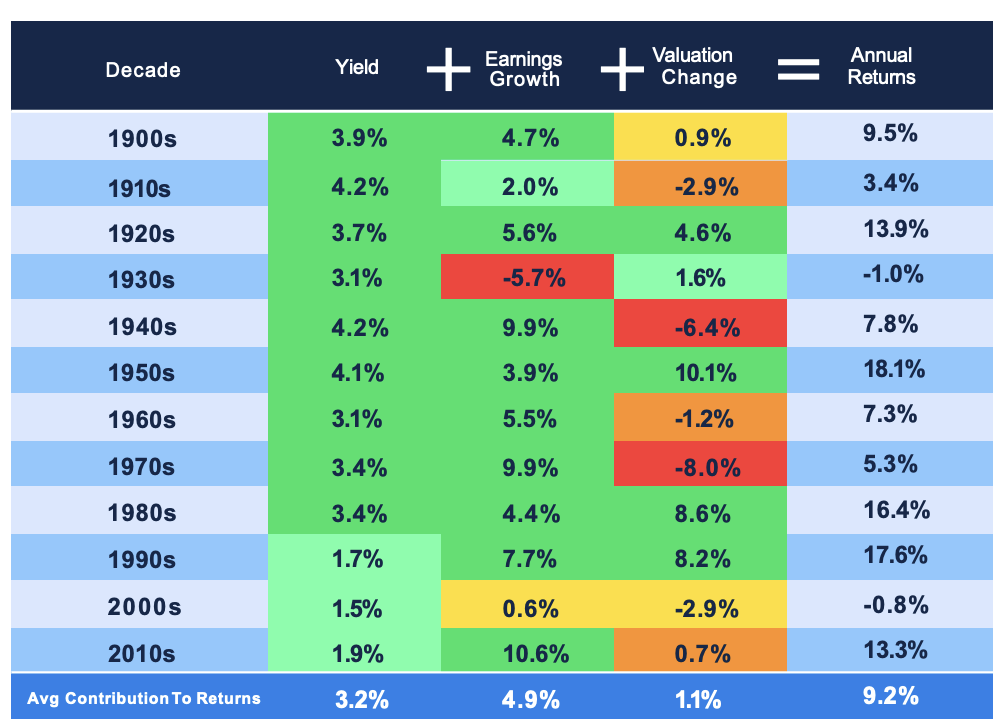

A quick reminder, the formula for generating investment returns looks like this:

Return = Yield + Growth +/- Valuation Change

Here’s the graphic showing each of the 3 potential drivers of return, broken out with annualized return of each component, by decade:

Source: John Bogle, Robert Shiller, Aptus Research. Data as of 12.31.19

Source: John Bogle, Robert Shiller, Aptus Research. Data as of 12.31.19

Notice the ‘yield’ piece. According to Bank of America’s data as of 11/28/2022, the dividend contributions to the S&P 500 Index’s total return from 1936-2021 was 36%. That’s close to our breakdown above through 2019.

Bank of America notes that since 2013, dividend contribution to the S&P 500’s total return is only 14%. Yield has been important to total returns historically. In the past decade it’s been less important. We think portfolio’s attention to yield should be a priority moving forward.

What has happened matters less than what could happen moving forward. Rearview vs windshield … our job is to make sure we make allocation decisions with a sound forward look. More to come on that front.

