I’d love to cut right to the chase, but many of today’s problems can be solved by proper allocation. It’s times like these that show why Aptus is built the way we are. We want to own More Stocks, Less Bonds, Remain Risk Neutral, so we can perform better in both the right tail and left tail.

The Aptus team and I are always around to explain our thoughts and to have these difficult allocation conversations. We view the world differently than most, but if you talk to anyone at Aptus, you’ll be quick to hear the amount of conviction that we have in our philosophy. Here is the most recent Aptus Allocation Presentation – Q2 2024.

Recent Market Commentary

It’s weird to state that it feels like investors have wanted market fireworks (i.e., a pullback) for quite some time. And, over the past month, not only have we witnessed a dramatic rotation from the U.S. Large Caps to U.S. Small Caps, but we’ve had a lot of political fireworks as well. And after a few difficult PMI readings that seem to be more of a trend than a standalone data point, alongside a “weaker” Non-Farm Payrolls (“NFP”) last week, it feels like the market quickly went from “soft landing” to “hard landing”.

Is that the full story? That the market is heading into a recession off of slower growth and a Fed Policy mishap – I don’t believe so. Below is a quick recap of the recent market commentary:

-

- Earnings: Earnings very mixed, not universally bad, but more signs of weakness than any other quarter since Covid.

-

- Magnificent Seven: Cloud vendors seem caught in an AI game theory trap. Completely unknown ROI, but the risk to underbuilding is huge if this a huge long term market, and the risk to overbuilding is limited given their balance sheets.

-

- The Fed: Now the market is starting to take more seriously that the Fed has overstayed their welcome and waited too long to lower rates (for International and US economy) – haven’t really had the “recession” narrative since early 2024, but seems to be creeping back into the market.

-

- Seasonality: We are entering a tough seasonal period for equities (August usually pretty flattish, then September and early October the weakest period of the year).

And, as we head into the NFL season, it feels like the market was caught offside due to the unwinding of the Yen Carry trade. These trades tend to utilize a lot of leverage, so a perfect storm of a few small moves can really exacerbate the problem. That is exactly what happened – a more hawkish BOJ, a more dovish Fed, and currency movements that make this trade much more expensive.

Let’s try to explain what happened on Monday:

What is the Yen Carry Trade?

For the padawans, the Yen Carry trade first showed its face back in the 2000s, as the Bank of Japan kept interest rates near 0% – well below their global peers. This trade felt like it was resurrected over the past few years as the spread between the 2YR U.S. Treasury and the 10YR JGB started to widen, yet again. At its core, investors are looking to profit with “safe” global assets that produce a strong yield.

For simplicity, the trade went as follows:

- Borrow yen at a very cheap rate (~0.60% – 0.80%),

- Convert the Yen to Dollars,

- Buy higher-yielding assets (U.S. Treasury trading at a premium) or positively trending assets such as the AI-related tech stocks,

- Translate back to yen to pay off debt, and

- Bro Down (until it reverses)

Essentially, the Yen Carry trade provides investment funds with very cheap debt to buy financial assets and either 1) Make a spread or 2) Lever up exposure to specific stocks or other assets. Investors used the yen because it was perceived to be predictable and would remain near zero for some time.

How is this Affecting the Markets?

Simply put, much like we witnessed on Monday, if the carry trade reverses, it creates forced selling of assets that were purchased with a very low interest rate loan from the Bank of Japan (“BOJ”). This transaction of utilizing the yen has become more risky as the BOJ has started to increase its JGB rates, making the trade more expensive and more sensitive to market movements. Obviously, this gets exasperated when utilized by leveraged funds.

This is exactly what we are seeing; forced selling. As stated above, many utilize the Yen Carry trade to:

-

- Make the spread on U.S. Treasuries that trade at higher rates that is considered “safe”, funded by cheap BOJ debt, or

-

- Lever up exposure to tech-proxies like the Magnificent Seven, or really any trend following asset class, from debt that is cheaper than what can be obtained here domestically.

Here recently, this trade finally moved against these tailwinds.

-

- The yield spread between the U.S. and BOJ has come in substantially. Remember, the U.S. 10YR Treasury has gone from 4.7% in April to 3.8%, currently. This has created a markedly less profitable trade,

-

- The equity markets have seen the tech proxies—which have led the market for almost 2 years—start to cool off. Since their July 10th peak, the Magnificent Seven has come down almost 20%.

To add fuel to the fire, the yen currency has gotten substantially more expensive over the last month. Why does this matter?

To unwind the Yen Carry trade, an investor must translate the currency from the U.S. Dollar back to the Japanese yen. If the yen has appreciated in value, that makes the cost to translate back much more expensive. Given the leveraged nature of this trade, once one levered fund started to sell, they all started to sell because they didn’t want to be the last one holding the bag… so behavioral momentum frantically ensued. Volatility begets volatility.

Luckily, we don’t have standalone exposure to Japanese markets because they’ve been hit even harder. In the last three trading days, or since the surprise Bank of Japan hike on July 31, the Japanese stock market has crashed by 20%, even bigger than the three worst three-day moves during the October 1987 crash!

