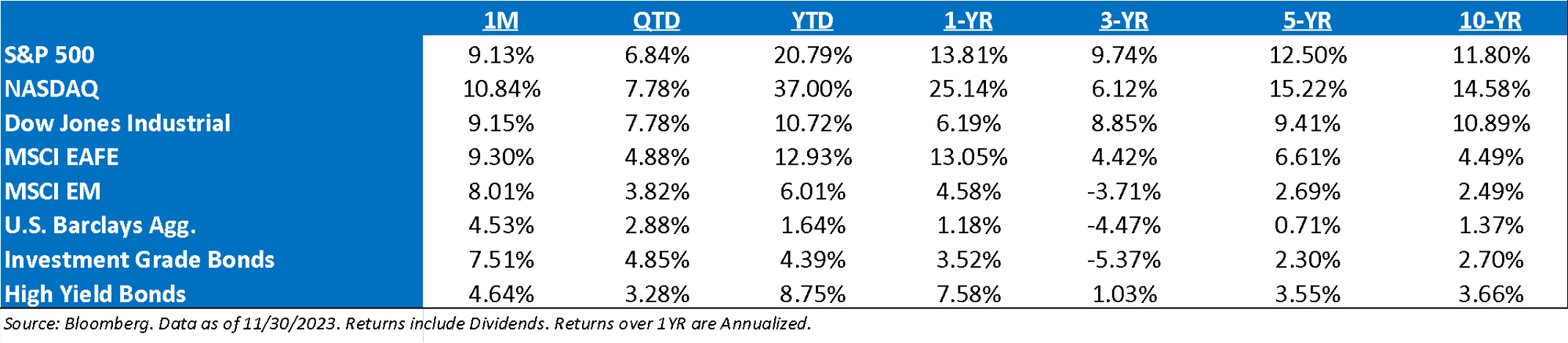

November ’23 Market Recap: After a 20% drawdown in many stocks between July and October, equities staged an impressive rebound in November thanks to the sharp reversal in interest rates. A good portion of this reversal was due to the pricing of a much more accommodative rate cut path over the next 12 months. Specifically, 130bps of cuts are now priced into Fed Funds futures through the end of next year—a dovish expectation in the context of stable economic growth in 2024. The driver of lower Treasury yields was slowing economic data globally, continuing the trend of “deceleration”, with PCE prices, ISM manufacturing, October consumer spending, holiday spending (according to NRF), China PMIs, and Europe inflation all showing signs of deceleration, and outright weakness from an economic standpoint. As we’ve continued to state, yields rule everything around investors.

Soft Landing Or Just Passing Through to a Recession? The equity markets are happy to support a soft landing thesis for now as the bond market is just taking economic weakness as a reason to send yields lower. However, the mathematical truth is that it is impossible to know whether we are just passing through growth rates consistent with a soft landing before slowing into a recession or whether the economy will stay at growth rates similar to today.

The Equity Volatility Tax: Since Nov. 8th, 2020 (Pfizer vax approval), every major benchmark average return is within 2% of each other. All the various style and size changes have just been giant reversions to the mean. Don’t get whipsawed by the equity volatility tax. Since then, the S&P 500 is up 10.30% annually, while the S&P 400 and S&P 600 are up 8.63% and 7.92%, respectively. It may not feel like it after the substantial difference in return numbers between ’22 and ’23.

It’s Been a Lopsided Market: Continuing the point above, the total return of the equal-weighted S&P 500 Index is up a mere +8.1% while the total return of the standard market-cap weighted Index is up +21.5%. When it comes to style performance, the performance differences are even greater. The Russell 3000 Growth Index is outperforming the Russell 3000 Value Index by a stunning 29%, the largest difference (ex-Covid) since 1999. It should be noted that Value normally bounces back after such lopsided underperformance.

Next Year’s Earnings Profile: Although expectations for S&P 500 earnings in 2024 have moderated to a degree, the Street is still expecting nearly a 12% increase in profits after what is likely to be a flattish year in 2023. As it stands now, the expectations largely come down to the earnings power of the Technology and Communications sectors. EPS has been quite negative year-over-year in 2023 despite real GDP and the labor market being better than expected. The best evidence is nominal means much more to earnings than real. Nominal growth should continue to decelerate in 2024, as consensus EPS seems far too optimistic for that reality.

November Fed Meeting: The revised “dot plot” from the September meeting was hawkish, but the November meeting felt slightly more dovish after the recent rise in nominal yields. With no surprise to the market, the Fed left their target fed funds rate between 5.25% and 5.50%. Unlike the September edition, the accompanying statement at least implicitly offered a justification for skipping this time, with the expanded reference to “tighter *financial* and credit conditions” that “likely” weigh on the economy, albeit still to an “uncertain” extent. This language seems rather tame, notably sandwiched in a second paragraph that’s seemed long-in-the-tooth and due a refresh. The hiking cycle has now meandered from its previous every-other-meeting groove, arguably largely, if not exclusively, on this account. Still, as the Chair conveyed at the presser, tighter conditions must persist to alter the path of monetary policy meaningfully.

Framing the Small Cap Landscape: The Russell 2000 rallied 9.1% in November, making it the 3rd best November going back to ’79. However, small still trailed large and QQQ. The YTD gap between the Russell 2000 and the Russell 1000 is the widest since ’98, while it’s the widest since ’99 vs. the QQQ.

Leaving Investors With Some Charlie Munger Quotes: 1) “The big money isn’t in the buying or selling, but in the waiting”, 2) ”People with high IQs are terrible investors because they’ve got terrible temperaments”, 3) “Acknowledging what you don’t know is the dawning of wisdom”, 4) “Invest in a business any fool can run, because someday a fool will”, and 5) “Assume life will be really tough, and then ask if you can handle it. If the answer is yes, you’ve won”.

What Concerns Us the Most: In short: 1) Continued volatility; 2) Inflation transitions to growth frustration; 3) The potential for a Fed policy error and continued collateral damage; 4) A general tendency to think about the economy and stock prices in V-shaped terms, i.e., a Fed Pivot saving the day.

Earnings: ‘24 S&P 500 EPS = 246 (+11.5%). 2023 = $220 (+0.8%). 2022 = $219 (+7.4%). 2021 = $204. 2020 = $136. 2019 = $161. *

Valuations: S&P 500 Fwd. P/E (NTM): 19.0x, EAFE: 13.2x, EM: 11.6x, R1V: 14.6x, and R1G: 25.5x.*

*Source: Bloomberg and FactSet, Data as of 11/30/23

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Investment-grade Bond (or High-grade Bond) are believed to have a lower risk of default and receive higher ratings by the credit rating agencies. These bonds tend to be issued at lower yields than less creditworthy bonds.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. ACA-2312-6.