As we think about economics from a high level it is arguably one of the most interesting and misunderstood topics we face as investors and humans. It is truly the crossroads of man’s two most influential ideas on civilization…what is the best way people and money should co-operate. As we come out of one of the largest (non-war related) setbacks in our American history, the forward path is at best case, murky. With Jay Powell’s update this week, we have some new information to chomp through this crazy market.

The Fed’s Job

The Fed’s congressional mandate is to maximize employment and price stability over the years ahead in service to the American people. This mandate creates what we consider to be a moving target on an inexact science created from an ever complicated, ever evolving global economy. We believe the Fed must remain fluid in their implementation of policy as the economy changes and new challenges arise.

Our problems today are far different than the conditions forty years ago where the economy faced extremely high inflation (stagflation) and Fed Chair Paul Volcker took drastic action to stabilize inflation to a more normal level. The monetary policies implemented by Volcker led to a relatively long period of economic stability (Great Moderation).

As the economy has morphed over time, long expansions that historically led to overheating and rising inflation have changed to episodes of financial instability and more government intervention to shore up the resilience of the financial system. As the Fed has adapted new policies to face an ever-changing economy, they have attempted to lay out a transparent inflation goal as the primary objective of their monetary policy.

Bringing Full Circle: Inflation Targeting and Implications

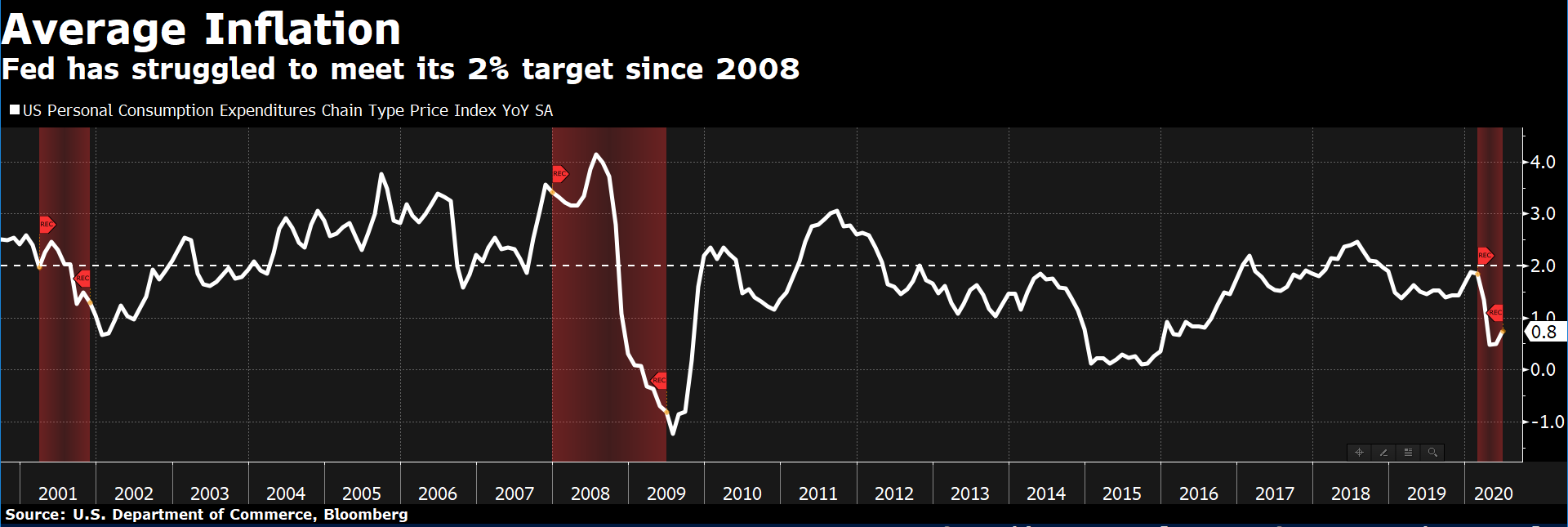

This week we got an update from the Fed Symposium in Jackson Hole by Fed Chair Jay Powell, where he emphasized the importance of maintaining a sufficient level of inflation of 2% over a full cycle. As inflation measured by the Fed has been below the 2% threshold even with record unemployment and a robust economy (pre-Covid), the Fed will likely seek to achieve inflation moderately ABOVE 2% for some time. One important takeaway…the Fed essentially stated they are abandoning one of their tools, the Phillips curve, as the responsiveness of inflation to labor market tightness has contributed to low inflation outcomes, contrary to previous beliefs.

This policy measure is to avoid the chain reaction of chronically low inflation which has led to the lower interest rates environment and in turn decreased the effectiveness of the Fed’s ability to use their monetary policy tools to achieve their mandate and spur the economy during downturns. We believe this is what the market is referring to when we hear the Fed is out of ammunition and it appears the Fed is trying to get in front of the issue. This is uncharted waters, so we are likely along for a bumpy ride.

To the Important stuff: Portfolio Considerations

We believe an important driver of both near and long-term market performance is the guidance laid out by the Fed. With Chairman Powell indicating moderately higher than average inflation for some time, we believe the implications of letting the reins go on inflation could validate the valuation of equities when compared to bonds.

As inflation woes work their way through the market, we believe we could see pressure on long duration bonds as investors fear returns on bonds (after incorporating the effects of inflation) could be negative. We will leave you with this, from a historical perspective, bond yields have NEVER been this low which when paired with a potentially inflationary environment creates a unique environment that requires an outside the box approach.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. More information about the advisor, and its investment strategies and objectives, is included in the firm’s Form ADV, which can be obtained, at no charge, by calling (251) 517‐7198. ACA-2008-37.