This is probably a little more granular than past posts, but I think it is important to use my background in fixed income trading/ credit analysis to roll back the curtain of the asset class and dig into root problems we regularly discuss with our advisors concerning fixed income.

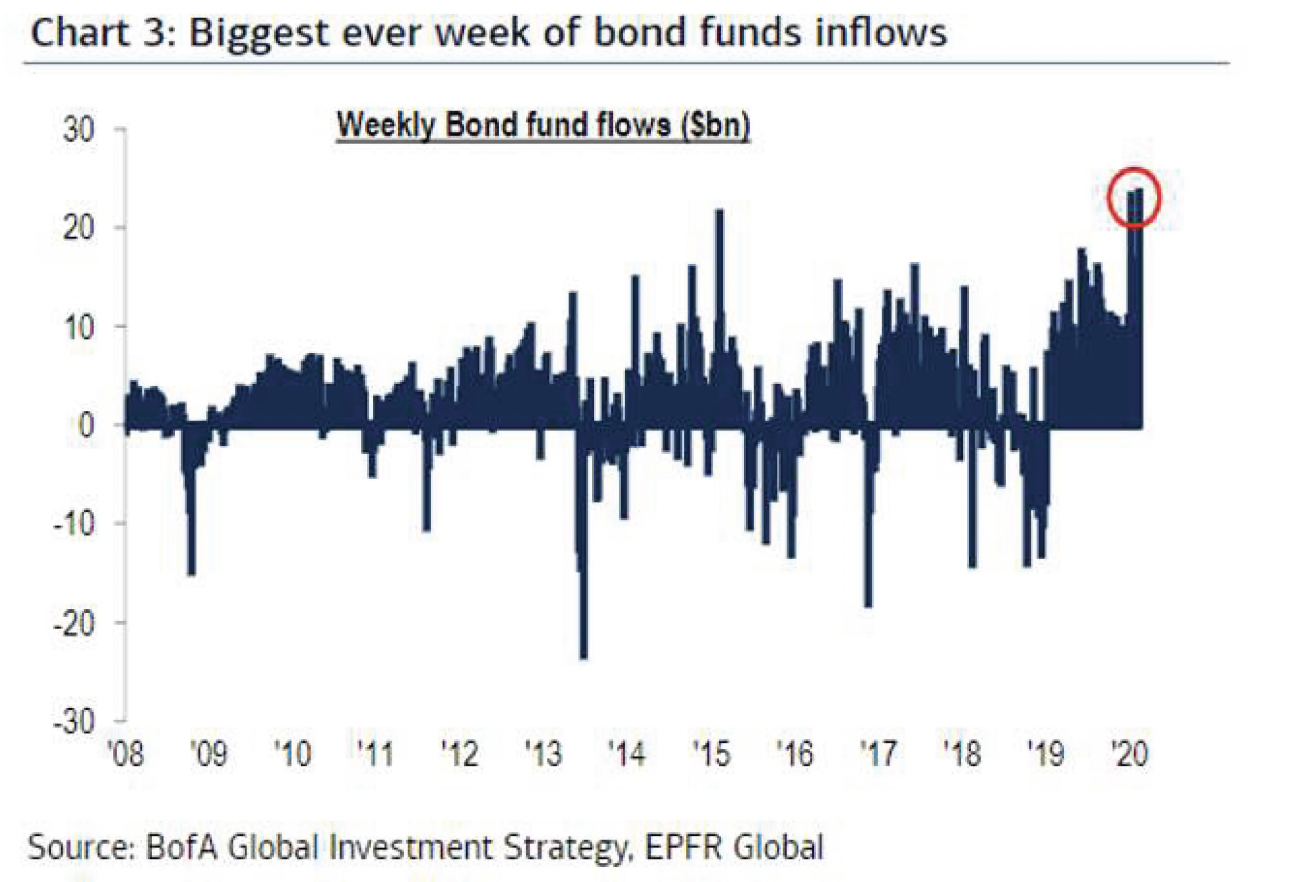

A month and a half into 2020, we continue to see incredible inflows into fixed income products. Massive bond-buying is pushing yields lower and spreads tighter. So what does this mean? The yield crazed environment allows borrowers (both high and low quality) to increase leverage on their balance sheets and increase the duration of their borrowings (flat yield curve). To summarize: we believe risk assets, specifically credit, are priced to perfection yet investors continue to pile into bonds seemingly ignoring the valuations! The last two weeks saw the largest inflow into bonds in more than ten years.

