A mere 23 years ago, America witnessed a Thanksgiving halftime performance that they had no clue that they needed. It embodied flying shirtless angels holding on to white bed sheets the size of a baseball diamond and a lead singer fist-bumping so high that it disproved Michael Jordan’s theory that the ceiling is the roof. The band at the helm? Creed.

Yet if you haven’t noticed, we’re in the midst of an extremely unlikely Creed renaissance, redeeming the most reviled and, perhaps more damningly, the most uncool band in the world. For much of the past 20 years, hating Creed has been a natural extension of being a music fan. Rolling Stone actually deemed them “the worst band of the 1990s,” beating out Nickelback and Hanson. Then, fast forward to today, somehow, my Bengals tailgate bus was used by a few cronies to tailgate the recent concert in Cincinnati.

This said, the NFL is back this weekend.

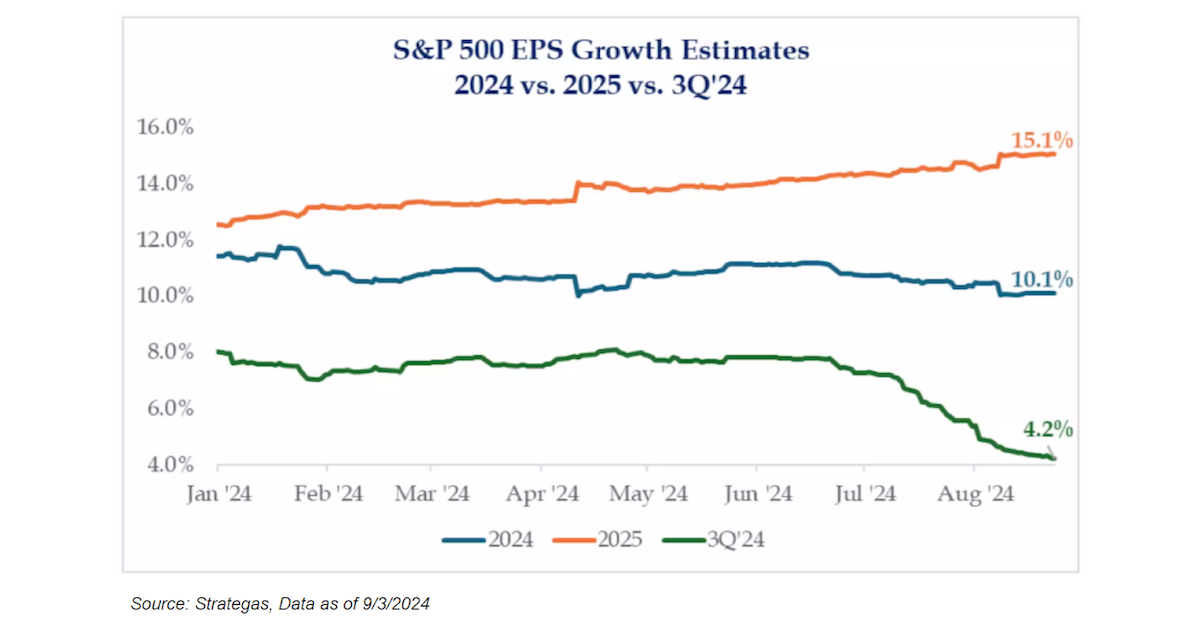

But the S&P 500 is having its very own renaissance. Just one year ago, the index was on the verge of two straight years of no earnings growth. Now, the market is estimating 10% EPS growth in ’24 and 15% growth in ’25. Though the period of dismay has been shorter lived for S&P earnings than Creed – both can be welcomed with Arms Wide Open.

In the current environment of above-average growth, investors are Torn as to which Creed song they should hitch their wagon to:

- Can The Market Take You Take You Higher?

- Please Come Now, I Think I’m Falling (One Last Breath), or

- Are Tech Stocks Livin’ in the Summer of ’99?

But, at the end of the day; football is back.

Who Dey.

Q2 2024 Earnings Recap

Most of you who read these Musings probably realize that I live and breathe earnings results. Why? Well, whenever government data and company commentary differ, believe the company commentary. It’s that simple.

