In prior posts, we have written about the continued tightness in oil markets driven by (among other things) structural underinvestment in productive supply over the past several years. In this post, we will focus more on the products side, specifically gasoline and distillates (diesel fuel). These products are created through the refining process, whereby crude oil (the input) is “refined” to produce such outputs. It stands to reason that as crude oil rises, so too should the various derivative products that require its use. But there is currently more at play driving product prices higher, and we will attempt to identify those factors.

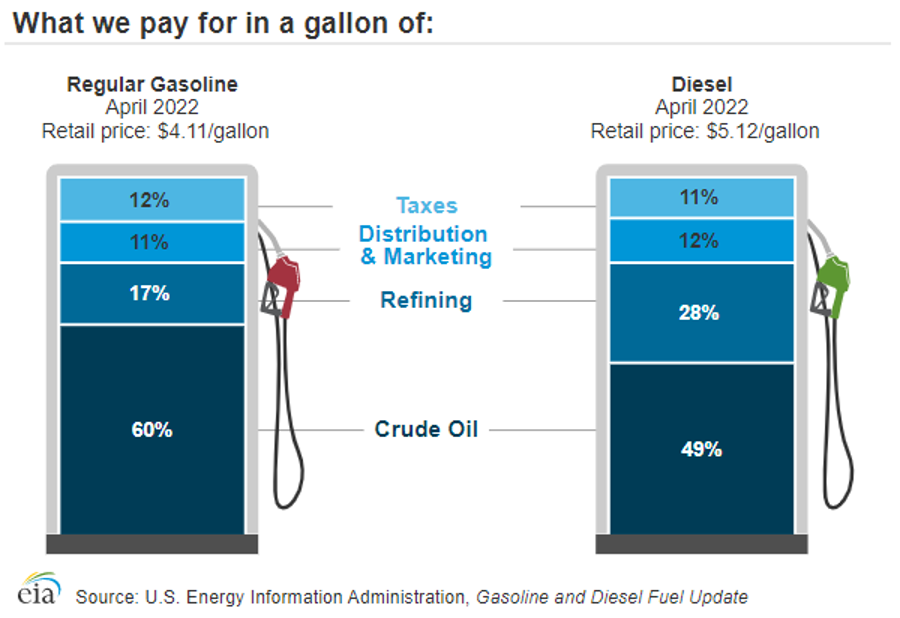

What Goes Into the Retail Price of Gasoline/Diesel?

Let’s start by looking at the components of gasoline/diesel pricing. It is not entirely uncommon for folks to refer to oil/gasoline interchangeably. But as this graphic shows, there are more forces at work than just the price of oil.

Data as of April 30, 2022

Data as of April 30, 2022

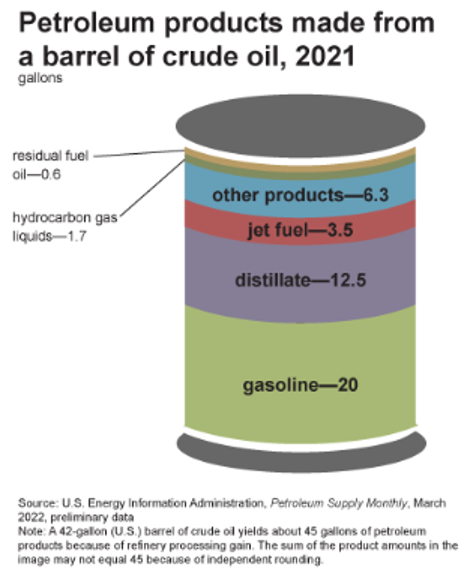

Perhaps the most important (and most complicated) component of that breakout is refining. As a brief primer, refineries break crude oil down into its various components, which are then selectively reconfigured into new products. Refineries have three basic steps, 1) separation – piping crude oil into a hot furnaces where resulting liquids/vapors separate into petroleum components called fractions, 2) conversion – additional processing of heavier fractions into lighter, more valuable molecules, typically though a process known as cracking, and 3) treatment – required blending in order to obtain the proper octane level, vapor pressure rating and other special considerations¹. The result is a number of various products for end-market uses, the majority being gasoline and distillates.

