Congrats on making it to the best part of the year – March Madness and The Masters. As many readers know, we say that D R S K was the fund that built Aptus. Well, in fact, it was a bunch of former college and professional basketball players that built Aptus:

-

- JD Gardner: UNC Wilmington & Wright State

- John Goldberry: UNC Wilmington & Brose Baskets Bamberg (Germany)

- Beckham Wyrick: UNC Wilmington & Brose Baskets Bamberg (Germany)

- Billy Graham: Wright State

- Joe King: UNC Wilmington

- Mike Sefscik: Allegheny College

- Will Gardner: Samford & Alabama Huntsville

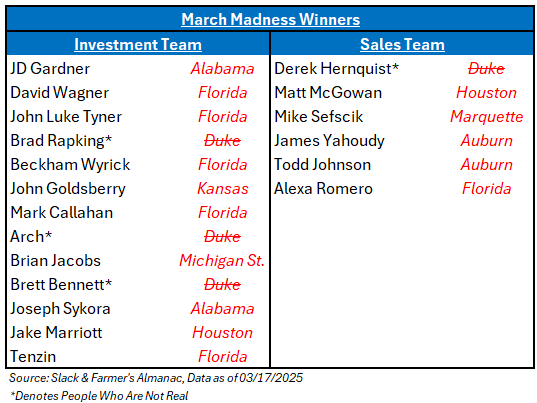

So, why not start off with our team’s March Madness Picks?

If you disagree with someone’s pick, please hit them individually to let your opinion be known! If you disagree with mine, please send all inquiries to Brapking@apt.us.

Let’s get started. I think the word of the month needs to be, “Keeping Perspective“. Perspective on the: 1) Tangible ramifications of tariffs, 2) The reason for the pullback, and 3) The necessity to not mix politics and markets –> They go together like Lamb and Tuna Fish.

Please reach out if you’d like a link to John Luke and I’s webcast last week on the market downturn.