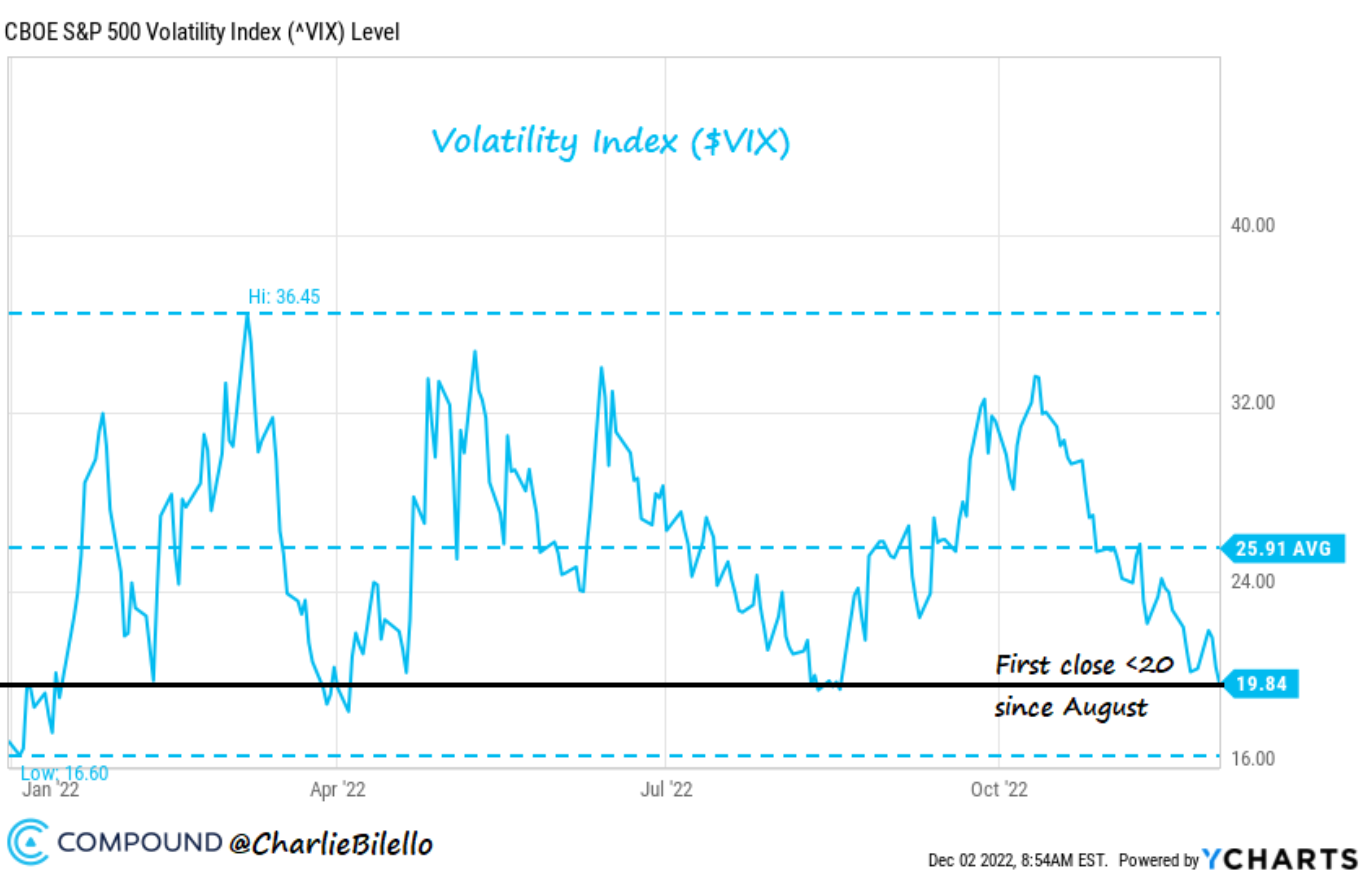

Everything Is Fine

The CBOE Volatility Index (VIX) is known as the market’s fear gauge. It’s derived from SPX index options to get a sense of market expectations of coming volatility. The mechanics of calculating the VIX are beside the point. The point is, an elevated VIX implies that the market expects near term volatility, and a lower VIX implies the market expects calm action over the near term.

According to VIX at the close on 12/2/22 … everything is fine.

The S&P 500 has exploded off the October lows near 3550 and currently sits near 4000. VIX has compressed significantly over that time frame.

This action has happened in the face of what’s arguably a setup for higher volatility (Geopolitical turmoil, inflation pressures, Quantitative Tightening, rate hikes, just to name a few).

