach out if you have any questions on these items:

- The Strategic Petroleum Reserve (“SPR”),

- December’s “most influential CPI report in recent memory”,

- Fed speak post market reaction to last Thursday’s softer-than-expected CPI report, and

- Any progress in the lame duck session regarding the debt ceiling.

I’m going to start on our 2023 Outlook over the next few weeks to be published in December.

Earnings Season Recap:

Given that earnings season is basically behind us, let’s dissect the results and asses its implications for market and inflation moving forward. Outside of a few retail stragglers, earnings season is essentially over. This earnings season appeared to be a complete redux of Q2. There has been earnings weakness, but largely not as bad as feared in aggregate. Earnings grew by 4.3% (+7.1% last quarter), while revenue growth continued to be strong at 11.0% (+12.7% last quarter), well ahead of the market’s expectations of 9.0%. If you exclude Energy, EPS came in slightly negative.

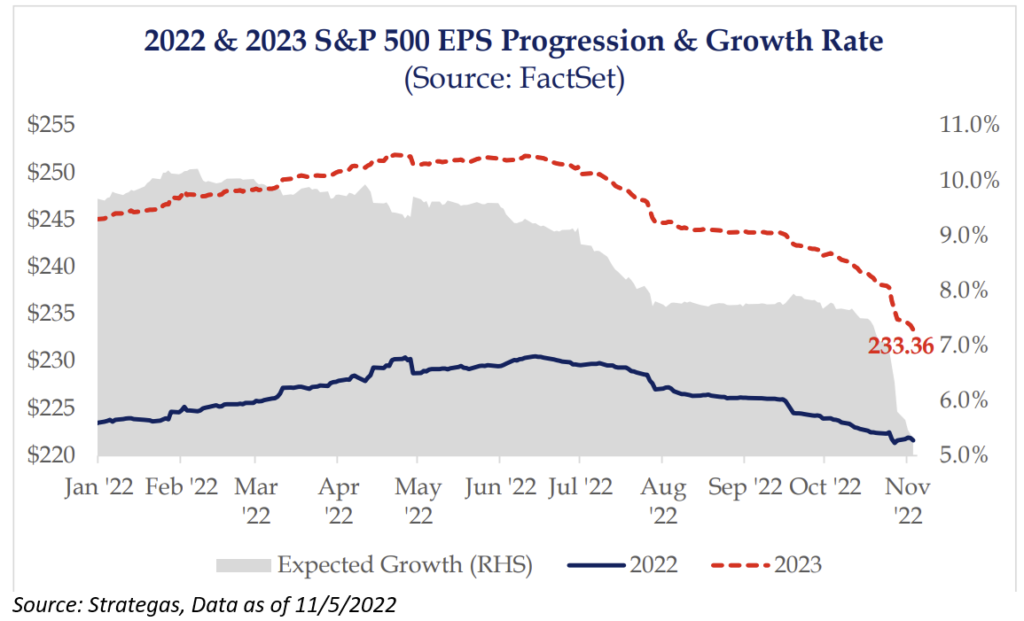

The biggest story from our perspective has been the lowering of 2023 outlooks. Currently, the aggregate EPS estimate sits just above $233 – down from a high of $252 back in June. Growth for next year is now expected to be +5.3% which is still well above expectations should a recession come into play. One item worth noting is that a 2023 recession is pretty much becoming the base case scenario but it’s possible that the strength of the labor market pushes it out further.

While revenue growth is still coming in strong—thanks to inflation—costs are rising at a much faster pace. This is putting pressure on profit margins. The margin story is a tale of two factors and highlights the Fed’s challenges. Unit labor costs have been sharply outpacing CPI within the context of anemic or outright negative YoY changes in productivity. The wage gains have underpinned producer price increases. The fast pace of PPI vs. CPI gains illustrates the margin pressures afflicting firms. More recently, PPI has been slowing. Is this a signal that tight monetary policy is working, and the Fed can navigate the glide path of a soft landing, which would help support margins and corporate profits again?

