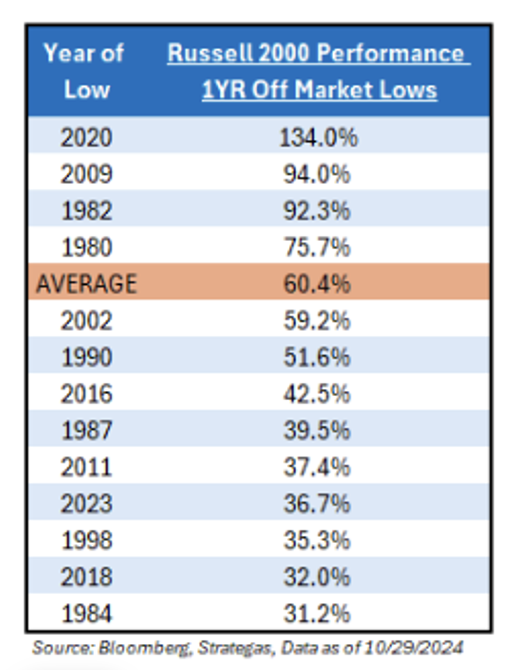

Both the S&P 500 and Russell 2000 marked their last major correction low roughly one year ago (10/27/2023) with each now in the top decile of their historical 12-month price momentum. Yet, small cap stocks have underperformed their larger cap brethren during this bounce back, which goes against the performance norm of Small > Large after a correction. As of 10/27/24, U.S. Small Caps were +36.7%, while Large were +43.1%. The narrative trade of Artificial Intelligence (“AI”) is to blame, given the dearth of supply in Small Caps.

Historically speaking, Small Caps have been one of the best performing asset classes to own coming out of an election; we’ll see if we get a catchup trade after November 5th.

Table of Contents for today’s Musing:

-

- What is the Market Telling Us?

-

- Non-Political Thoughts Around the Election

-

- How our Allocations are Prepared

If anyone wants to talk through anything market or election related, give me a call at any time.

Let’s Begin…

What is the Market Telling Us?

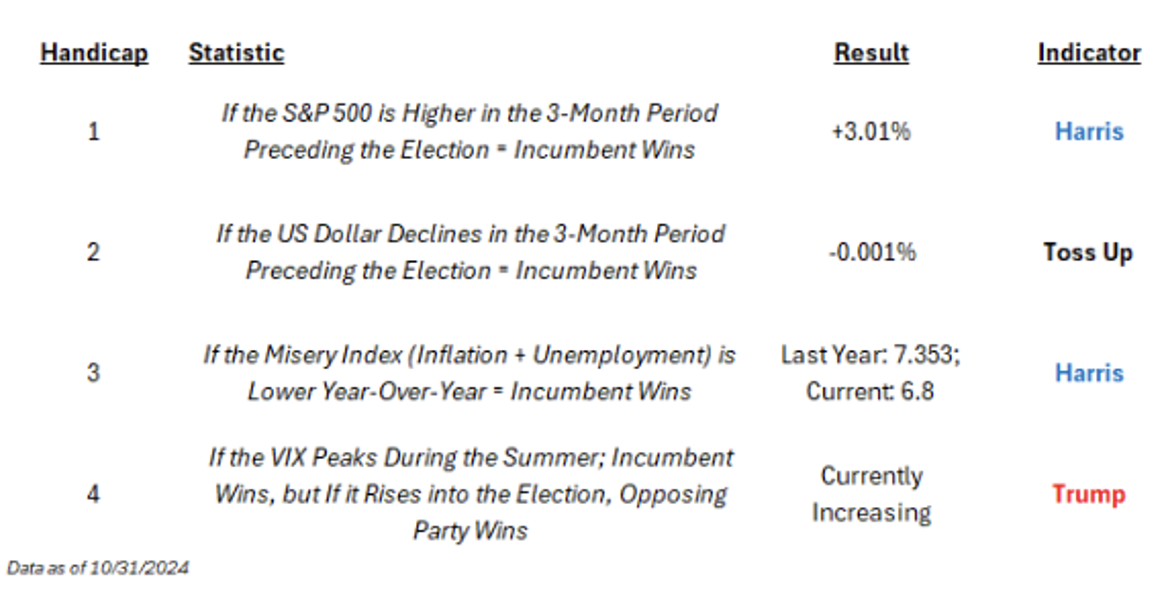

For every Election Musing, we like to “handicap” the election by looking at four different historical market statistics that have a strong track record of predicting the election.

