As many of you know, my word for Q1 and Q2 is “Perspective“. Macro news, like what we are seeing with tariffs, can seem and feel overwhelming, but just remember, the market is not the economy, and it’s still all about stocks, which are all about an underlying business.

I’m about to break rule #1 for me, quoting Warren Buffett. I respect him but believe that the charlatans of the Twitter world over-pontificate on him. It’s no secret that there is volatility all around us – market, geopolitical, societal, etc., and while it may be difficult to see how today’s situation resolves itself in a tidy fashion, let’s start with a little bit of optimism. Warren Buffett wrote this in a 2008 annual letter:

“In the 20th century alone, we dealt with two great wars (one of which we initially appeared to be losing); a dozen or so panics and recessions; virulent inflation that led to a 21.5% prime rate in 1980; and the Great Depression of the 1930s, when unemployment ranged between 15% and 25% for many years. America has had no shortage of challenges. Without fail, however, we’ve overcome them. In the face of those obstacles — and many others — the real standard of living for Americans improved nearly seven-fold during the 1900s, while the Dow Jones Industrials rose from 66 to 11,497.”

Just remember, it pays to be a rational optimist. Pessimism about the long-term does not align in any way with a historic worldview. Investors can choose to believe that right now is the beginning of the end, but that is a bet against all of human history and against human nature itself. As has always been the case, progress occurs against an inevitable backdrop of catastrophe. Always has and always will. Invariably, you can always find what you go looking for, and your investment results will probably mimic that worldview.

This old person used to tell me that some days it’s a good day to die, and some days it’s a good day to eat a grand slam breakfast from Denny’s. Luckily, for all of us reading this Musing, it’s the latter. Keep on L-i-v-i-n… Livin’.

Let’s Begin... with an “Executive Summary” because this Musing is long.

Executive Summary: Perspective in a Noisy World

The recent wave of tariff headlines has added to an already noisy macro backdrop. It’s easy to feel overwhelmed, but it’s worth zooming out. The market is not the economy, and stocks are still businesses — driven by earnings, not emotions. We’re not claiming to be trade experts, and we’re definitely not pretending to know how this all plays out. But we do know markets, and we know how to separate signals from noise. Right now, there’s a lot of noise.

Tariffs are part of the game now, like it or not. And while they could create a short-term drag on sentiment and earnings expectations, we should remember two things:

1. The U.S. economy remains more insulated than others, with only 14% of GDP tied to imports; and

2. Markets and businesses crave certainty. Lack of it can weigh on capex and hiring decisions, but so far, momentum has held up.

The short-term may be bumpy, but long-term impacts are still a mystery. Nobody knows if these tariffs are the end of the world or just the start of negotiations. What matters for investors is not how they feel about trade policy but how they react to it.

To borrow a favorite analogy: tariffs are the spinach. Tax reform, deregulation, and lower energy prices are the dessert. The market’s choking down the spinach now, but the second course could help balance things out. In the meantime, don’t confuse market drawdowns with economic collapse. Don’t let headlines dictate strategy. Stay focused on the long-term. It’s not volatility that breaks compounding, it’s how investors respond to it.

Keep perspective.

Liberation Day to Obliteration Day

It feels like everyone is now a macroeconomist and global trade expert. I can tell you that I am neither, nor is anyone at Aptus, but I am good at reading/understanding markets, remaining calm, and recognizing what is noise and what is relevant. To be frank, I have zero clue what the optimal solution is, but I always find it interesting when smart people on both sides of the argument have so much conviction in their beliefs and are unwilling to budge. Simply said, there are too many problems that need to be solved, too many moving pieces of changing information, and too many variables at play to have any certainty around an outcome. Remember that certainty tends to lead to suboptimal solutions.

