So far, the “important” part of earnings season is essentially over, and the results are better-than-expected. Companies have cited margin issues and supply chain disruptions, but management teams have been able to navigate these issues and investors are looking past the disruptions as temporary and are instead focusing on continued strong demand. Put plainly, fears that all of these factors would potentially reduce expected 2022 S&P 500 earnings has not come to fruition. That’s why you’ve seen this market rally to all-time-highs, led by the “average stock”, i.e., not MAGA.

Earnings have been more positive than feared early in the month, but upside is clearly less than the prior three quarters. In the prior three quarters, 2021 consensus EPS for the S&P 500 was increased by ~$10 each earnings season, this season it looks like it is going to be ~$3-4 (from ~$199 to ~$203). This is still very strong historically, but also shows the meaningful sting of supply chain shortages.

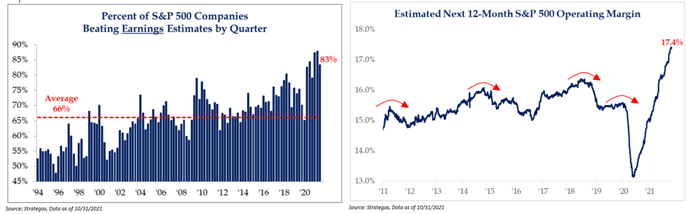

So far, in Q3, 83% of companies have beat earnings estimates – the rate remains well above the historical average of 66%. However, this figure is down from Q1 and Q2, where 87% and 88% beat earnings estimates, respectively.

The one big thing that we continue to focus on is overall margins at the index level. Historically, it’s difficult for the market to get into “trouble”, i.e., see increased volatility (or a downturn), when margins are increasing or stabilizing. While this is not the first pause we have seen in margins over the last year, it does come in the middle of earnings season – which is somewhat concerning.

For more detailed earnings analysis on our HNW Compounders sleeve, continue here: HNW Earnings Recap

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Aptus Capital Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Forward looking statements cannot be guaranteed. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2111-10.