There will be separated into two parts: 1) Consumer Takeaways, and 2) Overall Thoughts

The Consumer:

One of the most difficult jobs as Portfolio Managers is to discern a viable trend versus noise. The market is oversupplied with high-frequency information from US retail companies; it can’t be that every micro data point is taken as a referendum on the macro state of the US consumer (i.e., Dollar General earnings, etc.).

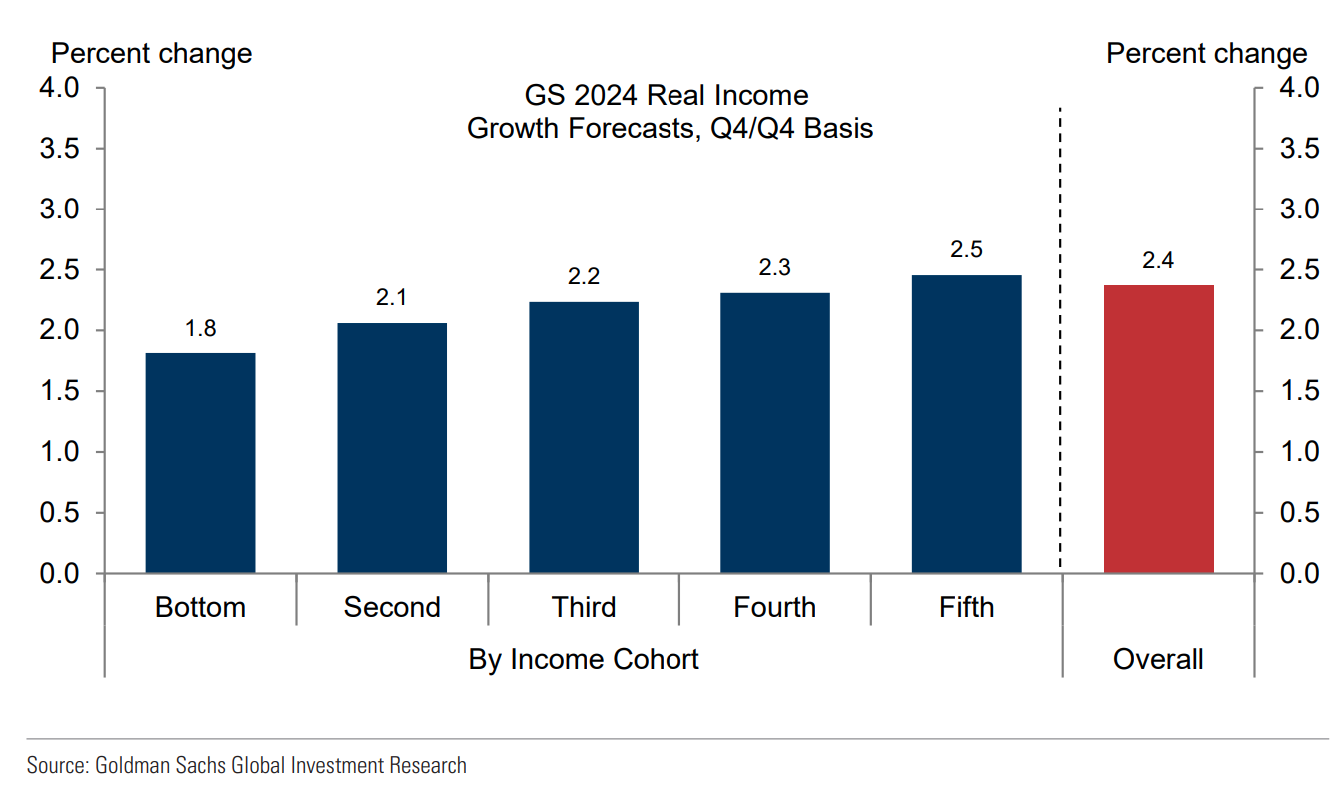

Many investor narratives this earnings season are that the bottom-up message signaled a sharp deterioration in the health of the consumer that the official data have not yet picked up. This view rests on concerning anecdotes in company commentary—especially around lower-income consumers—and slowing on downwardly revised sales expectations. Honestly, it’s tough for me to get behind this because the market isn’t driven by lower-end consumers, and investors can create any type of narrative when information is not on trend.

