I’ve fielded a lot of questions about DeepSeek and its potential ramifications on the stock market – I’ll be the first to say that I am not a pro in the technical jargon about Artificial General Intelligence (“AGI”), but I do think that one of my strengths is reading what the market is telling investors, and I hope that is more valuable to making money than understanding and knowing every technical detail about this evolutionary technology.

The question that the market is trying to decipher is this: Are we going to start witnessing the transition of “Performance-at-all-Cost” to “Optimization”, if so, what are the growth and profitability ramifications?

China’s DeepSeeking Missiles

Let’s start with the basics. The revelation was that a Chinese AI firm, DeepSeek, had released a new AI model, rivaling top competitors such as ChatGPT in performance at a fraction of the cost. The initial market fear is a challenge to the core of the artificial intelligence (“AI”) narrative. Simply said, DeepSeek is the Chinese version of ChatGPT. But Monday’s market move felt more like a shoot first and ask questions later type of situation.

The market took a draconian stance that DeepSeek threatens the entire bull case for the semiconductor and AI narrative, and if that occurs then the entire AI-driven rally in tech and the S&P 500 of the past two years is at risk. Said another way, the success of DeepSeek’s R1 model means a variety of chips can now be used for AI implications. It means that firms can spend more time on inference (the process by which an AI model uses data it’s never seen before to draw conclusions) than training, which could reduce data center and other capex requirements. In a way, this could benefit companies that own the data, such as META, AAPL, YouTube (GOOGL), X, and AMZN – which also explains the performance of these listed names in the face of NVDA and AVGO’s decline.

Here are my personal knee-jerk reactions:

1. A lot of the sell-off was focused on the areas of the market that have witnessed the largest earnings growth potential or valuation expansion based on the AI-narrative trade. This tells me that there was a liquidity event where a lot of heavily leveraged players became forced sellers. That’s why there was a lot of price-performance correlation amongst the basket of stocks that were hit the hardest. For example, Broadcom (AVGO) and NVIDIA (NVDA) were down -17.40% and -16.97%, respectively.

2. Only the AI-focused names were hit the hardest – the rest of the market did fine. In fact, 70% of the S&P 500 was positive on Monday. This means that the market has not given up on the AI story. It’s only questioning the amount of capex needed for many of these companies to create efficiency from AI, negating some potential spending in the future (i.e., one company’s capex spend is another company’s revenue). But, the rest of the market responded well, meaning that the market continues to understand the new technology as a way to create more efficiencies for the average company, which shouldbe the largest beneficiary of AGI. That’s why the market is digesting the narrative of “Performance-at-all-Cost” to “Optimization”. This would yield to the thesis of a broadening out market.

Outside of the main questions, it seems like more investors are still in the research phase as to whether there are counterpunches around the origins, behavior, and quality of newfound competitors. I would expect the bellwethers of the AI space to take this exact stance during the upcoming earnings calls. Could DeepSeek be smoke and mirrors?

-

- The founder of DeepSeek is a Chinese hedge fund guy (red flag),

-

- DeekSeek Product made on 2 gens old NVDA silicon (red flag) – I’m not buying that they didn’t have the most up-to-date Hopper Chips (they’re banned in China and they were likely obtained through a different country),

-

- DeepSeek was made for $6 mill –> this is simply not possible, and

-

- Most of the researchers are brand new college grads (also red flag).

Whether there is merit to DeepSeek’s results or not, we believe that it is a positive for the overall market. If this module can be applied or replicated, it could catalyze an acceleration in AI usage much faster than most anticipated. This, in turn, could drive higher consumption of AI hardware over the long-term.

Finishing With Allocation Thoughts – How are We Positioned for This?

The question that the market is trying to decipher is this: Are we going to start witnessing the transition of “Performance-at-all-cost” to “Optimization”. This is why the market is spooked, as this would slow down the capex spending on artificial intelligence.

Basically, in one fell swoop, the market narrative around AI started to change for the first time ever – with that the entire YTD gain in NDX futures have been erased. At this stage of the sequence, there are a lot of very tough questions being asked – what is the efficacy ? And, in turn, the sustainability – of AI capex now? Framed another way, this puts a bright and shining line under some pre-existing questions around AI spend and returns (and the risk of disruption in a space that’s evolved hugely since November of 2022). To be sure, the ante has been enormously upped for the coming run of US mega cap tech earnings (very specifically, for MSFT and META on Wednesday night). At the very least, the market will want some assurance the rug is not being pulled from AI capex spend, which would end up being a near-term headwind.

So, let’s heed to the wisdom from another disruptive period. If we were all sitting here in 1999 talking about the Internet, I don’t think anybody would have estimated it would be as big as it got in 20 years. For example, we didn’t have the iPhone; we didn’t have Uber; we didn’t have Facebook, etc. and yet, if you bought the Nasdaq in ’99, it went down 80% before that all came to fruition. I don’t believe that this is going to happen with AI. But, the output of AI could rhyme with the Internet as we go through all this capital spending. While it’s incrementally coming in by the day, the big payoff might be four to five years from now.

