I hope everyone survived the great bear market of April 2024. The market clearly created a wall of worry around earnings, and it appears that it largely cleared this hurdle.

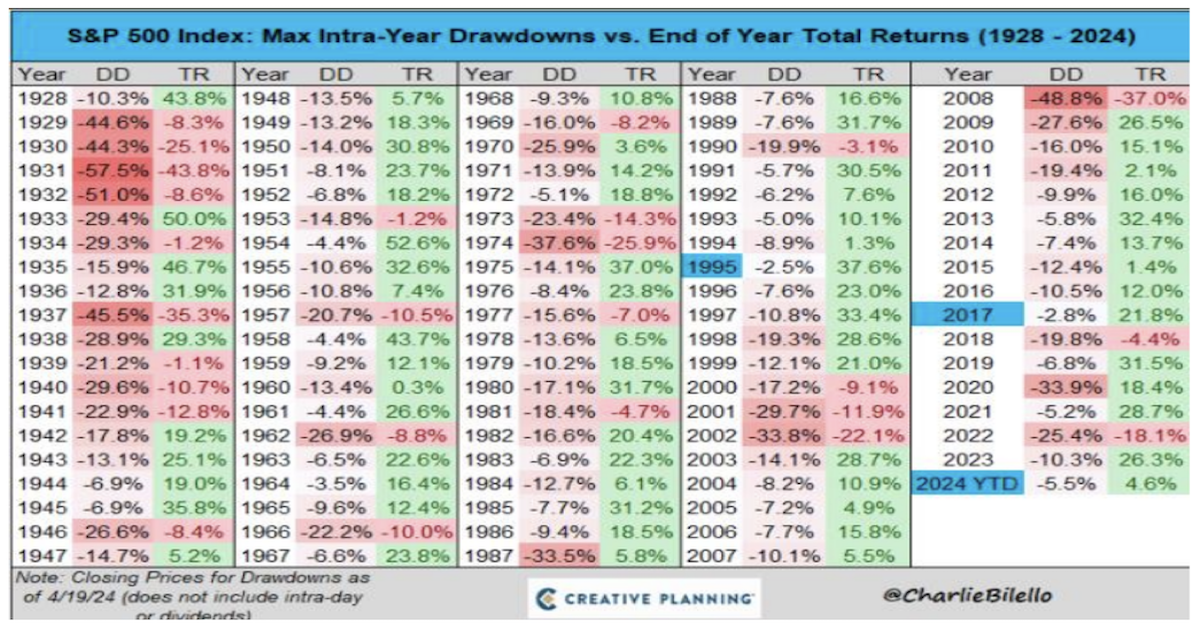

The April showers gave back much of the Q1 gains as 10-year Treasury yields increased from 4.2% to over 4.6%. The S&P 500 had given back ~40%, Midcap ~70%, and small cap over 100% of its Q1 gains in April. Remember, the market tends to witness three 5%+ pullbacks during a year, on average; pullbacks are healthy and should not cause concern. But market concentration continues to be high—even if market pundits aren’t speaking about it—as 77% of the YTD performance has been driven by mega caps.

Look at us now… we are already back to all-time highs!

Quick Blurb from John Luke on CPI: Nice to see underlying inflation data cool in April after 3 months to start the year of troubling prints. In our opinion, fears of entrenched inflation should be eased with signs of weaker retail sales internals (with downward revisions) which have been one of the main catalysts of above-target inflation (i.e., the rock-solid consumer) in addition to lagged housing data. On net, the latest report provided a round of dovish data versus expectations, which has rates rallying and stocks approaching all-time highs. We’d caution that it is just one print (that is still notably above target) coming on the heels of 3 hot prints to start the year. We’d suspect the Fed will need to continue to see the downward trend in inflation, presumably before touting rate cuts. One point that we think is important is that the comps from May, June & July of 2023 were quite low so the next couple of months will likely continue to see little progress in year-over-year (YoY) inflation reduction. In addition, super core inflation continues to press higher.

Q1 2024 Earnings Season Recap

Biggest Thought Leaving Earnings Season: The mega caps are becoming more capex-centric, vs. their focus on efficiency for the last two years. We’ll see if this strategy creates an environment where the market treats them any differently.

