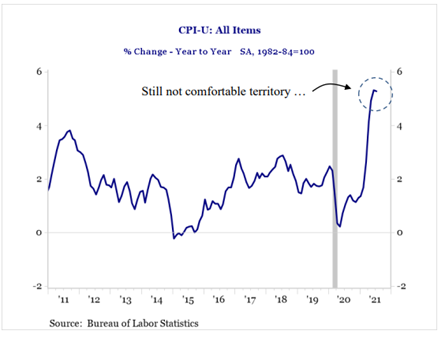

The U.S. CPI rose +0.5% m/m and 5.4% y/y in July. The core (ex food & energy) CPI rose +0.3% m/m and 4.3% y/y. While these numbers are more moderate vs. recent months, bottlenecks remain in the economy (consumers & businesses continue to report inflation concerns).

Source: BLS. As of 8/11/2021

Price measures of food, energy, shelter, and new vehicles all contributed to the July gain. Airfares and auto insurance costs declined. The report really showed us that re-opening sensitive categories did moderate, and the services categories will take the baton moving forward.

Simply put, transitory components of inflation are moderating but stickier underlying inflation dynamics (eg, rents, wages) have our attention longer-term where we could see “transitory” inflation readings lasting longer than expected by the Fed (i.e. Breakevens are >2.25% vs. 2% inflation target).

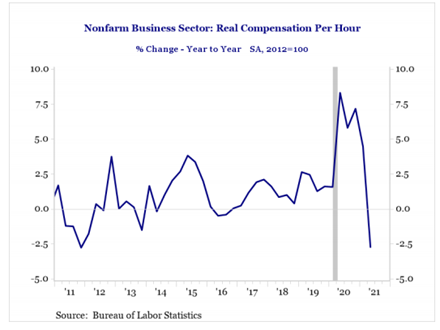

Wage Growth

We continue to watch for real wage growth, which printed (YoY) -2.6% in May -1.6% in June and now -1.2% in July after accounting for higher inflation prints. It’s possible this drop in real purchasing power may abate somewhat as inflation pressures moderate. However, as more workers return to the workforce after all federal unemployment extensions expire in early September, real wages may come under further pressure.

Source: BLS. As of 8/11/2021

The bear case to inflation is that without strong and sustained wage growth, it will be difficult for durable inflation to take hold. The expiry of pandemic jobless benefits, and more importantly, the re-opening of schools and daycares should herald the return of prime working-age Americans back into the labor force, capping wage pressures.

As more of the services side of the U.S. economy goes back to work, we think employment growth should outpace the growth in output, and lead inevitably to productivity declines. Remember productivity has gone through the roof during the pandemic as less workers have been doing the same amount of work (output) as pre-pandemic (seen with GDP surpassing pre-Covid highs).

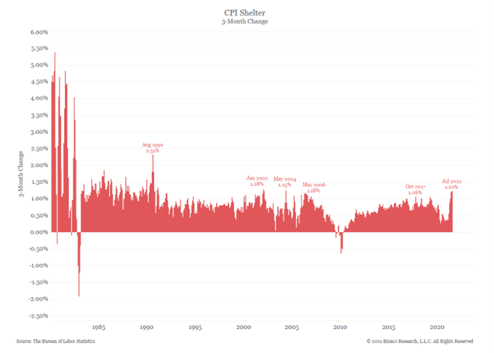

Rent/ Shelter Is a 1/3rd component of CPI and Is In an Uptrend

CPI Shelter, which includes OER and RPR, is up 1.22% over the past three months. That is its fastest 3-month increase since May 2004.

Source: BLS. As of 8/11/2021

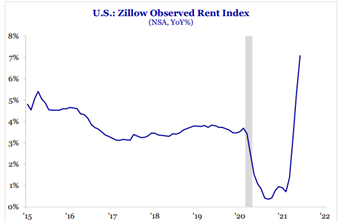

We believe this dynamic will continue to drive inflation prints higher, as rents are a lagging indicator. Shown below is the Zillow Observed Rent Index which is showing rents up around 7% YoY. There is quite a discrepancy between what Zillow’s Rent Index is telling us versus the wimpy 0.1% sustainable rents and OER components added to the Core CPI over July.

Source: Strategas As of 8/11/2021

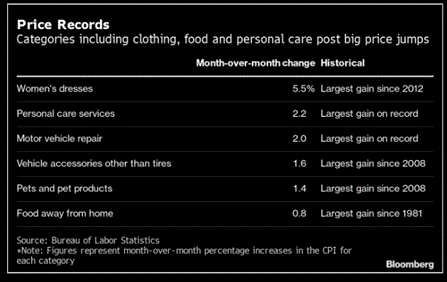

Stuff is Costing More

Businesses raise prices for goods and services as cost pressures mount. This can be seen across many consumer products where month over month prices rose quickly, especially measured against history.

Source: Bloomberg. As of 8/11/2021

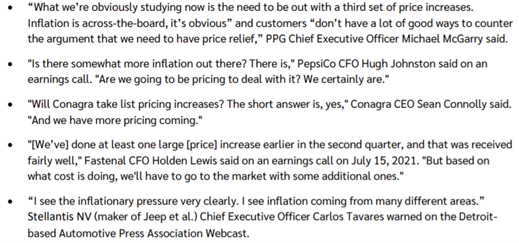

Below we’ve compiled several comments from management teams earnings calls where they continue to highlight inflationary pressures and the need for continued offsetting price increases.

Many of today’s market participants are seeing such inflationary concerns for the first time as this is the first time in a generation that U.S. CEOs have spoken in this fashion.

Bottom line

The July slowdown in extreme inflation readings is welcomed, and we think likely to continue to be excused as “transitory” by central bankers. Still, the longer that global supply constraints persist, the higher likelihood that prices continue to rise…paired with strong demand and with price pressures unabating, we see a greater chance for inflation expectations to remain elevated.

Don’t forget we’ve got $4 trillion in infrastructure package lined up for this year, extension of eviction moratorium, extended deferral of student loan payments, $300 per child, childcare credits, etc. Remember, there is a significant psychological component to inflation…when people believe that prices are going higher, they act in such a way that it causes prices to go higher.

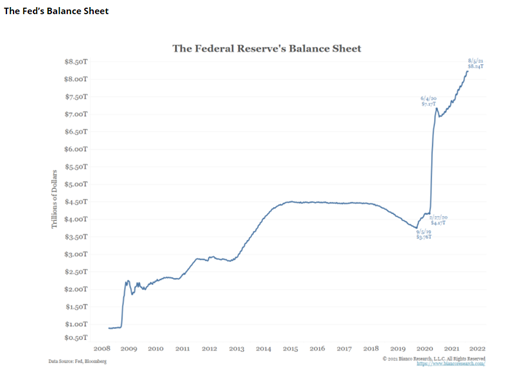

Last Point… Tapering

We’ve all been bracing ourselves for Fed color as to when we can expect asset purchases tapering. We’ve continued to see the Fed’s balance sheet swell. We believe the debate around tapering the next few months has more to do with the pace of labor market improvement than price pressures. More jobs = then we will taper. We take this to mean the Fed needs to see several more months of strong job growth, in line with what was seen earlier this month.

Source: Bianco Research. As of 8/11/2021

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2108-9.