This month’s note is a carryover from last month’s, where we highlighted the rise of the “set it and forget it” portfolio over the last couple of decades, and the potential issues we see with that mentality. These portfolios are dependent on bonds working. By working, I mean generating returns AND providing diversification benefits. Again, for 20+ years bonds have been a decent hedge with positive carry (yield). Think about that last sentence. “Positive carry” hedges are like unicorns.

Correlations and Carry

Positive carry diversifiers are not a unicorn, but they have correlation risk. These could be holdings like managed futures or other alternative strategies. They may help diversify a portfolio, but when you need them to go up when other stuff goes down, there’s no guarantee that happens.

A hedge is something that should protect what you own. If you own stocks and buy puts against them to hedge…you don’t have correlation risk, but you do own a negative carry position. When you find an insurance policy that pays you to own it, please call me. That’s my point from last month. In our reviews, cheap beta portfolios treat bonds not as diversifiers with correlation risk, but as a proxy for a hedge. 2022 was a slap in the face for those dependent on long-term treasuries to help with the equity sell off.

The investment world, thanks to the rise of indexing and our natural tendency to chase performance, has overlooked how perfect the landscape was for the entrenched 60/40 mindset in the recent past. Not only that, but they’ve also overlooked how different it is today.

We are scrambling to build tools and services to allow for the construction of portfolios that do better in the tails. It’s hard to sum up the scope of our work at Aptus, but if I had to, “better in the tails” would be the mantra at this point. Don’t worry, I’ll explain what I mean by that in a second…

My colleagues are much better at discussing the happenings of the markets. I try to focus on the concepts that drive our decisions with the information of today. I’m writing this on March 6th, 2023. We are on the heels of a Friday that saw markets rip higher into the weekend, VIX was evaporating again, and Treasuries across the board are all north of 4%. I used the word scrambling for a reason.

The Tails Matter

Before continuing, let’s cover a foundational truth to compounding capital. The IMPACT of returns matters more than the frequency. It’s the tails that worry us, not the mean.

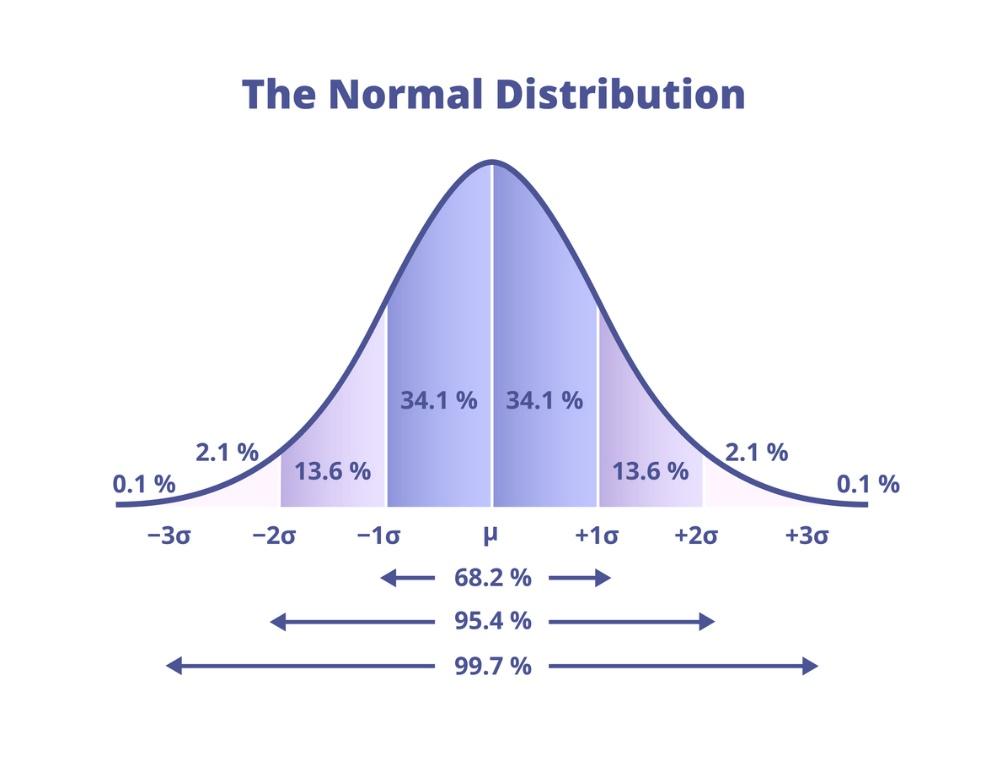

Going back to Stats 101, remember the bell curve?

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. This information is for illustrative purposes only and is based on estimated time frames. Portfolio characteristics, client restrictions, and market conditions could impact performance. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Many assume that returns are random and normally distributed. Let’s roll with that assumption for now. What you are looking at above is a sample of what these assumptions look like. Most returns occur 1 standard deviation above (to the right) and below (to the left) the mean – that’s 68.2% of all returns. The frequency of returns diminishes quickly outside the 1 standard deviation boundary as you see the downward sloping curve on either side.

We care less about the frequency of returns than we do the impact of those returns. It’s the returns out in the “tails” of the distribution that matter most. Our job is to help compound your client’s wealth in a manner that is digestible, and sufficient for their specific financial plan. When it comes to that objective – it’s the tails that worry us.

