It’s the weekend before the election and I want this month’s note to serve as a quick reminder of What Matters. The linked post is from July of this year and we wouldn’t change a word.

If you need more election specific commentary, Dave wrote an incredible Election Musing on Friday.

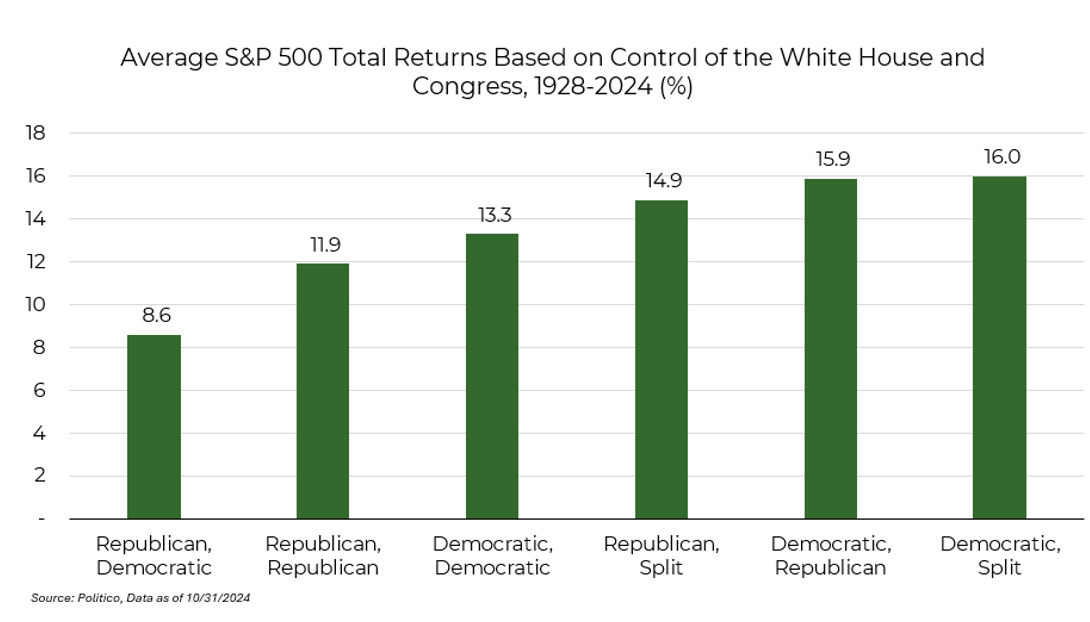

Between those links and the chart below, hopefully you can enter the week with some peace and confidence about the future. Your investment horizon is longer than you think. Don’t let polarizing short term events impact long term allocation decisions.

We don’t know what this election holds, but we do believe we are prepared for the outcome.

What We Do Know

The economy is growing, the Fed is lowering interest rates, and if the AI revolution is a fraction of the hype, these factors could all help keep the market’s momentum rolling. We’d argue these things are more important than the election outcome.

To pile on, we are still operating at deficits and neither candidate is going to change that in our opinion. Those deficits must be funded with an increased supply of debt which translates to an increase in the money supply. We believe this continues to be the reigning champ of inputs to allocation decisions.

What Does it Mean?

It means more stocks and less bonds for a typical allocation. For example, rather than 60/40 with 60% in stocks and 40% in bonds, our objective would be to shift the allocation to a higher percentage in stocks and a lower percentage in bonds.