Another example of Global Fund Flows:

Investors continue to flock to fixed income even with historically low interest rates, a flat yield curve, and some of the narrowest credit spreads we’ve seen. We’d like to highlight a few areas sticking out in our analysis.

Investment Grade corporate bonds:

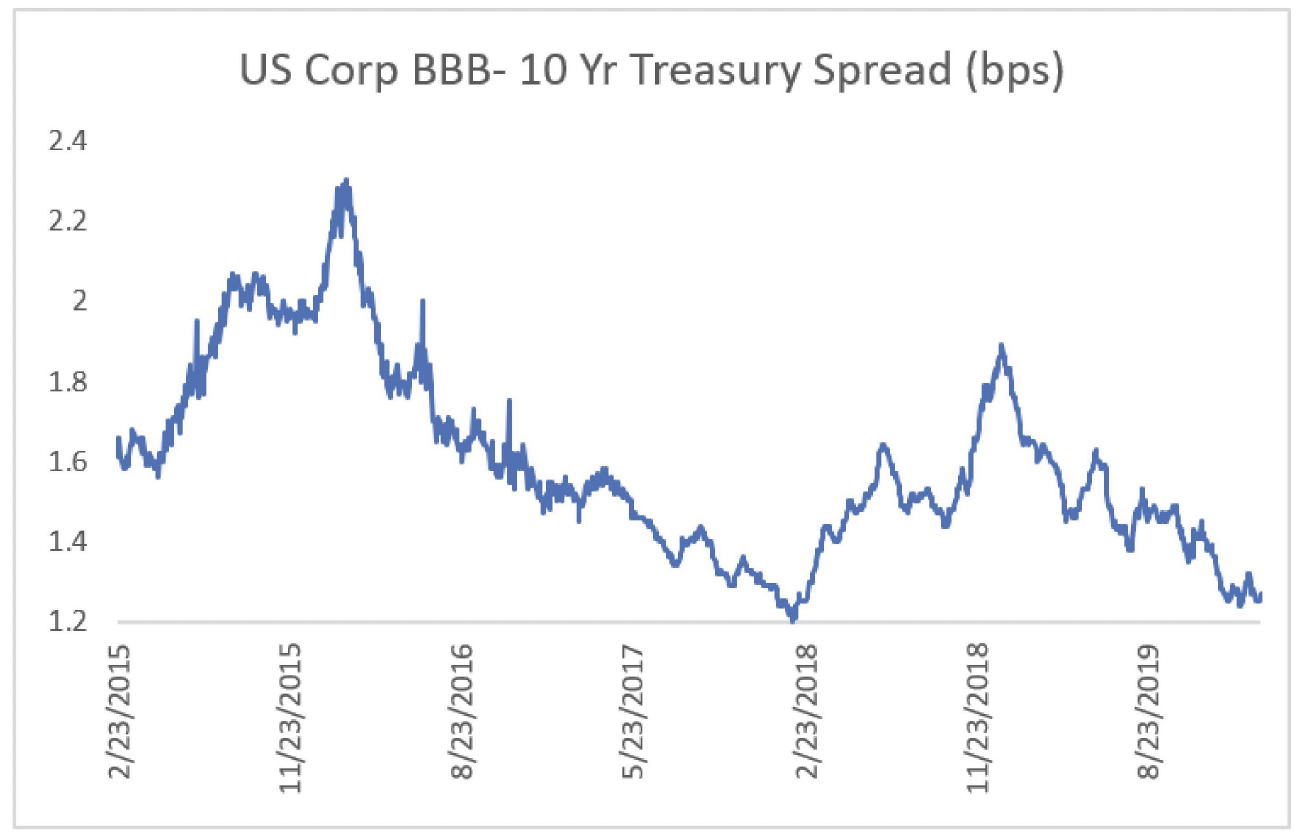

The spread between the CSI BBB index and the 10yr Treasury is near the tights of early 2018 (albeit the 10yr UST in early 2018 was >2.50% while today the 10yr UST is hovering around 1.50%). This metric helps tells us how investors are pricing credit risk (specifically BBB rated corporate bonds in this example). It is unique to see credit spreads tighten as interest rates