S&P 500 Earnings Recap – Q4 2023

Fox Business (Varney) – Earnings Interview

Heading into this year, at the market level, I continued to state that “the burden of proof remains with the bears”. I still agree with this statement at the market level. But, at the stock level, it appears to be the opposite; the burden of proof actually lies with the bulls. I acknowledge this because if a company has beaten expectations on both the top (revenue) and bottom line (net income), the stock has been rewarded the following day being up +1.4%, on average. This is right in line with historical averages (historical average is +1.5%). But, if the stock did not beat expectations on both the top and bottom line, the stock has been punished by 4.4% – almost 2x the historical average. This simply shows that expectations are very high for companies right now. Some stocks even priced to perfection; think MSFT and GOOGL.

This may sound confusing: the bears have the burden at the index level, but the bulls have the burden at the stock level. Let’s put some context to that. Right now, outside of when a company has been reporting earnings, the market is being driven by and focusing on more macro factors, i.e., soft-landing, rates, etc. I feel comfortable making that above statement. Outside of earnings days, the market is being more driven by top-down factors.

If it doesn’t make sense, I can always fall back on the old adage about the market: “If you aren’t thoroughly confused right now, you’re not paying enough attention.”

Simply put, the Q4 ’23 earnings season is turning out to be a strong one, especially with growth broadening out. Many people likely don’t recognize that the S&P 500 Equal Weight Index (RSP) just hit a 2-year high. As it currently stands, earnings per share (EPS) have grown +9.0% relative to last year, with 10 of 11 sectors outperforming expectations as of January 1st expectations. Sales also did well, growing +3.4% year-over-year.

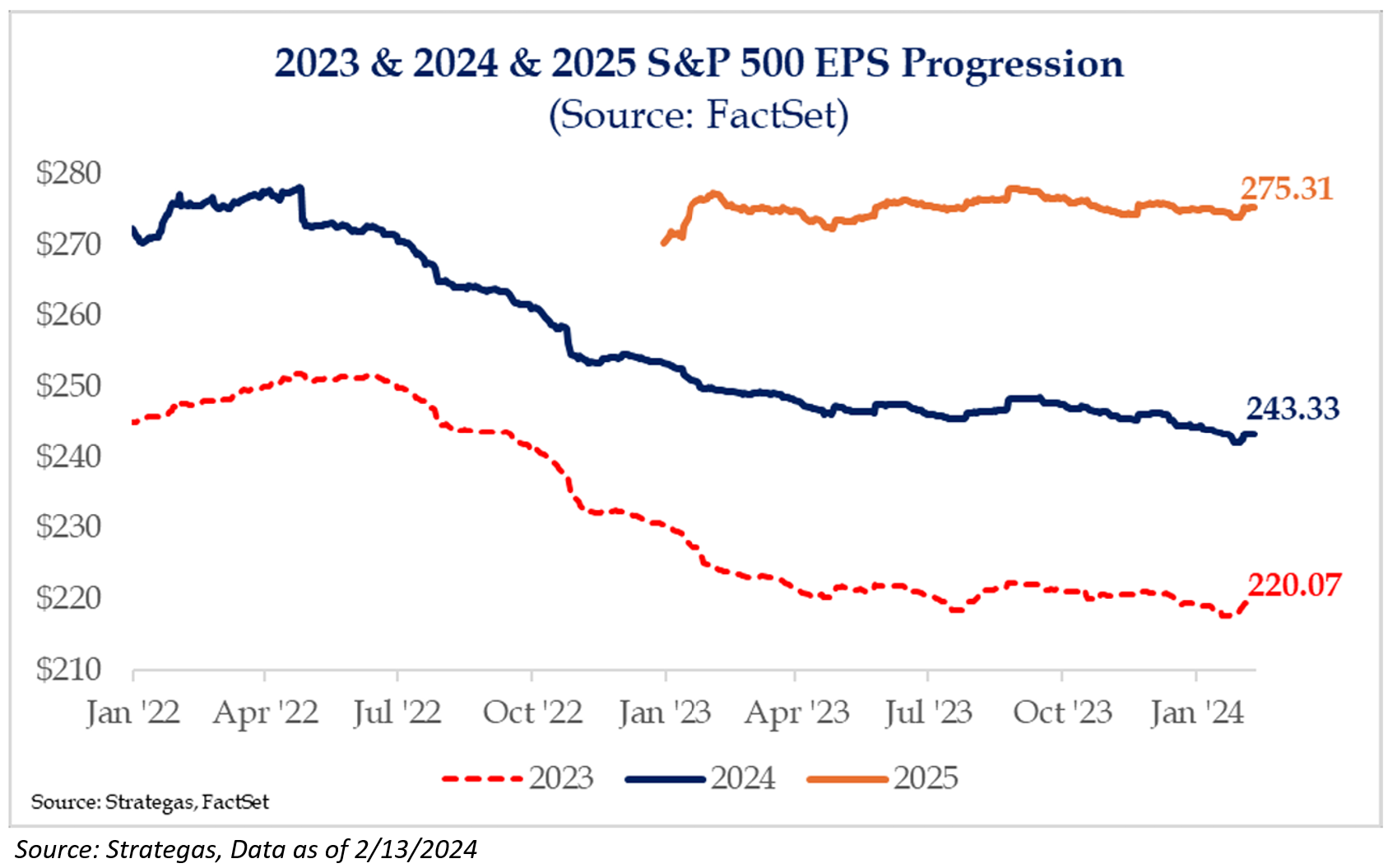

With the fourth quarter reporting season continuing to come in strong, 2023 EPS have ticked higher, but the growth rate for 2024 has suffered slightly with the lack of upward revision to 2024 figures. Growth now sits at about 10%, down from 11%. We suspect this growth rate will continue to slide with the traditional progression of EPS. It’s extraordinarily rare for large upward revisions to EPS figures later in the year. 2005 and 2006 are the prominent examples of this happening but it’s not the norm.

