The big debate in the final weeks of Summer is whether the delayed bite of the Administration’s trade and tariff policy will matter more for financial markets than the offset from likely rate cuts, monetary policy and fiscal policy. Best we can tell, it’s the latter still winning the showdown. We’ll see what happens in the seasonally weak periods of late August and September.

Here’s my favorite chart right now (it was in my last Musing). Let me know if you want more explanation of this chart:

Brad Rapking, CFA, bet me that I couldn’t go an entire Musing without writing the word “But”. I’ll do my best. So, let’s dive into the past quarters’ earnings seasons to talk through all of our team’s thoughts. I’d be remiss to say that earnings season wouldn’t be complete without NVDA reporting; that happens next week

Earnings Recap: Q2 2025

The single word to describe this past earnings season is Dispersion. And I know that many of our readers are personally witnessing this due to the increase in the number of stock requests that I receive on a daily basis: “What’s going on with XYZ stock?” / “Why is ABC down so much?”

Welcome to earnings seasons, baby! Because the Large Cap equity universe is witnessing the level of volatility that Brad and I are accustomed to in small cap land. Luckily, I firmly believe that our small cap acumen has helped us considerably navigate the past few weeks much better than others, in my opinion.

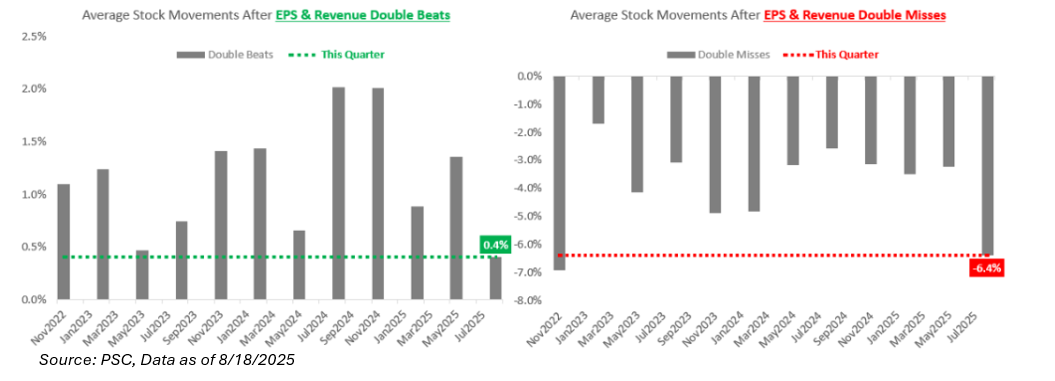

The chart below is a picture-perfect description of dispersion. If a stock has beaten Wall Street’s expectations, the following day, it traded in line with historical performance averages. But, if it missed expectations, the stock was down, on average, -6.4% the following day, almost 3x greater than the historical average.

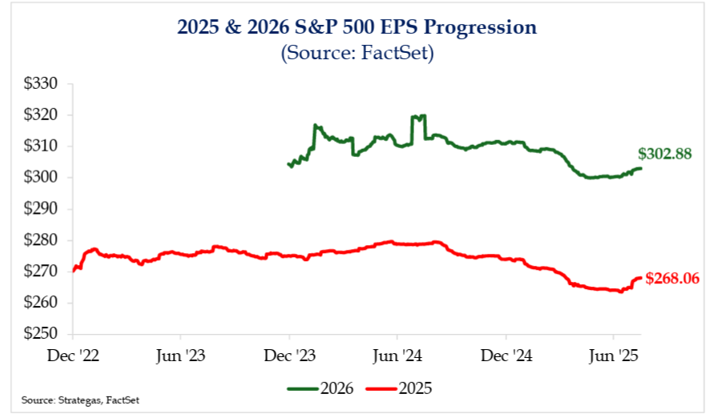

Despite the lower expectations, Q2 is shaping up to exceed even the pre-liberation day growth expectations, with growth coming in at more than double the initial expectations of 12.9%. Revenue growth is coming in at a whopping 6.3%, outpacing the previous four quarters, even before tariffs were introduced. Concerns over stalling sales have not materialized. Looking ahead, full-year 2025 EPS estimates are once again approaching $270, while growth projections for 2026 remain strong at around 13%!

As of June 2025

As of June 2025

Now, let’s get more granular:

- The math equation that explains corporate earnings is OBBB + weaker USD + sustained consumer spending + increased capex > tariff headwind. And that’s exactly what occurred during the quarter, as overall expectations beat a severely lowered bar and earnings revisions were broadly positive, with various breadth measures being historically strong.

