With the NBA finals beginning, let’s heed some wisdom from the NBA G.O.A.T., Michael Jordan, who once said that the ceiling is the roof. Unfortunately, that wisdom proved to be wrong. Over the weekend, President Biden and Speaker McCarthy unveiled their compromise legislation to raise the debt limit through January ‘25 showing the market that the $31.4T debt ceiling was in fact, not the roof.

Below, we’ll focus on three aspects of the deal:

- What’s in the Deal

- Replenishing the TGA Account

- Market Implications

What’s in the Deal

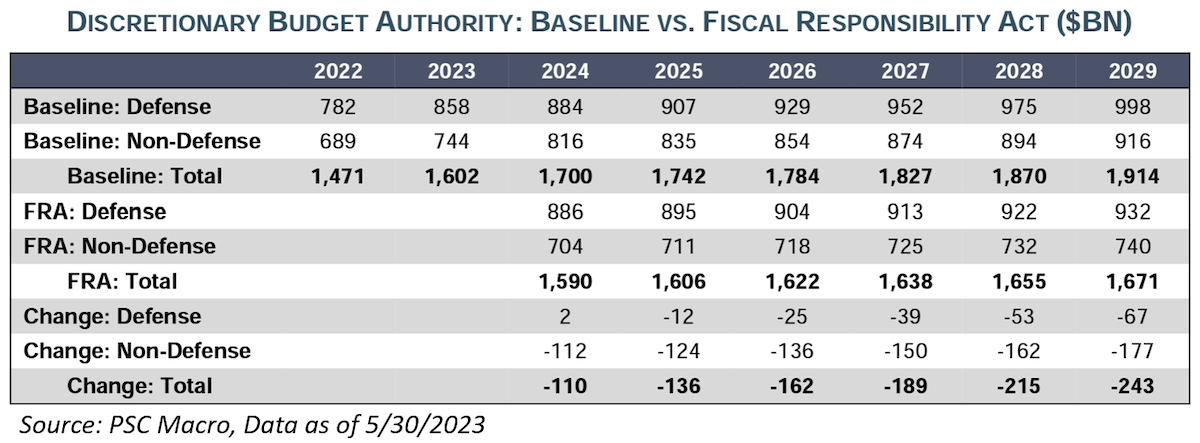

Investors, meet the “Fiscal Responsibility Act” (“FRA”). The FRA is highly likely to become law before the June 5 X-Date (when the gov’t runs out of money). This Act would raise the debt limit through January 1, 2025, and caps discretionary spending increases for six years – though the first two years are the only years that have enforceable spending caps. If Congress abides by the caps (over the next 6 years), the legislation could reduce spending by roughly $1.5 trillion over the next decade (estimated by Goldman Sachs). For reference, the federal government spent $6.5 trillion in FY 2022.

The main source of budgetary savings in the deal is a two-year cap on federal discretionary spending. Congress appropriates this segment of spending annually and it accounts for around 25% of total federal spending, with slightly more than half dedicated to “defense” and the remainder to other “non-defense” spending (generally domestic programs outside of the major benefit programs).

That said, the actual spending cut is likely to be much smaller, for two reasons. First, the caps apply for only two years, so most of the projected savings will depend on policy decisions made after the next election – as mentioned above, the description of the deal states that caps apply for 6 years, but they are only enforceable via sequestration for 2024 and 2025 and should have little effect thereafter.

Outside of spending cuts, many client conversations could be focused on student loans needing to be repaid again starting in September.

Honestly, this bill was status quo – the policies that account for most of the deal’s fiscal effects likely would have come about in any case. Roughly flat discretionary spending over the next two fiscal years already looked likely in light of the divided Congress, as Republicans were unlikely to agree to an increase for the coming fiscal year, and a restart to student loan repayment this fall also looked more likely than not.

All-in-all, the market may like the FRA, as it probably includes less discretionary cuts than originally expected, i.e., growth may be more insulated.

Let’s Talk Treasury General Account (TGA)