From a higher level, many of us know that over two-thirds of U.S. GDP is driven by the consumer. If you are tracking the estimates for U.S. real GDP, they continue to indicate healthy growth. Economic growth supports growth in corporate profits. If profits are expanding, it’s tough to get in big trouble. It’s a simple rule to follow, but it encapsulates the current environment.

Data as of 09.02.2024

Data as of 09.02.2024

Overall Earnings:

In summation, I believe the main takeaways from this earnings season is:

- First, worries about the health of the US consumer appear overly pessimistic,

- Second, the election has entered corporate commentary earlier than in past political cycles and is likely weighing, albeit modestly, on overall growth, and

- Third, the labor market appears fully rebalanced but, with layoffs remaining low, also is not rapidly deteriorating.

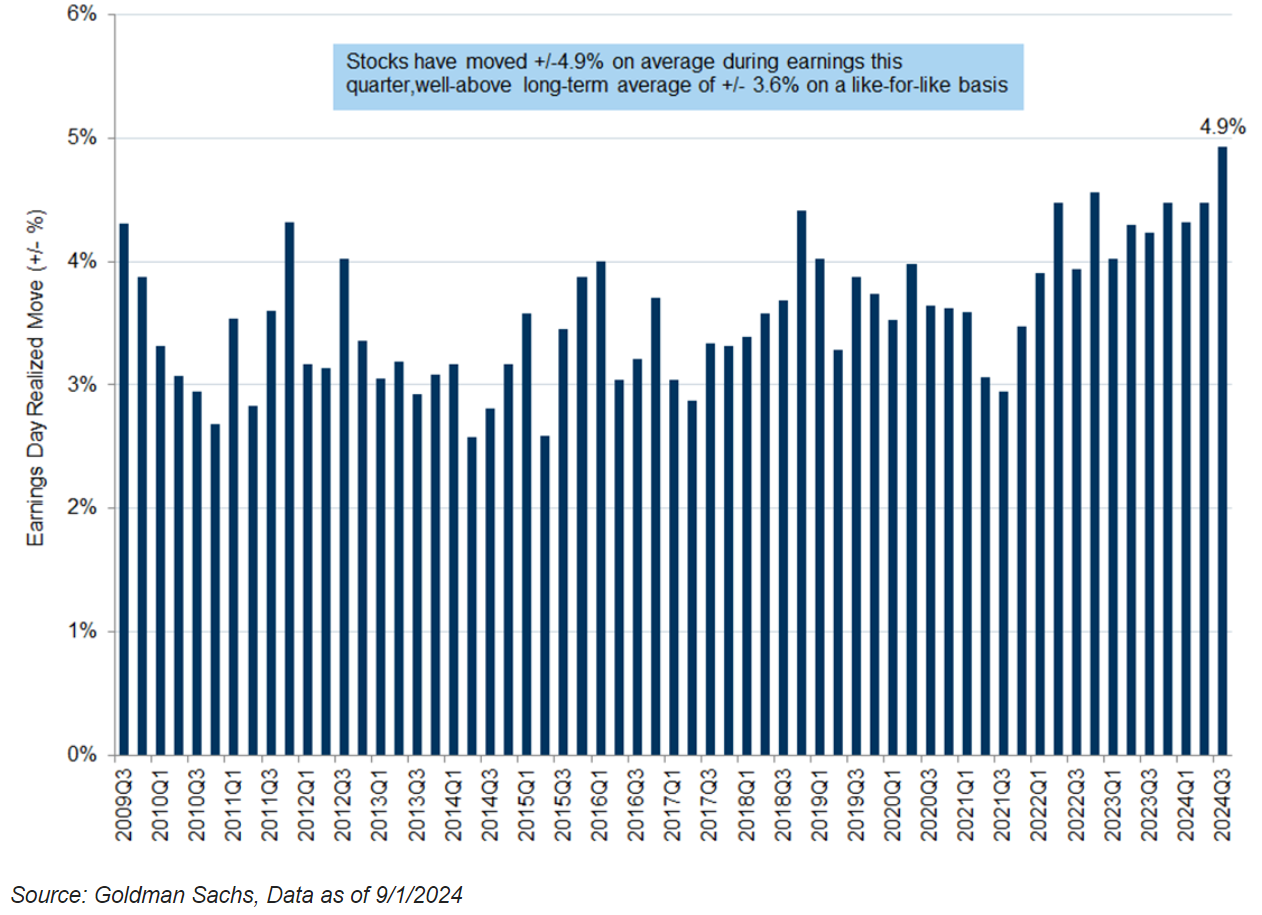

Throughout the entirety of Q2 ’24 earnings season, there have basically been no changes for earnings in 2024 and 2025. Yet, one of the most surprising facts of this past earnings season was that Q2 generated the biggest earnings day volatility since 2009. Personally, we think that says a little bit about where we are in the cycle, but also highlights the new phenomena of utilizing shorter-dated options.

