Let’s Party Like it is 1999!

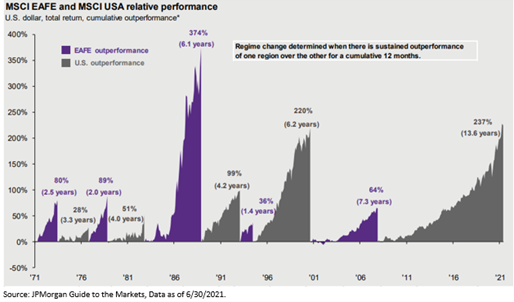

No investor ever wants to participate in a “Lost Decade” – domestic U.S. stocks encountered this problem in the 2000s, international caught it in the 2010s. Moving forward, we believe that traditional fixed income could be the lost decade of the 2020s. But, let’s focus on international exposure here.

The only thing harder than calling a future “Lost Decade” is having the wherewithal to call the bottom of one that is currently in progress. Yes, we believe that the fundamentals in international look great and that there could be some potential for mean reversion in the space – yet, it has still been a difficult area for investors to dip their toes back into.

Why Does International Exposure Looks Appetizing Right Now?

In the words of Prince, let’s party like it’s 1999, as international stocks were all the rave during the 2000s. But why do we believe that international stocks could be part of the revolution moving forward?

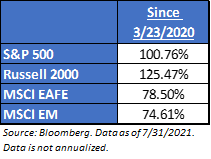

- More Growth – As the second quarter passes, Wall Street analysts are estimating earnings growth for 2021 to be +43.2% for the MSCI EAFE and +44.6% for MSCI EM – compared to +40.9% for the S&P 500. For 2022, growth is expected to be closer to longer-term historical averages, but with pending tax increases in the U.S., it’s possible that earnings growth could be stronger for the EAFE and EM in 2022 as well.

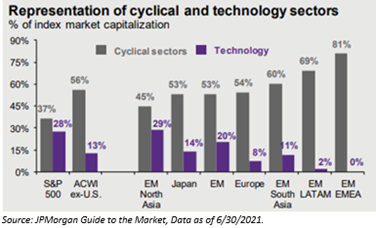

- More Cyclicality – Historically, it is the more cyclical parts of the market that tend to outperform coming off a market bottom. Fundamentally, this is due to cyclical companies generally being tied more to the economy, and the improving economy. They also tend to have more operating and financial leverage, so revenue growth tends to help EPS growth. Both developed and emerging markets have a higher exposure to these types of cyclical sectors, yet they have underperformed the S&P 500 and Russell 2000 since the market’s bottom on 3/23/2020.

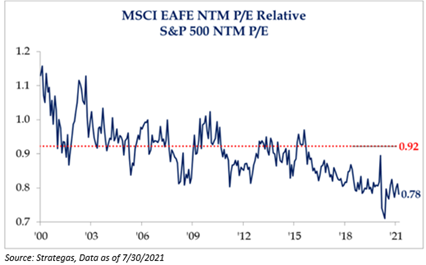

- Lower Valuation – We believe that valuations tend to be a poor short-term indicator, but it has the highest explanatory power over longer-term periods. International stocks have historically traded at a slight discount compared to the US., but currently, the discount is significantly wider than usual. We believe much of this can be explained by the sector composition of the index being less growth-oriented, less accommodative policy abroad, and lingering COVID-19 effects. This discount suggests that the developed international indexes have some catching up to do relative to the U.S. peers.

We understand that people have been pounding the tables on International for quite some time, but their rationale was solely based on mean reversion of valuation. But now, we believe that there Is finally a catalyst to drive this mean reversion – substantial earnings growth, given the dependence on cyclical sectors. In the words of Prince, it may finally be the time to get behind “The Revolution”.

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. ACA-2108-4.