Two Choices

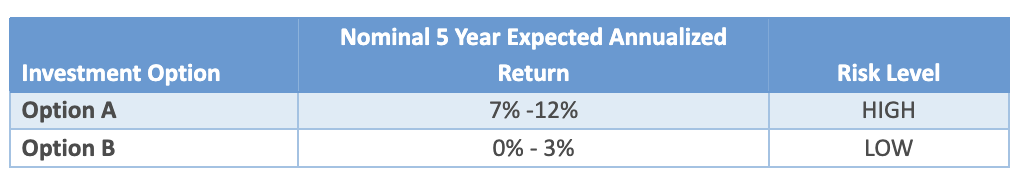

Let’s assume there’s only two potential investment options. For this exercise we’ll define risk as volatility in return stream, and exposure to large drawdowns…meaning it could be a wild ride where the drag of a volatility tax could come into play:

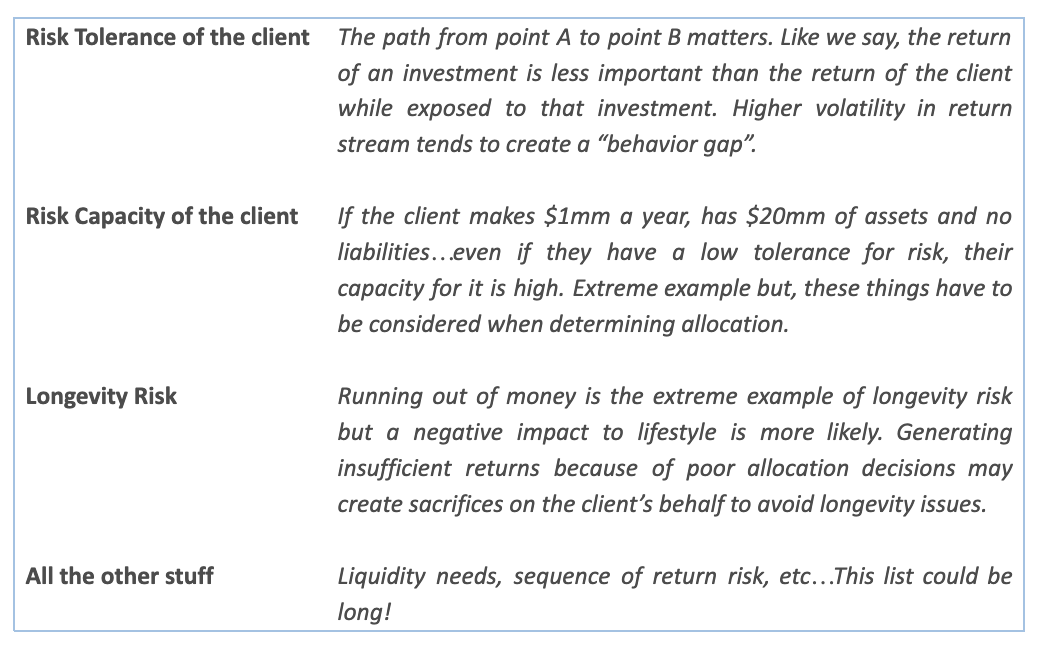

Your job is to make a forward-looking decision to the optimal mix of each. Seems like the simple answer is 100% to option A. But it’s not that easy. What’s not purely mathematical about that decision is the other factors that go into it:

Deciding How to Allocate

What if the world around you says 60% to investment A and 40% to investment B, with their advocacy of that allocation being supported with a rearview look…how can you add value if that’s the benchmark?

You decide to allocate 100% to Option A and forfeit any exposure to Option B. Your decision was driven by the fact that the majority (in the 90% range) of a portfolio’s return is attributed to asset allocation. If you can allocate additional funds to the higher-returning vehicle…you’ll crush the benchmark and put your client in a better position to fend off longevity risk.

You made a strategic allocation to own more of the investment with greater returns. The focus was on long-term return, and your strategic allocation decision powers your upside outperformance of the benchmark.

What you didn’t consider, and where there is still work to do, is return’s spouse…risk.

What About Risk?

The benchmark 60/40 advocates are equipped with historical data. Buy Vanguard and forget about it, this investing stuff is a commodity, right? They will point to all the issues of having too much risk in portfolios. We wholeheartedly agree. There are a host of behavioral issues that excess volatility can bring to light. But we wholeheartedly disagree with the common proposal.

The typical solution is to ratchet down risk by allocating to the vehicle with lower volatility. What’s not discussed often enough is the potential damage that does to potential return.

We think allocating to bonds lowers your portfolio’s overall return. That’s an ok compromise if bonds actually produce a real return. When they are producing negative real returns…it makes no sense to allocate just to reduce overall portfolio vol, because you crush return.

The whole point is the ability to allocate to a highly convex holding, whose convexity pays off when the growth allocation (option A in my example) is pooping the bed. Unlike bonds, this allocation keeps risk in check while IMPROVING return, as you can continue to hold more of the asset class with greater upside potential.