decline. Remember, longer-dated interest rates are an indicator of future growth! Is it smart to bid up bonds on companies with more leverage if consensus for long term growth is less than stellar?

*The CSI BBB index is made up of a universe of BBB rated corporate securities. BBB- is the last notch of investment-grade credit before falling into a junk/ high yield rating.

Source: Bloomberg LP.

Source: Bloomberg LP.

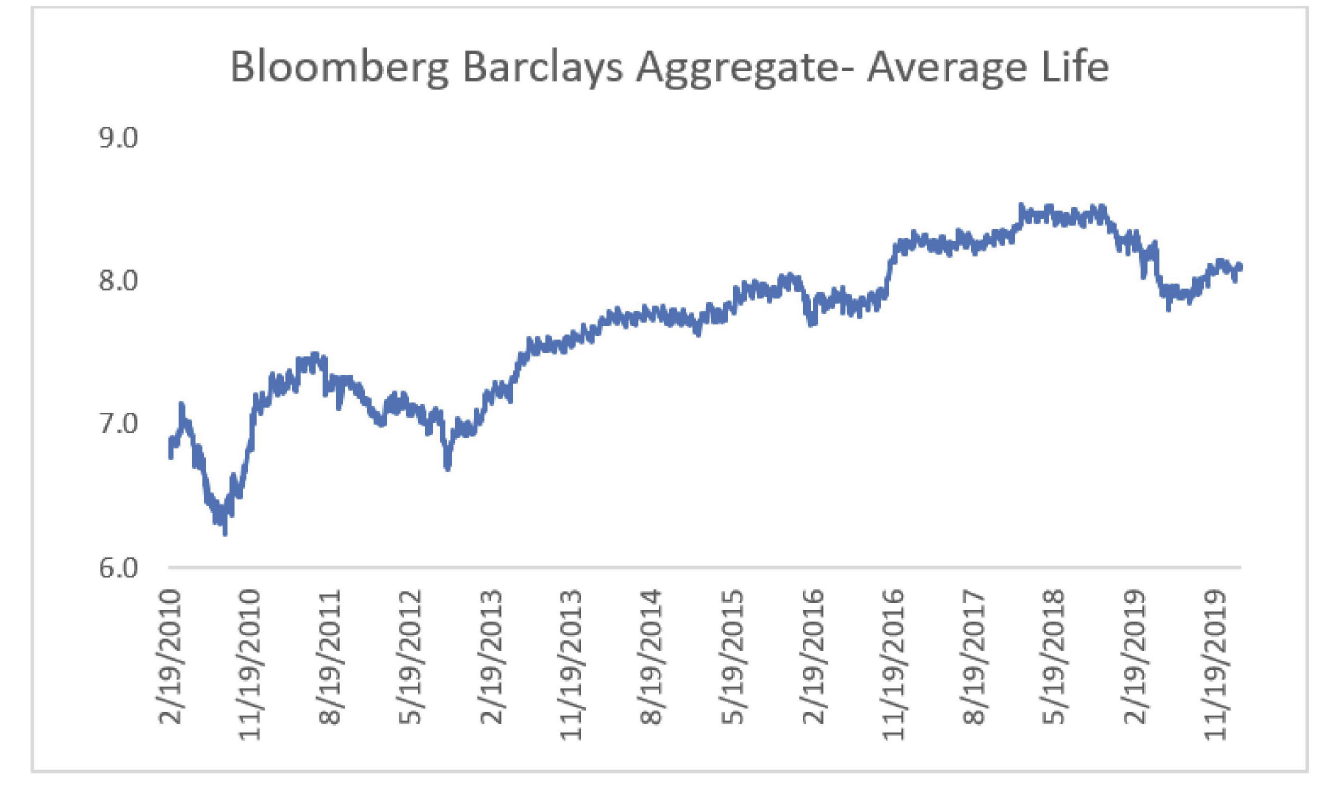

The average life of the holdings within the Barclays Aggregate has increased by ~20% over the last 10 years. Longer duration leads to greater price sensitivity to interest rate changes. This is good for investors as long as interest rates continue to decline.