Data as of March 31, 2022

Data as of March 31, 2022

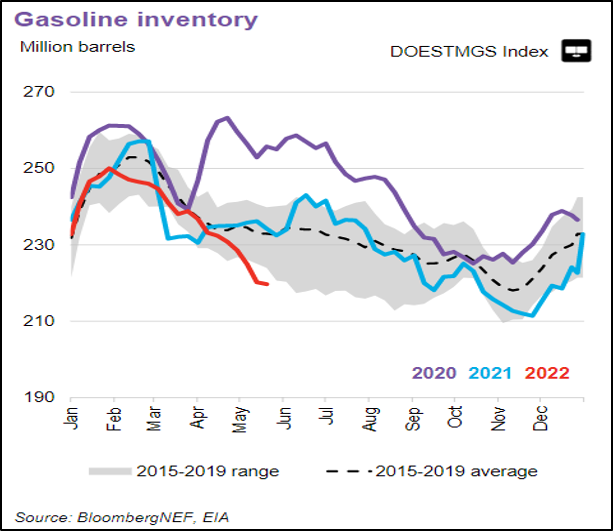

Refining and Product Inventories – The Supply Side

Now that we are all refining experts (minus the PhD in chemistry), it becomes clear that this process is vital in getting product (gasoline/diesel) to retail (gas stations everywhere). With product demand rebounding from the COVID lull (more on that later), the global refining system has to be ready to meet that demand. The problem is capacity is currently constrained. Raymond James estimates that three million barrels per day (MMbls/d) of global refining capacity is shut-in today compared to 2019². Furthermore, the IEA (International Energy Agency) estimates that refinery processing rates this year will be down about 1.3 MMBls/d below 2019³. Why the discrepancy in those two numbers? The answer is that refineries are running at near peak utilization, this according to the EIA:

¹ US Energy Information Administration https://www.eia.gov/energyexplained/oil-and-petroleum-products/refining-crude-oil.php

² May 27, 2022, Industry Comment

³ May 30, 2022, BloombergNEF

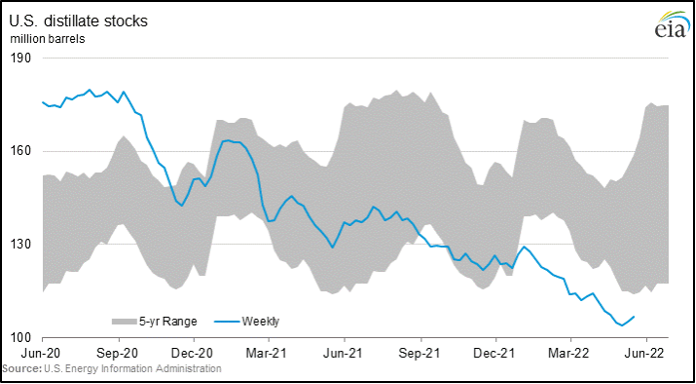

“Total refining capacity has decreased since 2020 because of several refinery closures and conversions. Gross inputs into refineries are only slightly above the five-year average even though refinery utilization is at the top of the five-year range, which indicates that refineries may be running closer to maximum capacity utilization than gross inputs alone would indicate. The faster increase in gasoline demand compared with production has led to inventory draws, and U.S. gasoline inventories are currently 8% below the five-year (2017–21) average for this time of year4.” The picture in distillate markets is even more extreme.