Source: Bloomberg

As many of you know, these are just four factors that have historically had a high hit rate in determining the winning party of an election. But they are not always correct and have the potential to flip quickly. For example, the USD continues to strengthen since the beginning of October. Over the first two months of the reading, the USD was down -3.6% at one point (on 9/27/24).

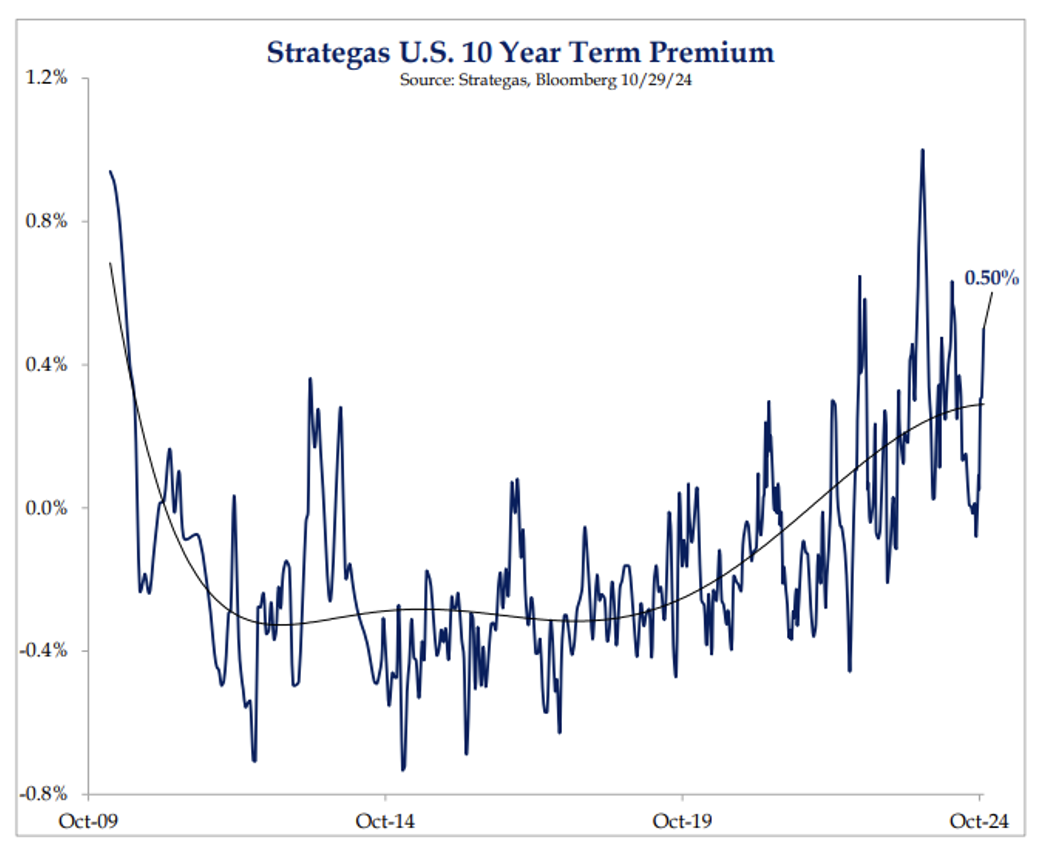

Secondly, many market pundits are stating that the increase in the term premium, which is simply the additional return an investor expects to receive by holding a long-term bond compared to a series of shorter-term bonds, indicates, in our opinion, that the market is calling for a Trump win. Said another way, we believe financial markets are reading Trump as the inflation candidate due to tariffs, deficits, and immigration. As such, it looks to us that bond yields are moving higher with his probability of winning. You can see this with the increasing term premium:

Source: Strategas as of 10.31.2024

Source: Strategas as of 10.31.2024

We know that this election is a toss up, as America is a 50-50 country. In 2020, within swing states, only 65,559, or just 0.04% of total votes cast, is what seemed to us to drive the election outcome.

Non-Political Thoughts Around the Election

Everyone is talking about early polling, but all of this data is likely overinterpreted when comparing trends to previous elections. Moreover, it is very early in the process and the results can change. But in what we believe to be nearly a 50/50 race, any individual data point becomes that much more important in determining which side has an edge.

Both the Republican and Democratic campaigns acknowledge Republican gains in early voting. Republicans argue that the data shows their voters are more motivated and that with a historically larger election day turnout than Democrats, we believe the polls could be underestimating Trump’s support. Democrats are stating that Republicans are pulling forward their voters into early voting and that the voters attracted to early voting are higher propensity voters. We believe the real effect is that Republicans are co-opting out of the playbook of Democrats, as they are banking more of their voters early, which gives them the time and resources to attempt a push ahead with the lowest propensity voters they need to win the election.

