Investors have often faced challenges in pursuing sufficient return. There have been times when stocks had risen to levels that squeezed out a chunk of their future returns. And periods when expected returns in fixed income trailed rates of inflation.

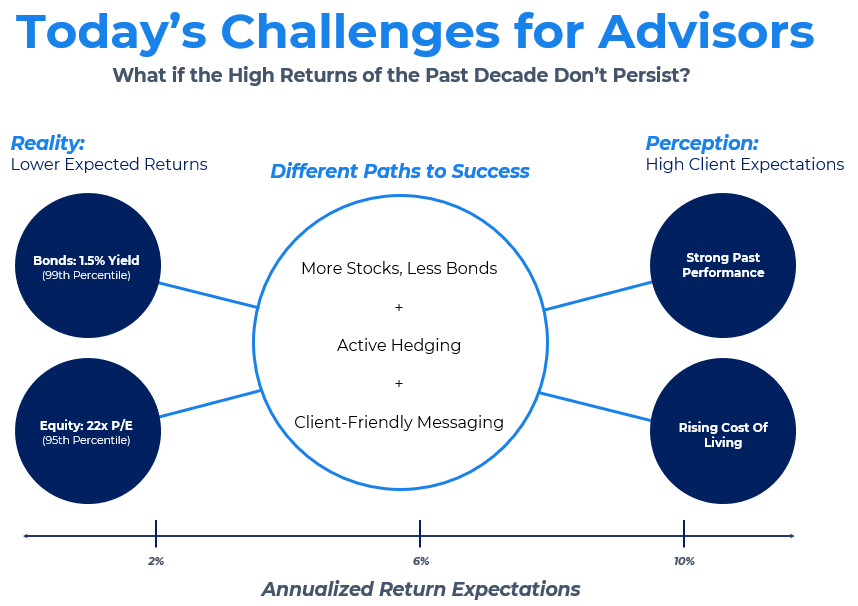

But we’ve not faced a period like today, where a long bull run in stocks and bonds may leave both primary asset classes starved for returns in the years ahead. This leaves advisors in a tricky position of high expectations from clients, and low potential for returns. Something like this…

You hear a lot from us about markets and portfolios, generally from a CFA®/Portfolio Manager perspective. We thought a CFP®-led series about the planning implications of the current environment made sense as well, to tie together key ideas the way you might.

Over the next few weeks, our own James Yahoudy, CFP® will write here on key planning issues driven by today’s market conditions, and how we see advisors empowering clients to seek more out of their allocations. Among the topics James will cover:

- Longevity Risk – its impact on future retirement income

- Sequence of Returns Risk- how the initial years of retirement can impact later years

- Asset Allocation – why we should think beyond just stocks and bonds

As advisors, you’re the expert on planning topics and have a front seat to each client’s unique situation. Where we can add value is helping you think through the implications of today’s valuations, and help you put clients in a better position to succeed. As always, thank you for your trust. Please reach out to [email protected] if you have additional topics you feel warrant a deeper discussion. Or even better, have a post you’d like to share yourself!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2112-17.