To be clear, I am still a true believer in the structural supremacy of US tech companies who arguably have only more incentive to spend now. Tactically speaking, however, I suspect the next few days will bring a hurried reduction in many companies that are leveraged to this trade, which could create market volatility. But our allocations welcome volatility, as it tends to present opportunity.

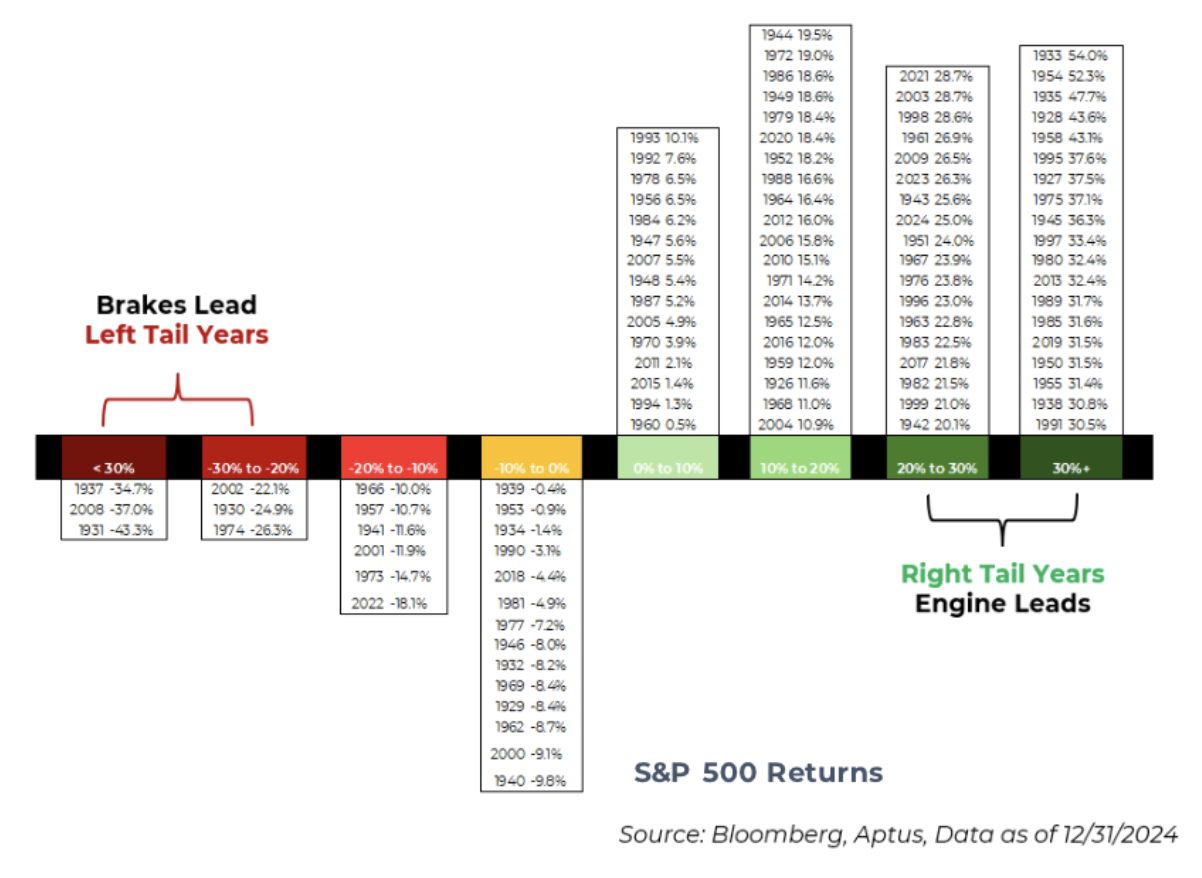

Luckily, as you may know, our strongest conviction is in overweighting equities across portfolios, owning less bonds, and hedging to reduce downside. Drawdowns happen, and selling at the wrong time is one of the greatest threats to long-term returns. We’d emphasize the below charts that show how much more frequent right-tail events are than the left. Staying invested and hedging to reduce drawdown is one of the most powerful tools in our arsenal and one that we lean on.

Let’s look at some of the possible outcomes of the market moving forward:

Right Tail: Large Caps Retain Leadership, as DeepSeek is Smoke and Mirrors: We believe that we have an advantage, as we are overweight stocks, which should drive relative performance.

Right Tail: The Market Transitions to Optimization, Instead of “Performance-at-any-Cost”: We are overweight a very cool small-cap strategy that we believe can perform well if the market broadens out, as the largest beneficiary of optimization is the average stock. Holding some equal-weight S&P 500 can also capture some of this opportunity more than cap-weighted does.

Left Tail: The Market Pulls Back Due to Uncertainty: We own volatility as an asset class, hedging against the exact worry that can keep investors up at night. As everyone knows, we believe that there is upside in less downside, and if we can utilize hedging that has a known inverse correlation to what you’re worried about, we believe that can let investors sleep well at night.

Onwards and upwards.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-44.