*As a side note – the table of Option A and Option B shows nominal annualized returns. Assuming inflation runs at 3% for 5 years…it would make Option B’s return range turn into -3% to 0% real. Stating the obvious, if inflation is higher, the more negative Option B’s real return gets.

Shifting to a vehicle with negative real return potential makes zero sense…I don’t care how steady the return stream is. Owning more of option B may address drawdown exposure and dampen volatility, but it injects longevity risk…the most insidious risk of them all in our opinion.

Your clients are worried about left tail (drawdown) risk, and so are we. The math of large losses crushes the ability to compound capital. What else can we do?

Option C

What if we expand the opportunity set to include investment option C. This is a negative return vehicle, but it carries a special feature – a convex payoff during volatility of Investment Option A.

In other words, this is a hedge against option A that requires small money upfront but has potential to return multiples if Investment Option A sells off hard. It’s designed to be true protection against the exact risk of Option A that worries clients and threatens their financial plan.

Most importantly, think about what this Option C could do to your strategic allocation decision…

When working from a 60/40 benchmark, Option C gives you the ability to not only improve return, but potentially reduce risk at the same time. It’s a vehicle whose risk reduction potential doesn’t crush return potential.

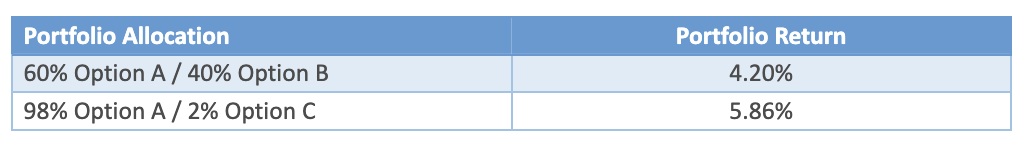

Think about the math. Let’s assume the lower range of returns from earlier: Option A returns 7%, Option B returns 0%, and Option C returns -50% (this should be conservative).

Now let’s compare a 60/40 allocation to 98% option A + 2% option C allocation:

The better return is found in the portfolio that can strategically allocate towards more potential for return…the math is straightforward.

*It’s worth noting, we are assuming the risk levels between these two portfolios to be relatively close, given the convex risk mitigation carried by Option C.

Portfolio Impact

Notice we estimate the return potential of Option C to be -50%. At the portfolio level it improved returns significantly without adding risk, but when you look at each holdings specifically it can blur the vision of the forest for the trees.

What we mean is when you look at each holding, some people might say the following:

“Well option A performed better but I sure wish we didn’t own this Option C thing…we lost 50% of the value.”

While they’d be right, what’s missing is the impact of Option C’s presence in the portfolio and what matters most is the portfolio’s return…not each individual holding.

Its presence is the thing that allowed the portfolio to strategically shift and be positioned for better upside through asset allocation—again, the decision that drives 90% (or more) of a portfolio’s return. Its presence allows for more risk to be taken, not less. Can you see the difference in this approach to the more traditional approach (‘Well if you don’t want risk, let’s just own more bonds’)?

This entire concept is reminiscent of our Team Over Players post. Please read that again when you have time, the overlap will be obvious.

As far as risk goes, Option C is the thing that does the heavy lifting during a market sell off. In periods of stress, Option C is that, ‘I’m sure glad we own this’ holding. In periods of friendly markets, Option C is the, ‘Why do we own this again?’ holding. That’s by design…

Our Portfolios ⇨ Allocation for Upside, Security Selection for Downside

Today’s market, in our opinion, has heightened the importance of allocation decisions. While the walk through above is overly simplified, it’s not far off from how we see things.

We believe stocks have potential for return but with elevated risk. We believe bonds are set up for negative real returns…especially with elevated inflation. The old 60/40 mindset is broken, given that bonds no longer offer yields that they have in the past and the correlation benefits may be a thing of the past as well.

Our approach to this, has been and will continue to be, strategic overweights to stocks with the added exposure of long volatility.

Unlike the simple example, we don’t allocate to hedges (long volatility) outright in our model portfolios. We have funds that provide this exposure under their hood more efficiently for your clients. Their presence allows allocations to be more aggressive and drive upside capture despite any potential drag from long volatility exposure. Security selection powers the downside as the benefits of volatility are easily felt.

Conclusion

If you own more of the asset that outperforms, you have flexibility to capture less than 100% of the pure beta upside and still outperform any relevant benchmark. In fact, by owning vol, you can almost guarantee less than 100% upside capture when equity markets are rising, but that’s ok…and by design.

We believe our strategic allocation can power upside despite any potential drag from vol ownership on the way up, while our security selection powers the downside as we benefit from our vol exposure.

This was a longer note this month. We appreciate you reading as this concept is an important one. Thanks for the trust and please don’t hesitate to reach out with questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The iShares 60/40 Core Growth Allocation ETF seeks to track the investment results of an index composed of a portfolio of underlying equity and fixed income funds intended to represent a moderate target risk allocation strategy.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-5.