Q1 2022 Earnings Preview

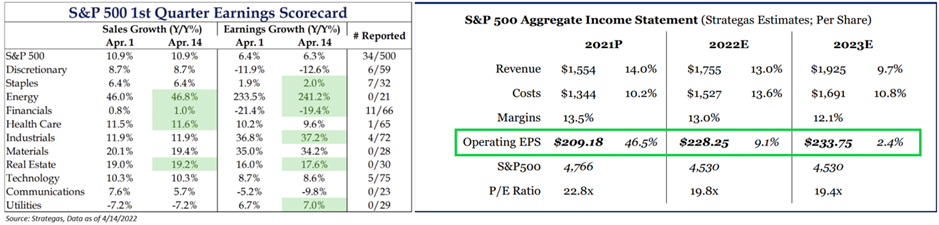

Earnings season started last week with JP Morgan (“JPM”) and a slew of other banks, and given the early tone, this earnings season could be underwhelming as we did not witness the outsized beats we have become accustomed to over the last year. Year-over-year, sales growth is still expected to be double-digits (10.9%) with earnings growth in the mid-single digits (6.3%). Excluding Energy these figures look less robust.

Anecdotally, heading into earnings season, it feels as if sentiment will ultimately drive the direction of the market – the latest bull/bear figures showed another retreat by the bulls. That shouldn’t be too surprising, given JPMorgan’s commentary last week, as it really stood out to us – they ‘re raising their credit reserves. Banks typically do that when they think that default rates, which are currently low, will start to rise. JPMorgan admitted to such during the call, saying it was a “preemptive move” if the economy slowed. JPM put their money where their mouth is, and the stock paid for it – down almost 4%. In our opinion the banks are clearly concerned about the economy going forward.

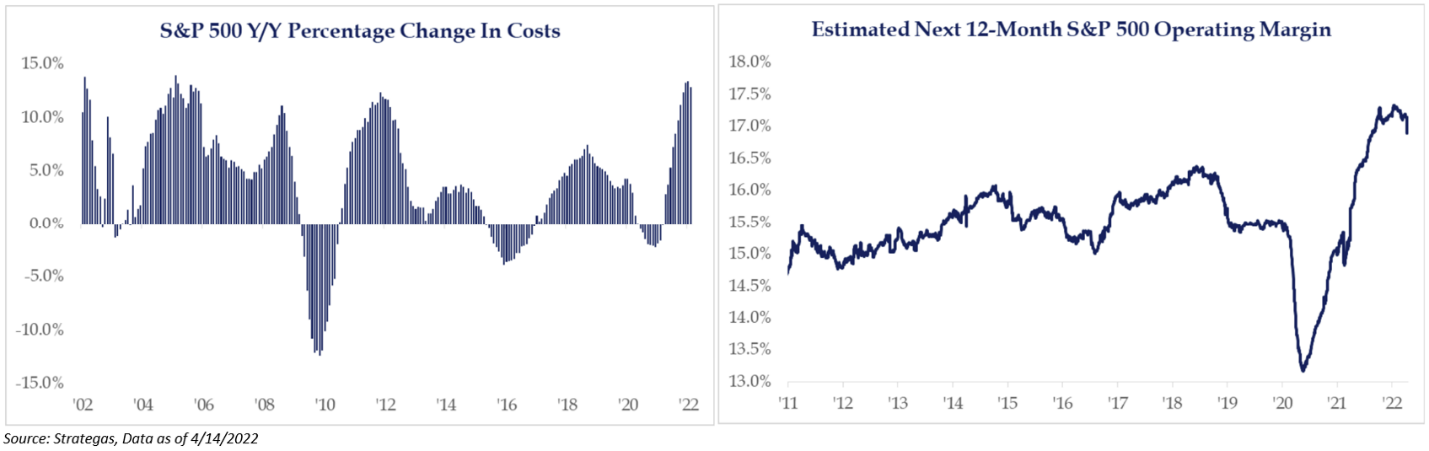

Second, we believe that inflation is no longer a net positive for earnings growth. While we appreciate how inflation can be good for nominal GDP and therefore revenue growth, we think inflation is no longer a net positive for earnings growth given the impact on costs that are now showing up in margins. With S&P 500 costs growth peaking at 13.4% in January, it should come as welcomed news that the current reading is 11.7%. This may look like a relief for companies on the surface, much of this is simply base effects.

Lastly, from a broader level perspective, we’re watching next year’s earnings guidance. If this ’23 earnings number comes down, don’t be surprised if stocks drop on earnings disappointments – as that will only raise anxiety for corporate profits if the economy slows (see above). Conversely, if the 2023 S&P 500 earnings do stay at current levels, that again could set up a near-term rally, as investors will begin to value the S&P 500 on 2023 earnings in June or July. And if you plug a 19.5x handle on the projected $243 EPS – that would equate to an S&P price of around 4750 – a rally of 7%.

During this earnings season, we are following sentiment, which is very low right now, and secondly, we’ll be following next year’s guidance commentary because we do expect this to be a more volatile earnings season relative to last quarter.

Why Focus on Growth Expectations?

Why are we following next year’s guidance commentary so closely? Simple – falling earnings revisions matter because price is correlated with revisions – there is a strong relationship between prices and revision breadth over time. We believe that this quarter’s earnings season may finally bring down NTM earnings revisions, which has been very elusive since the March 2020 bottom.

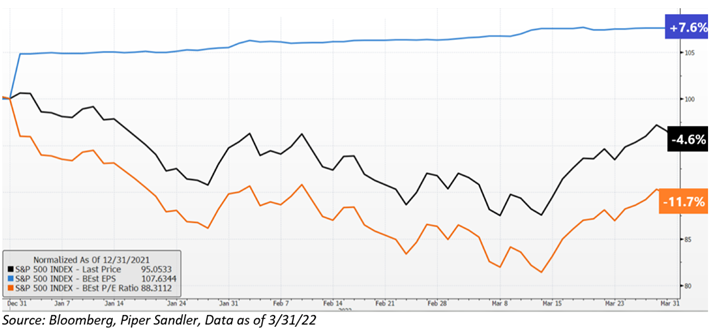

Historically, P/Es tend to de-rate when the market no longer believes the forecasts – you tend to see this with some cheap cyclical stocks. While P/Es have de-rated this year as we expected, they remain stubbornly high when taking into account the historically sharp rise in 10-year yields. In short, P/Es are down about 11% since we published our year ahead outlook (Investors May Need to Curb Their Enthusiasm), but that de-rating has come from higher rates, as the equity risk premium (”ERP”) has plummeted. This would suggest that the equity market has not yet worried about growth – only higher rates.

As shown above, P/Es have contracted, and NTM earnings expectations have continued to increase all year – bucking the trend of what has historically happened – stocks tend to go higher so long as forward estimates are rising. In our view, there is information in this price pattern because stocks lead revisions historically by about 3-5 months. We’ll see if this time is different, as stocks tend to not lie. We remain cognizant on watching management’s commentary, as this will be our best way to put our ear to the ground on EPS revisions.

Luckily, our funds tend to utilize volatility as an exposure, which we believe helps us remain convicted that we are properly positioned given the current climate.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “if,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Aptus’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2204-19.