No matter your time horizon, higher ending values of an investment portfolio are a good thing. That’s usually the goal. Invested wealth grows through time. It’s our job to help deliver solutions that recognize risk tolerance/capacity constraints and provide a return path that’s suitable over time.

Unfortunately, for some, the meaning of ‘suitable’ revolves around minimizing volatility, to the detriment of higher returns. Many have fallen victim to the belief that investors are willing to forgo higher wealth levels to feel safe. (Notice I said ‘feel’ safe).

We get it and aren’t discounting that completely, as we are well aware of the impact portfolio uncertainty can have. We’d just argue the bias assuming that ‘safe’ investments are protecting wealth.

As a reminder, the Aggregate Bond market is widely considered a safe place. Over the last 5 years, the AGG (an ETF that tracks the Aggregate Bond Index) has delivered a cumulative loss of 4%. That’s in nominal terms, meaning real returns (that factor in inflation) would be much worse.

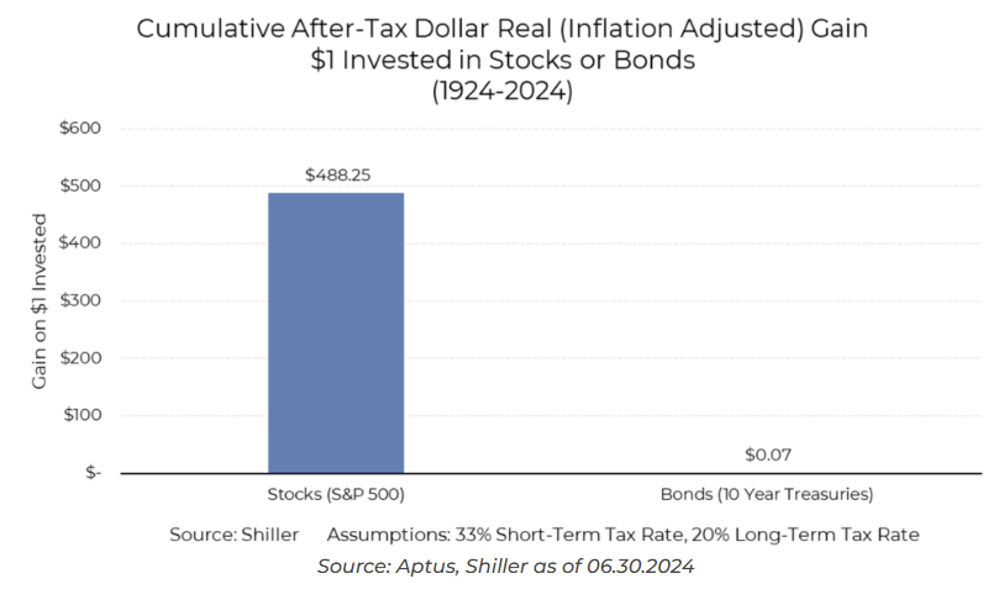

Here’s a sobering chart from our write-up, The Lost Century in Bonds.

That’s 100 years of going nowhere. At the heart of our approach is our conviction that no matter how risk-averse clients are, they’d prefer to improve their wealth.

Disappearing Return is another post worth reading that illustrates the impact of taxes and inflation on “safe” bond returns.

You can feel safe while having your purchasing power stolen. That’s not a proposition many clients would be excited about.

Clients want the highest compounded return possible, aka the highest terminal value of wealth. We’ve been on a 12-year journey to create a business that helps improve compounded returns through the ownership of optionality in portfolios. We’ve gotten plenty of things wrong, but we continue to learn, grow, and work towards daily improvement.

