Given the breadth of questions that I’ve received on President-elect Trump’s cabinet picks I thought I’d start with some commentary.

In my opinion, the market is not political. It doesn’t care about political views and rhetoric, suggested initiatives, or strategies. The market only cares about policies that:

- Increase (or decrease) earnings

- Support growth (or hinder it)

Any political movement or agenda that is viewed by the market as getting in the way of better earnings and growth will be viewed as negative and be a headwind on risk assets, regardless of whether those policies are from Republicans or Democrats. This is the way we must view political coverage over the next year (and likely four years) and this will help us cut through the noise and stay focused on the policies that will impact markets.

Let’s begin…

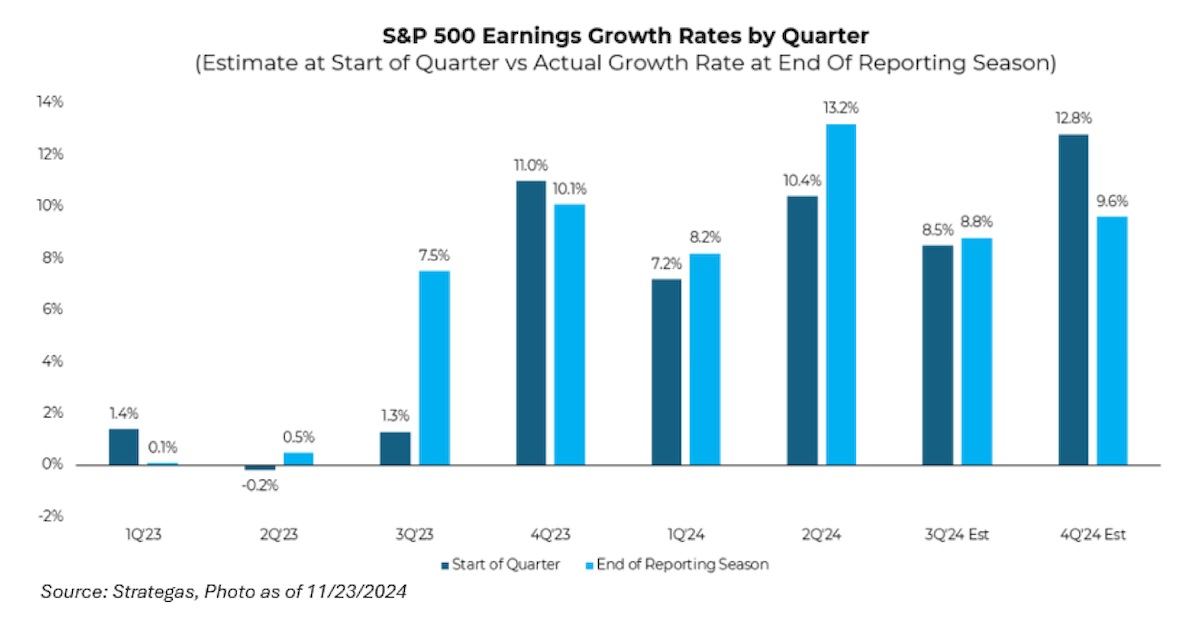

Q3 2024 Earnings Recap

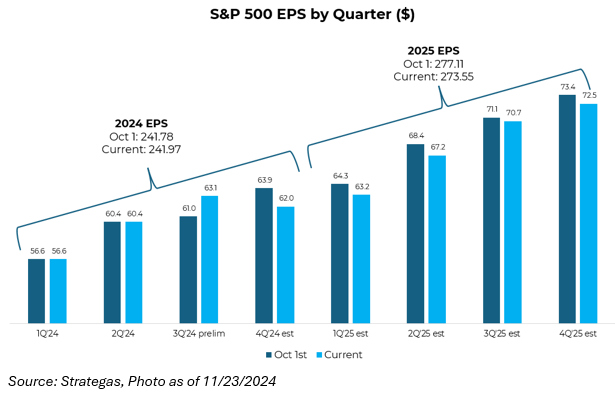

Simply said, earnings are starting to break out, driven by strong sales and record margins. Looking back, CY 2021 finished with trailing earnings at $209 and then spent the next eight quarters range bound between $215 (Q2 ’22) and $223 (Q4 ’23). This period could be categorized as a mismatch between softer-than-expected post-pandemic revenue growth and higher-than-expected costs. Well, fast forward, and the market has witnessed trailing twelve-month earnings of $235 during Q2 ’24 and Q3 ’24, with an end of year estimate of $245. The market can thank profit margin expansion, as profitability has risen 60bps during this time frame.

