You can let fear keep you out of risk assets (stocks), a lot of people do, but they are going higher with or without you. The show will go on. It must.

There will be ups and downs as there always are, but the pickle the Fed and our government find themselves in is evident, and in our opinion, their actions are clear.

This is a real time look at the situation: US Debt Clock. Here’s the highlights:

- $36+ Trillion of debt

- Federal debt to GDP is now ~123%

The solvency of the U.S. Treasury now relies on liquidity.

Think about that.

With the debt loads we have, and the deficit spend what it is; Trump or no Trump, tariff or no tariff, you’d better own risk assets.

To pay our debts, the Treasury is reliant on low rates and continued liquidity (that’s a fancy way of saying more money in the system) from the Fed. If the Fed doesn’t provide liquidity, it’s more expensive for the government to borrow and service the debt.

Risk assets thrive on liquidity and struggle without it. What scenario do you think plays out? More liquidity or less?

The Path Out

The Fed has a dilemma:

- Too tight for too long => asset prices drop, economy slows, deficits balloon, and the government cannot make good on its debt

- Too loose for too long => speculation wins, inflation runs, and risk asset pricing continues to rise

Both scenarios result in a path out of the current situation. The price you pay is where the rub is.

The first scenario is one of fiscal responsibility and this would create economic destruction. That’s all it gets for an explanation. One sentence. No more time wasted on that because its about as likely as a 12 point buck walking out for me next week in Baldwin County, Alabama.

The second scenario is where our money is, figuratively and literally. Sure, we are hopeful for true productivity that leads to real growth, and believe some of that is in the cards. We also believe it will be matched with a healthy dose of inflating our way out.

Explicit vs. Implicit

Some may argue my next couple sentences are too cynical. That’s OK. We can disagree on certain things. My main objective is protecting wealth, and it’s blatantly clear to me that higher CAGRs are the way to protect capital in real terms, while ‘safely’ holding cash and cash-like securities is a great long-term plan to have wealth confiscated.

Explicit taxation to improve the fiscal position of our government is far less digestible to voters than inflating the problem away. Silently stealing the value of the dollar from those that hold dollars is effectively what’s done.

For example, if you store $100,000 in a safe for the next 10 years, what’s it going to be worth in terms of goods and services? Our best guess is that ‘safe’ $100k loses value.

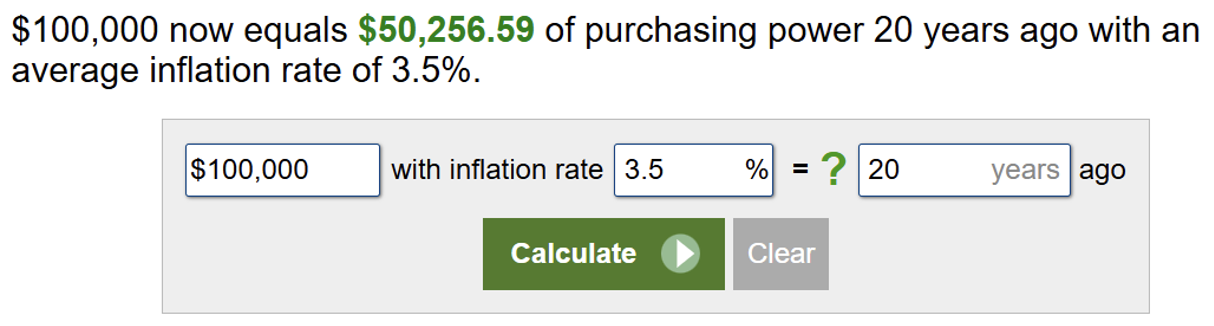

While it may feel safe, if it buys you 30% less goods and services, your $100k turns into $70k, that’s a 30% drawdown in real terms. How about 20 years? That’s a reasonable timeframe for many of your clients…at just 3.5% inflation (barely half of money supply growth), you’re down half!

Source: Calculator.net

Source: Calculator.net

Too many people fail to realize that what matters is the value of your dollars relative to the goods and services you’ll need to buy. Real returns should be the focus, not nominal.

Risk assets benefit from liquidity. Even if they are only going up nominally, they are still going up. Many avoid the risk of stocks in favor of holding bonds that cannot protect purchasing power and are incredibly tax-inefficient.

Our Solution

Yes, we are advocating for allocations to shift more towards equities and think that shift provides the best opportunity to protect and/or improve wealth.

No, we are not advocating a “sit tight and ride it out” mentality.

Stocks are the better engine to drive towards higher returns. We must own a better engine, but equip it with the best brakes we can find. Preferably, brakes that have no correlation issues! We advocate actively-managed hedged equity and other forms of convex payoffs, to blend with more of the additional equity exposure.

We think of risk in terms of purchasing power protection and drawdown of account value. The extra equity helps with higher CAGRs, and the presence of hedges help with drawdown.

Moving Forward

Dave’s Market Outlook is chock full of information that supports our general approach to helping position hard-earned capital for higher CAGRs.

We couldn’t be more convicted in our More Stocks, Less Bonds, Risk Neutral mindset. We believe we are improving our ability to deliver and message around that conviction.

“Better in the tails” as we like to say, as those tails matter when it comes to compounding returns. We believe we’re best-positioned to help investors accomplish the better in the tails objective.

We are beyond thankful for the opportunity to work with you. As always, thank you for the trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-4.