Quick Take

The most important things that we learned yesterday from the FOMC statement, forecasts, dots, and press conference are 1) tapering will most likely start in November and will last until early summer of next year, and 2) Powell is still very far from thinking about rate hikes (although the dot plot showed to be a bit more hawkish). But the market still is betting on 2022 rate hikes and fewer hikes longer term, which imparts further flattening pressure on the yield curve.

Powell stated that we can expect tapering to start “soon”, although the amount and speed are still left as a to be determined. Powell conveniently left several escape routes in case things go awry and noted that tapering will start if progress continues as expected. Powell did state that there was ample support for the taper (inflation above target while jobs still in recovery). HOWEVER, there is a very low chance of pulling both forms of accommodation together at once (rate hikes).

The other telling part of the speech was the verbiage regarding the ending timeline of tapering, where Powell indicated it would likely conclude by the end of next summer (doves thought it might take longer, say December ’22). This confirmed our base case of a taper starting in November (although we wouldn’t be that surprised by a December start) at a $15bn pace, and an even decrease monthly (pro-rata) until terminating in June or July. This timeline clearly could be fluid, as Powell indicated the power to speed or slow the purchases as new data arises. Taking Mr. Powell at his word, if the September jobs report (coming next Friday, 10/1) is “reasonably good”, we’d expect the taper to follow soon thereafter.

Bottom line, even if the taper starts in November and ends in June, the Fed’s balance sheet will still grow by another $540bn (putting the Fed’s balance sheet well over $9 trillion). With another half trillion to the balance sheet and interest rates firmly at 0%, there is still substantial accommodation through the first half of next year.

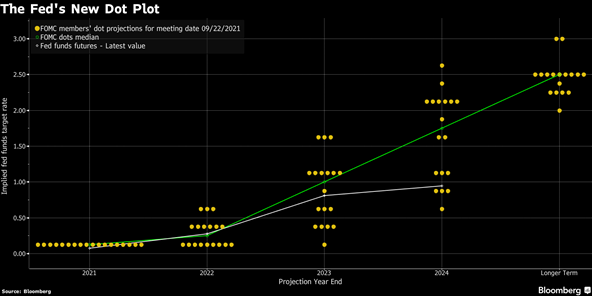

The Updated Dot Plot

Source: Bloomberg. As of 9/22/21

The FOMC meeting also provided a fresh dot plot with 2024 projections. While in today’s world 2024 seems eons away, the apparent takeaway was the very wide dispersion of views among the committee members of when and how fast to raise rates. The median 2022 dot moved up by half a notch which indicates that the FOMC is split evenly between those that want to raise rates next year and those that want to wait until 2023.

Based on Powell’s speech, we’d align him in the dovish camp (slower to hike rates). This is important though because when there are large divergences, like the present, the role of leadership becomes especially important. Our understanding of Powell’s dovishness could very well mean we don’t see the first rate hike until 2023. This would go slightly contrary to market sentiment, as Fed Funds futures are currently pricing in one full hike by next September (’22).

Next Fed Chair

The next most important decision regarding the Fed as we move into the end of the year will be who becomes the next Fed Chair. Jay Powell is certainly the front runner, and although his political affiliation doesn’t align with President Biden’s, he has shown the willingness to work across the aisle when it comes to policy decisions. While Powell has a foot in the door, we wouldn’t be surprised to get some volatility on that front. We’d expect that if Chairman Powell isn’t nominated, the market could react poorly.

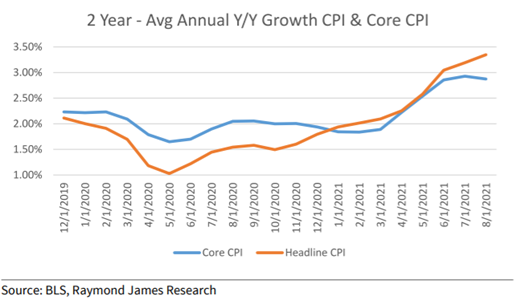

Update on Longer Term CPI

The chart below shows the 2-year average headline CPI and core CPI, which we believe is a better way to look at CPI given low comps in 2020. What it shows is both the core and headline CPI averaging ~3% over the last 2 years – we will see how this trends moving forward. Team “Transitory” believes inflation is peaking and will come down as transitory factors wane, while Team “Inflation” sees Owners Equivalent Rents (OER)/rent inflation continuing to drive CPI higher even with transitory factors decreasing.

Data as of 9/15/21

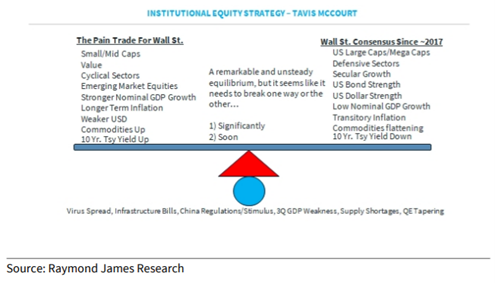

For a nice visual on the differing beliefs of Team Transitory vs Team Inflation, our friends over at Raymond James put together a fulcrum based upon the different interpretations of inflation expectations and general market positioning.

Graphic as of 9/22/21

Graphic as of 9/22/21

So, What Does All of this Mean for Markets?

Yesterday’s Fed meeting confirmed what the market expected, i.e. that tapering will likely begin before year-end (November or December) and it will likely run at $15 billion/month (we know that because Powell said most FOMC members want QE to end in mid-2022, which confirms a $15 billion/month pace). From a market standpoint, the Fed news wasn’t bullish or bearish as it was already priced in.

But it does help remove the potential for negative surprises, which for a market with a short-term confidence problem is a positive occurrence. While Powell likely eased investors anxiety over additional macroeconomics issues, we don’t expect a surprise market rally in stocks, as again this outcome was already priced in with the S&P 500 at 4,400.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2109-17.