Aptus Compounder Update

The Aptus Compounder Stock Sleeve is designed to provide equity exposure to a carefully selected group of individual stocks that offer attractive prospects through a combination of yield, growth, quality, and reasonable valuations relative to large-cap peers.

Strategic Context

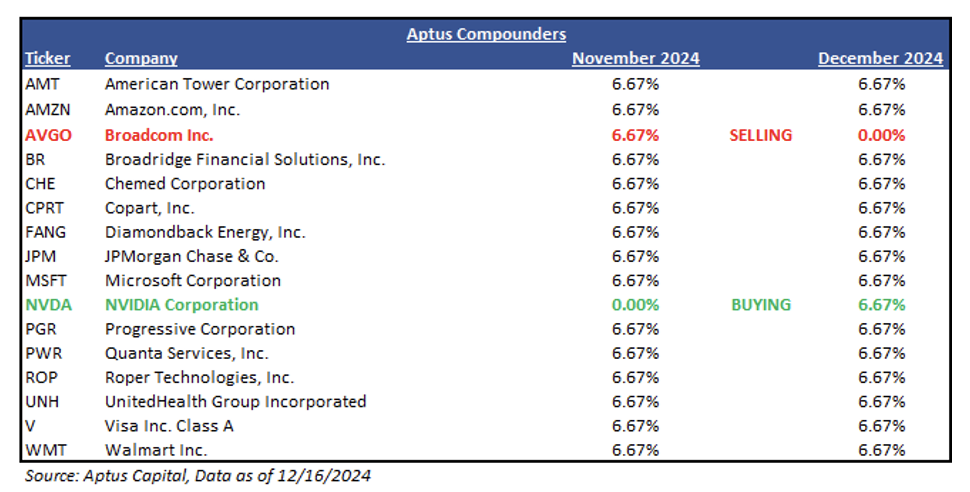

Given the concentration of its U.S. Large Cap benchmark, the S&P 500, the Aptus Compounders strategy maintains exposure to a few of the “Mega-Cap” stocks to minimize the risk of underperformance should the weighting of the constituents narrow. Periodically, we cycle through a few of our highest-conviction mega-cap names to maintain exposure and minimize tracking error. This update reflects this process.

Sale: Broadcom Inc. (AVGO)

We believe that Hock Tan (CEO of AVGO) and Jensen Huang (CEO of NVDA) both deserve to wear leather jackets with the former having now reached a market capitalization greater than $1T. In March 2023, Aptus Compounders swapped NVIDIA Corporation for Broadcom Inc. (AVGO), viewing AVGO as a more efficient and valuation-friendly way to play the artificial intelligence (“AI”) craze, particularly given any concerns about cyclicality. Since the purchase of AVGO, which was trading at the time at ~18x forward earnings, AVGO has delivered an almost 290% return, well above the return of the S&P 500’s 53.8% return over the same period.

Broadcom has historically sported a lower valuation than NVIDIA. At time of purchase, in March 2023, Broadcom was trading at 18x and NVDA was closer to 53x. Fast forward to today, this metric has flipped – AVGO now trades at a premium to NVDA. While we believe that there is merit to having AVGO trade at a higher valuation, we don’t believe the premium is justified.

We remain positive on AVGO, particularly given the company’s compelling growth narrative during its last earnings report. The company painted a beautiful 3-year (2027) picture, projecting a potential $60B – $90B AI revenue opportunity, which points to material upside vs. current AI expectations for the company. While the AI story for AVGO continues to be in full steam, we prefer to recycle capital elsewhere after the recent rally.

Purchase: NVIDIA Corporation (NVDA)

The Aptus Compounders reallocated capital from the sale of Broadcom Inc. to purchase NVIDIA Corporation (NVDA), driven by both fundamental conviction and portfolio considerations.

From a fundamental view, NVDA remains at the forefront of the 4th tectonic shift in computing, where parallel processing captures a share of the computing market. We believe that the market underappreciates NVDA’s business and its transformation from a traditional PC graphics chip vendor into a supplier, into high-end gaming, enterprise graphics, cloud, accelerated computing, and automotive markets. The company has executed consistently and has a solid balance sheet with what we believe to be a demonstrated commitment to capital return. While we understand the geopolitical challenges, such as U.S.-China restrictions, we believe these are manageable over time.

From a construction perspective, this trade enhances our AI exposure, complementing recent additions such as Quanta Services (PWR). Our initiation weight into these names within the Aptus Compounders is very close to the current weight of NVDA in the S&P 500, which should help the strategy maintain a long-term correlation to the S&P 500 while leveraging other aspects of the portfolio to add incremental value.

While NVDA trades at 33.7x forward earnings, this is lower than most of its Mega-Cap peers (AMZN = 38.9x, MSFT = 33.9x, AAPL = 33.8x, AVGO = 37.6x, & TSLA = 137.9x).

Thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Information presented in this commentary is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Information specific to the underlying securities making up the portfolios can be found in the Funds’ prospectuses. Please carefully read the prospectus before making an investment decision. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The company identified above is an example of a holding and is subject to change without notice. The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2412-13.