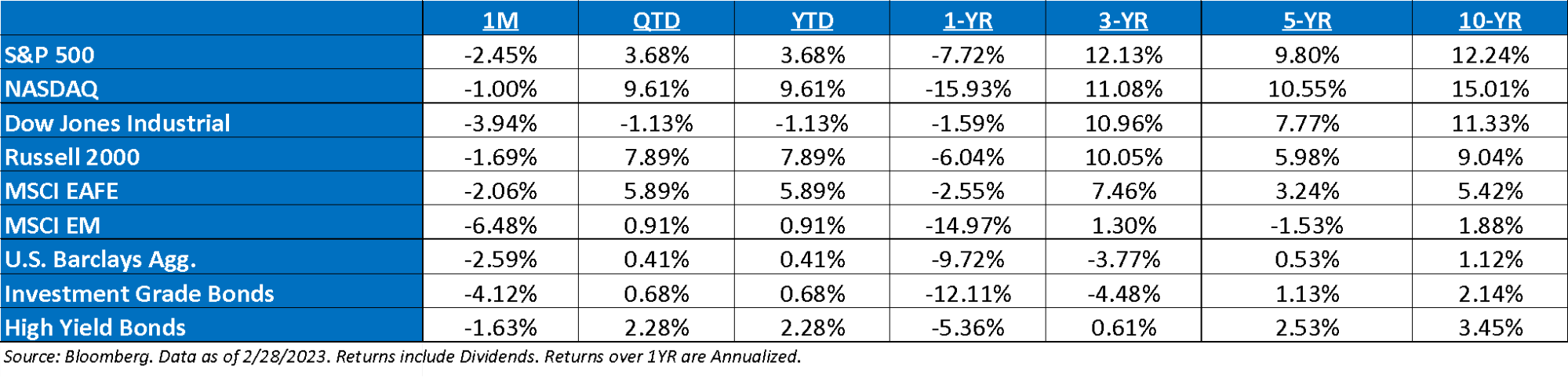

February ‘23 Market Recap: The January rally suddenly looks distant as equities closed lower for the month, finishing down 5.0% from their early February peak. This has been a confluence of technicals, bond yield increases due to uncomfortably strong economic data in January, the re-opening trade in China finally cooling down a bit, and U.S. indexes are either falling back to 50-DMA (small and mid) or broken through the 50 and hoping the 200 holds (S&P 500). Since the February 2nd peak, small, mid, and large cap indexes are down ~5-6% with the sectors that were the strongest performers in January, down the most in the selloff (consumer discretionary, comm services, real estate), while energy and defensives have outperformed.

Bond Market Update: Bond yields have increased meaningfully on the stronger than expected January economic data from 3.40% to 3.99% on the 10-year Treasury yield in just the last three weeks (2-year has increased even more), while credit spreads have widened as well by about 20 bps. For a few months in late 2022 economic data was telling a story of substantial weakening, while credit spreads were tightening, and during the last three weeks it has been the opposite.

Economic Data Update: After a hotter than expected retail sales, CPI, PCE deflator, and jobs number in January, disposable income numbers were restated, leading to a meaningful change in the savings rate. Essentially, the savings rate is now 4.5% vs. previously <4%, when the pre-pandemic average was now closer to 8-8.5%. The takeaway from all of this economic data is telling the same story as before. The consumer excess savings during the pandemic was ~$2.4 billion, and through January, the excess spending has evaporated ~35% of the previous savings. It’s unclear when consumer spending will normalize so that savings rates return to “normal”, but it clearly did not occur in January as personal consumption grew 1.8% m/m after declining in December and y/y increased to +7.9% from 7.4% in December.

Earnings Season Update: With earnings season grinding to an end, it looks like 2023 EPS will fall ~3-4% from early January levels, with S&P 500 consensus EPS now at ~$221, down from $229 before earnings season (and ~$253 last June), and marking the third straight quarter of a 3-4% drop (few “kitchen sink” guides evident). We saw consensus EPS come down in every sector during earnings season except for staples. Energy and materials saw the largest decline due to commodity disinflation and health care costs.

Earnings By the Numbers: With the Q4 earnings season nearing the end, the overarching message is that sales were stronger than profits. Earnings for the quarter are expected to decline -3.2% and excluding the energy sector, it would be -7.4%. While this is the first quarter of declining profits according to consensus for the aggregate, it would be the third excluding energy. Revenues on the other hand are expected to grow 5.7% and excluding energy, growth would be 5.0%.

Why a Paltry Response from the Market, Given Rise in Rates?: Since the beginning of February, the market has seen the 10YR Treasury increase from 3.40% to 3.99%. Investors have had difficulty reconciling the resiliency of the market, given the move in rates. Why has the market remained resilient?

- Yields spiked because economic growth (Retail Sales, Services PMI, NFP Jobs) has been much stronger than anticipated. If that’s the case, then the market should be able to withstand higher rates.

- The market has just begun to match the Fed’s expectations of a terminal rate. Thus, the Fed has not gotten more hawkish than they were previously – the market has just begun believing them.

S&P Valuation: The S&P 500 valuation increased over the month even though the market fell, as forward earnings fell more than the market (thanks to Q2 ’22 earnings seasons). The market trades at 19.4x (18.5x last month).

Earnings: 2023 Projected S&P 500 Operating Earnings = $221 (+7.2%). 2022 = $206 (+1.0%). 2021 = $204. 2020 = $136. 2019 = $161. *

Valuations: S&P 500 Fwd. P/E: 19.4x, EAFE: 13.6x, EM: 10.0x, R1V: 15.9x, R1G: 25.0x, and R2K: 15.2x. *

*Source: Bloomberg and FactSet, Data as of 2/28/23

Disclosures

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198 or contact us here. Information presented on this site is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Nasdaq Composite Index measures all Nasdaq domestic and international based common type stocks listed on The Nasdaq Stock Market. To be eligible for inclusion in the Index, the security’s U.S. listing must be exclusively on The Nasdaq Stock Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing). The security types eligible for the Index include common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. Security types not included in the Index are closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries*. With 1,387 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Investment-grade Bond (or High-grade Bond) are believed to have a lower risk of default and receive higher ratings by the credit rating agencies. These bonds tend to be issued at lower yields than less creditworthy bonds.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Nasdaq-100® includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. ACA-2303-1.