Let’s focus on what I believe the big ticket item is for November 5th: Taxes.

The Tax Cuts and Jobs Act (“TCJA”) of 2017 included significant changes to the tax code. Many of these changes were enacted on a temporary basis and are set to expire at the end of 2025. Former President Donald Trump favors extending all the expiring provisions. Vice President Kamala Harris hasn’t been specific, so the composition of Congress is going to be very important.

Here is a list of a few TCJA provisions that will be sunsetting: Individual Tax Rates, Standard Deduction, SALT Deduction, Child Tax Credit, and Alternative Minimum Tax.

As for the market, every Musing reader knows that it’s all about economic growth, as measured by earnings per share (“EPS”) of the S&P 500. While the corporate tax rate won’t be sunsetting in 2025, it is still a major issue for both candidates. Nowhere do the candidates’ tax plans differ more. Harris would raise the current 21 percent corporate tax rate to 28 percent while Trump would cut the rate to 20 percent for most corporations and 15 percent for those that manufacture their products in the US.

Why is this important? Well, in 2016, when Donald Trump was elected President, the S&P 500 rallied ~14% over the following three months – almost the identical amount that the S&P 500’s EPS would increase if his 21% corporate tax rate plan was enacted (which it was). This policy boosted EPS immediately by 13%.

That’s why I believe corporate tax policy is important; it directly affects estimated EPS and the market.

VP Kamala Harris’ plan is expected to increase corporate taxes to 28%, creating a ~7% hit to S&P 500 Earnings while former President Trump’s plan of lowering the rate to 15% would boost EPS by ~4%.

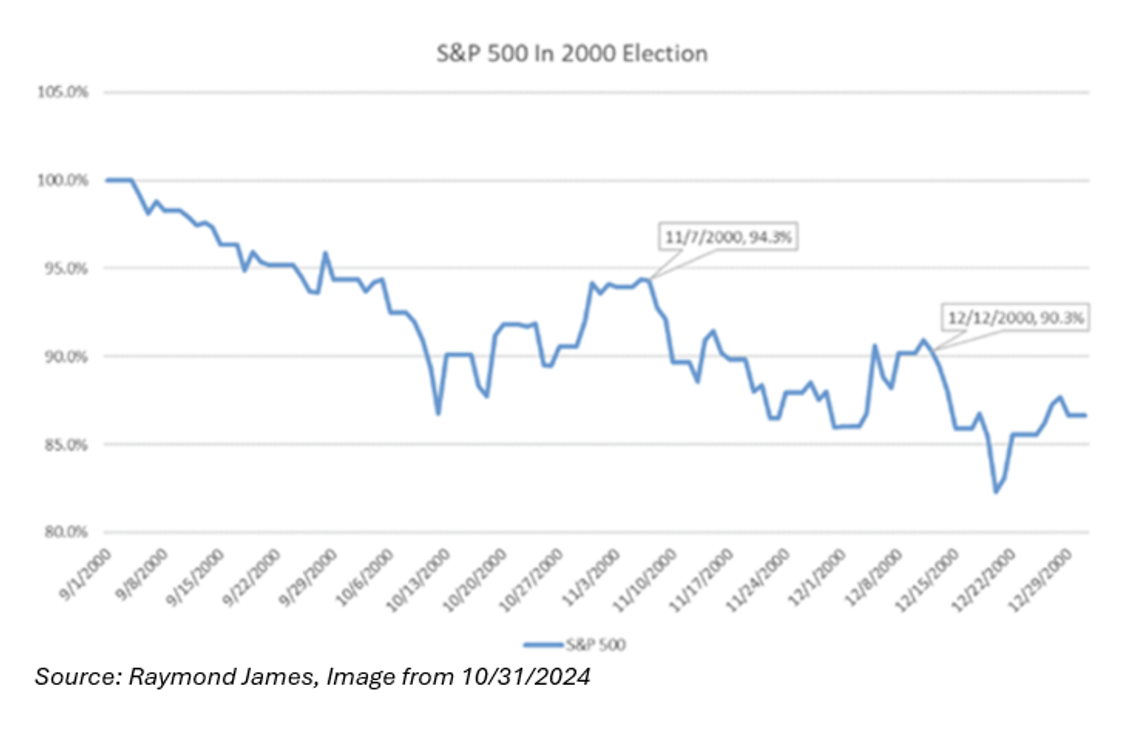

What Happens if the Election is Contested

First, if there is no clear winner emerging on election day and the election is contested, it’s not the end of the world for investors. Secondly, this would not be the first time that this has happened – think Bush vs. Gore in 2000. Americans did not have a clear winner until the beginning of December and the market was only down about 5% during this period of unknown. Not to mention, investors were not expecting a contested election in 2000. In 2024, investors know that this could be in the playbook.

