S&P 500 Earnings Preview – Q4 2023

It’s common knowledge that if the market endures two (2) consecutive quarters of negative GDP growth, it is considered a recession (most of the time, not every time—as we learned last year). Well, the market had been in an earnings recession for quite some time. Luckily, that officially ended last quarter (Q3 ’23), as the market finally realized positive year-over-year earnings growth. Nonetheless, the market has basically had zero earnings growth over the last two years.

Within the economy, we’ve been seeing nominal GDP—nominal consumer spending, nominal prices, essentially nominal everything—decelerating, although this process is VERY slow in the U.S. It’s happening much more severely outside of the U.S.

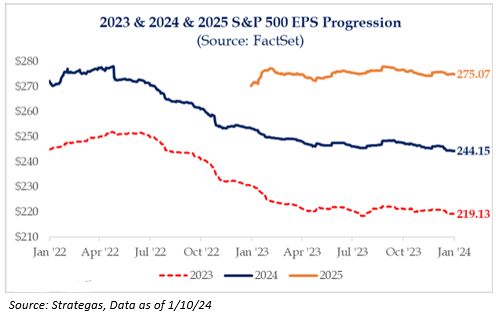

Given where savings rates currently reside (~4.1% – much lower than the historical average of ~6%), the slowing in spending will likely continue this year and yet, S&P 500 EPS are projected to re-accelerate in ’24 and ’25 by > 10% annualized. I doubt that investors believe these numbers, as seasonality shows that these estimates tend to come down throughout the year. In a nutshell, they look wildly optimistic. This isn’t new news to the market; the market understands that there tends to be negative earnings revisions throughout the entire year. Don’t let this fact lead you to a bearish investment thesis.

Last quarter marked the beginning of the earnings recovery with EPS growing 4% year-over-year (Q3 ’23 v. Q3 ’22). Below are the expectations for earnings in Q4 ’23:

1. Earnings Growth of +3%

2. Sales Growth of +3%

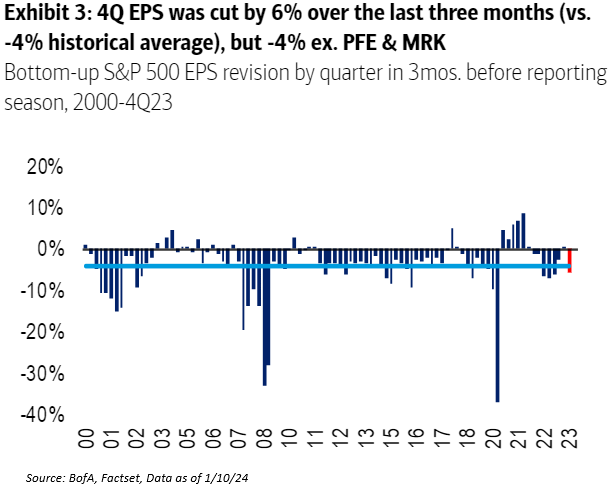

I believe that there could be some conservatism baked into Q4 ’23 earnings expectations. Consensus estimates for Q4 have already come down by 6% since September, which is larger than normal (typically a 4% cut into earnings). Furthermore, Q4 tends to be a seasonally weaker margin quarter (-0.30% on average), but analysts are already penciling in a much bigger decline of 1.0% to the lowest margin level for the S&P 500 since Q4 2020.

As one would expect, the Magnificent Seven (ex. TSLA, AAPL, etc.) are expected to drive a lot of the Q4 ’23 growth. The Mag 7 is expected to witness +48% earnings growth from a +12% revenue growth (that’s called operating leverage). Conversely, the average stock is expected to see EPS fall (~6%). But, on a positive note, earnings breadth (# of companies with positive EPS growth) is expected to improve for the third straight quarter. And, next quarter, the market does expect earnings for the average stock to inflect, accelerating +3% year-over-year in Q1 ’24.

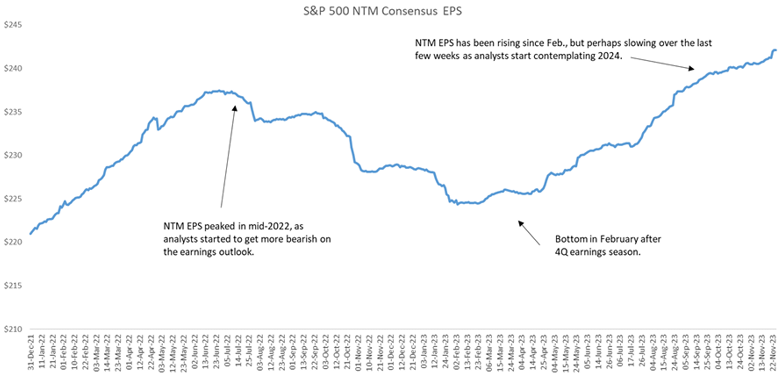

Reason to be Bullish: Equity prices are 90%+ correlated monthly with next-twelve-months (“NTM”) consensus EPS; for the S&P 500, NTM EPS has been increasing since February ’23 and is at an all-time high.

Source: Raymond James as of 12.31.2023

Source: Raymond James as of 12.31.2023

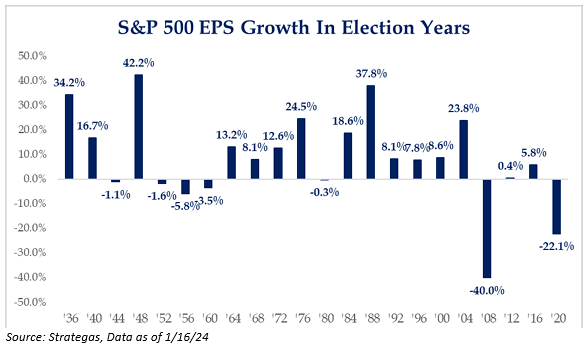

Now, here is an erroneous fact that simply shows that election years have no real effect on earnings: EPS growth, on average, is +8.5% during election years, slightly ahead of the LT average growth of +8.2%.

Throughout the entire year (hopefully not until after Primary Season), I’ll have a slew of musings on these subjects that should be great for answering client questions.

Current Yield + Growth Framework*:

Yield: 1.44%

’24 Earnings Growth: +11.42%

’24 S&P 500 Valuation: 19.47x

*Data as of 1/18/24 @ 2:26PM EST

As always, reach out if you have any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-29.