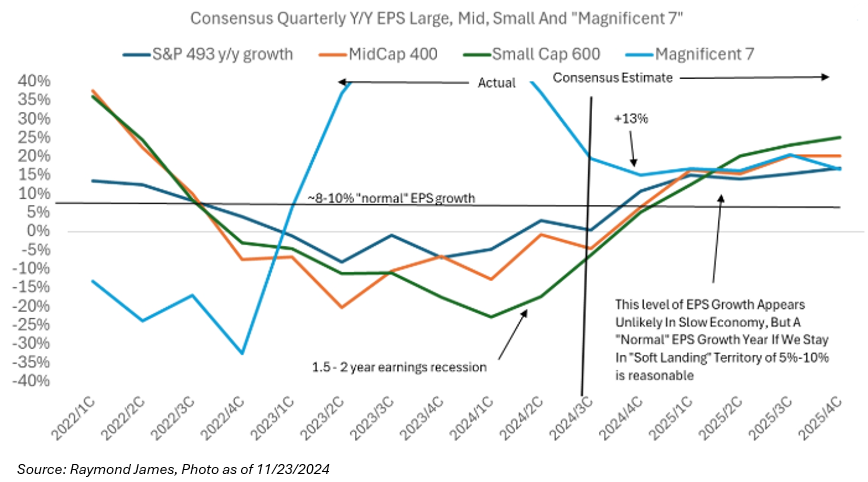

The bullishness is expected to continue next year, alongside 2026, with average estimates of $274 and $308, respectively. The continued strength is predicated on: 1) strong revenue growth, 2) Magnificent 7 follow-through (mostly NVDA), and 3) record operating margins.

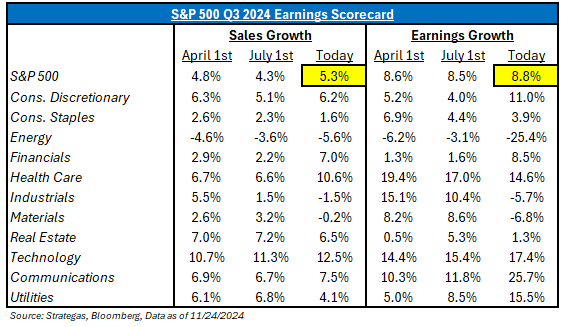

While some remain skeptical, there is no denying the fact that the S&P 500 continues to be characterized by operating leverage. Just look at the results below for this past quarter; strong top-line (revenue) leads to even stronger bottom-line (earnings) growth:

The U.S. domestic large cap market can achieve top-line growth of 5.3%, which equates to earnings growth of 8.8%. And, it doesn’t stop there; next year, the market is expecting 5% revenue growth and 15% earnings growth. As many people on the Musing distribution have heard me say: U.S. Large Caps are the only major asset class in the world that has this characteristic. U.S. Small Caps don’t have it (more service-based), EAFE doesn’t have it (service-based and slower growth), and EM doesn’t have it (commodity-based).

I’ve spoken on this topic at length on TV. Find the Yahoo Finance playback link here.

With the market no longer concerned about the election and its shifting focus toward policy uncertainty, the growth rate for next year has come in a couple of percentage points but still remains generally robust. The adjustments are being made to the first half of next year which isn’t all that surprising. As we receive more and more policy clarity, we suspect adjustments will be made. Keep in mind, Trump 2.0 will not see the same EPS benefit as Trump 1.0 simply because a large broad-based tax cut is likely not going to happen for corporations.

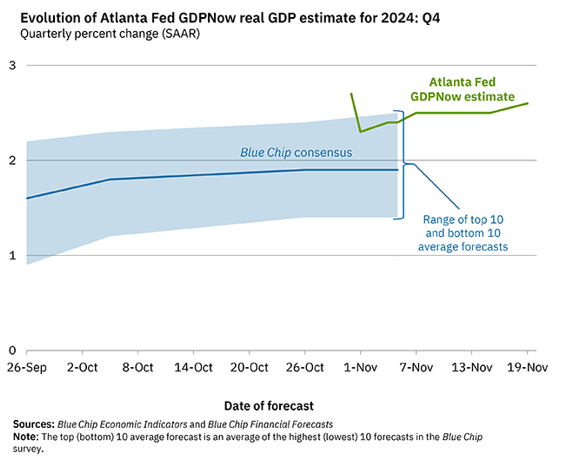

Bringing all of this together, earnings growth should be very supportive in the future, as just this past week, Walmart (WMT) and NVIDIA Corp. (NVDA) highlighted (yet again) that the bottom-up story is broadly constructive. Even if we look at the macro picture, US GDP is tracking +2.4% for Q4 – a rate that should continue through next year. I’d argue that’s a fine temperature for the market.

Below, the most up-to-date Atlanta GDPNow FedCast:

Thankfully for active managers like us, companies don’t grow at the rate of real GDP. Earnings get reported in nominal terms, and obviously some companies do better than others.

As always, for partners, if there are any individual stock reports you’d like about a recent earnings announcement, give me a ring.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-23.