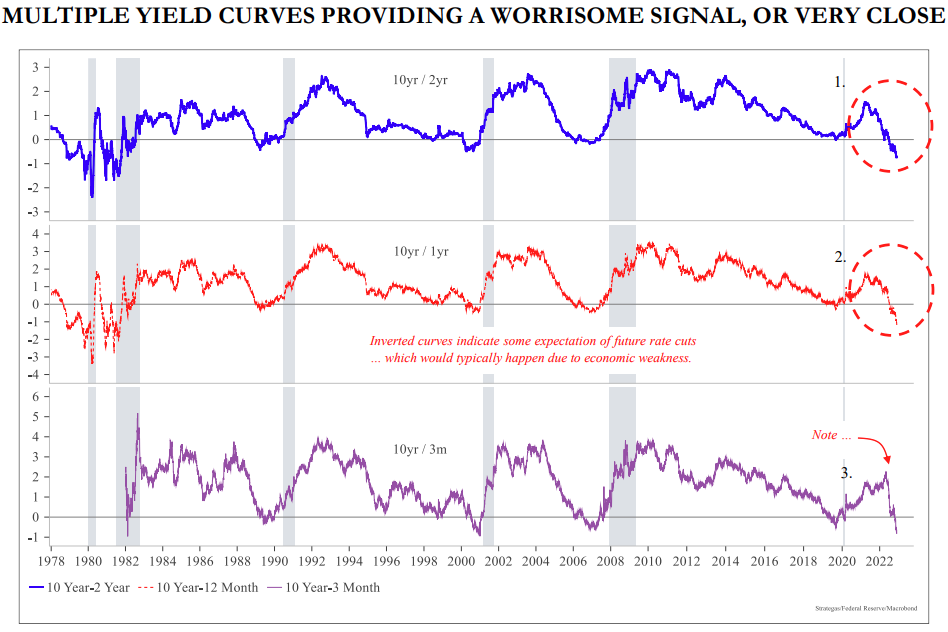

The Yield Curve Doesn’t Seem to Agree

Source: Strategas/Federal Reserve/MacroBond as od 11.30.2022

Source: Strategas/Federal Reserve/MacroBond as od 11.30.2022

The yield curve illustrates the yield on bonds with different maturities. Normally, short term bonds yield less than long term bonds. When near term yields are higher than further out bonds, that’s called an inverted yield curve, typically seen as an indication of bad things to come.

The slope of the curve illustrates how the bond market expects rates to move, as well as expectations of economic activity and inflation. The curve, especially the long end, is saying the market expects the Fed to keep control of inflation, and growth too slow.

VIX and the yield curve don’t seem to jive.

Our Positioning

We think quantitative tightening will be a challenge for risk assets. We think the Fed’s appetite to ‘hike and hold’ is real, to tame inflation. We think slowing growth, and the potential for cash flows available to businesses and households to fall while borrowing cost increase, is something to think about.

Thinking about a portfolio’s ability to generate yield, we believe yield’s importance is elevated, as growth and valuation expansion both face headwinds for the foreseeable future.

Volatility is an asset class to us, and a tool we can harness to help alter portfolios to better position for future returns. We are leaning into ways we can harness volatility with three main goals:

- Mitigate Risk

- Enhance Yield

- Capture Upside

We’ve gone as far as launching new strategies to help facilitate this. Rising volatility is not something we worry about. It’s something we are constantly preparing for. It’s something that can help illustrate how effective our approach to risk can be, and elevated vols helps improve the overall yield profile of certain strategies.

We continue to believe more stocks and less bonds is the needed allocation shift when hunting for long-term real returns. Our approach to volatility is what helps facilitate this shift while keeping risk in check. The traditional approach to portfolio construction that relies on the historical relationship of stocks and bonds is broken. I’m sure glad we don’t subscribe to that line of thinking as we enter 2023.

As always, thank you for your trust and please don’t hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-4.