Given this information, what’s the possible market reaction? Obviously, we do not know for sure, but ultimately markets know a contested election is only a temporary phenomenon; at some point, there will be closure. This may not stop a knee-jerk reaction of selling but again, we didn’t see a knee-jerk reaction in selling in 2000 and investors weren’t expecting some unknown outcome on that election day.

The levels that cause mandatory recounts in most swing states —in order for there to be a recount where the mail-in ballots would be contested— the margin of victory needs to be less than one-half of one percent (or 0.50%).

The point is, most elections can’t be challenged (at least not legitimately) unless there’s a recount. For there to be a recount, the margin will have to be less than 0.50% in most of the swing states. And, those swing states will need to represent enough votes to turn the election. That’s not impossible, but it’s very unlikely, and simply not a high probability event.

The Most Important Chart for Clients

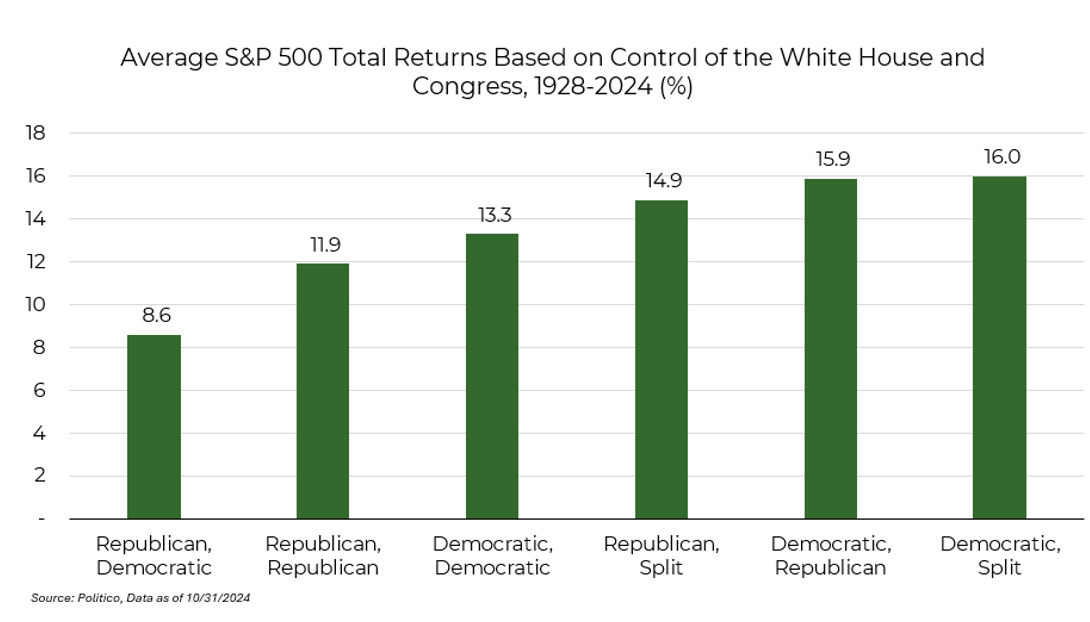

Going back to 1928; the political regime in Washington D.C. has not materially changed the long-term performance of the market.

