Ride Wit Me – Copart, Inc.

As fundamental analysts, we need to do the work – we need to roll up our sleeves and get our hands dirty. We don’t solely rely on sell-side analysts’ expectations, price targets, etc. If Nelly, the rapper, was a sell side analyst and he told us that it was “getting hot in herre” – it’s not our job as fundamental analysts to take off all our clothes. It’s our job to look out the window and make an assumption on our own. That’s what we’ve done with Copart, as we believe it is still somewhat a hidden gem in the institutional world.

Copart, Inc. is a leading provider of online auctions and vehicle remarketing services in 11 different countries. Through their patented platform, their site auctions used cars that are salvage titled, damaged, or rebuilt. I believe CPRT presents a great investment opportunity because:

- Unique business model provides great profitability with an economic moat.

- CPRT shows strong revenue growth and a bright outlook.

- Their management team shows a track record of financial discipline.

CPRT has a very unique business model with two approaches for listing vehicles. They may directly purchase cars damaged by accidents or natural disasters and then sell the vehicle through the platform. Alternatively, they provide auction services for insurance companies, financial institutions or individuals to sell vehicles on their behalf. On the purchasing side, most buyers are licensed vehicle dismantlers, rebuilders, repair licensees, or used car dealers.

We believe this revenue growth will continue into the foreseeable future and possibly accelerate because of the 1) increasing technological complexity of new cars, 2) increasing labor costs, and 3) auto part shortages are causing insurance companies to designate cars as totaled with greater frequency.

Here’s a great write up on the name – About CPRT – Masters Invest Blog. My favorite take away is how Willis Johnson, the Executive Chairman (and Founder), describes CPRT’s business model:

“Think of us [Copart salvage auctions] like the local sewer system. We’re a utility. Nothing can get rid of us – nothing. Two of the biggest businesses in the world are car manufacturers and insurance companies. If insurance companies don’t write insurance policies on cars, then they’re out of business. If manufacturers don’t make cars, then they’re out of business. They’re always gonna make cars, and they’re always gonna insure them. We’re the guy in between. As long as we’ve got the land in the right place to put the cars on, we can’t fail. We are like the septic tanks of the sewer system. You can’t have the system without us.”

Side note, the CEO, Aaron Adair, pays himself $1/YR in salary – he’s compensated fully with shares, hence why insider ownership is north of 10%! Talk about alignment of interests!

Grillz

After the recent CPRT news, you won’t have to rob the jewelry store because CPRT is going to sell people some (car) grilles. We’ve been really impressed with CPRT, which operated in a duopolistic market. The only other competitor is IAA, Inc. CPRT has continued to take market share from IAA. In fact, they just won the contract with GEICO, which was previously 100% serviced by IAA. Why? Simply put, IAA had weak execution after Hurricane Harvey. Secondly, given CPRT’s international expansion, they have a far more reaching global network than IAA – hence, they had more potential buyers to bid up a car’s salvage value, i.e., a higher yield. CPRT has continued to expand internationally – something IAA is not doing.

We believe that they have done a great job expanding the EU unit, as the demand is certainly there. People in Europe, specifically eastern Europe, have a desire for western cars. If they can get the supply side of the equation right, there is substantial runway for growth in this division.

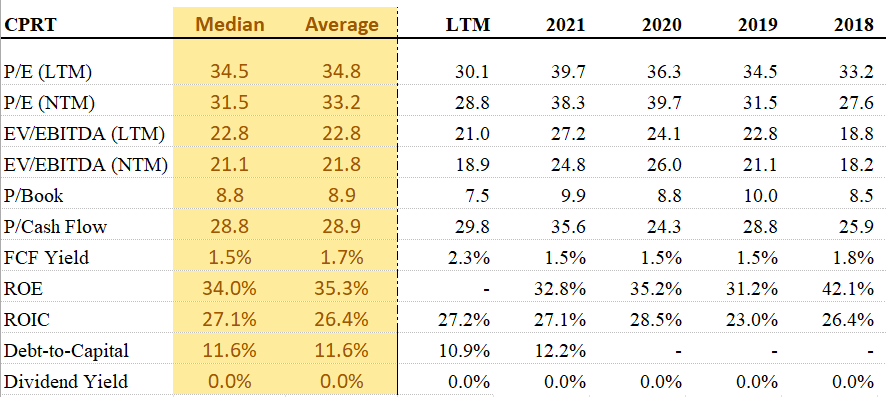

Valuation

Relative to their only peer, IAA, CPRT looks very expensive. But there is a fundamental reason as to why – see market share commentary above. This may be one of the most expensive stocks in the portfolio, but given the growth opportunity and the dynamics of the overall duopolistic environment, we believe that price is what you pay and value is what you get.