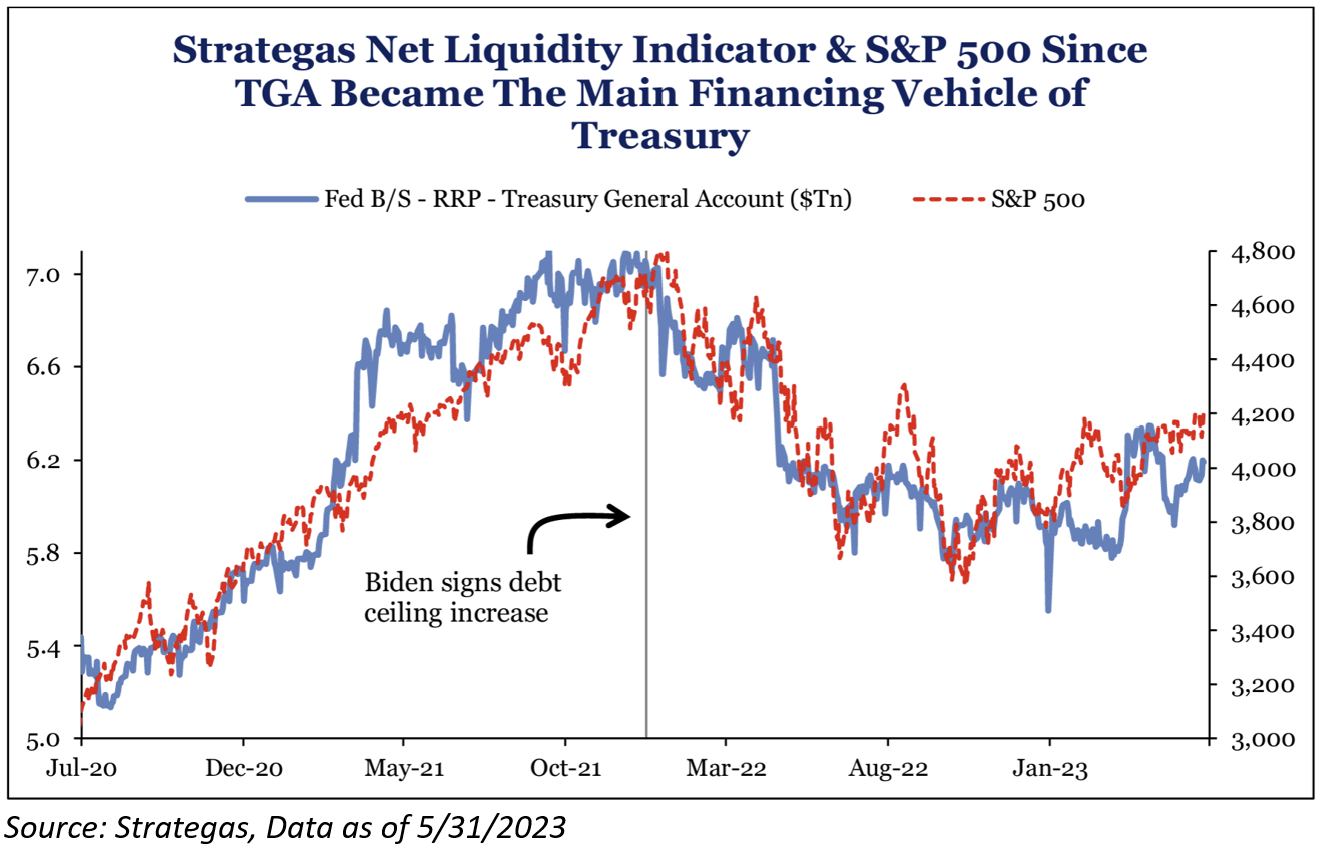

As many of y’all have heard from us, one of our main focal points has been the impact of the new issuance of treasuries on market liquidity. Since January, Uncle Sam’s checking account, officially known as the Treasury General Account (“TGA”), has been spending down the available capital to pays its bill since the government was unable to issue treasuries (they were at the debt ceiling). Now that a bill likely appears that it will be passed, the US Treasury is going to need to issue a substantial amount of US Treasuries (“UST”) to replenish the TGA. Morgan Stanley estimates the Treasury will sell over $1 trillion in short-term debt through the end of the third quarter. For reference, during the last extension in 2019 saw then-Secretary Mnuchin issue nearly $1T with little drama. That was then and there are a few differences now.

The worry here is that it will increase the supply of debt in the market, which could weigh on the prices of existing debt. For bonds, if you increase supply, the price will decline, as yields rise. Secondly, money-market funds (“MMF”) have been happy to stay in overnight reverse repo agreements at the Fed, instead of utilizing UST. Thus, Treasury Secretary Janet Yellen may not know how much supply the market can take before it’s too late since there may be less demand, i.e., think more collateral damage from interest rates.

Market Implications

My biggest takeaway is that it appears that the debt ceiling is neither a positive nor a negative for the market. The main concerns about any debt ceiling deal were that it would result in substantial spending cuts, similar to the “fiscal cliff” the U.S. economy encountered following the 2011 debt ceiling deal. That matters because government spending contributes to economic growth (think of all the private citizens the government pays salaries and wages to) and if there were material cuts to government spending, it’d increase the headwind on the economy and increase the chances of a hard landing. However, that didn’t happen because Federal spending will essentially be flat over the next two years (at least non-defense discretionary spending) and as a result the debt ceiling will not result in a dramatic drop in Federal spending, which means a hard landing isn’t more likely.

Despite positive progress towards a deal, we’ve read that there is still a chance that Fitch could downgrade the U.S. credit rating. If you remember, back in 2011, the market impact of the final debt ceiling deal was felt after the deal was struck from S&P’s ratings downgrade and the larger-than-expected budget cuts. The positive market impacts of a deal being passed this week could accordingly be limited by a Fitch downgrade, but, as of right now, the market apparently views that it’s unlikely to be the same sticker shock to the markets as in 2011.