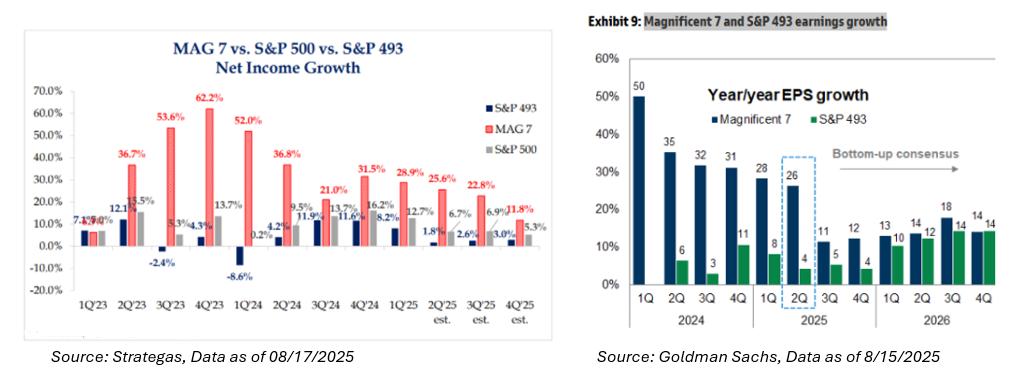

- The great broadening out in EPS growth beyond the “Magnificent Seven” and into everything else just keeps getting pushed out in time.

On the first point, the market traded down during March and April off of lower-than-expected EPS growth due to tariffs; it was a classic growth scare selloff. Well, in the first quarter that fully included tariff ramifications, the market had strong earnings growth (and great revenue growth!), boosting future expectations off of optimistic guidance.

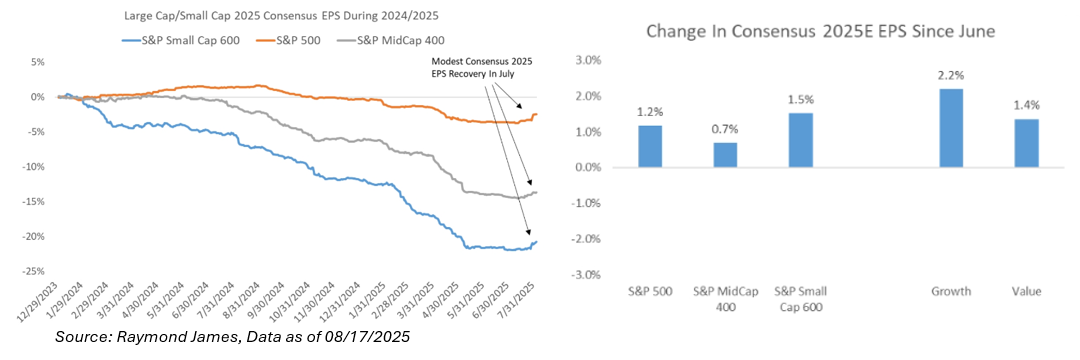

In fact, consensus 2025 EPS estimates moved up 1-2% across indices and styles during the earnings season, which is highly unusual. Typically, investors see a 1-2% cut during Q2; it was the strongest quarter since 2021. Said differently, Year-over-Year (“YoY”) next twelve months (“NTM”) consensus EPS, which has the highest R-Squared to Index returns long term vs. any other EPS metric, started moving up again in May and continued through earnings season, after dipping sharply in February through April. This fueled a lot of the market’s rebound in recent months.

And on the second point, we’ve shown this chart for the last year or so, and it shows how the Mag 7 was driving most/all of the earnings growth in 2023/2024, while the rest of the index was in a modest earnings recession. This trend was expected to reverse in 2025, but the line keeps getting pushed out to the right. Mag 7 EPS continues to outperform (+26% in Q2 ‘25), while EPS continues to underwhelm everywhere else with small, mid, S&P 493, and Europe essentially with flat EPS YoY. The lines are now expected to cross in Q4 25/ FY26, which would be consistent with broadening performance in the equity market. At this point, we would expect more delay for this much anticipated event.

Tariffs’ Effects on Earnings

Personally, I think this is the focal point of the Street moving through the next few earnings seasons that will ultimately be the north star for ST trading.

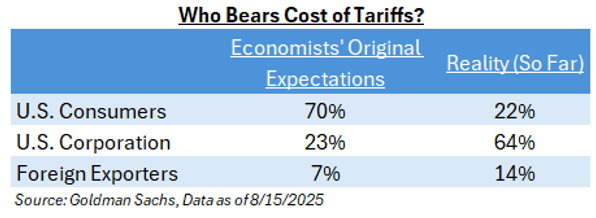

Per Goldman, they expected the consumer to bear ~70% of the tariff cost. That has not been the case so far, as they estimate that corporations have footed the majority of the bill so far, estimated to be ~64% as they work their way through pre-tariff inventories. Consumers, estimated by Goldman, have only eaten 22%, while foreign exporters about 14%. To me, this makes sense, as we have not seen inflation materially jump, nor the 3 and 5-Yr breakevens, the latter being the important part. Some of this data should be seen in the S&P 500 operating margin. Although it is decreasing, it seems like the operating leverage of the Magnificent Seven has more than insulated this margin degradation.

Compared to recent history, the second quarter was slightly below past quarters, but in no way indicative of a broad slowdown.

This is what I would keep an eye on through the remainder of this year:

Does the consumer slow their spending?

When does the consumer get stretched on an income basis?

Because it’s not going to happen from their net wealth or balance sheets. Right now, policy very much favors the large corporations. AI investment, capex incentives, deregulation, lower taxes, and loose financial conditions all keep the bid under big businesses. Profits rule everything around us.

As always, let me know if any partner would like some individual stock thoughts after the recent slew of earnings reports.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed, and all calculations may change due to changes in facts and circumstances.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2508-19.