What’s Your Average

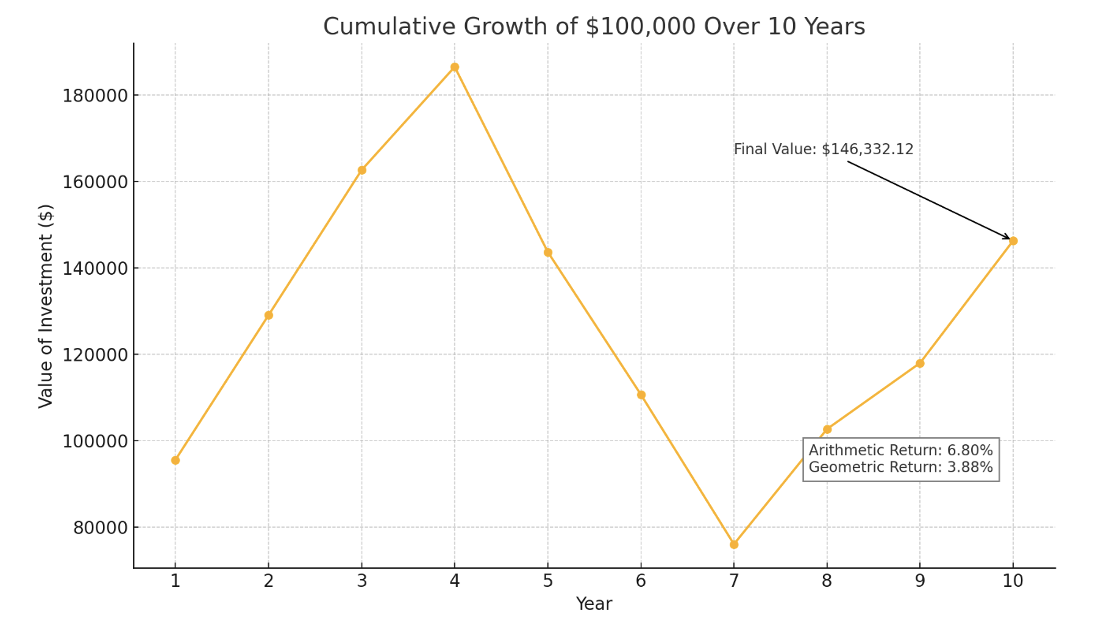

Imagine if this were your next 10 years of portfolio returns:

-

- The average (arithmetic return) is 6.80%

- The geometric mean (compounded return) is 3.88%

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flow.

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flow.

These next couple paragraphs are the heart of this note:

The ability to compound capital depends on a portfolio’s ability to be durable in the tails. Given our allocation shift from less bonds to more stocks, a shift that creates more potential volatility or dispersion from the mean, this concept needs to be understood.

In this example, you could say the expected return is the average outcome of 6.8%. Just as in the real world, the annual return is very rarely the expected return. Investors must deal with divergences from the expected outcome, sometimes rather large divergences. Dealing correctly is where compounded returns (what actually matters) are made.

Our goal is to be better in the tails, you’ve heard us say that. In right tails, we want to participate. In left tails, we want to minimize the damage.

-

- Right tail: Large divergences from the expected outcome to the upside -we like these

- Left Tail: Large divergences from the expected outcome to the downside – we don’t like these

Durability in the tails reduces the volatility tax, and closes the gap between the simple average and the compounded average. In other words, it improves the compounded return and therefore increases the terminal value of the invested portfolio.

As we move through time, your portfolio’s success depends on how it handles the outcomes that are outside of expectations.

Your Portfolios

I hope this note is read. I hope it’s understood. The math may sound complicated, but it is as straightforward as can be.

Asset allocation is what matters. If you can solve problems at that level, everything else is easier. We think there is a massive allocation problem with the ownership of fixed income. I’ll spare you of all the reasons we believe this.

The solution is the ownership of optionality.

Own the risk, hedge the tails.

Our entire approach is designed to own risk assets, as we believe they are the stronger engine to drive returns. We want to hold negatively correlated hedges to protect against the extreme left tails that inevitably occur. The hedges are the brakes.

This is different than the traditional approach, the one that allocates away from risk assets in favor of things that have what we believe to be inferior engines for returns, all in the name of dampening volatility.

We want volatility. Specifically, upside volatility. We want to avoid massive drawdowns, or the left tails. We do that through owning hedges. Return / Vol is not the risk metric that concerns us. We want Return / Drawdown to be as attractive as possible.

The presence of our hedges, and the convexity in their payoff in a left tail, allows us to own the risk confidently.

The team put together a write up that illustrates how using long volatility can benefit portfolios, and free investors of the emotional distractions that come with investing: A Modern Approach to 60:40 (a must read, in my opinion).

Going Forward

There will be bumps along the way, without a doubt. We will experience negative returns from time to time. The ever-present risk in the market is why there is potential for return.

We are confident that if we can improve allocations to perform better in the tails, better outcomes are ahead.

We are working daily to continue to earn your trust. We appreciate you. Please don’t hesitate to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-2.