![]()

Most Surprising Data Point

I think that many investors will focus on the strength from the Magnificent Seven, as their EPS grew +57% year-over-year, while essentially the rest of the S&P 500, mid- and small-caps witnessed EPS down 8% – 16%. This would equate to a 5th straight quarter of an earnings recession masked by EPS strength from a handful of names.

Being the optimistic person that I am, I’d state that I came out of earnings season more enthusiastic than many for the “average stock.”

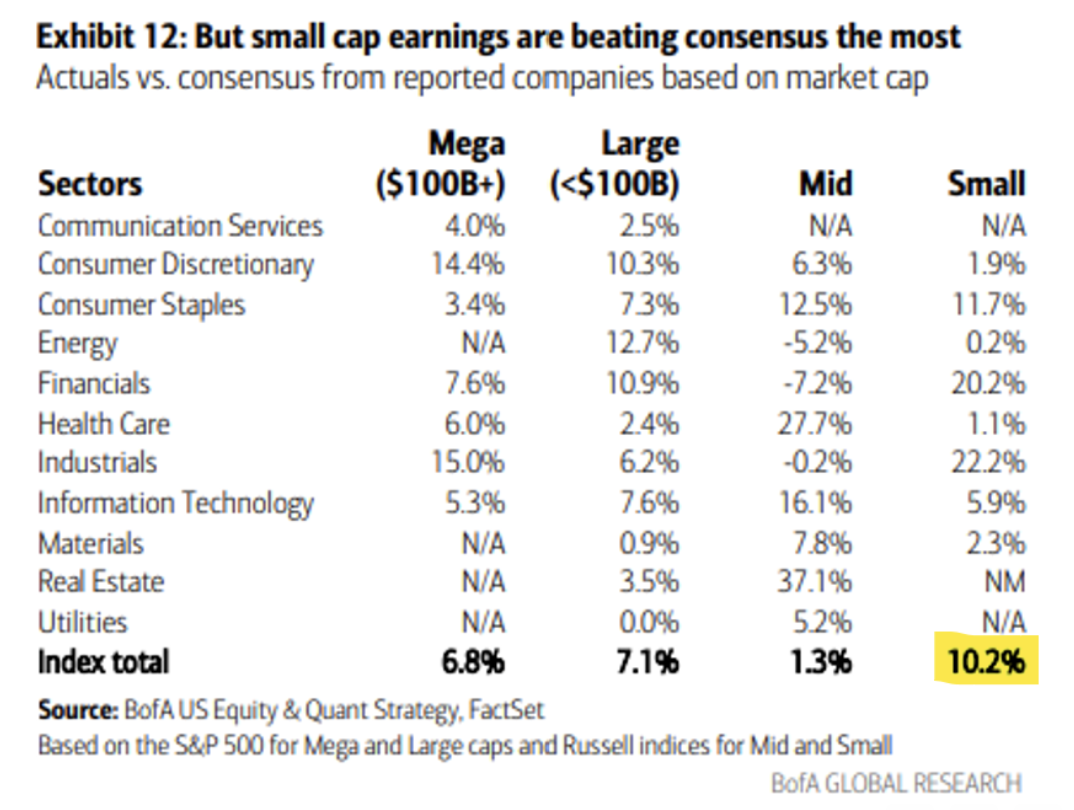

The Magnificent 7 (ex. NVDA that hasn’t reported yet) beat EPS by 7%, in line with the other 493. Mega caps ($100B+ in market cap) also beat by the same amount, while small caps are posting the biggest beat, +10%.

Mmmm, small caps…

Source: BofA as of 02.12.2024

Source: BofA as of 02.12.2024

Most Surprising Data Point #2

Q4 ’23 capital expenditures (“capex”) is tracking just +1% YoY (vs. +2% in 3Q) amid rate pressure. But 55% more companies are guiding above consensus on capex than below so far this earnings season (vs. 39% historical average). The aggregate capex guidance from 81 companies so far suggests healthy 7% growth in capex in 2024 YoY.

In our view, the nascent AI investment cycle, combined with domestic investments coming from both public and private sectors, should lead to a strong and prolonged capex cycle ahead. I’ve been a big believer that the consumer remains healthier than most expect, but also that corporate spending will not dry up. We’ve seen a slew of fiscal spending transition to corporations – think CHIPS Act, IRA, etc. Not to mention that there are a few bills bouncing around Congress that can help from the full depreciation of capex. I think this trend continues, insulating sectors like Industrials. The industrial sector is now the fourth sector that is expected to have a growth rate that exceeds the October 1st estimate; very strong.

Net/net, many market participants thought that beginning the year, ~10% EPS growth for the S&P 500 was too aggressive, but it looks more reasonable now, although largely driven by just a handful of stocks. We still would expect mid cap, small cap, and large cap, ex-Mag 7, to be more resilient than many originally thought.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-12.