Avoiding Agency Mortgage Allocations in our Models

We’ve been saying since the middle of last year that the percentage of total returns in fixed income coming from price return wouldn’t likely be the same into the future. Interest rates have nosedived lower following the global pandemic as investors flocked to safety, pushing the prices of safer credits higher. We will be the first to commend you for holding long term Treasuries in 2019- Q2 2020, which would have been a heck of return. As always, we manage our shareholders money looking through the windshield as opposed to the rear-view mirror. Simply put, we don’t believe long dated Treasuries or frankly any fixed income sector is likely to perform as it has the last twenty years. Putting words to actions, we’ve altered our fixed income allocation through both our asset allocation within our FI sleeve but also through the allocation of risk managed strategies allowing us to have less exposure to traditional bonds. Moving forward, one area that is particularly concerning is residential mortgage backed securities.

MBS saved by the Fed?

The agency mortgage backed sector has been temporarily “cured” by the FED during the COVID crisis. In mid-March the Fed pulled out a tool from their GFC toolkit where they vehemently started buying Treasury and MBS products. Following the Fed’s purchase announcement, many buyers knowing the Fed’s actions would stabilize the market started buying. We saw that present across several large investment banks which were able to arb profits by loading up their balance sheets with agency backed mortgages and quickly offloading them to the Fed at hefty premiums. Needless to say, the spreads of mortgages to Treasuries narrowed substantially due to Fed support.

Although mortgages have been a strong performer in 2020, we believe they will likely face future headwinds as the support from federal programs simmer down. There are three specific reasons we’ve moved our fixed income exposure away from mortgages.

#1: Elevated Prepay Risk

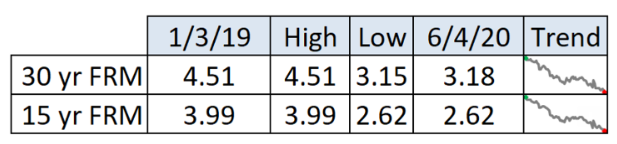

Mortgage rates are at their lowest levels… ever. If there is one thing we know even in a pandemic is that Americans enjoy a deal. I don’t think any person would tell you they don’t want more money in their pocket each month and at current rates, many mortgages are in the money to be refinanced. Considering the lack of a prepay penalty on residential mortgages, borrowers will continue to refinance in droves if the numbers make sense, putting more money back in their pockets (Think Quicken Loans aggressive ad campaigns). Imagine being a mortgage investor and continually having to reinvest massive principal prepays at lower interest rates, talk about reinvestment risk!

Source: Vining Sparks IBG, LP

#2: Fed Support

The Federal Reserve announced back in March that it would buy unlimited amounts of Treasuries and agency mortgages to grease the wheels of the credit markets. To say these purchases have been massive is an understatement. Given the widescale Fed purchases in the MBS market, the spread over Treasuries narrowed drastically (leading to price of the security rising higher). Once purchases slow, I expect spreads to widen out when demand shrinks as investors that are actually judged on performance fear the negatively convex return profile.

#3 Primary vs Secondary Spreads are WIDE:

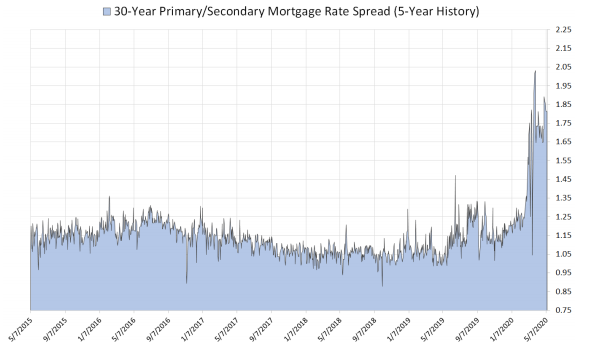

When thinking about mortgage rates, most borrowers only care about what interest rate they can lock in to borrow at; however, that is only part of the mortgage process. The Primary Mortgage rate (rate you can borrow at) is substantially different than the Secondary Mortgage rate which is the interest rate investors receive when purchasing pools of mortgage backed securities. The difference between the rates is the deduction of several fees from the primary mortgage rate which includes servicing fees, guarantee fees (the Fannie Mae or Freddie Mac P&I guarantee ain’t free!), and securitization fees to name a few.

Currently, the interest rates for mortgage borrowers are at all time lows HOWEVER the spread of primary rates to secondary mortgage rates are substantially wider than their 5 year average. Mortgage lenders can increase borrowing costs to slow down their pipelines due to over demand for refinancing or a potential hesistancy with their current lending criteria. Most likely the WFH trend caused by COVID has limited the ability for mortgage lenders to handle refinance activity which created a pause on mortgage rates falling lower. If rates normalized we’d be looking at a ~2.50% 30 year mortgage rate, as one could imagine many would be looking to refinance!

Source: Vining Sparks IBG, LP

As rates have dropped, the price of mortgage securities has gone up. Considering that, most MBS purchases prices regardless of coupon are above Par value ($100). As these securities prepay faster than expected, investors get their principal back quicker than expected which can result in negative yields. The entire mortgage investing world is heavily reliant on expectations of what the borrower will do… investors don’t have any sort of prepay protection on the securities they purchase so holding pools of fast paying mortgages at substantial premiums (>$100) can be quite the doozy. Defaults also result in the same issue as prepays where investors get the principal back at Par, much earlier than expected. If borrowers can’t service their mortgages following the crisis that could be another pain point for mortgage investors.

To sum it all up, we predict major headwinds in the mortgage backed security space moving forward. With the Fed buoying the market with their purchases on top of continued prepay risk it appears to be an environment with limited upside and significant downside. In saying that, we continue to tweak exposure in the portfolios to eliminate mortgage exposure for the time being.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. More information about the advisor, and its investment strategies and objectives, is included in the firm’s Form ADV, which can be obtained, at no charge, by calling (251) 517‐7198. ACA-20-135