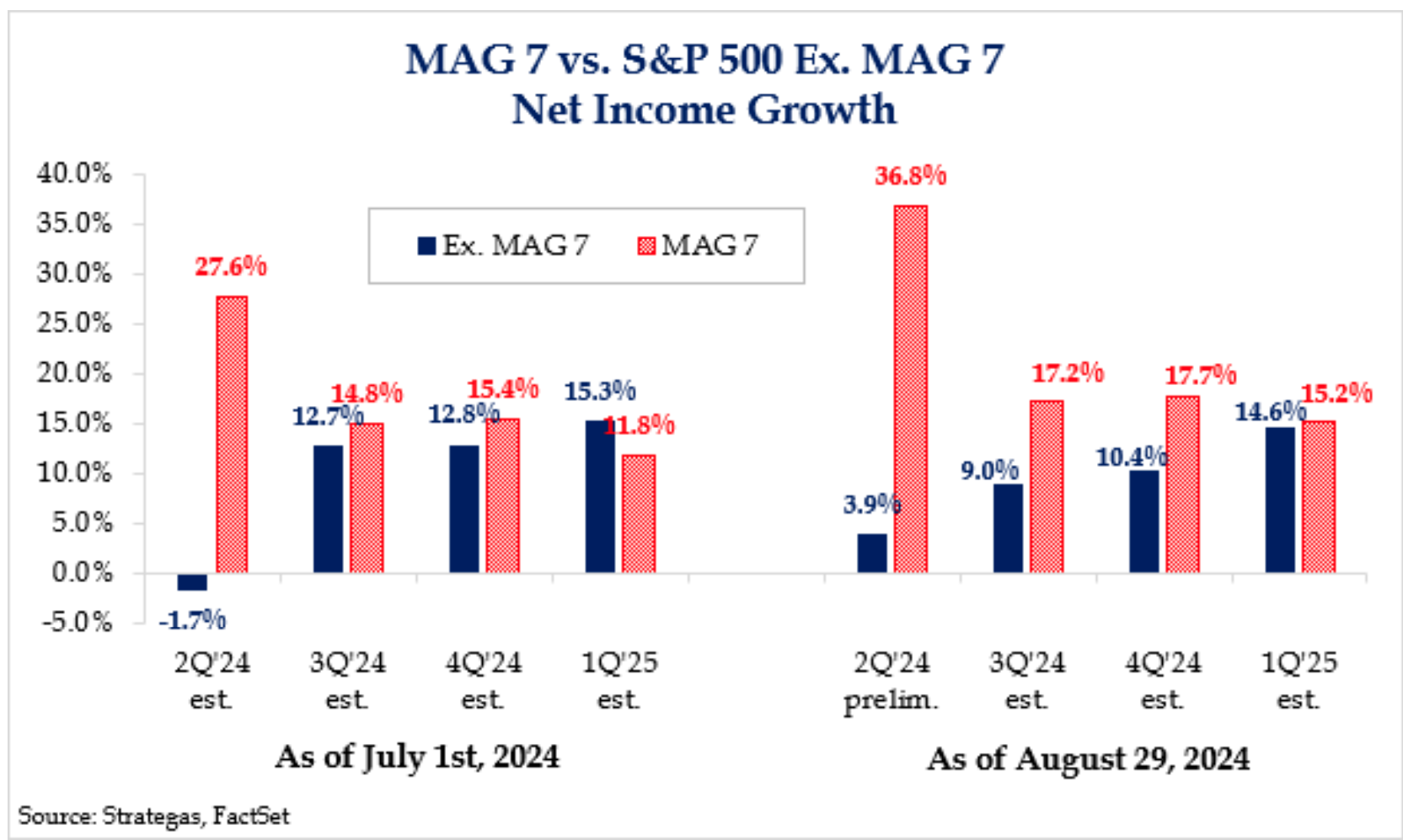

I’d characterized the earnings season by stating “widespread strength.” Year-over-year earnings are on track to grow 11% year-over-year (versus an expectation of 9% at the start of earnings season), with 56% of the S&P beating consensus earnings expectations by more than a standard deviation of analyst estimates (versus a long-term average of 48%), and earnings growth expectations for 2025 have been raised by 1% since the start of Q2

More importantly, it’s tough to get bearish when 1) the market is broadening out, and 2) the liquidity bazooka from D.C. is locked and loaded.

Touching on the first point: if an investor looks under the hood of the S&P 500, from a sector perspective, Financials / Staples / Utilities drove the market from both a technical standpoint and an earnings revision perspective.