Personally, I think that many assumed that April 2nd would be a clearing event for the market. It likely did the opposite, but negotiations should move quickly from this point in time. Yes, the announced tariffs could be challenged on legality – the following night, alone, the US Senate voted to remove the tariffs, but the House is unlikely to allow this to pass. This just shows that there may be some initial cracks in the Republican party on this topic. But, investors must play the hand of cards that they’ve been dealt, and tariffs are the current bower.

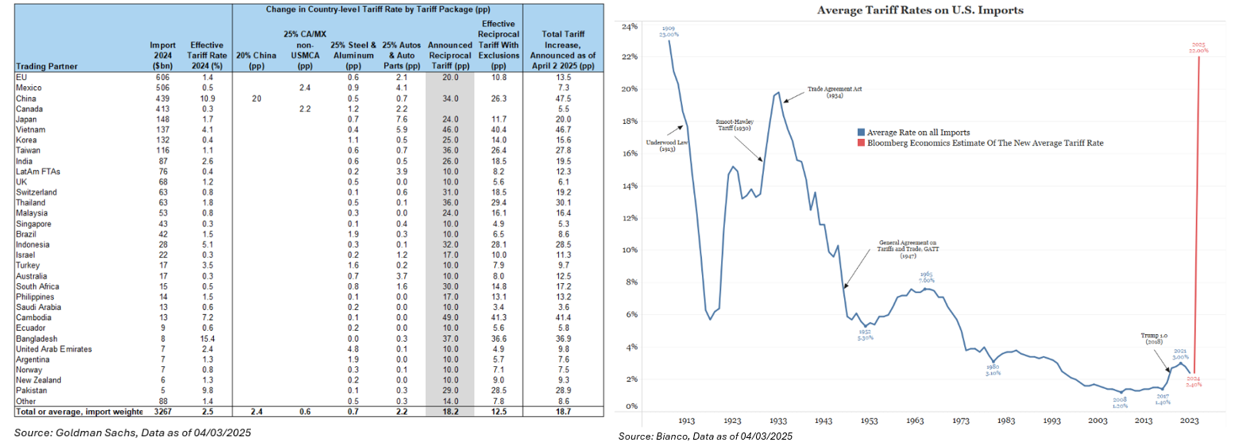

Nonetheless, the rules of engagement have officially been announced, but that does not mean that this will create certainty in the market. The focus now turns to the downstream effects from a sentiment perspective on what will happen to consumers’ spending habits. The base is a 10% tariff on all imported goods (goes into effect on April 5th). Additional tariffs were imposed based on a ratio of the trade gap with individual countries to the total trade with those countries (goes into effect on April 9th). The aim is to address trade imbalances. Outside of spending, the other big question is if the more business-friendly policies, i.e., taxes and deregulation, will be able to trump the effects of tariffs in the near term.

It would be a mistake to think the tariffs announced on April 2nd will not affect the US economy. The 2018 tariffs on China — one trade partner, albeit a big one — caused a significant, though short-lived, economic slowdown. This time, the economic impact will be bigger. The inflation impact will be different this time, too. The Commerce Department is right that the 2018 tariffs did not cause significant inflation, but that was at least in part because the US quickly switched from Chinese suppliers for many goods to other international suppliers. But for now, political, emotional, and likely market volatility may remain.

The genesis of today’s economic angst is trade policy coming out of Washington, but two realities would suggest the U.S. will be far from the economy most acutely impacted.

-

- The U.S. is the most insular major economy. Trade makes up 96%, 73%, and 37% of gross domestic product (GDP) for the EU, Mexico, and China, respectively, compared to just 25% for the U.S. Although these countries have varying degrees of reliance on the U.S. specifically, trade disruptions are likely to echo throughout supply chains, impacting those economies most exposed to trade; and

-

- The U.S. had the strongest economy coming into this episode. U.S. GDP has grown consistently between 2.5% and 3.5% for the past two years and came into 2025 with solid momentum. Many other economies, including China and many in Europe, appeared fragile even prior to the onset of tariff risks, leaving them more exposed to its impacts.

