We’re one month down, with 11 months to go and let me tell you, there was a lot to digest in January.

Week 1: Rates moving off of a hard landing narrative due to a strong Non-Farm Payrolls (“NFP”);

Week 2: Goldilocks Vibe (lighter-than-expected CPI);

Week 3: Stargate;

Week 4: DeepSeek; and

Week 5: Tariffs.

And this is before I even mention that the market also navigated: a Presidential Inauguration, Jevon’s Paradox, LA Fires, USD strengthening, and earnings.

…It’s even before I mention that my Kentucky Wildcats have already lost 5 games to start the year. Or even that our Dallas faithful (Mark Callahan & James Yahoudy) lost one of their own to L.A. – Luka Dončić.

I will say one thing before we get started. It’s my personal belief that tariffs are being “over” blown, and the ramifications of deregulation are “under” rated.

Are Tariffs … Tarif-Fying (H/T Brad Rapking, CFA, a new father to Lorna, on the title)

Before I get into all the details, let me go on an important rant.

Investors need to be careful to not let their feelings about President Trump, whether they are positive or negative, inform their investment decisions. It’s our job to interpret the market’s reaction to policies and how they might determine whether portfolio changes are necessary, and if so, when and how they should be implemented. Please recognize that the previous statement says nothing about trying to guess what the Trump administration will do next or what policy may be best for the current environment.

We are not politicians; we are not policymakers. There is absolutely no point in wasting our time on things that we do not have control or influence over.

We invest in the world that we have…not the one we want. And old macro wisdom states that economics (and earnings) supersede politics (and geopolitics). Always have and always will.

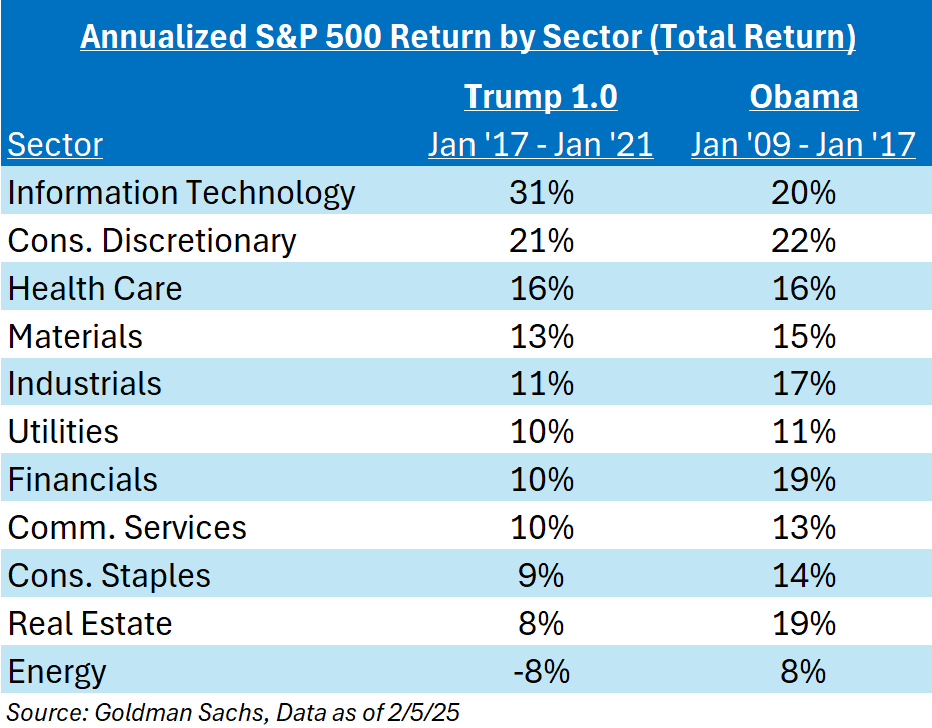

Specifically, I spoke with one of our partners and they made a great point, and though rudimentary, is telling. Investors will rarely know how the market is going to react in the short-term; how can anyone read anything we see in the news immediately and infer any LT impact without first questioning whether it’ll actually stick or not? As it relates to the long-term, consider the table below, which simply juxtaposes sector returns under Trump’s first term vs Obama’s two terms:

As you’ll see, despite a very distinct set of policies and philosophies, the top of the leaderboard was very similar, as were the bottom.

