Before we get into the topic du jour, let’s hit on a few things:

-

- Joseph Sykora, CFA, Head of Private Investments at Aptus, sent out an awesome quote this morning:

-

- “Equities aren’t offering a great deal of insight either. The stock market isn’t the economy, and US tech dominance distorts everything. Remember 2022, when higher rates were bad for tech? Or 2023, when rates stayed high and the sector didn’t care. Or the start of 2024, when the mkt rallied on expectations of lower rates. The Fed didn’t cut, and that wasn’t a reason to sell. Well now the Fed IS going to cut and tech is selling off. Perhaps the market does what it does, and we backfit narratives.” (courtesy of TS Lombard)

-

- This is a perfect quote to help show how difficult it is to time the markets and the importance of remaining patient, instead of clever (This quarter’s quotable). The proper structure is what should be the focal point.

-

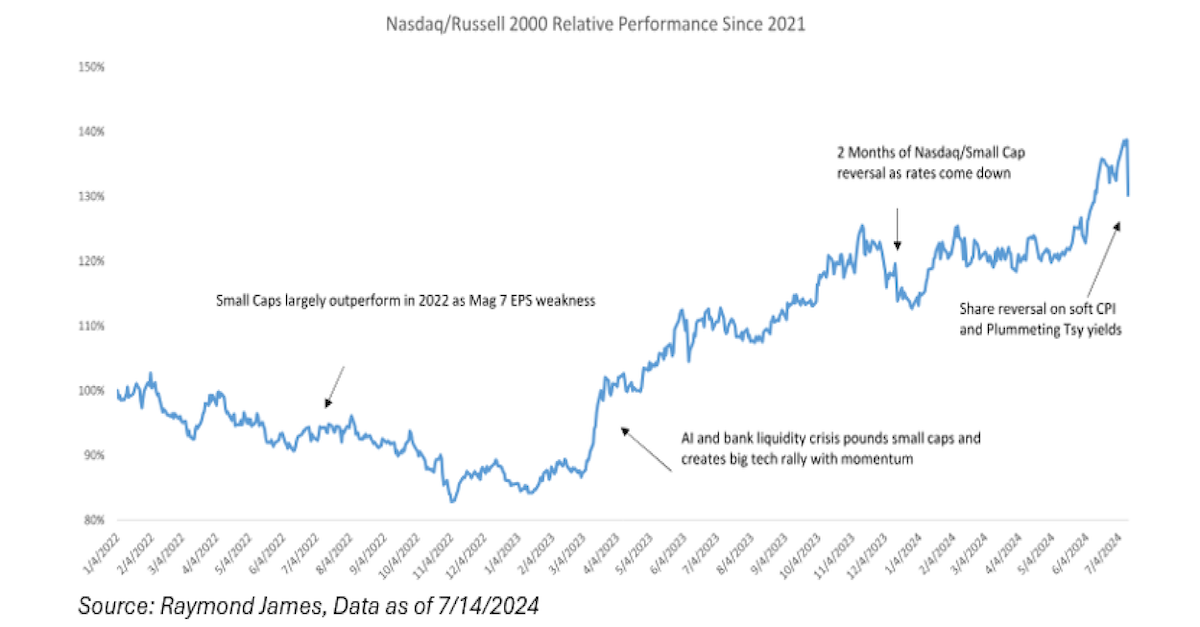

- As a small cap fund manager, everyone on this musing list knows that I absolutely love the recent run in US Small Caps (even on a relative basis v. US Large). A very popular trade amongst macro funds is to long Nasdaq/short Russell 2000 when the economy is perceived to be decelerating and reverses this when accelerating. Although this week’s small cap rally was extreme, it’s worth noting: it just reversed a couple of weeks of gains in the Nasdaq/Small Cap pair trade in June. This has been wildly profitable since March 2023 (bank crisis combined with AI narrative). Ultimately, earnings will determine the sustainability of the trend, but long term, the valuation logic is undeniable.