Let’s keep tariffs in perspective. According to the World Bank, imports of goods and services (% of GDP) in the U.S. were about 14% in 2023. The other 86% is domestic. In other words, Trump’s tariffs are impacting 14% of GDP (directly). If there is some softening, there is a whole other side of our economy that can help support the demand destruction. Then, there’s the potential for deregulation and tax cuts to help insulate the damage.

Lastly, the market is not the economy. While the economy and market live in the same house, they reside on different floors. The S&P 500 sources ~1/3rd of its revenue from international customers, while exports only make up about 13.7% of U.S national income. Said differently, while the market drawdown may be more appropriate for worsening prospects, investors should not assume the recent market is also identically moving in the underlying economy.

Where to Focus

At the end of the day, the name of the game for market returns is all about domestic economic growth.

Short-Term Growth: There could very much be some short-term pain, driven solely by sentiment. Like the market, businesses love certainty. When they make business decisions, they want to have as much certainty as possible as they weigh the risks and the potential rewards of an investment (i.e., capex, hiring, etc.). So, a resetting of EPS expectations is likely coming during the first-quarter reporting season, which could lead to additional downward pressure on equities. Looking at the quarterly estimates, it’s clear that EPS growth has been revised lower for both the first and second quarters, while expectations for the second half of the year have largely remained unchanged –> meaning that the duration of the worst-case scenario is one of the key factors moving forward.

-

- Luckily, there has been a great deal of inertia in our economy from a growth perspective. Going back to Q1 2023, 7 of the last 8 quarters have exceeded 2% in real GDP growth, as the S&P 500 continues to outkick its coverage from an earnings perspective.

-

- We’re not naïve enough to believe that this heightened uncertainty won’t cause this inertia to slow, but we still don’t have enough information to make a call that the economy will come to a screeching halt.

Long-Term Growth: Who’s to say? Let’s ask some questions:

-

- Will the tariffs announced yesterday immediately affect your spending habits?;

-

- Are these tariffs considered the “worst case” starting point

-

- Will the tariffs cause permanent impairment on US growth and GDP?

-

- Is there an opportunity to use tariffs as a revenue aspect to lower taxes and the deficit?

Simply said, we have no idea the answers to all of these questions. It’s an unsolved mystery. Only time will tell, and until the answers show themselves, the rules of engagement are likely to be completely different than today.

John Luke had a great analogy on our quarterly webcast (reach out if you missed). Tariffs are the unwanted policies out of D.C., while tax reform and deregulation are the most desirable policies. If we call the former spinach, then we’ll call the latter dessert. Much like at the dinner table growing up, you don’t get dessert unless you eat your unwanted vegetables. The market is just navigating the first part of this dinner transaction because we need to think holistically – there are two sides to the ledger: spinach and dessert. Said another way, to counter these disruptive economic policies, extending tax cuts, lower energy prices, and lower corp., tax rates will be needed.

Whether one believes the formula used in the tariff’s equation or not, Trump’s ultimate goal was to earn $600B, and the current architecture does just that. With this newfound revenue source, Congress can now have the ability to deliver on large-scale tax cuts to sterilize the negative impact on higher tariff rates. Per Strategas, the government will collect more from tariffs this year than the corporate income tax revenue in total. So, this is very meaningful.

Another byproduct of some of the tariffs is that they could push interest rates lower in the near term. I won’t make any assumptions on the long end, as that’s very complicated, but shorter-term rates will move lower with more rate cut expectations. This will be a direct benefit to the fiscal deficit, as nearly 1/3rd of our debt is coming due in the next twelve months + 54% due in the next three years. Honestly, substantial reshoring from tariff policy in the near term is highly unlikely because policy could change around midterms or in 2028’s presidential election. The market isn’t going to witness TVs to be made in Boring, Oregon. BUT, if yields can come down materially, we can start to refinance our debt on more favorable terms, potentially saving hundreds of billions of dollars.