Source: FactSet Data.

Source: FactSet Data.

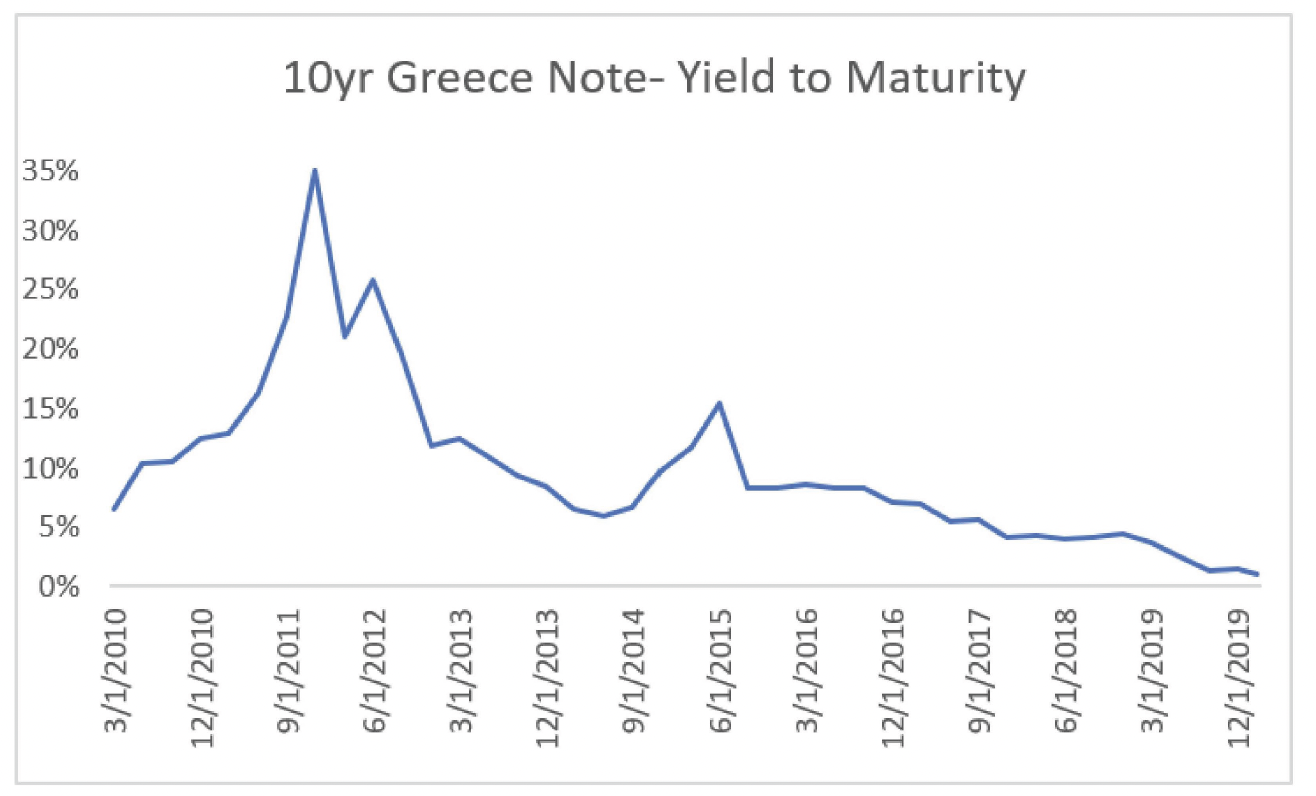

Emerging Market Debt

We’ve seen a massive bid up in prices of EM debt securities. Notably, Greece Debt: 9 years ago, the yield on a Greek 10 year note was ~35%. Currently, their 10 year note is yielding less than 1%. The sovereign debt of Greece is rated B1 by Moody’s and BB- by S&P, well below investment-grade. The Q3 ’19 Greek Government debt as a % of GDP was 178. This is significant. For comparison, the United States has a debt to GDP ratio of 107%.

