The Road Goes on Forever, But the Party Never Ends?

Cathie was an Investor at the only Growth shop in town,

She had a reputation as a girl that’s investments only go down,

Down Wall Street after midnight with a brand-new pack of ETFs,

A fresh new low on the charts and her tail between her legs,

She’d double-down on stocks, calling them “Deep Value” with all her friends,

The road goes on forever and her party will surely end.

–The Road Goes on Forever, Robert Earl Keen (Probably)

For most of the last decade, there have been many economists and charlatans perpetually calling for a structural crash in the stock market. The list of scapegoats is long – extended valuations, an explosion of the Fed balance sheet, and record high national debt – this list could go on forever. But, you know what? The equity party hasn’t ended.

For thematic purposes, singer-songwriter Robert Earl Keen is a giant of the Americana music genre, a member of the generation of Texas songwriters—George Strait, Steve Earle, Nanci Griffith—that followed in the wake of Townes Van Zandt and Guy Clark. He’s also been an ardent student of Willie Nelson ever since he first picked up a guitar in high school.

Value investors are Feeling Good Again ever since the market started to exhibit a prolonged rally in the more cyclically exposed areas of the market. Will this area of the market take the baton from growth and lead the next charge forward of relative performance? Possibly. But we are more positive that the current economic and political environment has been permanently altered from its pre-COVID days, although many of these changes aren’t from the pandemic itself. The result of this regime change is potentially an atmosphere that can breed higher dispersion, making stock picking this year even more important.

This means that investors need to continue to remain balanced – don’t get too bearish or too bullish. Don’t get too growthy or too deep value. Don’t get too defensive or too cyclical. Own high-quality stocks. This style tends to outperform during periods of slowing growth and market uncertainty.

The underlying economy continues to remain very strong on the back of the U.S. consumer – they have never had so much excess liquidity with an unencumbered balance sheet. On the other hand, the market is a bit of a different animal, as we know that the market and the economy don’t mean the same thing. Even though the economy is strong, it doesn’t mean that there will not be normalization in the market moving forward, i.e., the potential for volatility.

We believe, even though investors may need to Curb their Enthusiasm next year, that the equity market remains the best alternative relative to bonds, given the opportunity set. Based on the shape of the yield curve, the drop in unemployment claims, and a vast reservoir of personal savings, we believe the odds of a recession in the U.S. are low in 2022, but that doesn’t mean that next year will be a smooth ride.

We believe that the choppiness can be centralized in the unprofitable, highly-valued stocks that never seem to inflect – owning them would be a Dreadful Selfish Crime. We believe that the market’s path of least resistance is up, but for the aforementioned style of stocks, we believe the road will go on forever, but that party may likely end.

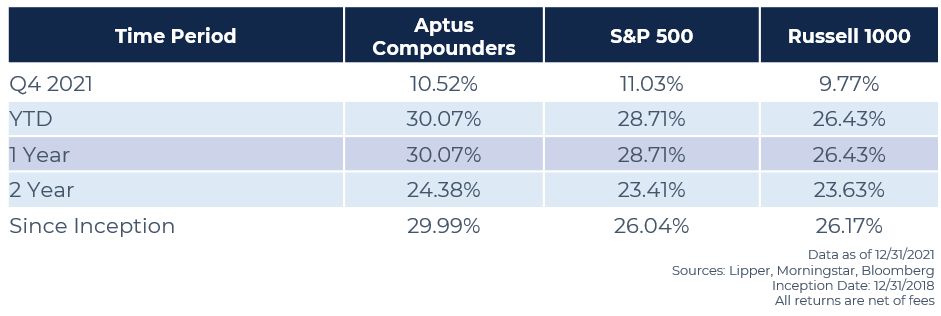

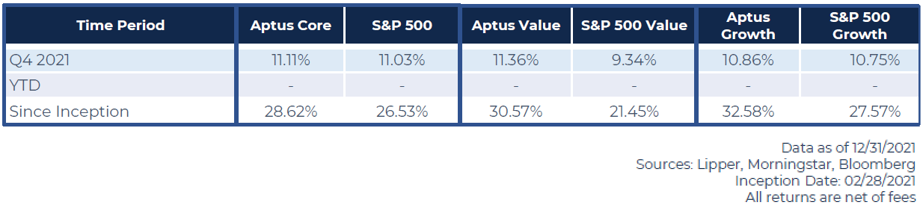

Stay nimble, stay prudent, and remain thoughtful. Please find the Aptus Compounder and Stock Sleeve performance below:

One of the goals of our investor letters is to give readers insight into our philosophical views regarding how we build, construct, and manage our portfolios. The “Halftime Report” from 2021, homed in on the fact that we construct portfolios that can endure a wide range of different environments. Within this 2021 “Full-Time” Report, given that it is an end of year rundown, we want to focus on how we avoid large losers. We firmly believe that one of the best ways to seek alpha is to minimize the risk of making big mistakes.

Over the last few years, we’ve been extremely proud that we have been able to avoid any sizeable unforced errors. It’s no secret that the Aptus Compounders portfolio is concentrated – it’s 15 high-quality stocks. The problem with concentration is that a few large losses can wreck a year. This is why we’ve always been fixated on the downside – own companies that we believe exhibit characteristics that outperform during periods of volatility. Thus, we are extremely proud that we have once again dodged the big landmines of 2021, by avoiding all exposure to the “Ponzi Sector” – ARK-style investments.

Many people try to make this investing game much more difficult than it should be – there’s no reason to always swing for the fences, when singles and doubles will suffice. You buy good businesses for less than fair value. Sure, we can all argue about fair value, as there are always surprises in the future trajectory of a business. This game has some wrinkles and drama, but at its core, it’s easy when done correctly. Emotionally driven decisions rarely tend to be the most rational. This means that one should only make decisions when one has calibrated conviction. In fact, the best decision could simply be doing nothing.

That’s what we did last year. We patiently waited until we had conviction. Many of y’all heard me proffer a bet to all Aptus employees regarding the Aptus Compounders performance for the year. In March 2021, our concentrated portfolio was underperforming the market by ~7%, as low-quality factors were unsustainably driving the market higher. The bet was that, by year end, we would outperform our benchmark, the S&P 500 – because our team had conviction. As of year-end, we beat the market by 1.4%.

Over the years, we have learned that it is never the boring compounder that really hurts you—it’s making decisions based off feelings, not facts. This game is easy – own stocks with a pricing power, a competitive edge, and a long runway of growth with management teams that understand capital prudence. We believe, if we all stuck to the process and allowed our capital to compound over long periods of time for us, we’d all be a whole lot wealthier today. The first rule of investing is to never put yourself in a position where you can lose it all. We all have been burnt in the past; hence, we focus an inordinate amount of attention on how we can get hurt; not on where we can make the most money—that part is easy.

Many investors try to overcomplicate things from time to time. These decisions can prove to be very costly mistakes along the way. I think that many people reading this, myself included, can joke that their career is nothing more than a decade of finding creative ways to lose money. I understand that we are all human, but, in this market, we need to be dynamic, pragmatic, and most importantly, thoughtful.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2201-19.