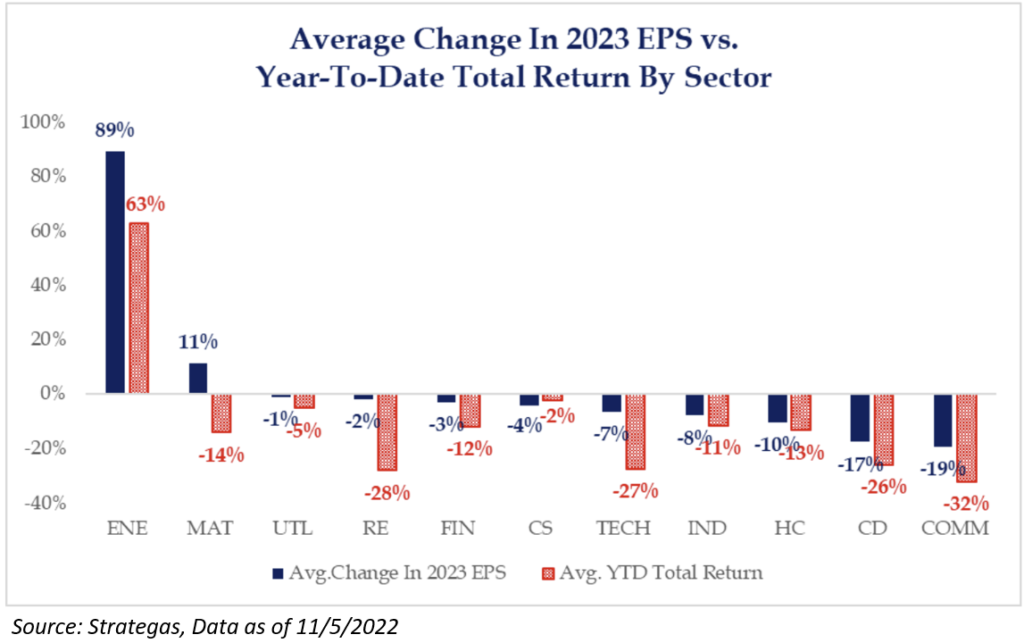

Nonetheless, Energy was the main driver of earnings growth this quarter. Every other sector saw miniscule growth or an outright decline YoY. When you fast forward to ’23 – Energy continues to appear the area of strength.

When reflecting on individual earnings reports, META / FIS / AMZN / GOOGL / Highly-Valued Tech stick out as the names that were punished the most. If a company missed earnings expectations, the stock was down 640 bps relative to the S&P 500 on the following day – the largest in history (242bps is the historical average). Beats saw a slightly smaller reward (+134bps v. +149bps historical avg).

We are still seeing an interesting skew with small/mid cap index EPS expectations holding up better than large cap, while EPS expectations in value indexes are holding up better than growth indexes. We suspect this will continue as the substantial weakening in international economies seems increasingly evident, even as U.S. consumer spending and the overall U.S. economy remained strong through Q3, and the greater international exposure of larger caps and growth as a style is becoming evident.

Lastly, given inflation and the trajectory of the Fed’s monetary policy, it will be interesting to see when earnings finally bottom out. I believe that this is one of the main catalysts of the market finally being able to begin a new regime.

Mid-Term Elections:

I’ll be brief because politics disgust me.

Almost a week later, results have not been finalized, but signs point to a small majority for the Republicans in the House and the Senate being retained by the Democrats. But while it’s clear expectations of substantial Republican gains proved false, the net result for markets is the same: A split government. While that doesn’t change the impact of the elections, again a split government, it does account for why we saw markets unwind some of the split-government rally of the past several days.

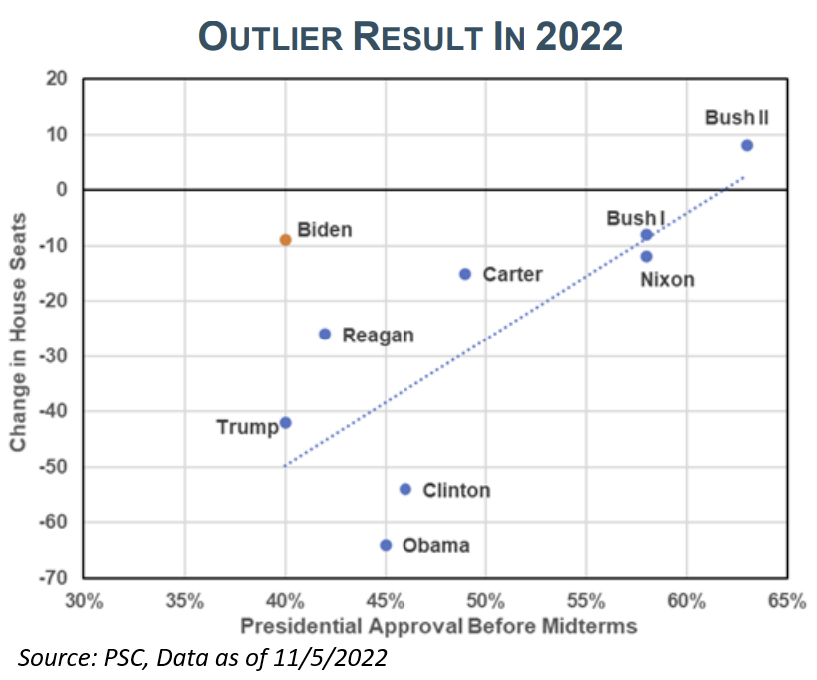

President Biden defied logic and history in this midterm election. A president with a 40% approval rating should lose 47 seats in the House (based on history). Democrats are tracking at just a 7-seat loss. No other president even comes close to such a trend deviation.

Our thesis has been that if the Republicans didn’t sweep in the midterm elections, the odds of a more aggressive lame duck session of Congress increase. We believe this to be true now that it is looking more like a divided government scenario.

My biggest hope for the markets is that potential House Leader McCarthy can push the Democrats into taking care of the debt crisis before January 20th – otherwise, the market could repeat 2011 next year – debt crisis volatility. More on this at a later date.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-14.