This is why perspective is key because consumer behavior is simple: investors hate losses and have little patience for Washington D.C. policies that might not immediately contribute positively to stock market returns. We’re just focused on the spinach right now because it tastes horrible. Let’s hope we can finish it to be able to get to the dessert.

Conclusion

It pays to keep one’s eye on the prize, and that’s long-term compounded returns. And old macro wisdom states that economics (and earnings) supersede politics (and geopolitics). Always have and always will.

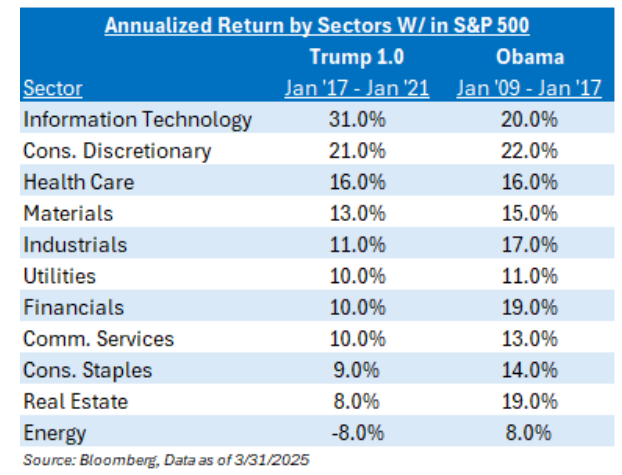

Investors will rarely know how the market is going to react in the short term; how can anyone read anything we see in the news immediately and infer any LT impact without first questioning whether it’ll actually stick or not anymore? As it relates to the long-term, consider the table below, which simply juxtaposes sector returns under Trump’s first term vs Obama’s two terms:

As you’ll see, despite a very distinct set of policies and philosophies, the top of the leaderboard was very similar, as was the bottom.

I recently read the following market analogy from Andrew Korz and FS Investments:

“Is the stock market a thermostat, or a thermometer? Thermostats control a room’s temperature, while thermometers simply react to it. The market fancied itself a thermostat heading into the second Trump term, believing it could guide the policy temperature by the market reacting positively to policies it liked and negatively to those it didn’t. All presidents care about the stock market – even more so one that presides over an economy in which equity and mutual fund assets comprise 30% of household net worth. Or so the theory went.

Wednesday’s announcement made it clear the market holds less sway over the administration’s policies than previously thought. The stock market has turned out to be more of a thermometer — a reflection of the expected impacts from policy on corporate earnings — than a thermostat, and the recent sell-off demonstrates that. That is not to say the market plays no role in shaping future policy decisions; this is American politics, after all, and there is always another election right around the corner. However, as we sit today, the “Trump put” appears to be set significantly lower than current market levels, a notion that should concern all public equity investors.“

Personally, I don’t have much time for people who criticize tariffs on academia or any other aspect of the trade policy. We invest in the world that we live in, not the one that we want. As investors, we need to play the game with the cards that we’ve been dealt. If you do that, you’ll be much better off than questioning the rules of a game where you are not the puppet master. This is one of the toughest lessons that investors need to learn –> Follow the tape; follow what the market is telling you because at the end of the day, it’s the only arbiter in town.

As always, there will be winners and losers. But remember, the losers could be the previous winners who offshored our jobs and wealth while importing cheap labor before. But the easiest way to lose the long game is to let your emotions get the best of you.

It is not adverse market conditions that derail compounding; it’s investors’ reactions to them.

Allocation Thoughts

Please reach out if you’d like us to review your custom allocations, as we couldn’t be more convicted in how our structure is built for uncertainty, much like what we are seeing today. JD’s monthly note is a great reminder of what we are building at Aptus – read Own the Risk, Hedge the Tail on our Content Hub.

Our Q1 information packet is live – reach out if you’re interested in viewing Q1 2025 deck, Q1 Webinar, and Q1 Newsletter.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-11.