To me, that’s healthy, especially as the market favored the relatively lower valuation areas of the market in August – i.e., Small Caps & International.

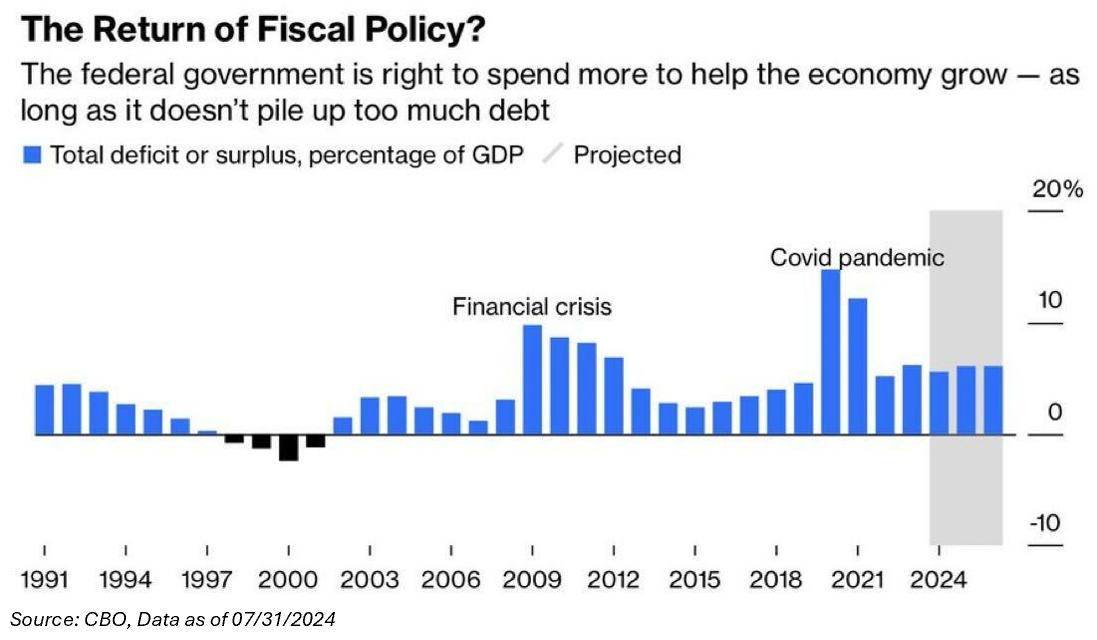

Regarding the second point, the amount of liquidity getting pumped into the market continues to be well above sustainable levels. Politicians tend to grease the skids for their own reelection by spending money they don’t have and establishing regulatory giveaways to keep big businesses and big donors alike happy.

While this has been a bipartisan phenomenon historically, the current administration has taken these actions to levels previously unseen in the annals of American economic history. Couple this position with the expectation of the Fed beginning their easing in September. Liquidity will likely be plentiful.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-7.