It’s over. But, in a way…it has only just begun.

Election Superlatives:

-

- 9 out of the past 10 elections, the results have yielded a situation where power flipped parties. This has been the highest level of political regime volatility since the Civil War. The only ramifications of this are that it continues to create policy uncertainty for businesses.

-

- There has never been a situation where all three arms of government (President, Senate, and House) have switched parties. Obviously, this is dependent on the Democrats winning the House, in which the Republicans currently have a slight advantage.

-

- This is the first time a Republican has won the popular vote since ’04. Over the last 40 years, only in ’88, ’04, and ’24 have the Republicans won the popular vote.

-

- Donald Trump is the first president since Grover Cleveland to win the presidency in non-continuous terms.

-

- Nate Silver has been downgraded to Nate Bronze (hat tip to a few people out there we saw saying this).

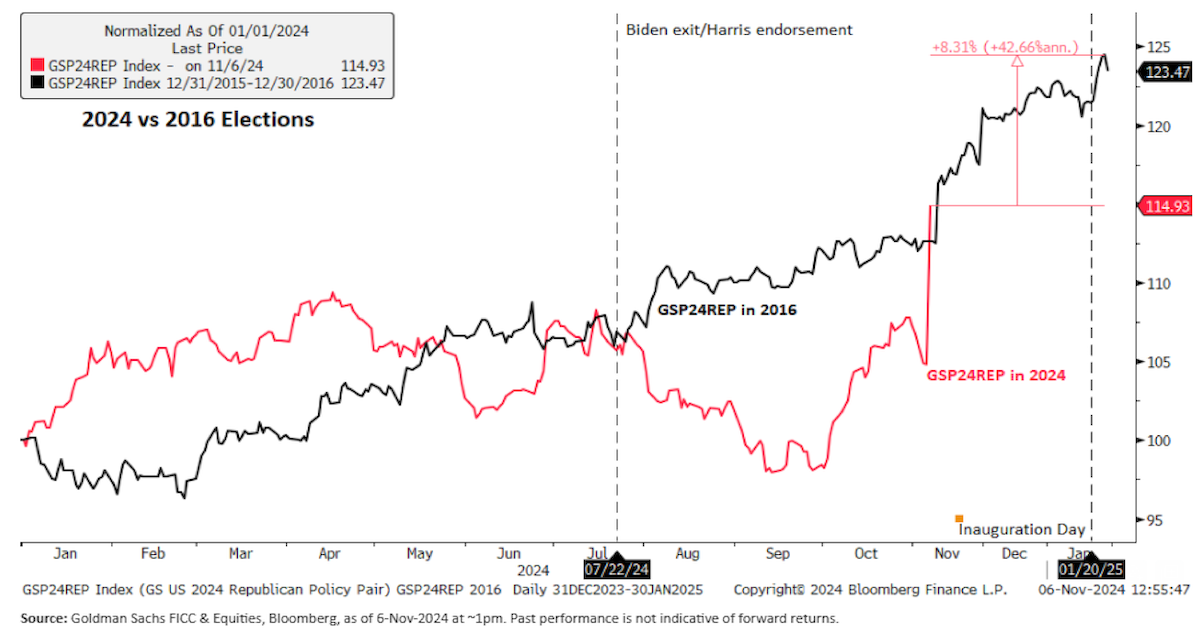

2024 vs 2016 Election Equity Moves:

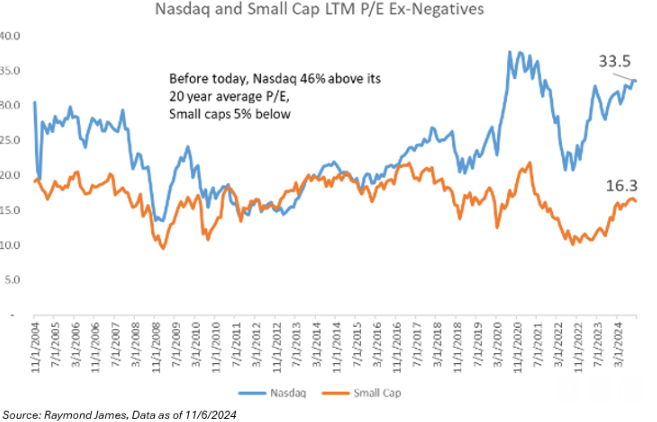

Oh, and if anyone wants to ask me about Small Caps… be my guest!

Election Results

In its most simplistic form, Donald Trump is the nominal GDP growth candidate. This is why stocks are running, specifically small caps (IWM > QQQ), and why rates are ripping. Joseph Sykora, CFA (Head of Private Investments) said it best this morning: “Seems like everyone is saying the same thing; the move in the 10YR really matters, just not today.”

This spurs the argument: Is it due to inflation expectations? or is it about growth? or both? Nonetheless, we’re seeing a reversion trade in small caps with QQQ’s being the funding mechanism today.

Next year is going to be a big year for Washington, D.C. It’s going to have to navigate a debt crisis, the sunsetting of the Tax Cut Jobs Act (“TCJA”), corporate tax rates, and the enhanced premium tax credits in the Affordable Care Act (“ACA”) are set to expire at the end of 2025.

Likely FAQ’s from Clients:

-

- Post-Election Risk – Trump’s Sentencing in November: Given the large win by Donald Trump, it likely takes some of this risk off the table as he won the popular vote. The judge will make a decision on if the sentencing will move forward on 11/12/24. Given the popular vote, Trump likely has a lot more leverage to benefit his case than if he did not win the popular vote, which can buy him time to push sentencing out past inauguration day. In a way, he got a “mandate” from the general population. Obviously, this is all up in the air.