-

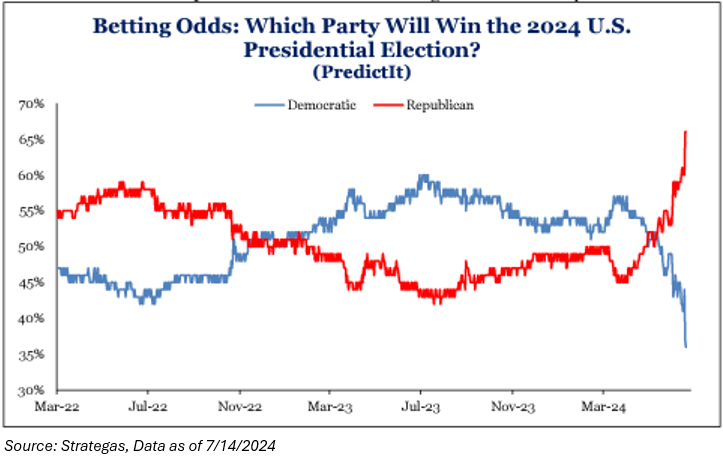

- Lastly, I’m guessing that a few of you are receiving questions about the events of this past weekend. Our thoughts: The black swan events that we’ve witnessed in this election cycle (Trump, convicted of crimes and survived an assassination attempt, and Biden, showing severe signs of aging that raised questions about his ability to campaign and even govern) have been intellectually rigorous with no historical playbook. While obviously this weekend’s assassination attempt was a troubling event regardless of political affiliation or preference, the market impact of it should be relatively limited for two reasons:

a. First, the market already assumes a Trump win and potential Republican sweep in the November elections; the events of the weekend do not reduce those chances.

b. Second, the ultimate direction of this market will still be determined by economic growth and whether there’s a material economic slowdown, or not; we believe the events of the weekend won’t impact growth one way or the other.

Q2 2024 Earnings Preview

Given the length of the opening monologue, I’m going to keep this section a bit shorter than normal.

Remember, just one year ago when the S&P 500 had three straight quarters of negative earnings growth (which was considered to be an earnings recession). Well, fast-forward 12 months and all of those worries seem to be a thing of the past, as the S&P 500 is +27.1% (1YR return)

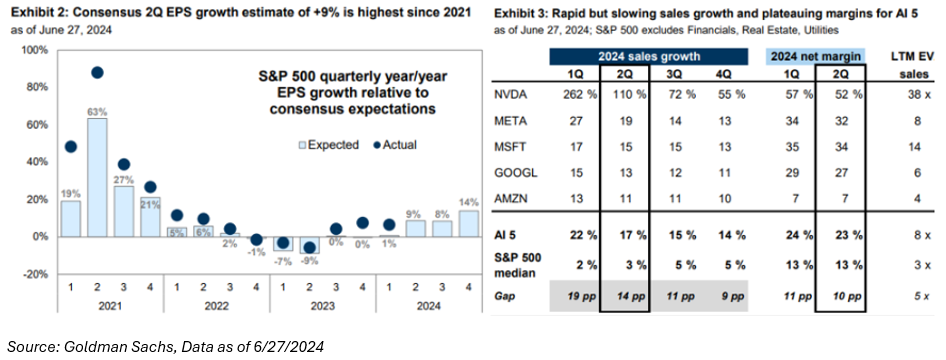

S&P 500 earnings for Q2 2024 are expected to be up by +9.1% year-over-year (“YoY”) on +4.4% higher revenues based on consensus estimates. Earnings growth forecasts are positive for 7 of 11 sectors led by communications and healthcare while materials and real estate are expected to be the largest drags. If analysts’ predictions are accurate, this quarter’s YoY EPS growth rate will be the highest since Q4 2021 (see below). Moving forward, it appears that the next three quarters of the year for the index, as a whole, are positive with consensus EPS growth estimates of +8%, +14%, and +15%, respectively.