4 May 23, 2022, EIA Gasoline and Diesel Fuel Update

Data as of May 30, 2022

Data as of May 30, 2022

Data as of May 31, 2022

Data as of May 31, 2022

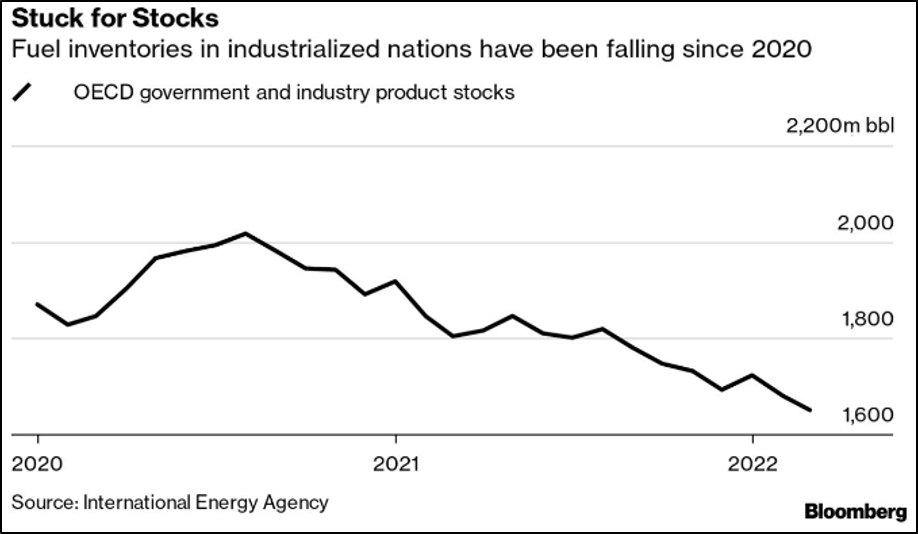

Furthermore, the same thing is happening internationally across all major product lines.

Data as of May 29, 2022

Data as of May 29, 2022

Speaking May 10th at a conference in Abu Dhabi, Saudi Energy Minister Prince Abdulaziz bin Salman said, “I am a dinosaur, but I have never seen these things,” referring to the surge in refined products prices. “The world needs to wake up to an existing reality. The world is running out of energy capacity at all levels.”

Refining and Product Inventories – The Demand Side

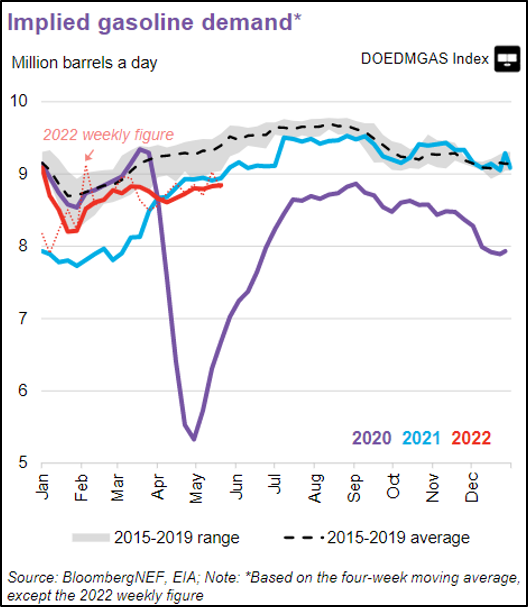

Here is where the real tug-of-war lies. We have seen that supply is constrained, with refineries running near peak capacity and product inventories well below average. The makings of this shortfall came out of the 2020 COVID lockdowns, where expectations did not foresee the vaccine-induced reopening effect of 2021. Demand came roaring back, leaving the aforementioned supply issues fully exposed. Now gasoline demand, while still firmly above 2020 levels, is back in question, as fears of an inflation-fueled slowdown riddle global economies.

Data as of May 27, 2022

Data as of May 27, 2022

The supply side is proving to be the bigger issue, as even muted demand is gobbling up what product is available. The result has been soaring refiner margins, known as crack spreads.

Data as of May 30, 2022

Data as of May 30, 2022

Conclusion

Soaring prices at the pump show little signs of abating any time soon. Not only are crude oil prices high (even in the face of indefinite Chinese COVID lockdowns), but the global refining system is running near full capacity in an attempt to compensate for lingering inventory shortages. The result is tightness in inputs and outputs that could only be partially solved in the near-term by material demand destruction. Longer-term, change in investor sentiment and public policy will likely be required to necessitate a sustained investment cycle leading to secured and predictable supply.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2205-25.