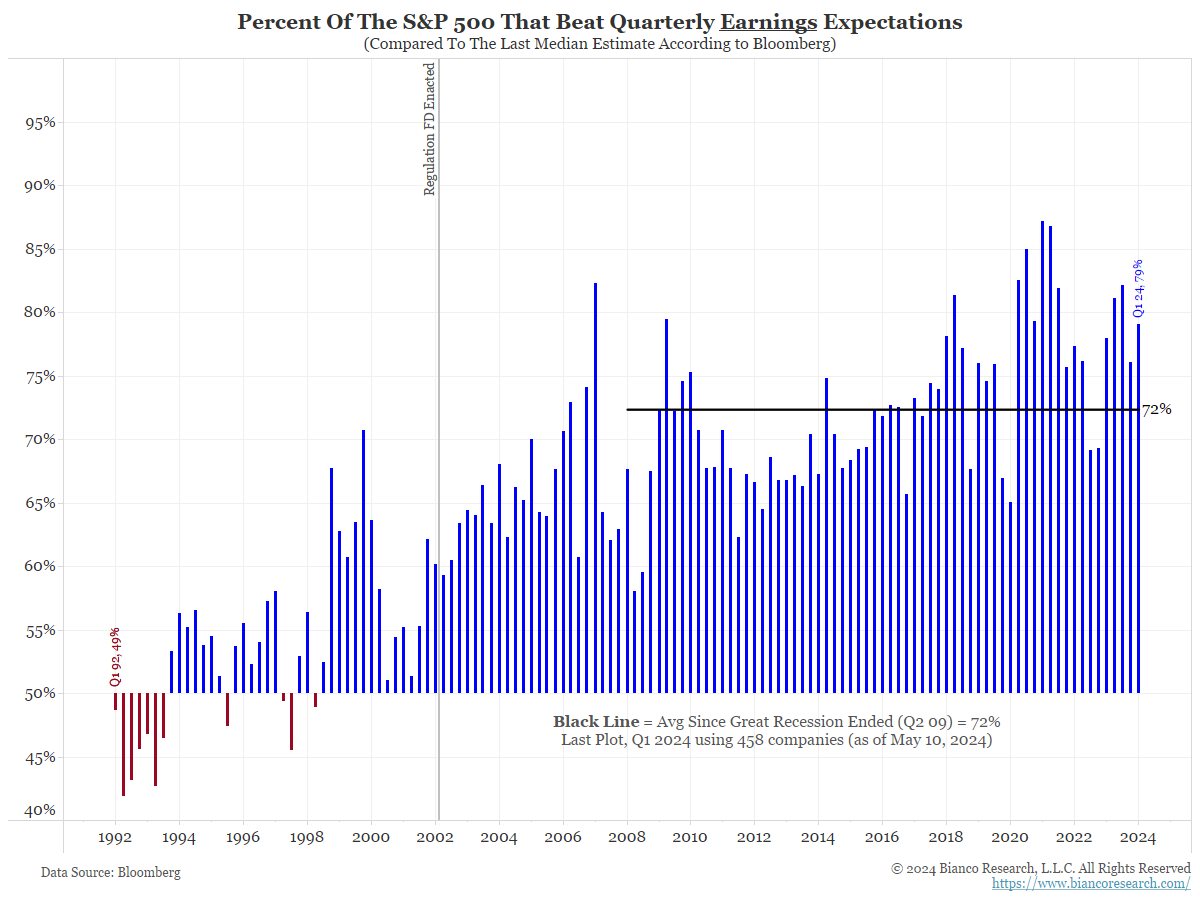

Much like the past few quarters, Q1 ’24 earnings were no different. The reporting period objectively brought a clear story of corporate earnings strength, as 60% of S&P companies beat by at least one standard deviation (the historical average is 51%), while only 10% missed (the historical average is 12%). Said another way, 79% of companies beat on the bottom line (Net Income), well above the 72% average.

Investors can debate price action here and there – the fact is that many of the largest stocks in the land made higher highs on their respective prints. Simply said, Wall Street continues to underestimate growth, leading to a bounce in growth forecasts as results trickle in, leading to a bid on the market. I am a firm believer that this earnings season “saved” the market from the aforementioned “bear market” of April 2024.

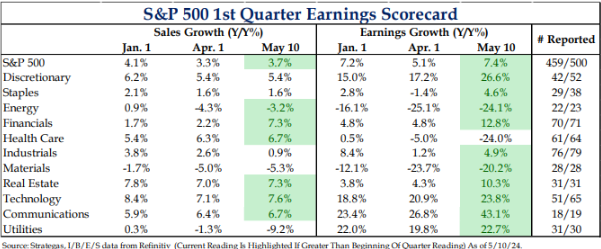

With no surprise to anyone, the aforementioned largest stocks drove a lot of this past quarter’s earnings growth of +7% YoY. Within that, the Magnificent Seven stocks are +48% YoY and the remaining 493 are -2% YoY. With the Q1 earnings season wrapping up for large caps, seven of the eleven sectors have seen earnings growth rates better than their January 1st estimates. The major outlier is health care due to a one-time charge for BMY, and if that charge were excluded the S&P growth rate would have been greater than 10%.