How our Allocations are Prepared

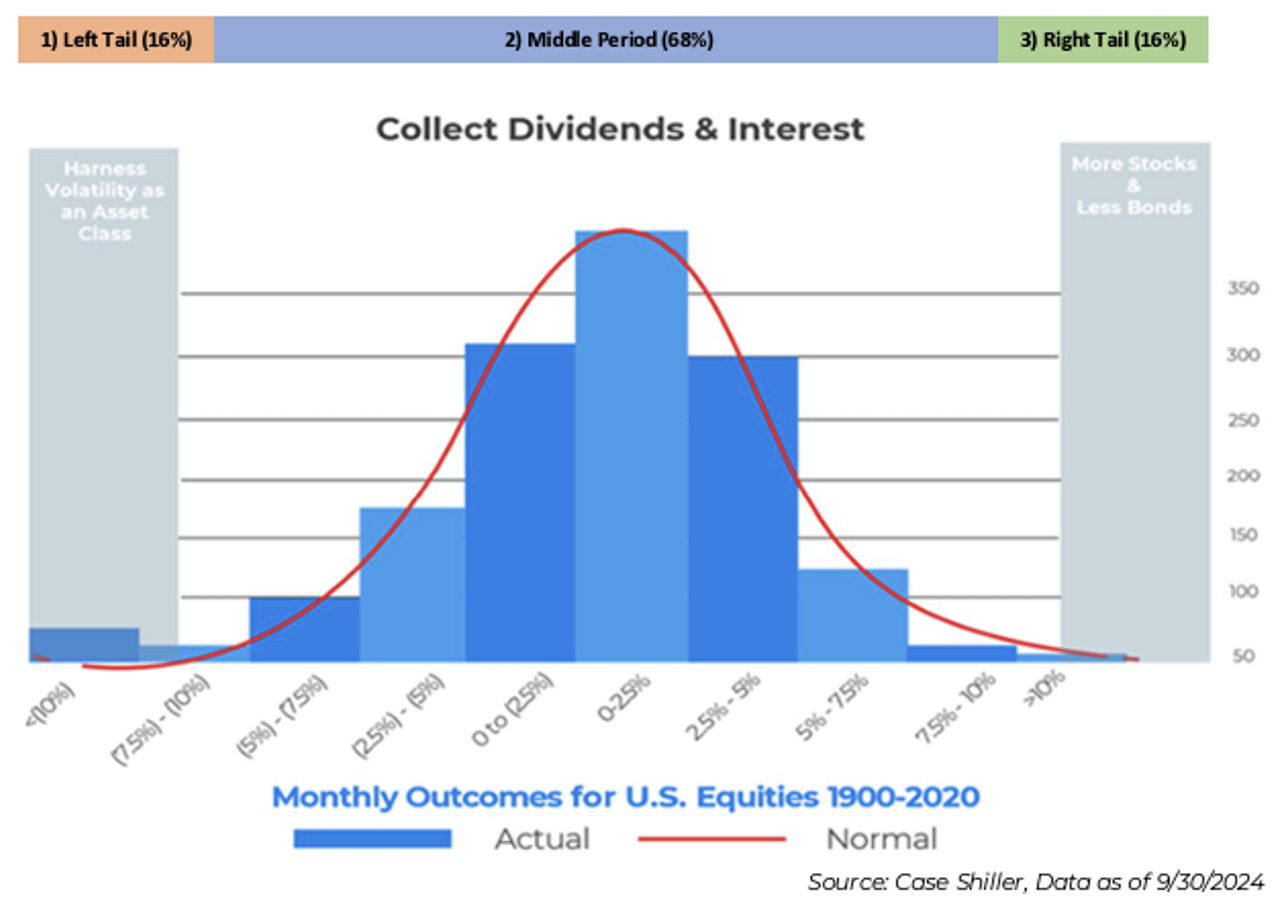

When speaking with clients, I get the feeling that everyone expects some type of tail event to occur, whether it’s a right tail (stocks scream higher) or a left tail (stocks scream lower). This is exactly what our allocations are built for.

If stocks scream higher, as both fiscal and monetary stimulus continue to inject liquidity into the market, we’re prepared. We own more stocks and less bonds. Said another way, we allow our allocation effects to drive performance.

If stocks scream lower, our allocation owns hedges that directly hedge against what we are overweight, beta (S&P 500). This can allow us to protect hard-earned capital, especially if fixed income continues to be correlated with equities.

We like to compare our allocations to a scratch golfer (golfers like John Luke Tyner and Joseph Sykora). On any given day, a 10-Handicap golfer can beat a scratch golfer if they play well. But, on a bad day, a 10-Handicap golfer could shoot in the high 90s, while a bad day for a scratch golfer could be in the high 70s – a score much more consistent and palatable. We’re big believers that we’d “rather be right, until we’re wrong; than wrong until we’re right.” And if we are wrong, our wrong is very digestible, like a scratch golfer.

Our allocations are able to accomplish this by not taking egregious outsized tilts at the allocation level. Our outsized tilt is going to be overweight growth assets, i.e., stocks –> and this is exactly what we are hedging against. This is why our “wrong” is much more palatable.

We once read that: “With everyone looking for alpha, we think beta is underappreciated”. The Aptus Impact Series wants to own as much Beta as possible, without increasing risk. We believe that this is the best way to consistently provide alpha over longer periods of time.

Enjoy your weekend.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-3.