What Are They? What Does this Mean?

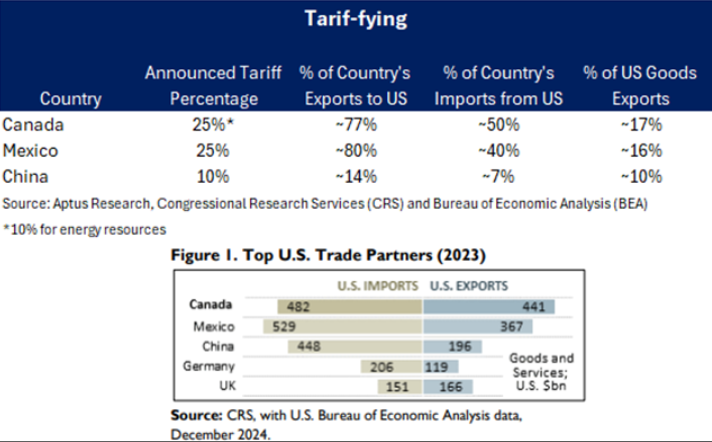

What are Tariffs? Tariffs are taxes on goods imported from other countries and they are typically paid by companies that import goods from abroad.

What are the Positives? They are seen as a way of growing the US economy, protecting domestic jobs and raising tax revenue.

What are the Negatives? The potential for higher costs for consumers and a one-time bump in inflation.

Why is it a Negotiation Tool? While companies pay tariffs, they can indeed hurt foreign countries by making their products pricier and harder to sell abroad. Otherwise, Foreign companies could cut prices to offset the tariffs to maintain their market share in the U.S.

It’s no secret that the prospect of new trade barriers has introduced another layer of volatility, with markets reacting negatively to the uncertainty. History has shown that tariffs are rarely viewed as a net positive for equities, and while they could lead to a temporary bump in inflation and price levels, the Fed is unlikely to respond to a one-time inflationary shock.

Simply said, the extent and duration of these trade policies should be the focal point.

What Will I Be Focusing On?

Large and prolonged tariffs can pose a risk to S&P 500 earnings. If company managements decide to absorb the higher input costs, then profit margins would be squeezed. If companies pass along the higher costs to their end customers, then sales volumes may suffer. Firms may try to push back on their suppliers and ask them to absorb part of the cost of the tariff through lower prices. Goldman Sachs estimated that for every 5% increase in the US tariff rate would reduce S&P 500 EPS by roughly 1-2%. As a result, if sustained, the tariffs announced over the past weekend would reduce S&P 500 EPS forecasts by roughly 2-3%, not taking into account any additional impact from major financial conditions tightening or a larger-than-expected effect of policy uncertainty on corporate or consumer behavior.

