Performance During Taper Tantrums:

I would consider the cliché idiom, “nothing is certain except death and taxes” to be wrong. Why? Because I would personally add the following certain items:

- The Cincinnati Bengals will lose their next playoff game, and

- The Fed will, at one point, begin a tapering process.

But, by request of compliance, I cannot be that promising.

So, let’s reference a newer adage, one that is currently true, but should ultimately come to an end. To quote a modern-day Aesop, Kanye West – “Let’s go on a living spree, because they say the best things in life are free.” There is no doubt that Americans have been livin’ the Good Life on the heels of unlimited quantitative easing and water spigot of fiscal stimulus that would even make the Bolsheviks jealous. But, what happens when Jerome Powell steals the microphone from America’s princess, the printing press?

Jerome Take My Money, and Now I’m In Need:

The Fed has grown their balance sheet to over $8 trillion dollars over the last fifteen months by printing money to purchase ~$120 billion worth of treasuries and mortgage-backed bonds on a monthly-basis. Why the Fed is still buying $40 billion per month of mortgage-backed bonds when U.S. house price gains are at their highest for over 30 years is head-scratching stuff – but, I’ll let our Bond King, John Luke, handle that.

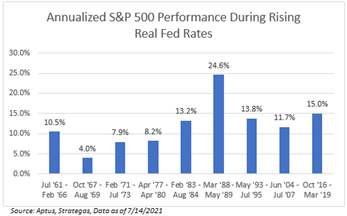

Since Kanye is a College Dropout, let’s give a history lesson: Historically speaking, what happened to the markets when the Fed announced a tapering or a period where we saw the Fed funds rate rise?

Focusing on the equity-side of the market, it should come as no surprise that stocks would rally into the beginning of a Fed tightening cycle – stocks are still being supported by a Fed put. And for those of us that remember the most recent taper-tantrum, it should be no surprise that the first three months after the Fed tightening begins, there tends to be a bit more volatility and uncertainty amongst market participants.

Though, if you look at longer-term periods, the market tends to continue to reward those willing to accept risk. Six months into the tightening, the market tends to recoup all losses. In fact, if you look over the entire tightening cycle, equity market performance during periods of a rising real Fed Funds rate shows that overall, it tends to pay to remain invested. The average return over the 9 periods below is 12.1%, which outpaces the overall compound annual return of the equity market since 1960 by about 150bps.

I Had a Dream I Could Buy My Way to Heaven, and When I Woke, I Spent it On a Necklace:

It’s projected that the Fed will announce some type of tapering plan at their summer retreat in Jackson Hole, WY (August 26th – 28th), and keeping with the idioms – “history never repeats itself, but it does tend to rhyme” – let’s look through the rear-view mirror and the windshield to see if we can tilt the odds in our favor to buy ourselves a necklace.

First, we would assume that traditional fixed income would be Heartless, given that real rates tend to rise on the announcement of a tapering. So, what areas of the stock market have outperformed during these tightening periods? Well, for one, and this surprises me, given my marriage to smaller stocks, it pays to be large.

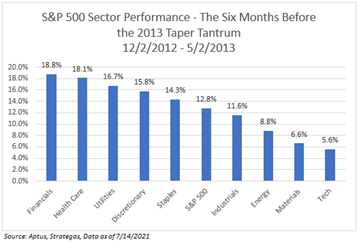

From a sector perspective, leading up to the taper tantrum in 2013, the financial sector was a significant outperformer while technology underperformed, which is very similar to the performance we have seen in the last six months. Look at Tech, a higher-duration sector, underperforming on increasing expectations of higher rates. However, major differences exist, as Utilities and Consumer Staples outperformed in 2013 before the taper and Energy and Materials underperformed. The complete opposite has occurred this time. What is different? Inflation Expectations.

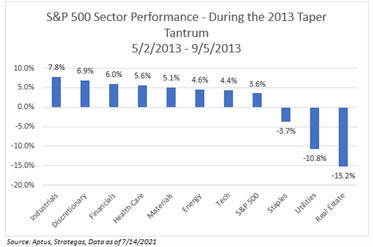

During the Taper Tantrum, the Industrial sector, followed by Consumer Discretionary, were the best performing sectors during the 2013 period. On the opposite side of the spectrum were the yield-oriented sectors of Real Estate, Communications, Utilities, & Consumer Staples.

Bought More Jewelry, More Louis V., Aptus Better Get Through to Me:

In a nutshell, during any type of taper tantrum, we believe it pays to have diamond hands (from Sierra Leone) – even if you encounter a brief bout of volatility – that is why we own vol as an asset class. If the Fed announces any sort of tapering, I hope you’ve learned a few things:

- From an asset allocation perspective, in a rising rate environment, we believe it pays to own more stocks than bonds.

- And underneath the hood we believe it pays to be underweight longer duration and highly-rate-sensitive assets.

If you don’t prepare now, you may have a more volatile ride than Kim and Kanye’s marriage.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2107-17.