Real-Time Update

I started this note with markets at all-time highs, or close to it. As I type, we are now in a ~8% pullback. VIX hit 65 this morning (August 5th). This type of market action makes July’s note even more relevant. Please hit us with any questions. Now is the time to be proactive with clients.

To stress, when you deal with convex payoffs in hedges like we do… the worse it gets, the better we look. We try and impact asset allocation with the goal of more stocks, less bonds, risk neutral. Currently, our risk is in line with benchmarks, which is good. We will see more separation from the benchmarks if this market decides to keep selling off. That’s the nature of convexity in hedges. It’s nice to be in this position, especially after the upside capture we’ve had year to date.

Now, back to my original thoughts…

One-of-a-Kind

“One-of-a-kind” – the pinnacle of descriptive phrases; set apart from everything else, nothing quite like it, rare, distinct, and in possession of qualities you can’t find elsewhere. Whether a person, a hand-crafted item, an experience, or any other context you can think of, it’s a descriptor to emphasize uniqueness and irreplaceable value.

I think human nature is attracted to things worthy of that description. I’d rather have the pocket knife my grandad gave me than the one I bought online and I don’t believe that sentiment is unique to me.

The problem is, it’s hard to provide one-of-a-kind things, profitably. Most businesses need to mass produce a product or service, for the unit economics to make sense for them and the consumer. Mass production provides scale. It’s why big-box stores or tract homes are cheaper than your mom-and-pop shops or a custom home builder. Customization is sacrificed on the table of scale.

Selfishly, there’s no better industry to highlight these tradeoffs than in the world of center console fishing boats.

Custom Sheer Lines

The sheer line of a boat defines its silhouette. It’s the curve that runs from the bow to the stern and creates a sense of fluidity and motion even with the boat at rest. Maybe I’m strange, but there’s just something to a custom boat with beautiful lines.

The picture below is of what I think is the best-looking boat on the market. A custom boat builder that’s as good as it gets (call me if you want to discuss!). The lines speak to the craftsmanship that goes into the process.

To most, a boat is a boat.

Production boats get you on the water just like a custom boat, and they typically do it much cheaper. Great production boat builders can bring hundreds of boats to the market with unmatchable efficiency. But they cannot do the opposite. They cannot cater to the desires and demands of a single customer to create that person’s one-of-a-kind vessel. It’s just not something that can be profitably done at scale.

The incentives to create are different for custom boat builders. Maybe not for all of them, but most of them are doing what they do because they love it. I’m sure they want efficiency, but more than anything, they want the result to be effective at solving the stated objectives. They aren’t worried about volume; they are worried about a single customer at a time.

I think you can feel that on a custom boat. They are a testament to skill and dedication, with every meticulous detail poured into them. It is a unique creation for the owner.

Production boats float, just like custom boats float. The similarities end there. Performance, quality, customer service, and all the intangibles are worlds apart.

Scale and customization rarely co-exist. That’s the point of this section. If you want to pay a lower price, forget customization. If you want a one-of-a-kind boat, you are going to pay for it.

There are limited businesses in the world where you can provide the custom boat mentality and the efficiency of scale. Which brings me to the point of this month’s note.

Options-Based Strategies

Thank goodness for the active ETF wrapper.

The ETF wrapper has allowed our business to offer option-based strategies where the ongoing management and attention are more akin to a custom boat build process than a production process.

We can deploy option-based strategies within a fund wrapper. They are open to you and your clients at scale but, our concern is the single strategy’s effectiveness in maximizing the benefit for each shareholder.

We spend hours thinking, tweaking, adjusting, and improving our process. That’s reflected in our performance over time. There’s almost no other business that I can think of that provides that blend of customization and scale.

We aren’t the first mover in the space, as options strategies have been around for decades, but I do believe we are providing more effective options-based exposures. The investment arm of our business has the mission of being the go-to options-based provider.

The Go-To Provider

If we want to be the go-to provider, we must be the best. As our track record expands, we are earning that title.

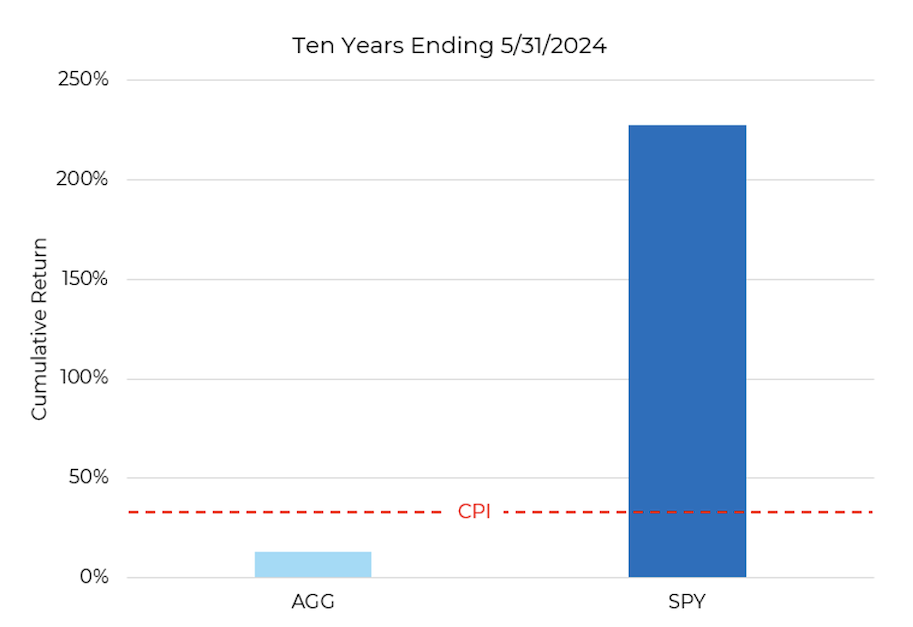

The world is waking up to what we preach. We’d rather own a known correlation in hedges that create friction at the fund level, but free us up to own more risk at the allocation level. We believe that’s a better path to allocating than the “buy and hope for correlation benefits” vehicles designed to have your purchasing power confiscated.

As a reminder, here’s the chart from last month that illustrates wealth confiscation in bonds and wealth growth in stocks. Stocks > Bonds.

Source: Aptus via Bloomberg

Source: Aptus via Bloomberg

Options-based strategies have seen impressive inflows. The launch of buffered funds by several providers has caused a frenzy. In addition, some of the legacy providers have seen inflows as they’ve dug their heels into a larger product offering to try and capture a larger portion of the demand.

We believe the environment is ripe for our message and the flows are in their early stages. More people want these strategies than the traditional approach (see the chart above for an explanation of that).

When you survey the assets devoted to this option-based universe, you notice one thing. Most of the invested assets are in legacy providers that offer production strategies. Whether it’s buffers, collars, or structured notes, they are designed for scale. They are calendar-based and require very little input from their builders. They are option-based strategies with watered-down effectiveness.

We won’t be perfect each day, but in the long term, we think our attention to detail will produce effective results that put us at the top of the list when it comes to option-based providers.

Closing

We believe we offer the best version of option-based strategies on the market. We think our focus on the details and the customization of each strategy will continue to shine with our current lineup and the new funds we launch.

We think the need for option-based strategies has never been greater. We plan to continue to spread the word and increase the wind in the sails of the options-based space while setting the bar within the category.

The ETF wrapper has allowed us to be as efficient and effective as possible when deploying these types of strategies.

If you have any questions on this note, the current volatility we are seeing, or if you want to talk fishing boats…I’m all for it.

As always, thank you for your trust and please don’t hesitate to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-8.