Let’s Put all of this in Context

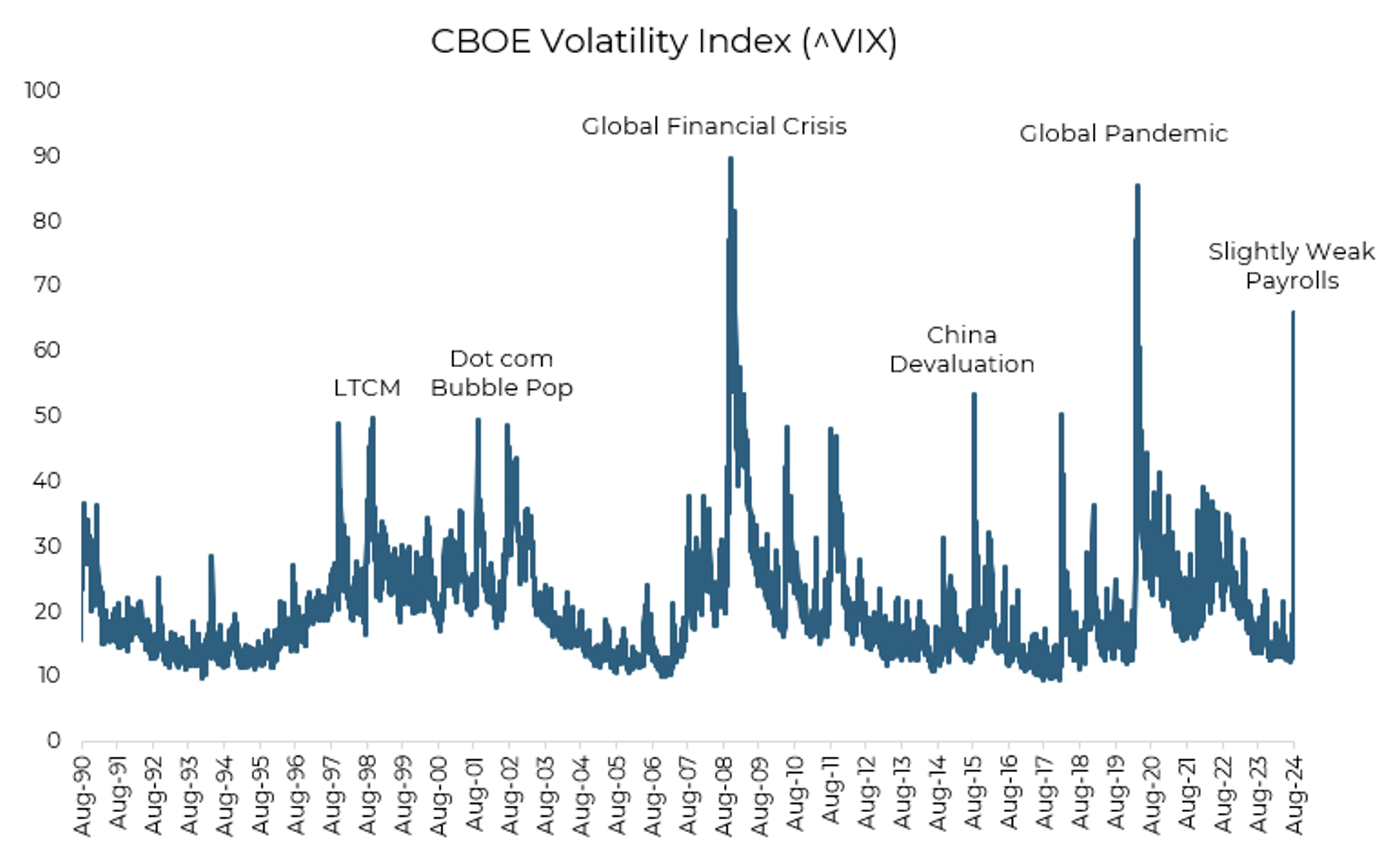

In speaking with Aptus team member, Brian Jacobs, CFA (Investment Solutions / Strategy), the last periods with a VIX spike this large were during the global financial crisis and COVID-19, both of which had profound and widespread economic impacts. In contrast, the current situation stems from a technical adjustment in the Yen Carry trade, accompanied by slightly weaker payroll numbers, while unemployment remains low. This seems to indicate a more contained and less systemic issue.

Keeping things in context, one of these things is not like the other:

At the end of the day, this doesn’t feel like a drawdown that stemmed from slowing growth or a Fed miscue, but it does call into question – how long can this persist? I do believe that the Fed has the tools to stave off a recession. I can hear the objection; central banks always cut too late, and they are behind the curve already. But unlike in a ‘typical’ economic cycle, there are no obvious excesses to correct in the US economy – and especially no debt excesses. In fact, there is still an excess of liquidity that could rotate into risk assets if real rates become unappealing. In other words, the Fed has the right tools this time, it just needs to use them when the time comes.

Does This Event Necessitate a Trade?

Simply said, no. Aptus has built these allocations to weather tough times, and with vol waking up, we’re ready to see separation if we get the next leg lower. And if the market reverses its course, we are also ready to participate, as we own more stocks and less bonds.

John Luke, CFA (Head of Fixed Income) penned a great note to our team about this exact topic. “The last 10 months have been a strong proof statement for our Aptus Asset Allocation structure. As we consistently communicate, asset allocation defines long term success. When markets prove friendly (such as the last 10 months), our allocations are positioned to capture above benchmark upside given our portfolios carry a bigger engine (we hold more stocks without taking on more allocation risk). Following a period of things working it can be difficult to hold steady as you feel like you need to do something. It pays to take a step back and stick to the plan, letting our structure work for us. As our head trader, Mark Callahan, often reminds the team, “Sometimes the best trade is no trade”. At Aptus, it’s our job to educate and help our advisors understand “What you own and why you own it”, to paraphrase Peter Lynch’s famous quote.”

As always, it pays more to be patient, than clever.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-10.