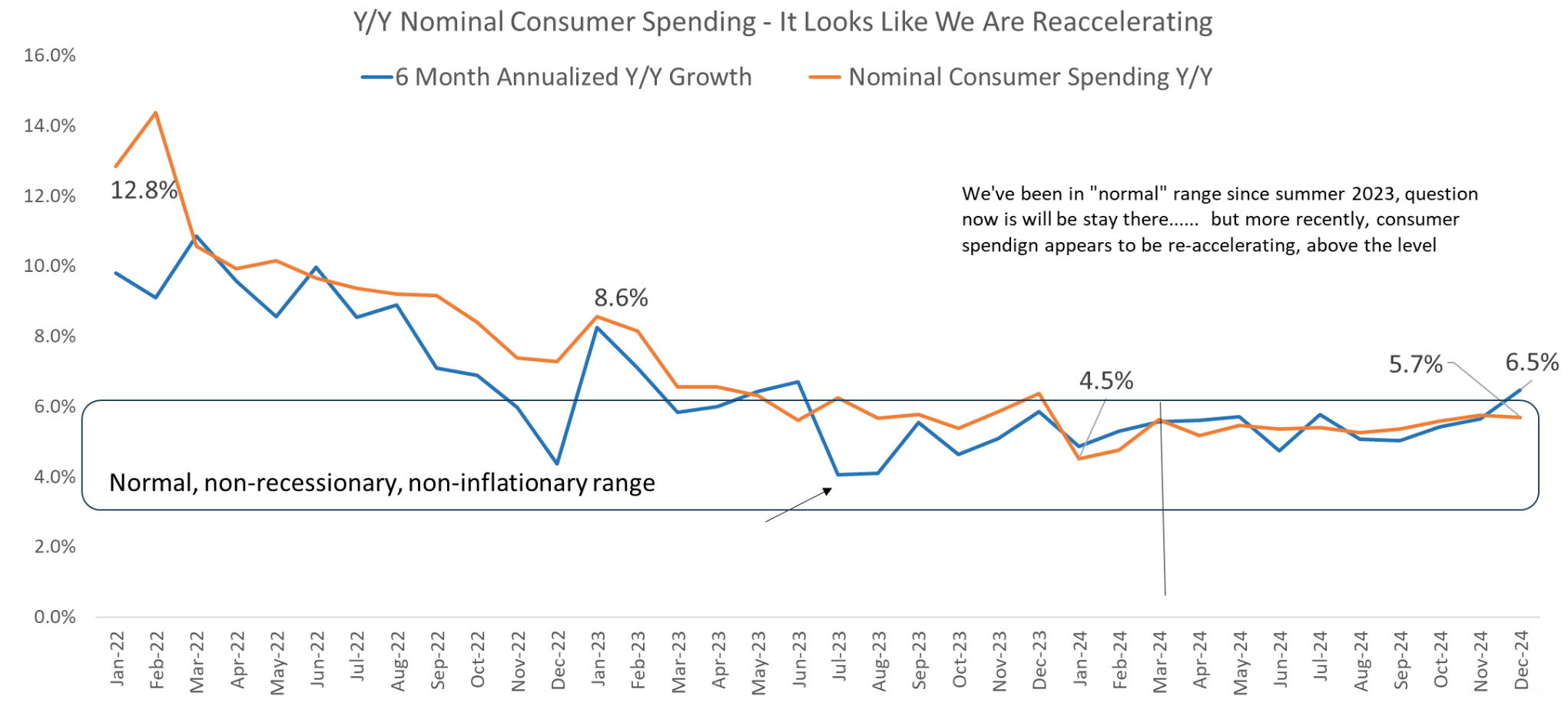

In the grand scheme of things, this does not pose a significant risk to the market, in my opinion. We are threatening tariffs at a point in time where the dollar continues to strengthen, which dilutes the ramifications of tariffs, but also during a period of time when consumer spending is actually on an uptrend. Said another way, tariffs, in their current form, are about a $300B consumption tax that totals 1.5% of consumer spending. Tariffs may in fact help cool inflation from a consumer spending perspective. We actually needed some slowing in consumer spend to keep the Fed happy, so the timing of this was pretty good in terms of having some consumer spending momentum.

Source: Raymond James as of 01/31/2025

Source: Raymond James as of 01/31/2025

At the end of the day, the cost of tariffs to growth and inflation can only be speculative, still too many unknowns, namely where tariffs end up and FX settles. Yet, the market was still able to shake off this past weekend’s news, as the market was only -0.50% on Monday. For now, it seems like the narratives of AI, AI optimization, and deregulations continue to control the market.

We’ll see if that changes.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-9.