High Yield/ Junk Rated Corporates

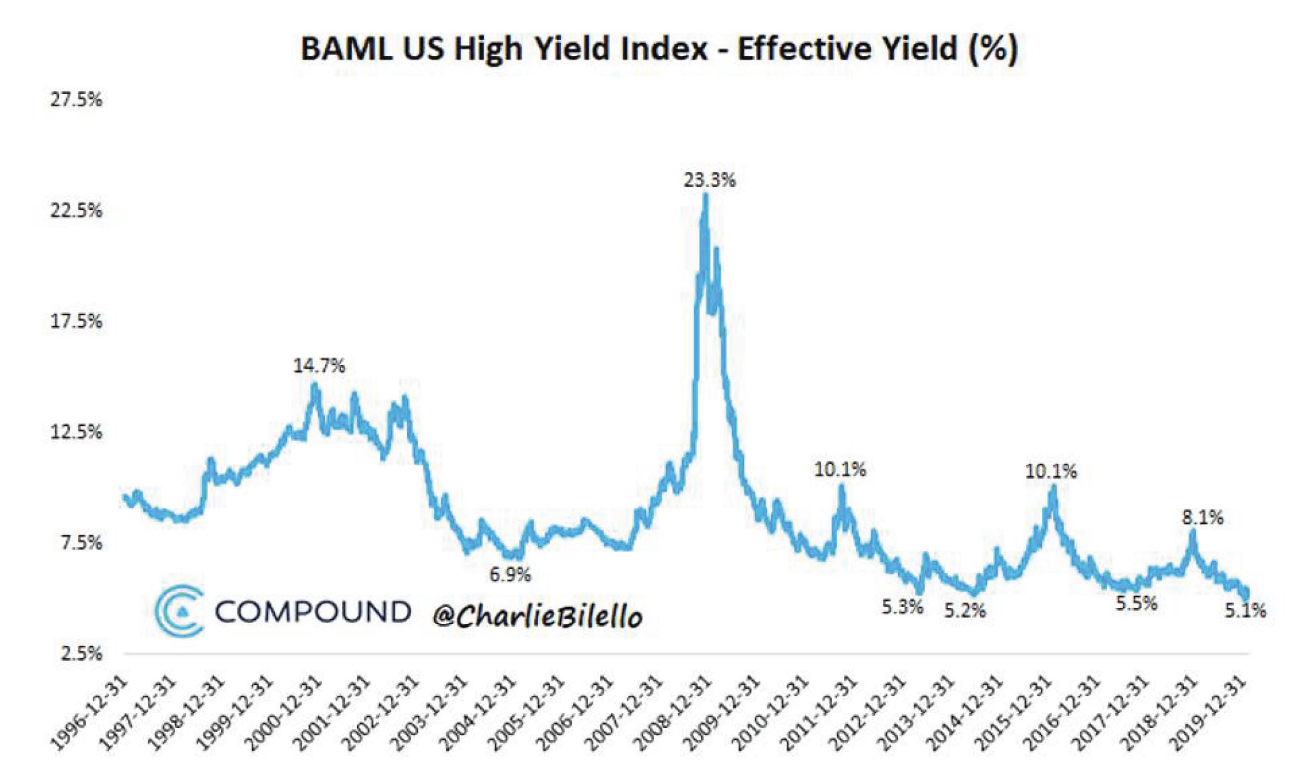

As investors scramble to meet yield requirements in their portfolios, we have also seeing a mass influx into the junk credit sector. High yields bonds are near their lowest yields ever.

