“Risk isn’t what you think is going to happen, it’s what hurts if it does happen.” David Dredge, Convex Strategies

Reading and listening to David Dredge has been a joy; it’s a great thing to see how a practitioner can simplify even the most complex topics through deep expertise.

His interviews may be the most useful I’ve heard in years, and took me days to complete even at 1.5 speed due to so many notes. Here’s one from MacroHive in September, worth bookmarking if you’d like to hear for yourself. The grand theme is that we want two things when we invest:

- To know our money has some resistance to falling markets

- To know we can benefit from rising markets

How can we accomplish this? By taking growth assets and adding protection through the convexity of options, where price gains can accelerate when moving in our favor, and losses decelerate when moving against us.

Nice combo – how does this happen?

When we own a convex vehicle, our cost is limited to the price we pay, while the payoff has no real limits. Something like this:

Source: Vitalik Buterin

Geek Alert: Long Options vs. Short Options

Options can get a bad rap, but used properly they can be unrivaled when it comes to a) reducing downside and b) pursuing upside. Selling options is a different story, where some get lured into capturing “income” month after month but miss the open-ended financial obligation that comes with selling that ante. Think about the historic investment blowups you know, the common catalyst has generally been a “short volatility” profile.

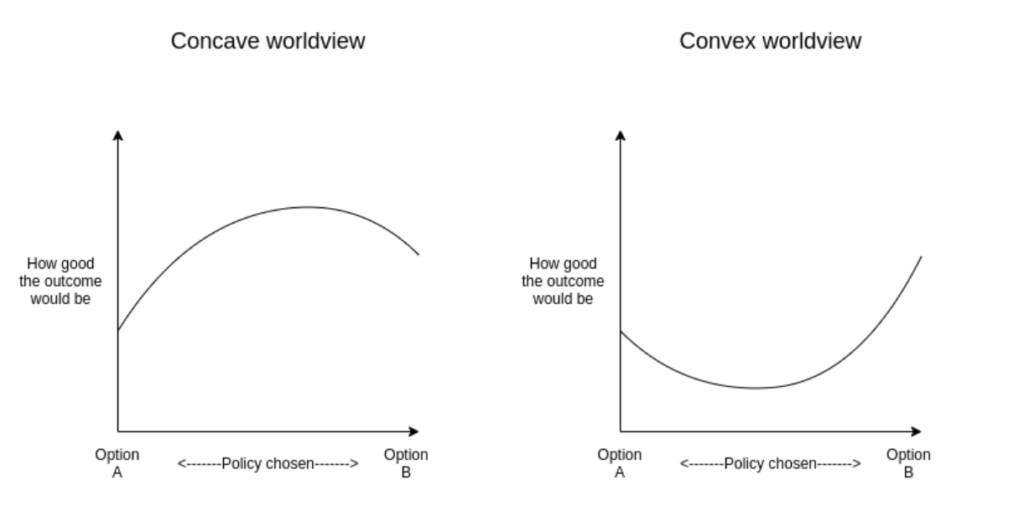

The option buyer, put OR call, pays an ante for the chance at a convex payoff. The options seller collects the ante but absorbs the risk of the buyer’s convex payoff. There are times when the ante gets high enough to warrant being a seller vs. a buyer, but it’s generally AFTER the risk has been exposed in a selloff, not before. In general, shouldn’t we prefer investments with defined risk and uncertain return (convex) to those with defined return and uncertain risk (concave)?

Dredge’s Beautiful Mind

Buying options (being long volatility) is a defined-risk activity. You place some amount of money at risk, in pursuit of profit or protection (or both), and your worst possible outcome is losing the amount you paid for the option. This distinction between recourse leverage (short options) and non-recourse leverage (long options) leads into three of my favorite Dredge analogies:

- Banking: paying interest on deposits has a cost to the bank, just as buying puts has a cost to the owner. But the bank can more than recapture their cost by lending those deposits out at a higher rate. Similarly, by paying to own puts, an investor can comfortably invest in more growth assets and reduce the need for bonds as “safe money”. The beauty of owning options is that they provide true non-recourse leverage, with nothing at risk beyond the cost of the option.

- Soccer: fans evaluate teams based on the win/loss standings, but for some reason investors are often drawn to something more akin to “goals scored”. For a team to achieve success, they ultimately need to not only score, but prevent the other team from scoring more. So a team (portfolio) of proven goal-scorers and goal-keepers seems most effective, yet investors often fill portfolios with midfielders who are mediocre at both offense and defense. Sounds like bonds and midfielders have something in common?

- Formula 1 Racing: the car that ultimately wins is not determined by its speed on the straightaway. It’s the car that can best balance the speed of the straightaway with the brakes on the turns. Without the effective use of both, the driver will either crash and burn, or simply fall way behind over time.

Compounding Your Money

We should care about the standings at the end, not the scorecard. High average returns may look appealing (see Ark Funds), but your compounded return is what you end up with as an investor. And as we’ve noted before, the math says that boring can be beautiful when it comes to compounding, especially if account withdrawals are part of the equation.

As Dredge makes clear, two things matter in compounding money…time and downside. if you don’t get the downside right you won’t get the time to benefit from the upside. This leads back to the mantra that we share: Protect and Participate. He refers to his friend Nassim Taleb’s take on modern portfolio theory:

“The so-called ‘optimal’ portfolio is in effect the worst of all worlds. It offers scant protection against tail risk and, at the same time, achieves an under-allocation to the riskier assets with higher returns in the long periods of economic expansion such as the past decade.”

Bonds Don’t Help Right Now

In Dredge’s mind, everything in a portfolio should be judged on those two simple parameters of protection and participation. He talks about eliminating bonds in favor of owning volatility:

“All that dead capital that does neither needs to be weeded out and reallocated. It most certainly should not be levered! One simply is not going to achieve the objective of compounding by not participating in good markets (or only getting a portion of ‘participation’) and not protecting in bad ones (while always getting one’s full share on this side).”

We couldn’t agree more. We’ve avoided bonds for multiple reasons, but mostly because a) the yield doesn’t justify tying up capital and b) there is no assurance that they can serve a role as protector. At these levels, we think bonds whiff on both protection and participation!

We’ll continue to take a proactive approach to seeking upside while explicitly mitigating downside. And we’ll continue to look for ways to help explain the why and the how, including the opportunities to monetize the puts and rebalance into market selloffs. We believe the best strategy is the one your client can stick with, and the comfort level sometimes matters just as much as the math.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-9.