The Market Correction of 2025

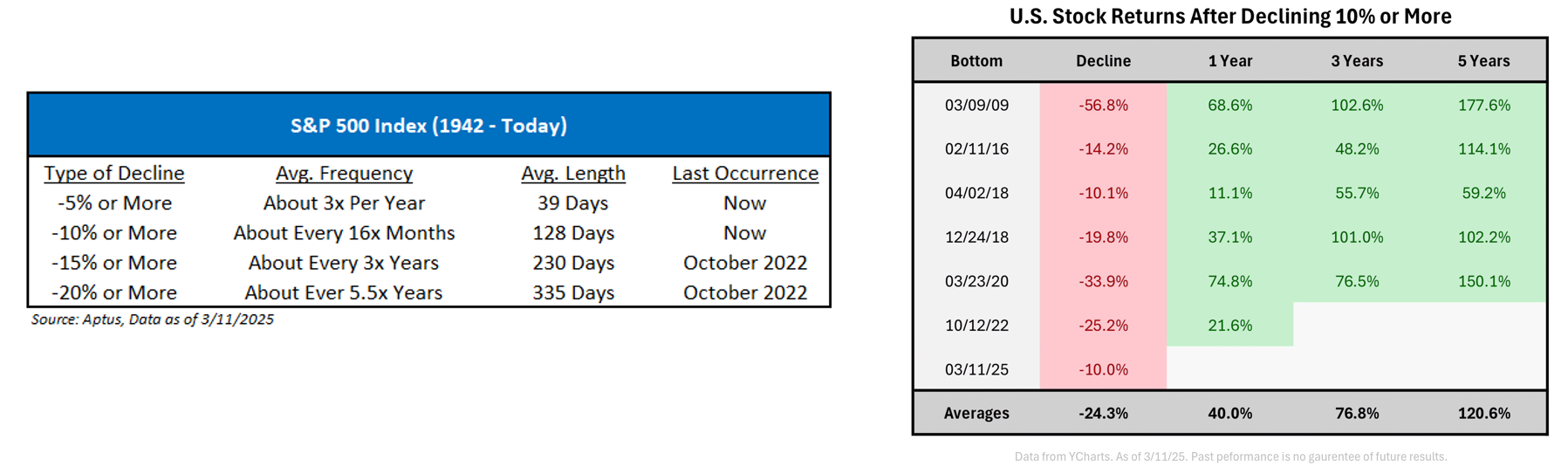

The first half of March is in the books and a dizzying stretch to put it lightly. The S&P 500 officially entered correction territory last week as investors digested the economic outlook. The S&P 500 just fell 10.0% in 20 calendar days which is the 5th fastest correction in the last 75 years (fastest ever was 8 days during the onset of Covid – 2/27/20).

Personally, I do not believe that politics and policymakers are the sole reason for the recent 10.0% pullback in the S&P 500. I’m a firm believer that the root of this pullback is slowing growth, while the intra-day volatility has been headline-driven regarding tariffs. Why do I believe this?

-

- U.S. Large Caps > U.S Small Caps;

-

- Defensive Stocks > Cyclical Stocks (This part is very intriguing, as the latter tends to outperform when rates come down. Rates have fallen from 4.79% to 4.31%. Since this phenomenon is not holding true, it makes me believe that this is more of a growth scare); and

-

- The stocks leading this downturn are pretty much impervious to tariffs. These hardest hit stocks have exhibited higher valuation and higher beta. The best analogy that I can use here is one that I learned from my mentor, Len Haussler. During a market pullback that is growth-related, it’s better to have a lower valuation. Think of skiing: when riding down a black diamond slope, I’d rather fall as a 6YO that is 4′ tall rather than a 30YO that is 6′ tall. The taller human falls harder, faster, and tends to get hurt worse, much like valuation.

But, no matter the reason for the pullback, they are healthy and normal. To be quite honest, it’s not normal when the market goes straight up without a pullback.

We all know that the market experiences three 5%+ pullbacks per year on average. These corrections are healthy and should not be alarming. The data below shows that these pullbacks are common rather than extraordinary. Since 1928, the largest annual drawdown averages -16.0%, yet year-end returns typically remain positive. The message here is clear: it pays to stay patient, not reactive. Plus, as you see on the right chart below, volatility breeds opportunity.

Now, don’t get me wrong, there is a set of variables that I’m concerned with. These are objective truths: U.S. growth is slowing, U.S. Fiscal dominance is narrowing, and no investor actually knows how tariff policy will play out. This is why I feel safe saying that the animal spirits provoked by Trump’s victory in November have given way to serious and widespread concerns about a new world economic order. The duration of the current anxieties regarding tariffs could have a significant impact on our future odds of a recession.

To me, it’s simple, it is clear that people hate losses and have little patience for policies that might not contribute positively to stock market returns immediately.

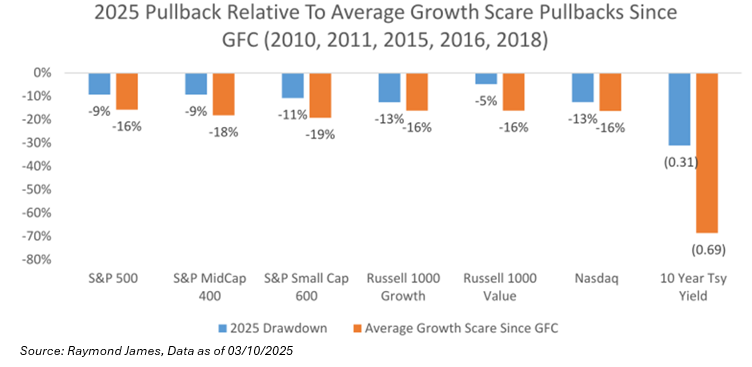

Corrections are a function of price and time – on the price side, we’re likely in the ballpark after -10.0%, but we do wonder if the time consideration lingers in the weeks ahead, especially with the looming April 2nd date. But, if we compare ourselves to historical growth pullbacks, excluding COVID (2022 was rates-driven, not growth-driven), the drawdown isn’t uncommon. These previous growth scares have resulted in a drawdown closer to -16.0%. While we aren’t necessarily down as much as average, I would say that the consumer and corporations remain much stronger today relative to these previous periods. Another way of saying the bond and credit markets don’t seem to be as concerned as the equity market.