This is our opinion but at some point, we believe lenders will have to scratch their heads on the valuations and terms of the loans/ bond deals they are making. Remember, the Lender sets the terms on these loans and as risks change, so does pricing. As seen in the graph below, High Yield can quickly reprice. There have been multiple explosive upward moves in yield (high yield bonds lose value) since 1996. A significant repricing in credit can lead to painful drawdown risk.

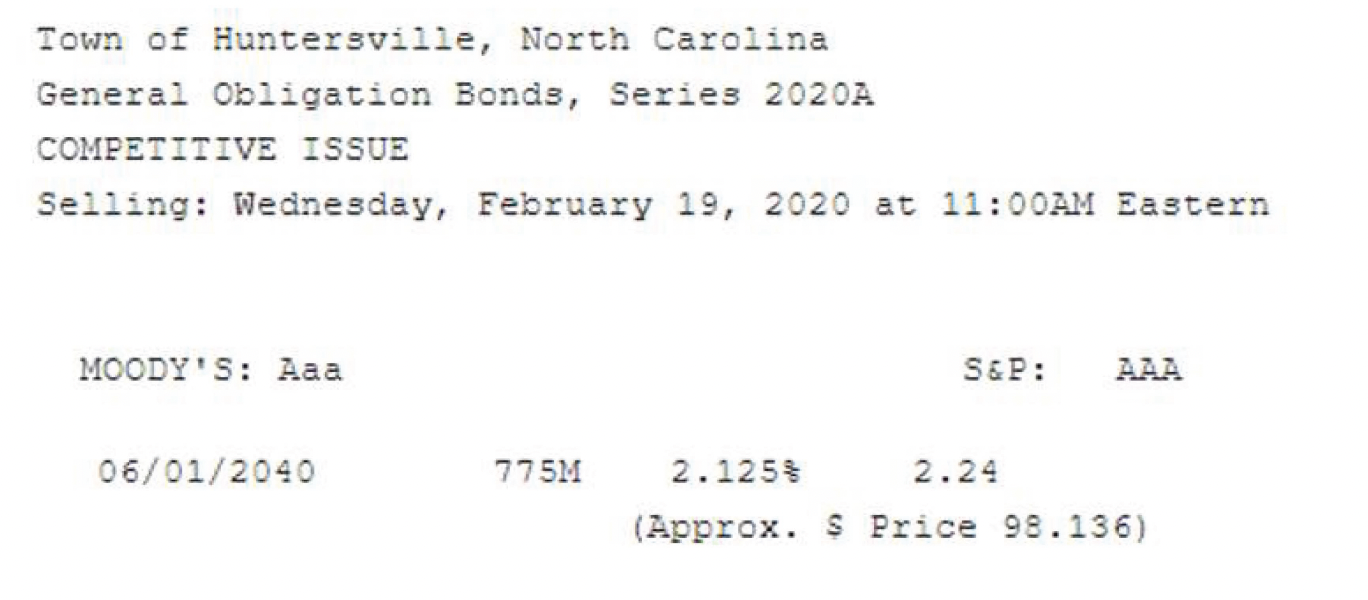

Municipal Bonds

We constantly look at new issue municipal deals as they come to market. A deal that caught our eye was a AAA-rated Town of Huntersville, NC General Obligation deal. The security highlighted below was the longest maturity available, due in June of 2040. What stuck out in this deal is that typically investors prefer premium coupons on longer duration bonds, especially when interest rates are low. A security with a premium coupon (coupons at above-market rates) decreases the price sensitivity of the security to interest rate risk. The highlighted bond below is actually offered at a discount coupon…2.125% coupon due in June 2040 priced at $98.136 offering a yield to maturity in 2040 of 2.24%. An investor with a 30% tax rate would lock in a 3.20% Tax Equivalent Yield on a 20yr maturity bond.

We believe we must pay close attention to the bond math. If interest rates rise by just 50bps, this bond would price at ~$90 for an 8% loss in market value. If interest rates moved up 100bps, this bond would price at ~$84 for a 14% loss in market value. So much for a safe/ stable bond investment. Keep in mind, there is zero growth and the only way you’d profit on this security is further drops in interest rates.

