A repeated question that I’ve continued to receive is: What’s Going to Kill the Market Rally? In fact, this was the exact question I was asked on Fox Business’s Varney & Co this week. There’s been a lot of people stating: 1) Geopolitical Risks (queue Saturday night), 2) A second bout of inflation, and 3) Lower-than-expected rate cuts in ‘24.

While all those events could derail or cause a healthy pullback —pullbacks are healthy (on average, the S&P 500 witnesses three 5% pullbacks and one 10% pullback on an annual basis)— I fully believe that growth (or lack thereof) will be the culprit to something more material and structural.

Remember, stocks have levers for growth, while fixed income does not. We’ve continued to witness positive correlations between the asset classes. But take notice of the below; I think it’s quite interesting. As of EOD 4/15/24, the max peak-to-low for the market and bonds is as follows (it may surprise people):

Peak-to-Low in 2024 (the maximum drawdown year-to-date is today – 4/15/24)

S&P 500: -3.66%

US Barclays Agg: -4.02%

This is exactly why growth and increasing allocations to growth without taking on more risk are so important. So, let’s focus on the earnings profile heading into Q1 2024 earnings season. If you’d like to view our full Quarterly Market presentation, please reach out.

Q1 2024 Earnings Preview

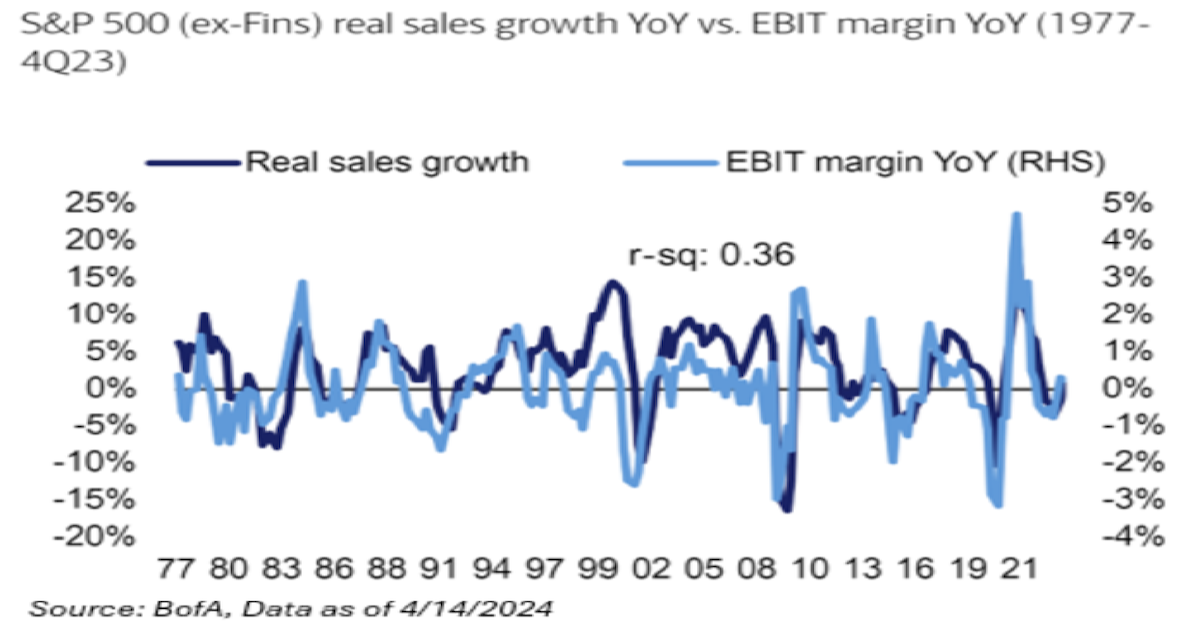

This quarter, my big focus is on demand. Why? Well, the market has finally seen a turnaround in earnings after a full year of no earnings growth (we were technically in an earnings recession back in early 2023). This EPS growth was largely driven by margin expansion. I believe that the next leg of the earnings upcycle will be led by volumes. Operating leverage should drive margins further as demand recovers. As long as margins continue to remain insulated, so should current market valuation.

Last quarter was another strong quarter for earnings, beating consensus by 4% and EPS growth accelerating to +8% YoY. While macro data has been mixed vs. consensus since last quarter, general trends remain positive, and March’s Retail Sales were a prime example (plus they revised February higher to +0.9% from +0.6%). That leads us to this upcoming quarter.

Year-to-date, earnings expectations for Q1 2024 have been cut by 2%, led by Energy and Materials. Historically, first quarter earnings are cut on average by 4% so this is a positive. Yet, overall earnings are expected to grow 4% – 5% YoY in Q1 ’24. As for revenue growth, it is expected to be +3%, which is comparable to the levels that we saw during the fourth quarter. One item worth noting is that the consensus currently shows revenue growth accelerating for the overall index throughout the remainder of the year, ending 2024 at north of 5%.

