In the world of finance, it’s often assumed that a thriving economy translates to robust stock market returns. However, when we scrutinize the Chinese stock market, a stark disparity emerges, challenging this conventional wisdom.

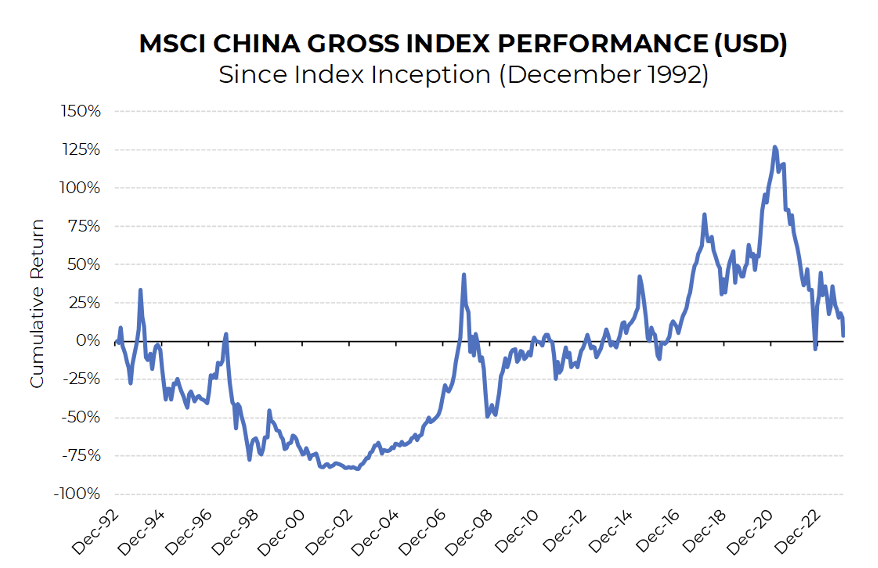

Let’s delve into the heart of the matter with a chart that speaks volumes. Despite a Chinese economy that has grown almost 13-fold since the end of 1992, the MSCI China Index, a widely tracked benchmark for Chinese equities, has been on a rollercoaster ride, and just like a rollercoaster ride, an investor ended up right where they began with an impending zero percent cumulative 30+ year return.

What’s perplexing about this scenario is not the lack of growth in the stock market, as the market cap of Chinese stocks is up, but rather the divergence between the economic boom and the stock market’s lackluster performance.

Source: Aptus 01.19.2023

Source: Aptus 01.19.2023

The Disconnect Between Market Cap and Market Returns

A crucial factor contributing to this disconnection lies in the discrepancy between the success of Chinese companies, and the returns they provided to an investor. While the market cap of the MSCI China Index has surged tenfold as the economy has led to the rise of larger and more profitable companies, shareholders have not experienced proportional gains. The culprit here is share dilution and new issuance, a phenomenon that has diluted shareholders 1:1 relative to all the growth experienced.

The Crucial Role of Shareholder Protection

In unraveling this mystery, the importance of shareholder protection comes to the forefront. Investors should rely on robust regulatory frameworks and corporate governance practices to safeguard their interests. The divergence between economic growth and stock market returns in China underscores the need for shareholders to be shielded not just from the leadership within the companies they invest, in but also from the leaders of the countries where these companies are based.

Implications and Considerations

This disconnect prompts essential questions. What factors contributed to this divergence? How can investors shield themselves adequately from this risk? Are investors receiving fair compensation for undertaking this risk? Is this a transient anomaly, or does it signify a trend in the relationship between China and foreign capital that is likely to continue? An investor unsure how to answer these questions may find it imperative to reassess their holdings, and the protective measures in place for shareholders as they move forward.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-34.