The lifeblood of financial services is the $500k to $3 mil family nearing or in retirement that will need to tap assets at some point. They need two things:

- Sufficient growth

- A return stream they can stomach.

These families and the advisors serving these families are why we exist.

We talk about the importance of avoiding drawdown. We talk about owning volatility and treating it as an asset class that can be used to reduce risk AND improve upside potential. 2020 put this investment process to the test and words into action. The good news, by industry standards we believe we passed.

To preface the remaining words, we need to stress two major points:

-

- Upside/Downside Capture: Nearly everything we talk about and think about boils down to this. Can we improve our ability to capture as much of the upside as possible, while reducing our exposure to the downside? Perfection is not the goal. Rather, avoiding large drawdowns is. Accomplishing this objective improves our ability to compound capital.

- To help with #1, we own volatility. It is an asset class that goes up when everything around it goes down. This ownership allows us to alter the allocation away from bonds and more towards stocks. It should pave the way for solid returns and acceptable risk.

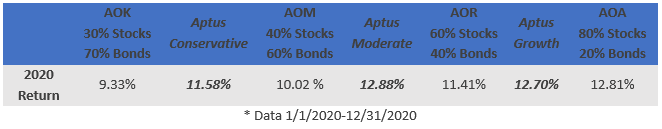

The returns matter. Let’s start there. Below is a table of our composite numbers relative to the iShares benchmarks. Our composites represent groups of actual client accounts. For example, our Moderate composite consists of hundreds of client accounts that have similar portfolio objectives.

At first glance, the return numbers look good. Each of our three composites returned in-line or higher vs. the more conservative benchmarks to the left and the more aggressive benchmarks to the right.

But what about risk?

Risk and return are in a marriage that cannot be broken. You cannot have one without the other. A review of return alone is not enough. We need to understand the risk associated with these return streams.

We will look at risk through two lenses:

- Volatility (standard deviation of returns) and

- Drawdown (peak to trough losses of value).

We’re happy with how our portfolios performed in 2020, and even more excited about our positioning moving into 2021.

Standard Deviation

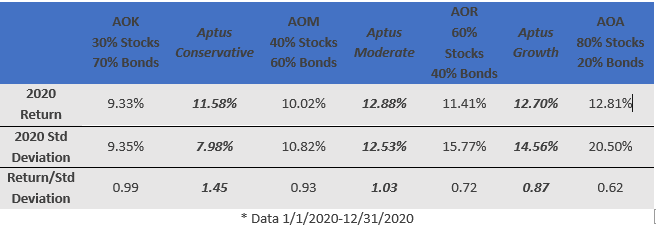

In statistics, standard deviation measures the amount of variation or dispersion of a set of numbers. Below is the same table above, we’ve just added the standard deviation of monthly returns during 2020 for each composite and the same benchmarks.

The first table showed returns; this shows returns per unit of risk. More return + less risk = a portfolio built to hold.

Look at the Growth composite. It had performance aligned with the 80/20 allocation benchmark and did so with a near 30% reduction in standard deviation of returns. Reduced volatility can mean an easier portfolio to hold. It’s the equivalent of going from riding in a Wrangler to riding in a Lexus. If you have a long trip ahead of you, you want to be as comfortable as possible.

Another way to look at it – divide the return by the associated standard deviation. This is a simple way for gauging your bang for your buck. Looking at the growth composite, let us do that math. 12.70% return divided by 14.56% standard deviation, gives you 87%. It is a quick way to adjust returns for risk.

87% is more compelling than the 60% the iShares AOA allocation gives you! You can apply this simple formula across the board.

Now to the big risk measure…drawdown.

Drawdown

I know we are a few sections into this piece, but our process starts here. Reduce drawdown. It is the most important concept in how we think about portfolio construction.

Big drawdowns hurt. They create a tax on our ability to grow portfolios. We all understand the math. Losing 50% requires a 100% gain to get back to even. Mathematically, it makes sense to lose less money.

Behaviorally, it makes sense too. We think large drawdowns are prone to triggering poor behavior. Watching a portfolio go down 15% is one thing, watching it go down 40% is another.

We position portfolios with exposure that allows us to avoid big chunks of drawdown. We cannot avoid all risk (remember it’s married to return), but if we can reduce major drawdowns it improves our chance to deliver a portfolio that can be held.

Quick side note – our volatility exposure can not only reduce drawdown, but can create dry powder to deploy during market sell-offs. This helps with upside capture when markets rebound. If valuations get reset lower, your potential for return goes up. That only matters if we have cash to deploy!

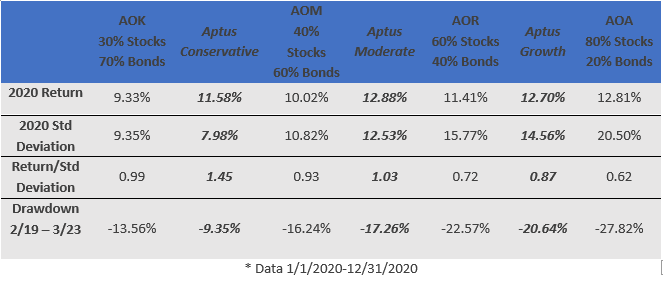

2020 gave us a chance to test our allocations. The S&P 500 fell nearly 34% in just over a month, from February 19 to March 23. Below is the same table with an additional row comparing the drawdowns during that period.

The story is the same. The return streams had significantly less drawdown than corresponding benchmarks. This leads us to the final thoughts and the most important question we could ask.

If return is married to risk, how can we produce higher returns vs our benchmarks with less risk?

Asset Allocation & Upside/Downside Capture

To repeat – we own volatility.

We think this empowers more effective risk management than owning bonds, and 2020 was a good real-life test of that approach. That said, the overlooked benefit of owning volatility is how it positions us for upside capture. What good is defense if you can’t score?!

The most powerful lever we can pull to drive returns is altering allocations away from bonds. This means more reliance on equities, and less on things like duration or credit spreads tightening. Things that have been beneficial to bond returns in the past could very well be handcuffs moving forward.

We move from a more conservative asset class (bonds) to a riskier asset class (stocks) purely because we do not see return potential in bonds. We inject our specific strategies to provide the risk management we need at the portfolio level to make this a comfortable transition.

Upside capture potential can be higher than respective benchmarks IF the allocation to bonds can be reduced. Downside capture can be compelling if embedded with volatility exposure. The goal is using this shift to produce a better, more “holdable” set of returns – upside pursuit with downside protection.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Impact Series Benchmarks are the iShares Core Allocation ETFs. iShares Core Asset Allocation ETFs are designed as diversified core portfolios based on the specific risk consideration of the investor. Each iShares Core Allocation Fund offers exposure to US stock, international stock, and bond at fixed weights and holds an underlying portfolio of iShares Core Funds. Investors choose the portfolio that aligns with their specific risk consideration. iShares Core Allocation ETFs offer investments to meet a Conservative (iShares Core Conservative Allocation ETF), Moderate (iShares Core Moderate Allocation ETF), Growth (iShares Core Growth Allocation ETF), and Aggressive (iShares Core Aggressive Allocation ETF). Source: Blackrock. The volatility (standard deviation) of the Impact Series may be greater than that of the benchmark.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2101-24.