Over the past week, headlines have been dominated by news of Silicon Valley Bank’s collapse along with the failures of Silvergate Bank and Signature Bank of NY. The FDIC has stepped in to take control of assets for both Silicon Valley Bank and Signature Bank and many bank stocks tumbled on the news.

What’s Going On?

If we look back to the beginning of 2022 the fed funds rate was 0-.25%. Fast forward to March of 2023, after 18 rate hikes, the fed funds rate currently sits between 4.5-4.75%. Such a quick move in rates has put pressure on banks to offer higher rates or lose deposits to other risk-free higher yielding investments.

Banks use deposits to earn a spread on that cash typically through treasuries or other interest rate sensitive vehicles. As rates move up, treasuries lose value, especially longer-term treasuries. In 2022 alone, the iShares 20+ treasury Bond ETF lost over 30% of its value given the move in rates.

We have seen these rising rates plus money fleeing traditional banks to find yield put extra pressure on certain banks to either find liquidity or sell securities at a loss to create liquidity. Ideally a bank can find cash from other areas of their business or even a 3rd party in order to avoid selling these longer dated treasuries at a loss as opposed to holding to maturity and receiving their principal back. Selling for a loss significantly changes the math of these banks balance sheets and typically not in a favorable way.

This is an oversimplification of what led to these three banks failing as each had a myriad of reasons their business failed however the pressure on the banking industry remains. As investors digest the storm of information and ominous articles about runs on the bank they are left with a key question: Is my money safe?

Rather than prognosticate on what could happen next, we wanted to quickly share what the protections are to clients if things were to escalate. Specifically, answer the questions on what is insured by SIPC and FDIC and considerations for both your bank and brokerage accounts.

For starters, What is the Difference Between FDIC and SIPC?

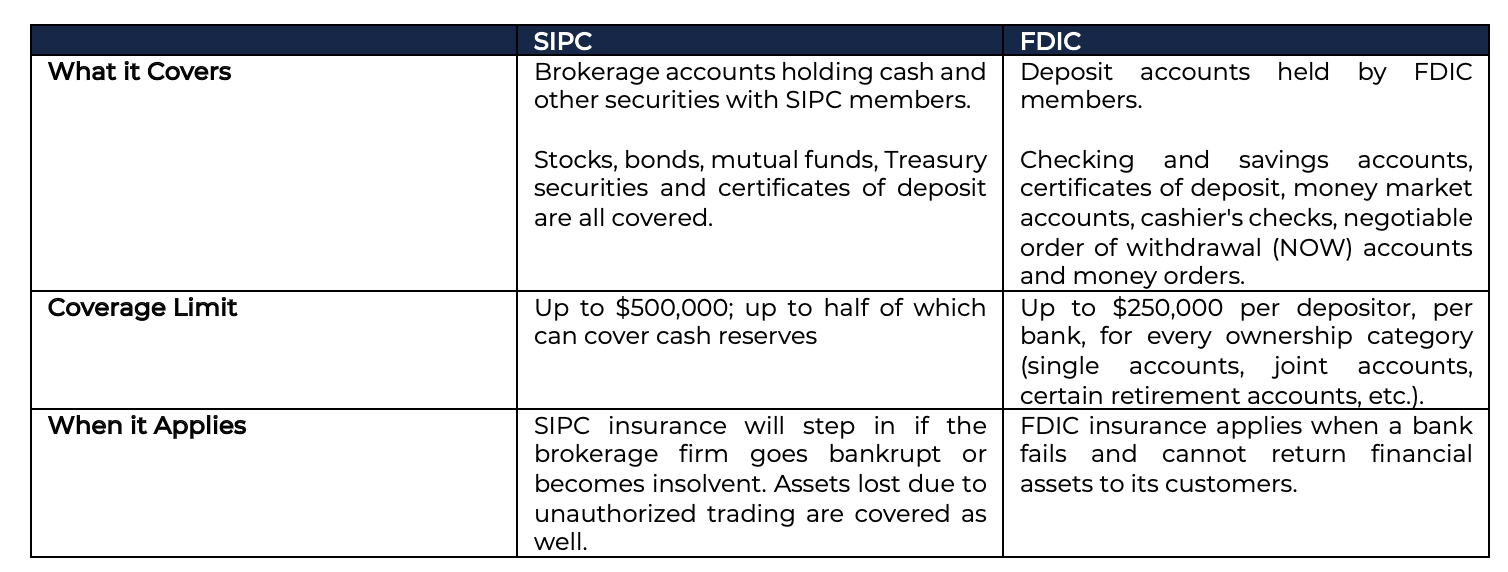

FDIC and SIPC are often mentioned in the same breath – both serve the purpose of maintaining confidence in the American financial system. The primary function they play is insuring accounts across their member institutions and helping to return an investor or account owner’s assets in event a financial institution fails. The key differences between the two are that FDIC’s member firms are banks and savings associations while SIPC’s members include broker-dealers and clearing firms. The FDIC also takes a more active role and has the ability to examine, supervise, and work as a receiver of failed banks. A quick chart below shows what and how each organization insures assets.