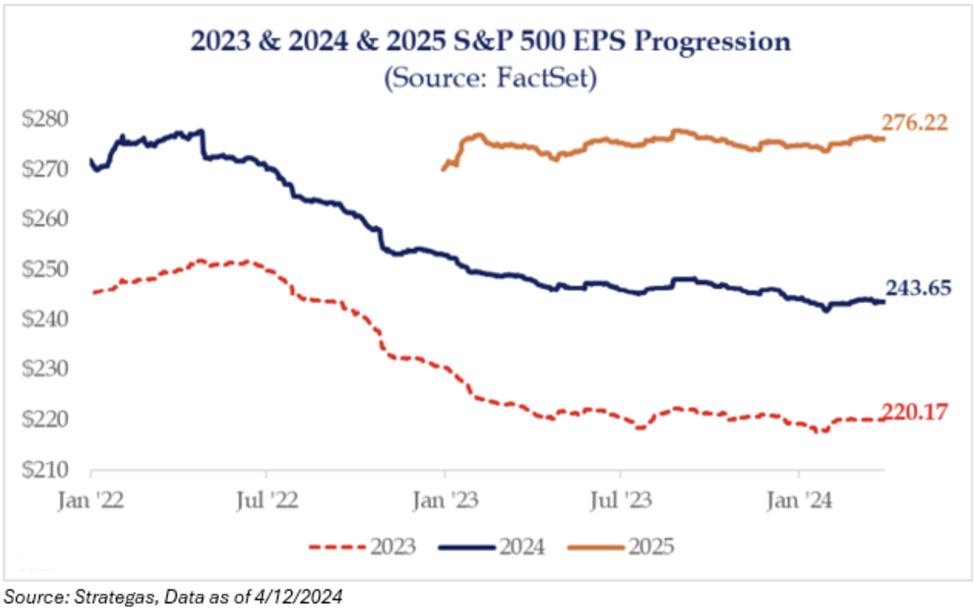

For the year, earnings growth still sits at about $243/$244, which would be about a 10.5% growth rate. 2025 is still sitting between $276/$277, for a growth rate of 13%. The acceleration of growth that is expected into next year is encouraging, although it’s starting to feel as though some of that growth may be pulled forward into this year. In my opinion, the biggest risk to these numbers is that higher oil prices could create the surprise for 2024 EPS which would likely eat away at 2025’s number.

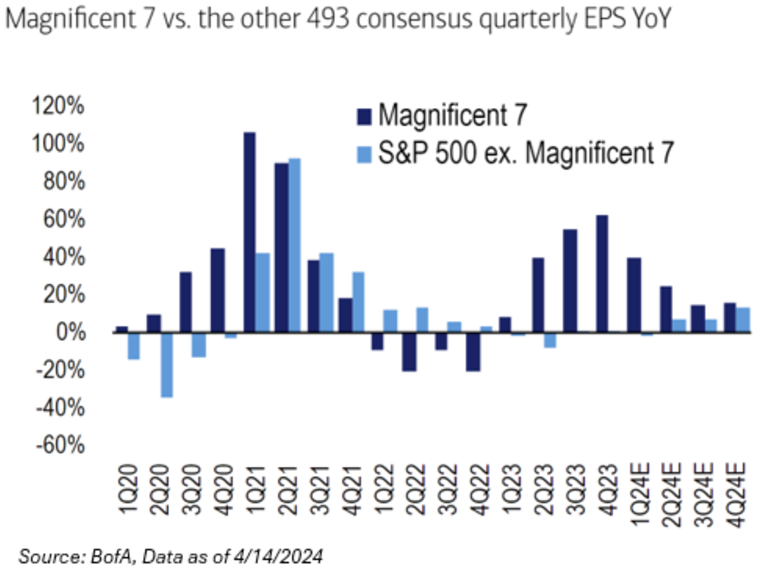

When it comes to earnings, you need to mention the Magnificent Seven (“Mag. 7”). This group of stocks posted 63% earnings growth YoY in Q4 ‘23, driving growth for the S&P 500 (ex-Mag. 7 flat YoY). But going forward, earnings are expected to decelerate for the Mag. 7 but accelerate for the other 493, with the growth differential essentially merging by Q4 ‘24. Given the high correlation between Tech’s outperformance in stocks vs. earnings, we expect the narrowing growth differential to be a catalyst for the market to broaden out.

Over the next few weeks, we’ll see to what degree better economic data and hotter inflation lead to better earnings, or whether these individual data points predict a weakening that just has not shown up in government economic data yet.

As always, I’ll have a recap email once earnings season ends. Reach out with questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-24.