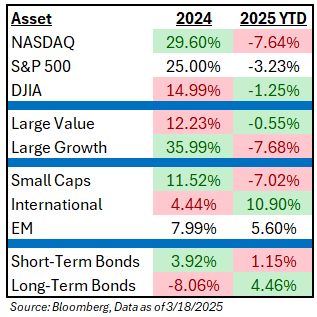

Diving into this year’s performance more, investors have been paid to do the opposite of 2024. In fact, the consensus longs in the market (i.e., O/W Small Caps, U/W Duration, and U/W International) have underperformed – likely marking a difficult year for active allocation management.

The above chart looks pretty familiar to the “Volatility Tax” chart that we’ve always spoken about.

The Question on Everyone’s Mind: International v. Domestic Stocks

In a knee-jerk reaction, in my opinion, it seems that Donald Trump has started to make international equities great again. The theme of US exceptionalism has been as powerful as any; whether an investor starts the clock in 2009 or 2020, I believe the US has been the best game in town. Flash forward to today, some investors are wondering if this narrative has changed to the benefit of Europe and China. These are similar stories in a way; both were seriously under-owned coming into the year, but we’d argue they’re fundamentally independent. China caught a bid on the back of Deep Seek, which was amplified by President Xi’s embrace of his national champions. While Europe is not a tech story, it appears to be more of a concession to reality that serious policy changes need to be made on both growth and security.

Nonetheless, the first leg of this rally seems to be more of a capital flows story, as international was substantially under-owned heading into the year. The way this looks in our US equity market is “rotation” or “broadening”, as the global asset managers, that we believe have been funding much of the “US exceptionalism” of megacaps and winners of the last 2 years, are likely rejiggering global weightings at the beginning of this year Which doesn’t hurt the entire US equity market, but only the part of the equity market that those global assets have moved into the last several years (i.e., mega cap tech). For those that don’t know, capital flows can really move the markets, especially if the money flows from something that has been “over-owned”, to something that has been substantially “under-owned”.

To be specific, U.S. equities have underperformed Internationally due to the following reasons:

- Europe is still lowering rates, even with inflation above 2%, while the US is clearly done until the economy weakens. European economies are very sensitive to the short end of the curve, so economic improvement should be evident very soon;

- Germany is likely to start allowing EU countries to expand fiscal stimulus in order to increase defense budgets, and start the process of taking the US training wheels off of the European experiment of the last 80 years;

- At the same time, the U.S. will be cutting the deficit (we’ll see, that’s just a narrative right now), which will create an economic headwind in the US at the same time Europe is expanding. And, after 6-7 years of compounded overweighting of US equities, global managers appear to be talking themselves into rotating back into the rest of the world;

- On top of this, year-over-year (YoY) growth is broadening out. For the last 2 years, most equity indexes around the world including the US had modestly down YoY earnings, at the exact same time the Magnificent 7 was putting up 40%+ EPS growth.

- In essence, the valuation spread between “winners” the last 2 years, and “losers” the last 2 years had gotten very extreme, with the same sectors, styles, factors, outperforming and underperforming almost every month for 2 years. This phenomenon is highly unusual. At some point, you get some reversion to the mean and it feels that we reached that point at the start of the year.

Personally, I would not be chasing International markets here, as the return has been all valuation-driven, and there remains a lot of skepticism on the potential follow through of policy. Secondly, and most importantly, I’m totally fine missing out on the first few innings of a broader-based market rotation into international to make sure that the potential for these structural regime changes becomes tangible.

As always, feel free to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-19.