Source: FactSet as of 3/21/2022

Source: FactSet as of 3/21/2022

Yield + Growth Framework

0.00% (Yield) +10.50%(Growth) = 10.50% (Y+G)

Yield: Given the growth prospects internationally and other avenues, CPRT has decided to re-invest back in the company. Management has a strong history of execution. At a point, we would expect CPRT to start paying a minimal dividend, given free cash flow and current cash balance.

Growth: US Sales Growth + Margin Improvement + US Market Share Growth + International Expansion + Buybacks.

10.75% – 1.00% + 0.00% + 0.50% + 0.25% = 10.50%

Bull / Bear Case

Bull Case:

- Long Runway for Superior Organic Growth:

- Increase in Number of Cars Considered Totaled – As each new car model becomes more elaborate, it is expected that the number of cars being considered “totaled” will continue to grow. With more technology being engrained in each vehicle, vehicle repair costs are steadily rising, skyrocketing the number of vehicles deemed a total loss. Historically, around 14% of cars involved in a wreck have been considered a total loss. Now, this figure has been on a consistent upward trajectory with over 20% of cars being deemed a total loss.

- Growing Average Age of the North American Car Fleet – The number of registered vehicles and average age of the North American car fleet are at historical highs. This will likely drive down used vehicle values, sending a higher proportion of crashed vehicles to salvage auction.

- Number of Miles Being Driven Per Year – Given lower gas prices, Americans have been driving more than ever before. Last year was the sixth consecutive year of increased miles driven on public roads and highways, reflecting a strengthening economy. On average, miles driven per year have grown by 3.0%. This wear-and-tear on cars will drive a shorter than expected useful life, increasing the potential salvageable car universe.

- Growth Outside the United States – Copart has been diligently investing internationally, which has already proven successful by adding growth to the topline and a meaningful impact to earnings per share. International demand for repaired/salvaged cars has been very strong, outperforming internal goals.

- Competitive Moat – CPRT has focused on reinvesting into improving technology and additional fixed assets. Not only does this add capacity and drive organic growth, but more importantly, we believe this creates a breadth of offerings for the customer, solidifying relationships, and increasing the opportunity cost for the customer to change auctioneers.

Bear Case:

- Sentiment Surrounding Autonomous Vehicles – Though not a short-term threat, sentiment can create unintentional near-term volatility around the stock. Longer-term, self-driving cars with better driving records than humans could reduce available supply of “totaled vehicles”, albeit this is probably well into the future.

- Earnings Volatility – Copart doesn’t hedge foreign currency transactions, which can create some volatility in net income and earnings per share. As Copart continues to grow its International business, this could create earnings volatility.

- Not Recession Proof – What is the main component driving growth in Copart’s sales? The fact that people are purchasing new cars, sending their old ones to online auctions. During a recession, buying a car becomes a very discretionary purchase. If there are fewer cars being purchased, there are fewer cars going to an online auction block.

The Stock has Been Going “Down, Down, Baby…{But now we believe} It’s Cocked Ready to Let it Go!”

The stock had a very difficult start to the year. It was not safe from the valuation de-levering event that occurred in January and February. Secondly, you saw some investors selling the stock, as they believed that the company was at peak Average revenue per unit (“ARPU”). Copart is a quality name that is on the shopping list for many institutional investors if there is some type of pullback. Thus, there should be a base on valuation.

Technical Analysis

Clear long-term support has been found for CPRT at the pre-Covid highs of $105 (white line) where price has found support multiple times when testing it since 2020, including the most recent blowout low from 3/8/2022. From here next upside resistance is the green dashed line where price has had some trouble staying above. Price is back to its 400SMA, and above its ST and MT trends (similar to the broader market). A nice sideways / basing action around the 120-130 levels the next few weeks would do well to renew bullish energy after the large +22% pop from the 3/8 lows to 3/18 highs.

During the selloff, we were monitoring potential buying opportunities – which we did in one of our active ETFs. If you look at prior downdrafts, the stock tends to retreat 32%-36% in a normal correction until investors tend to start buying it up again. During this bout of volatility, the stock retraced 31.6%. Somewhat surprising to us, as we view CPRT to be a much better positioned company than during previous corrections.

Source: Bloomberg, Data as of 3/21/2022

Source: Bloomberg, Data as of 3/21/2022

Country Grammar

As analysts, we need to be dynamic. We need to be like Nelly; not just a one-trick pony. Obviously he was a rapper, but he was also a movie star, e.g., The Longest Yard, Training Day. In fact, he even dabbled into a country singing career with Tim McGraw. Yes, Tim McGraw is wearing both a cowboy hat and a durag in this music video.

This stock has been one of our favorites for years – we love the growth story, we love the pricing power, and we love the management team. But we know it tends to be one of the most volatile names in the 15-stock portfolio. But we embrace this, as we believe the stock will continue to perform well on a fundamental basis.

Buckle up buckaroos – Copart is going to be a fun ride.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-20.