-

- What if the Democrats Win the House?: The Democrats will likely target some TCJA tax cuts to go away – think tax levels on the wealthy. In 2011 and 2023 we learned that the House of Representatives does have some leverage when it comes to the debt situation where they can get some of their individual and corporate tax policies enacted.

-

- For example, in 2023, Biden had to negotiate with the House (led by the Republicans), since they had the leverage on the debt ceiling. The House was the only chamber that could increase the debt ceiling, since the Senate needed 60 votes to approve the passage (Democrats didn’t have 60 seats in the Senate). Thus Biden was forced to negotiate with the Republicans. This same thing happened in 2011. What does this mean? A Democratic-led House of Representatives actually has leverage to get some things passed on the tax side, even if they don’t have control of the Presidency and the Senate.

Market-Focused Policies

There are 3 buckets to focus on regarding policy. But, as always, it comes down to what you can push through in Congress. On the Senate side of things, there’s a substantial difference between the Republicans having 52 seats vs. 55 seats, given some GOP dissenters. Regarding the House, the margin of advantage is going to be razor thin, so it will be tough to get everything on Trump’s agenda passed.

1. Extension of TCJA (Major Catalyst): In the near term, investors will be focused on the debt side of this ledger, but I believe that as time passes, they’ll start to focus on the economic implications if the individual tax breaks sunset at the end of the year. If the Republicans take the House, tax policy will be one of the first things pushed through the budget reconciliation process. But, if the Democrats win the House, it could be a drawn-out battle.

2. Executive Orders: This is where there will be an immediate impact.

-

- Immigration: The border will likely be shut down on Day 1

- Energy Policy: Likely a relaxation in the testing of liquid natural gas (“LNG”) exports

- Trade Policy: Investors are going to have to break Trump’s trade policy into two baskets: 1) China, and 2) everything else. The Chinese tariffs will likely happen, but the latter is going to be much more difficult. Trump will likely increase the tariffs that he put in place back in 2018 & 2019, driving more companies out of China and into places like India. The North Atlantic Free Trade Agreement (“NAFTA”) is going to be a bit more confusing, as there will be an overhang of immigration policy and the fact that Canada and Mexico will have different Prime Ministers. Lastly, in my opinion, the 10% across-the-board tariff will likely never happen, as it will be challenged in court.

3. The Deficit: The majority of investors believe that the next crisis will be a debt crisis. It’s no secret that the rate of growth is unsustainable. In fact, we are witnessing the largest fiscal cliff in U.S. history, coupled with the largest year for taxes since the income tax was enacted in 1913. But, the deficit has started to decrease over the past few months, given the increase in tax receipts, which is offsetting the increase in interest expenses. We’ve started to see sell-side analysts decrease their “deficit to GDP ratio” from 6.5% to 5% and we’ll likely get confirmation of this in a few months from the Congressional Budget Office (“CBO”).

Said another way, the fiscal situation could be better one year from now, as the economy is trying to grow out of its egregious deficit problem. This allows for an easier budget reconciliation process to pass an updated TCJA. That’s why I said that Donald Trump is a candidate for nominal GDP growth. This is also why we are not sure if rates are rising due to growth or inflation expectations.

All-in-all, next year is going to be a busy year for Washington DC.

Bringing it Back to Allocations

Given the number of items that D.C. is going to have to tackle next year (corp. taxes, TCJA, debt crisis, etc.), I bet many investors would assimilate this with market volatility. But I actually disagree here. Given the amount of fiscal and monetary stimulus coming into the market, there will be winners and there will be losers, so there could be a lot of volatility in sectors and industries underneath the hood of the market. Yet, at the index level, I believe that volatility could be muted. This shouldn’t be that much of a surprise because: 1) The market is a diversified investment vehicle, and 2) just look at what the market has had to endure over the past few years and the overall (muted) volatility of the market.

That is why I love this saying: When everyone is searching for Alpha; we believe that Beta is underappreciated. Own as much Beta as you can without taking on more risk because I’m a firm believer that risk assets are the place to be right now.

Why do I love risk assets right now? Simple:

-

- Monetary Policy: The Fed is cutting rates and will likely have to stop QT next year, boosting financial liquidity

- Continued Deficit Spend: Continued spending was a bi-partisan issue. I’m not sure that anyone believes that the water spigot of fiscal spending can be turned off.

- Earnings: Given the amount of economic spending, tax cuts should continue to boost earnings. And, as we know, it’s difficult for the market to get in trouble when earnings and margins are growing.

- Lower Deficit: Many investors may not know that the deficit has been slowly decreasing over the past few months, by ~$300B (i.e., tax receipts increasing). Not because the stimulus has slowed down, but because spending and growth have been very strong. As John Luke Tyner (Head of Fixed Income) has said, “One of the best ways to fix a debt problem is to grow out of it”.As mentioned above, many analysts are expecting the “deficit spend as a percentage of GDP” to decrease next year to ~5%. Right now, the CBO has an estimate of ~6.5%. This only frees up more capital to be injected into the economy through tax cuts.

At the end of the day, I believe the market will be flush with liquidity (from fiscal and monetary spend) and should have a lower deficit (relative to GDP) that should create a tailwind for economic expansion. But, given the immigration expectations and the potential for structurally higher inflation, we believe that investors must own as many risk assets as possible, without taking on more risk.

Again, that’s why Donald Trump is the candidate of Nominal GDP growth. And, as Aptus’ JD Gardner says: “You either own risk assets or own the currency that deflates.”

Always feel free to reach out if you have any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-10.