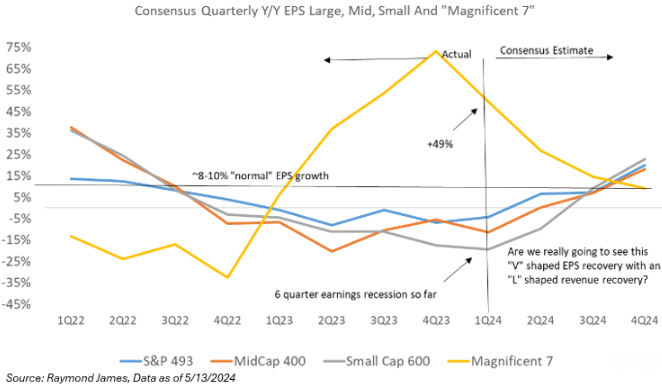

We know that the market is a forward-looking mechanism, so I’m spending my time focusing on the potential convergence of mega and small-cap stock earnings growth profiles, and what that means for markets:

With earnings basically in the rearview (minus NVDA next week), consensus 2024 growth looks good in large cap (thanks to 5 names), flat in mid-cap, up modestly in small cap. However, consensus is factoring in a much bigger than typical earnings ramp vs. normal seasonality, solely due to the expectation of margin expansion. EPS tends to move lower throughout the year, but 2H ’24 should be higher YoY for most indexes, which would be the first broad growth since mid-2022.

In my Q1 2024 Earnings Preview, I said I was focusing heavily on revenue growth, as that should be the catalyst for operating leverage at the margin level. Revenue growth was +3.7% YoY in the quarter, which is not horrible. But a worry of mine may be that expectations across indexes are for more of an “L” type recovery, not a “V” for revenue growth. It’s all about the expectation of material margin expansion as the year progresses, and that may need to come from revenue growth.

Side Bar Muse: Let’s touch base on my first sentence in this section since it’s my biggest thought coming out of earnings season that could have ramifications moving forward: “The mega caps are becoming more capex-centric.”

We’ll start with a wild statistic: Total capex + R&D for the Magnificent Seven this year is expected to total $348B. Another way to frame it is the Magnificent 7 reinvests 61% of their operating free cash flow back into capex + R&D –> that’s tracking to be 3x the remaining 493 stocks.

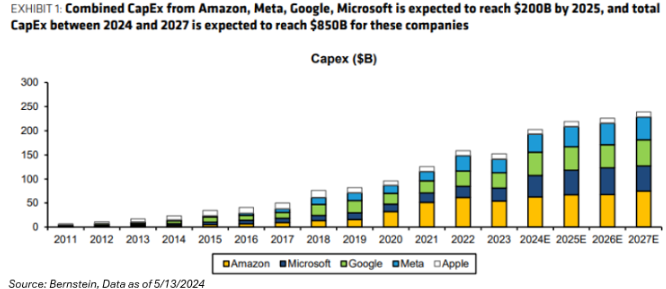

The combined capex of Google, Amazon, Microsoft, Meta, and Apple is $200B annually. What has been surprising is that while everyone knew big tech would spend an enormous amount, the magnitude measured by capex revisions has caught everyone off guard, especially this past quarter. Classifying AI spending as ‘growth’ vs. ‘maintenance’ likely doesn’t apply. Meta’s recent investment into their content recommendation suggests that the outlay is both offensive and defensive – to be determined upon whether there are enough incremental revenues to deliver a positive ROIC against this AI investment cycle. But, if Big Tech doesn’t invest, they leave themselves exposed to disruption – think GOOGL’s spending to maintain search (vs. Open AI).

Spending this amount on capex is not the negative where an investor should focus. The focus should be on whether or not this incremental spend can translate into revenue growth and profitability expansion. In the interim, Bernstein stated that the incremental capex for Big Tech could be a headwind of 100-300bps in 2024 or ~200-700bps in FCF margin compression. That is substantial, as the market loves efficiency and profitability.

There are a trillion ways this can go sideways, but could this investment cycle be worth it? Only time will tell.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-14.