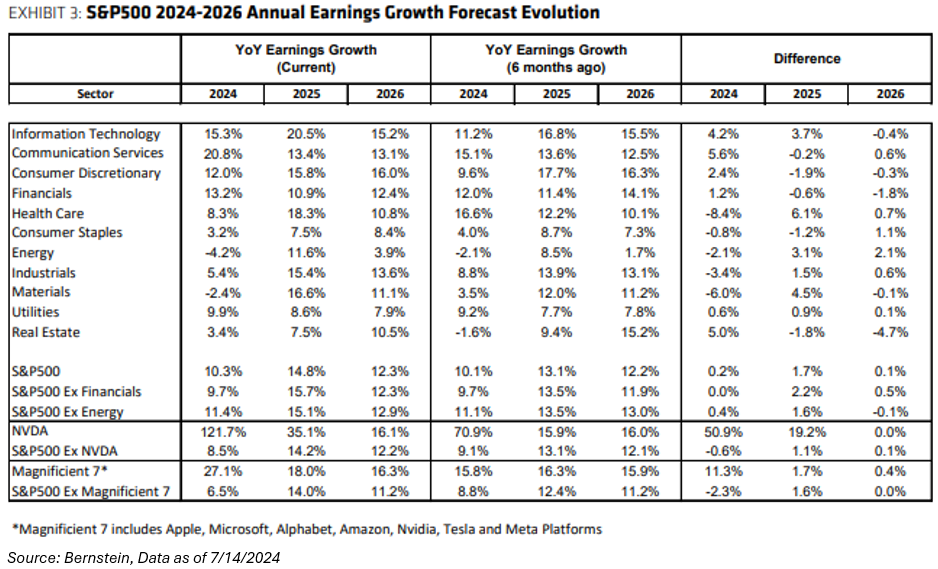

Excluding NVDA, the S&P 500’s Q2 earnings growth rate estimate would be +7.2%, and excluding all the Mag 7 stocks, the growth rate would be +5.2%. According to analysts’ current forecasts, the Magnificent 7 effect will start to moderate in the fourth quarter.

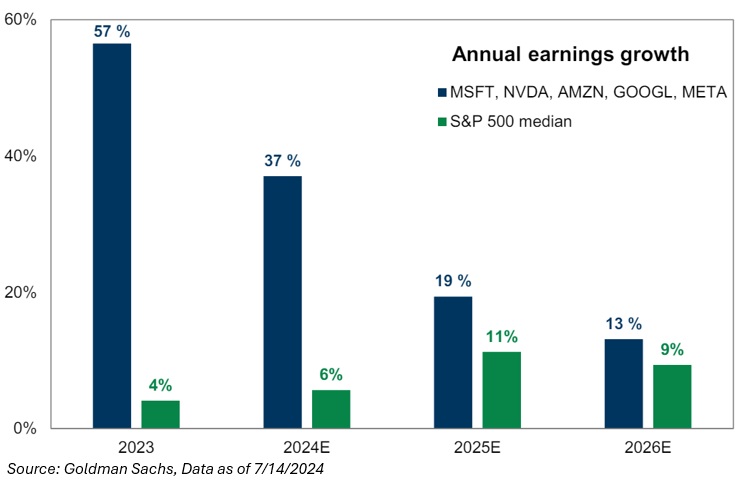

The below chart is a reminder that the earnings growth premium earned by the largest names is expected to narrow. Myself included, this has been one of the most intriguing charts for those who like the average > mega-cap stock. If someone is looking for a catalyst, it’s the gap in earnings growth closing with large slowing and small accelerating. I’d also state that a rate cut would be very nice as well.

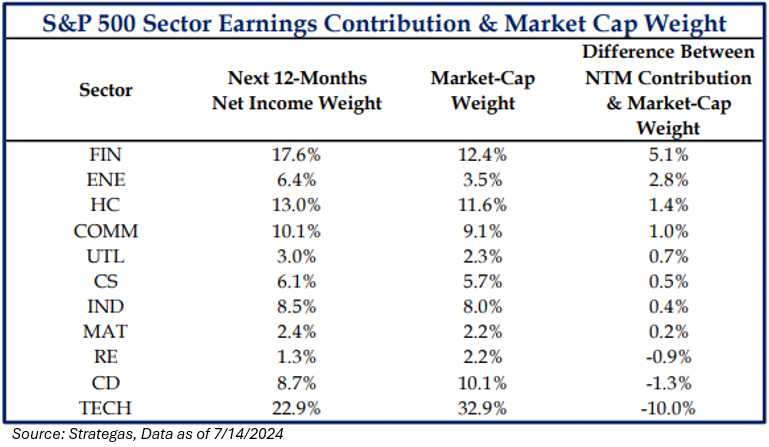

I always find the chart below interesting – though it’s unfair, for a few reasons, to utilize it to make investment decisions – as it doesn’t take into consideration the expectation for longer-term growth alongside valuation, but that’s a conversation for another day.

For us, the biggest questions moving forward are:

- Are we starting to see cracks form at the consumer level?

- How likely are companies able to continue to grow gross margin?

- Does enthusiasm remain in the AI space, driving revenues?

- Are the changing prospects for the election resulting in changes in business strategy?

As we’ve continued to say, moving forward, it’s all about growth. Inflation around 2.6% (Core PCE) isn’t inherently threatening to the market or economy, but the Fed’s approach to how it handles slowing growth could be the lynchpin to the market moving forward. The “higher for longer” environment could increase the likelihood of an economic slowdown, posing a real risk to the current rally. The bottom line is that growth remains a focus and will be the ultimate driver of this rally.

Said another way: Will the Fed cut rates in time to prevent a slowdown?

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-24.