Our yield + growth framework drives the majority of decisions – both at the asset class level and the security level. We continue to believe international equity is deserving of a spot within a portfolio given the market’s backdrop. International’s y + g combined with lower relative valuations have driven our interest there, shared in Why International?

The main focus of this rebalance is to blend our drawdown patrol mentality into our international exposure. While we like the potential for return, we have to understand the risk associated with that return. In terms of international stocks, volatility is to be expected and we want to make sure we deliver that exposure with some form of left tail control in place!

Trim: Developed and Emerging Markets exposure

Add: Hedged Developed and Emerging Markets exposure

We believe that the fundamentals in international look great and that there could be some potential for upward mean reversion in the space – yet, it’s been a tough ride in recent years. We believe that this allocation update hits on both points – how can we best help clients participate?

Own International, With Guard Rails

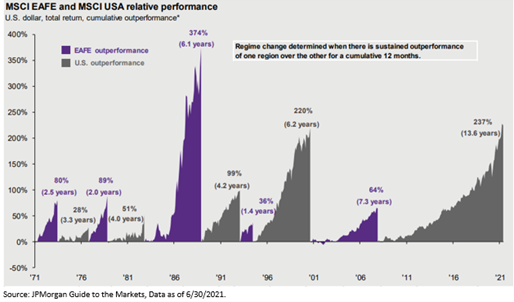

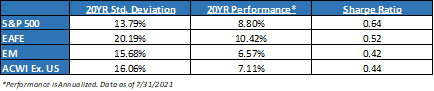

We appreciate both the lower valuation and higher growth opportunity overseas, and want that cyclical exposure. But it should be no surprise that international markets, whether developed or emerging, tend to have a higher standard deviation than domestic stocks. This is basic finance – higher risk for higher potential of return.

One of the main reasons for international’s higher volatility is the frequency of crises. For example, since 1989, there have been more than 2x as many EM equity market crises with >50% drawdown than in developed markets. Furthermore, developed markets have more crises with more drawdown risk than domestic U.S. large caps.

Why? When comparing against the U.S., the domestic U.S. market has, for instance, a protective structural earnings advantage and, being a mostly domestic-growth driven market, is much less exposed to swings in global growth while also enjoying a much more stable currency.

But when a crisis occurs in international markets, investors respond with predictions of the apocalypse – the Chicken Little Syndrome: they’ve been hit by an acorn and scream that the sky is falling. Look no further than what just happened in China at the end of July. The velocity of the decline in Chinese and Hong Kong equities reflected the “get me out at any price” attitude, often found in a capitulation phase.

When poorer markets enter times of crisis, there are generally fewer certainties. Perhaps a government will default on its debt, or, even more extreme, maybe war has uprooted an established political system. When poor countries enter these same financial crises, the question is not when, but whether, their economy will truly recover.

So, the Guard Rails:

That said, the combination of stronger potential growth and cheaper valuations provided by international stocks has to factor into portfolio construction decisions. We just believe that there is a caveat to owning an international exposure – own it with guard rails.

We see this rebalance as an opportunity to inject risk management into a needed exposure that is known to deliver volatile returns. We call ourselves the Drawdown Patrol for a reason. We believe large losses create behavioral and mathematical frictions towards an investors’ ability to compound capital. They must be avoided.

Our preferred method of ‘chopping the left tail’ comes through a tactical approach to hedging. We speak on volatility as an asset class, and our approach to hedging within international stocks provides additional exposure to volatility.

Our exposure to international stocks (both Developed and EM) can now be a combination of two things:

- Cheap beta EAFE and EM ETFs

- Downside Protection via hedges and explicit long volatility exposure

Upside/Downside Capture Matters

When it comes to delivering a return stream investors that can fully participate in…it might matter more than anything else. If our international exposure can capture 75% of the upside and only 50% of the downside – that’s a pretty compelling combination. It can lead to a path from point A to point B that is more digestible for most investors.

Having effective risk management in place allows for upside capture to be less than perfect while still compounding capital at sufficient rates, as we don’t have the friction of climbing out of large holes after steep drawdowns. More importantly, it helps address the issues mentioned above, both potential behavioral side effects and the math of large losses.

We think minimizing exposure to drawdown is a great first reason to deploy hedging. We believe steep drawdowns trigger emotions that are best left untriggered! If we can accomplish that by dampened drawdown, great. But an even more compelling reason is to create capital when the opportunity to deploy is at its greatest.

Think about why you can minimize drawdown. It’s because what started as a small hedge can grow in value as markets drop. Converting this value to cash can provide an opportunity to buy at lower prices when future potential returns improve. More shares at lower prices, a good combo in seeking more upside capture when markets recover. That’s the real driver for the approach to hedging that we take.

Portfolio Impact

We believe portfolios need some form of international exposure, but risk management should be a priority.

Ultimately, the ability to expand our hedges to international stocks can offer potential advantages as it relates to both return and risk:

- Return – The y + g framework may lead to strong relative returns for international stocks, especially if the valuation gap adjusts

- Risk – Adding long volatility may help us continue to avoid bonds in favor of holdings with real potential for return while keeping a lid on risk. Not to mention, this downside protection could help to capitalize on wild market swings if they are to come.

We believe that we can win by losing less, both domestically and now internationally.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2108-5.