How Does Coverage Work?

Both FDIC and SIPC limits apply at the owner level, however they both provide separate coverage based upon category or capacity and is specific to each member firm, meaning accounts at different banks or brokerage firms would have separate limits.

The FDIC provides separate coverage for deposits held in different account ownership categories. Depositors may qualify for coverage over $250,000 if they have funds in different ownership categories and all FDIC requirements are met. All deposits that an accountholder has in the same ownership category at the same bank are added together and insured up to the standard insurance amount. More information on FDIC coverage can be found here.

SIPC protection of customers with multiple accounts is determined by “separate capacity.” Each separate capacity is protected up to $500,000 for securities and cash (including a $250,000 limit for cash only). Accounts held in the same capacity are combined for purposes of the SIPC protection limits. Additional information on SIPC’s here.

What If I Have More Than $500,000 invested?

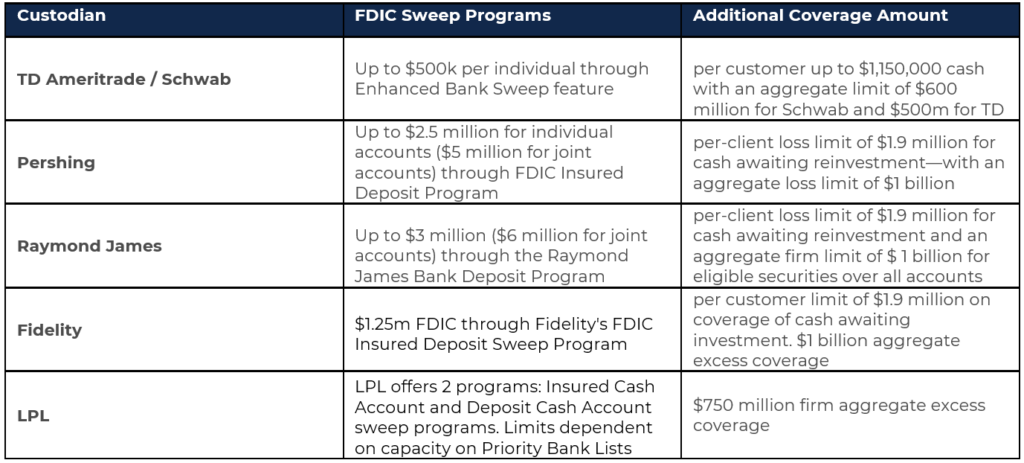

As described above, the limits apply differently across various accounts, however custodians also purchase insurance above and beyond that of standard SIPC coverage. Also, there are some custodians who utilize multiple member banks to increase the FDIC amounts.

One important point is the SEC customer protection rule requires client securities to be separate from broker dealer securities. Which means if you held 100 shares of Apple and your broker dealer/custodian were to fail, you still own the same 100 shares in Apple that you owned before failure. Because of this we wanted to focus on the cash coverage.

After review, we did our best at outlining the insurance amounts above and beyond the standard SIPC and FDIC, below.

The Opportunity

There is a lot of uncertainty today, and times like this can be a good opportunity to communicate with clients about their plan and review how portfolios are positioned. We had two blog posts recently that without meaning to be, come across as quite prescient.

The first, titled It’s Time to Move Cash Out of the Bank was written by our resident CFP, James Yahoudy. James talks about the opportunity presented by the disparity between bank rates and money markets. Combined with recent events now may be a good time to speak with clients about where cash is held and what role that plays into their broader plan.

The second article, It’s the Tails That Worry Us, was written by our founder and CIO, JD Gardner, where he referenced the outsized impact sharp drawdowns have on portfolios in the long run. We think there is a lot of uncertainty in the markets and want to build portfolios that can still add value in tail events.

We spend a lot of time working with advisors thinking through the challenges their clients are facing to find solutions. Please reach out if there is anything we can do to help.

Custodian Links

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. ACA-2303-21.