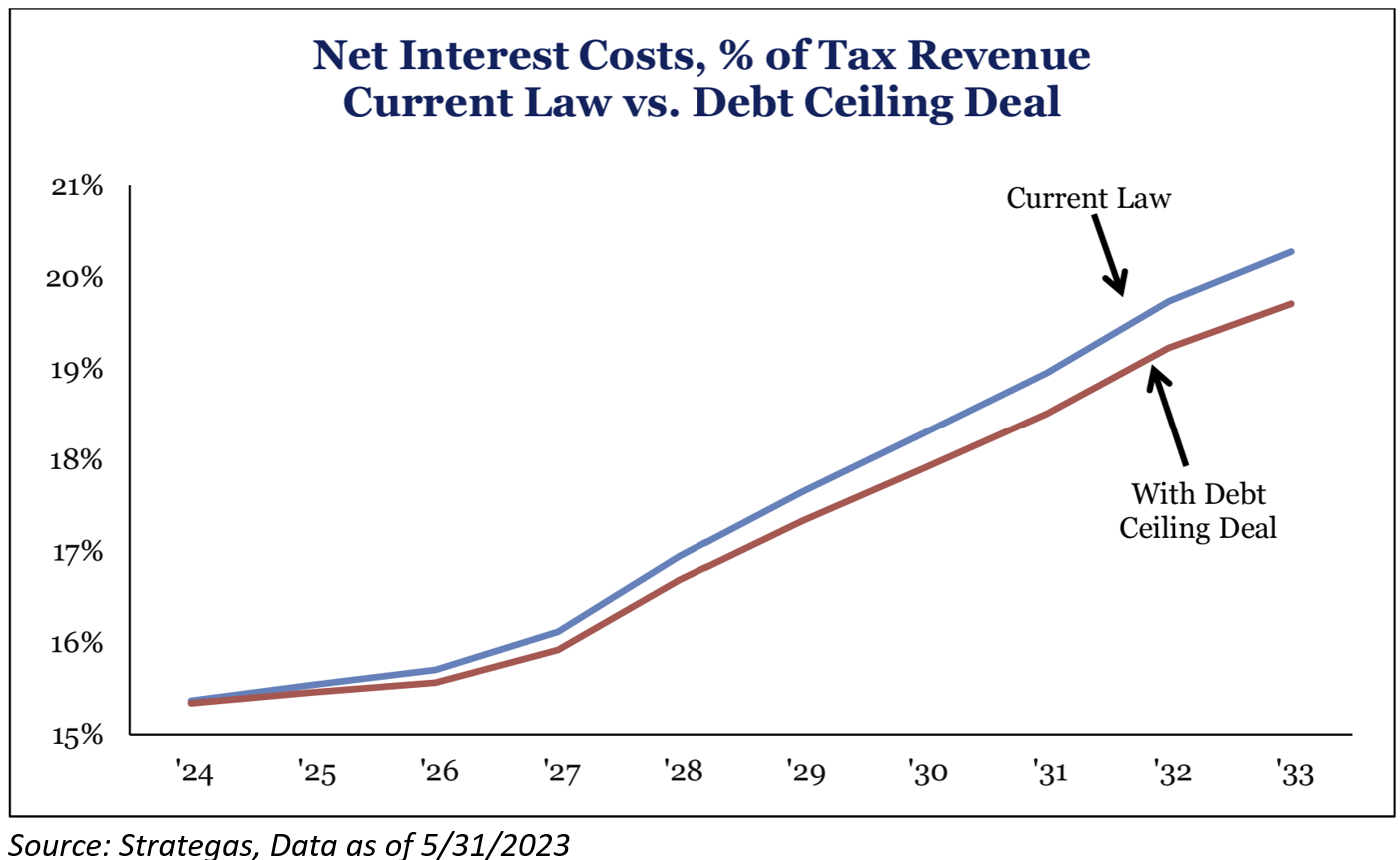

Lastly, the thing that we are going to continue to follow is the government’s debt service (as a % of revenue) as this could continue to create a larger austerity battle. Strategas has continued to point out that when US debt servicing cost hits 14% of tax revenue, the US goes into longer periods of strictness. This level hasn’t been hit since 1998 (when it was decreasing) and has not been increasing in over 35 years. Below, Strategas charted the US debt servicing cost with and without the budget deal, and what is apparent is that this deal does not stop the debt servicing cost from crossing over 14% threshold and has little impact on the long-run fiscal trajectory.

Just something to keep an eye on.

In 10th grade, I had to write an essay on the last line from the Great Gatsby (of which, I received a -20% on it – the teacher took 20% off my next report, as I did not write it in MLA format, had it stapled wrong, and was late to class). But the last line reminds me a lot of this situation:

“So we beat on, boats against the current, borne back ceaselessly into the past.” … We’ll just have to wait for the bill to come due.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-31.