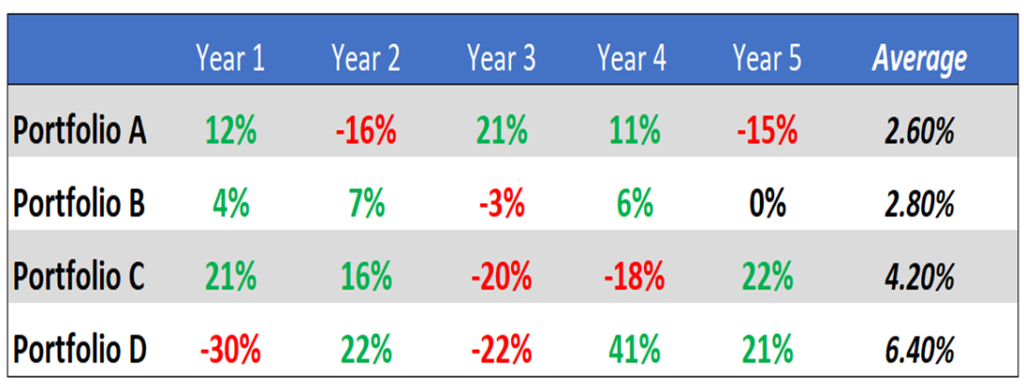

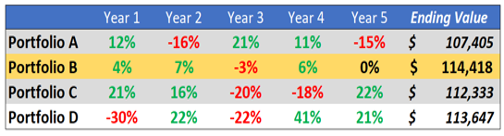

While +/- 2 or 3 standard deviations away from the average occur less frequently, their impact matters most. Think back to our favorite investor: Which portfolio would you prefer over the next 5 years?

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. This information is for illustrative purposes only and is based on estimated time frames. Portfolio characteristics, client restrictions, and market conditions could impact performance. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

I’ll give you a second to choose if you haven’t already seen this…

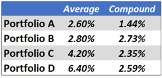

The answer is portfolio B, despite having a simple average return nearly 4% lower than portfolio D. Why? Because it avoids the impact of a large loss. Specifically, the volatility tax associated with large losses.

Remember, simple averages do not equal compound averages. The compound average will always be less than the simple average. Money grows via compounding, and the volatility of return streams is what creates differences between the simple average and the compound average.

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. This information is for illustrative purposes only and is based on estimated time frames. Portfolio characteristics, client restrictions, and market conditions could impact performance. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Optionality and Convexity

The amount of uncertainty in the markets, we’d argue, is high. There’s no way for us to know what’s going to happen. The path of markets, given today’s backdrop, is anybody’s guess. The S&P 500’s forward multiple is close to 19x – if you think there’s room for upside in that number, good luck. And remember the volatility associated with a return stream dictates the drag between simple and compound returns.

Under any level of uncertainty, much less than what we have today, the value of optionality exists. Rather than try to forecast or be exact with predictions, we like to build in optionality. Optionality carries with it convexity via asymmetric payoffs, where potential gains are greater than potential loss. In other words, the payoff function is convex. Risk one, for the chance to earn multiples of one.

The exposure to convexity is another way of saying we are long volatility. As uncertainty increases, so does the value of that potential convexity – our embedded optionality.

Our portfolios have hedges in place. We have and will continue to beat the drum that convexity, in the form of hedges, will have its day in the sun as it benefits from disorder and chaos. We think there’s a growing importance for better brakes on portfolios. As more and more investors get fed up with the lack of payoff that 2022 gave us, it only stokes the fire of our belief.

Rather than depend on bonds, we’d prefer embedded optionality. We believe it serves as protection in the left tails, which supports holding enough upside potential for the right tails.

Our Portfolios Today

Another form of optionality embedded in portfolios today is our focus on yield. Given the move in rates and our ability to use volatility to enhance yields, we continue to think yield is a critical source of return for 2023.

The reason I say it’s a form of optionality is because we are hunkering down into a return driver that carries lower volatility and stable payoffs while waiting for opportunities to present themselves. Meaning, yield rather than growth or valuation expansion.

While we aren’t overly bearish, we sure aren’t overly bullish. Just think about it…

Remember, if a stock earns $2 and trades at a P/E multiple of 10x, the stock is trading at $20. We can do the same for the S&P. The earnings for 2023 the S&P have dropped from around $250 to the current estimate near $220. If we multiply that estimate by current valuations – say ~18.5x – you get the price of the S&P. Will earnings remain intact, or will they fall? Will multiples stay at this level or contract? We don’t have to make that prediction – that’s the thing about owning optionality.

Your Client’s Objectives

Hurdle rates of return that keep a financial plan on track are not astronomical. Given the market backdrop, this is great news. For most plans, if we can compound capital in the 6% to 12% range, all is well.

That’s our objective…to position portfolios for returns that keep plans on track. We want to empower advisors to deliver consistently around the following three questions:

Am I going to be OK?

Can I maintain my family’s quality of life?

Can I improve it?

We are making portfolio shifts and adding strategies, to position based on the windshield and not the rearview. Using volatility to create optionality is how we are approaching portfolio construction, with helping clients comfortably achieve goals our one and only goal.

As always, thank you for your trust and please don’t hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-11.