In Conclusion:

What we believe to be a lack of adequate options in the fixed income space has led to massive inflow to bond securities across a wide spectrum of credits. This has led to what we view to be a massive shift in the risk versus reward in fixed income as less credit-worthy borrowers continue to issue more debt at longer durations. To emphasize, yields are low, spreads are tight, and we believe risk assets are priced to perfection.

Stolen from our January month-end note: Let us try to explain the current and unexplainable bond market. The current 10-year Treasury bond yields 1.52%. That’s a dollar and a half for every $100 people are loaning the government. Not to mention, that $1.52 WILL NOT GROW. If you think about that $1.52 as earnings – people are paying over 65x earnings that are guaranteed not to grow!

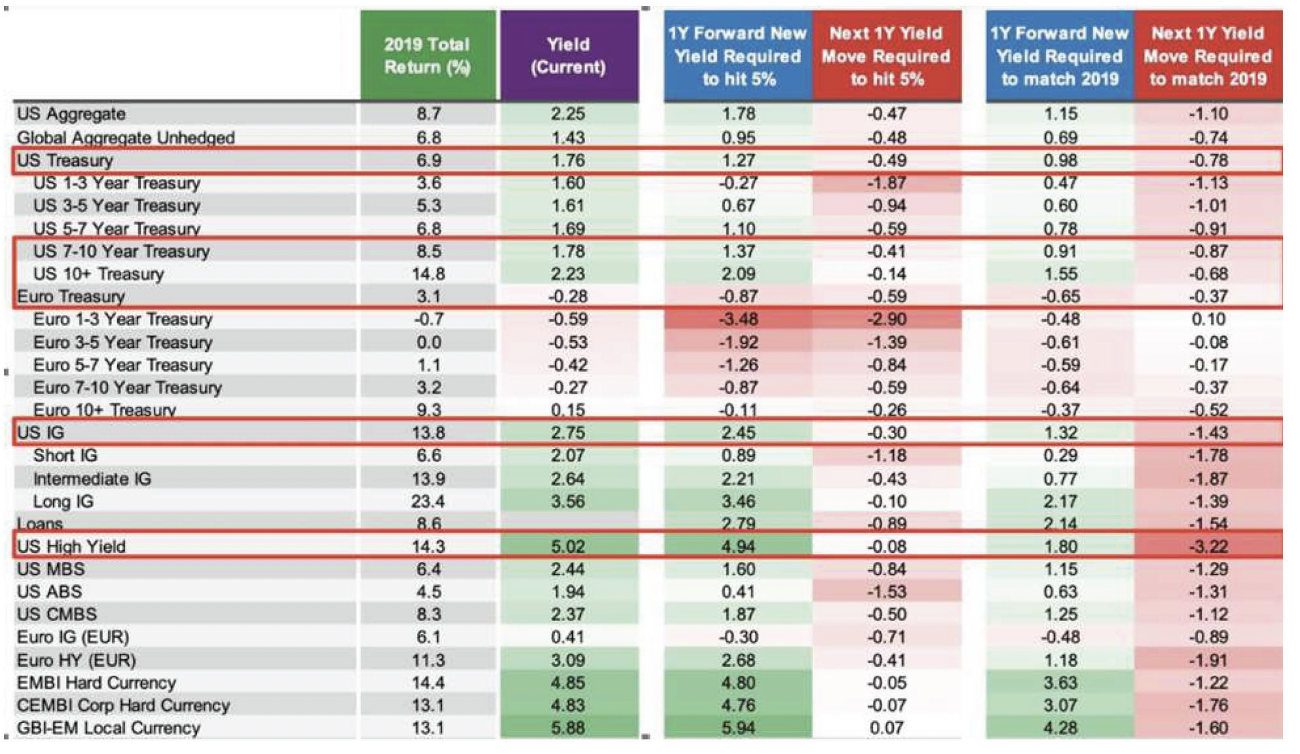

I will finish off with a chart showing the incredible move in rates needed in 2020 to give bonds the same type of returns as 2019. Truly 2019 did rob future bonds returns.

Source: BlackRock