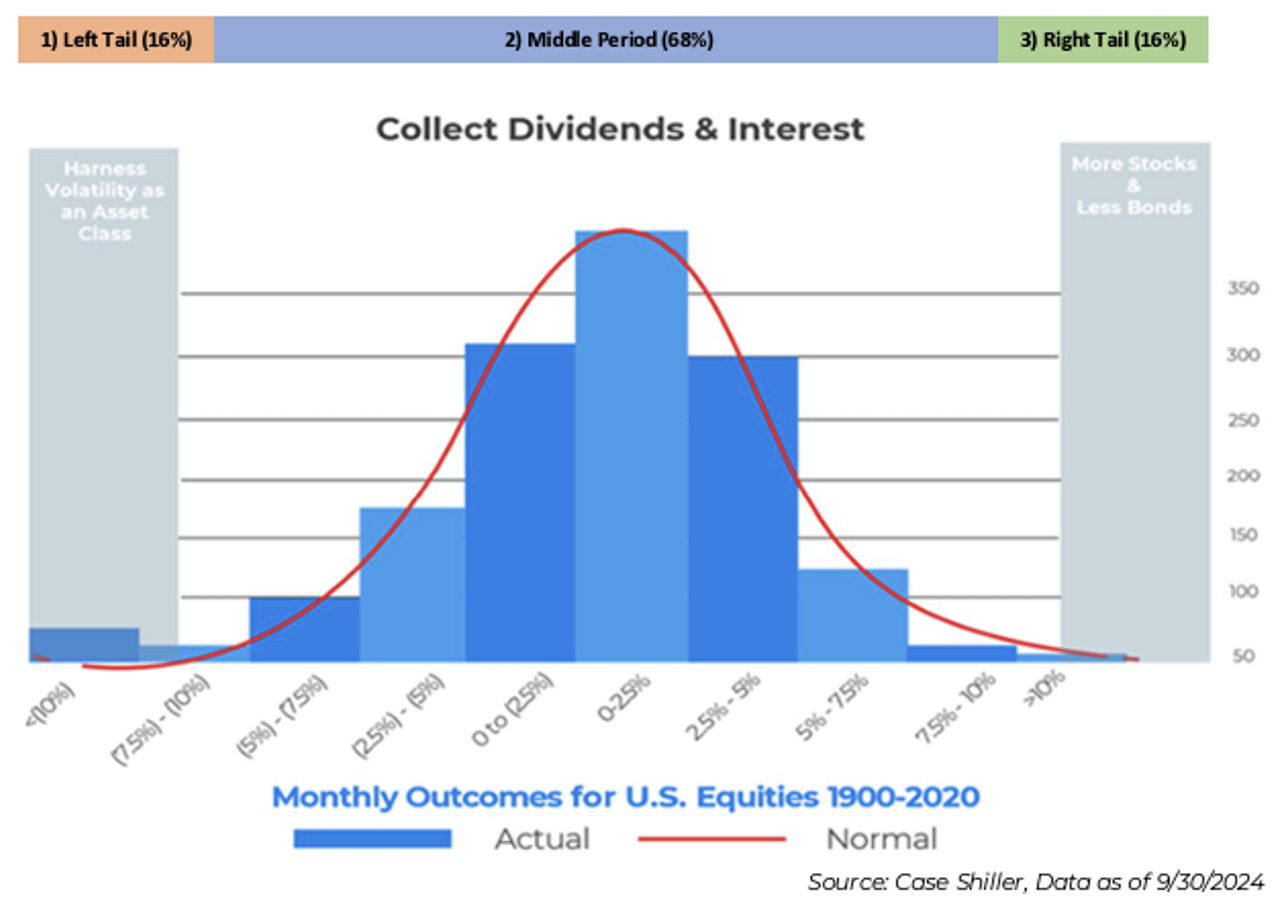

The trick is, can we make that shift in a risk-neutral way? We believe hedges are needed to accomplish this.

Hedges cost us to hold them but provide us with a known correlation to stocks. That known correlation is negative, meaning hedges go up when stocks go down… we don’t have to hope for it, it’s just the math of a hedge.

Hedges allow us to prepare for the right tail because our allocations are more exposed to stocks. Hedges allow us to prepare for the left tail because if our additional stock exposure goes down in price, that’s the exact environment that our hedges pay off the most (I’m trying not to use the word convexity).

Higher compounded returns, that’s the objective. Compounding happens in the tails. Our strategies and portfolios are designed to make allocations ‘better in the tails’.

Closing

In investing, the most important decision is asset allocation.

More stocks, less bonds, risk neutral.

We believe in 10 years, stocks will be higher. We believe over that time frame, bonds are not safe.

Our allocations need to reflect that conviction, and that conviction will not be impacted by the outcome of the election.

As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-5.